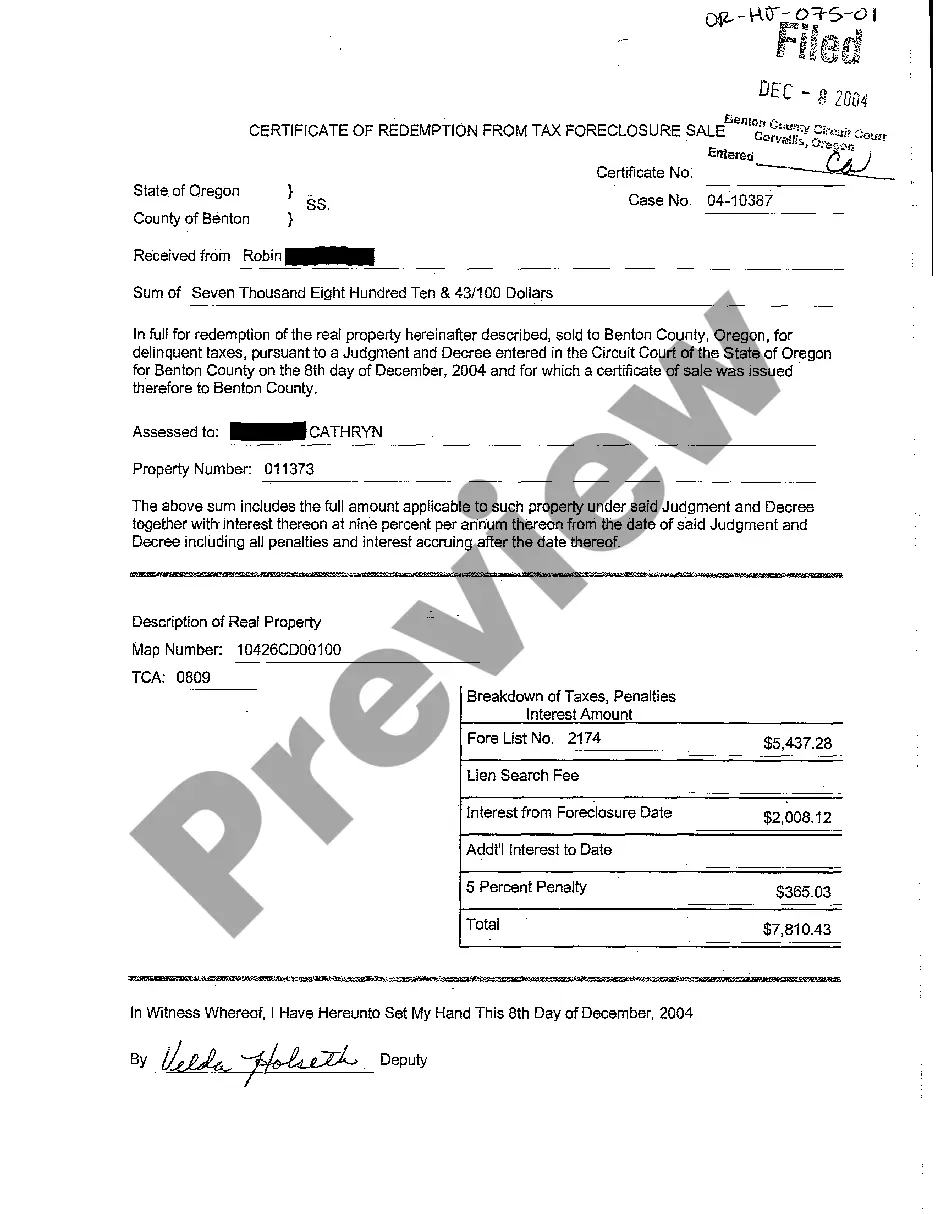

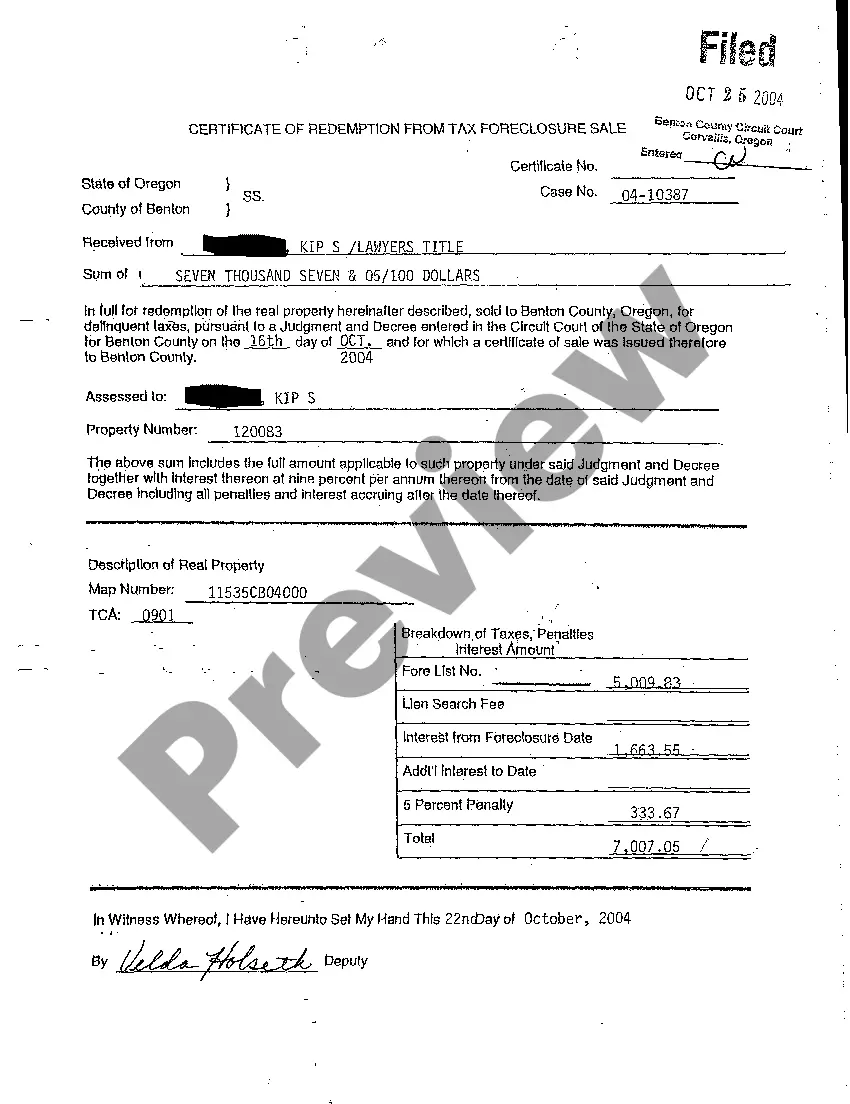

Oregon Real Estate Foreclosures Sample Case 2 Form

Description

Form popularity

FAQ

Foreclosure auctions in Oregon occur when a property owner defaults on their mortgage. The lender usually schedules the auction, where bidders can place offers on the property. Understanding the Oregon real estate foreclosures sample case 2 form helps you navigate the paperwork and bidding process efficiently, ensuring a smoother transaction.

The 120-day rule in Oregon requires lenders to provide a 120-day notice before initiating the foreclosure process. This notice allows borrowers adequate time to address their mortgage payments before facing foreclosure actions. Understanding this rule is vital for both lenders and borrowers involved in Oregon real estate foreclosures, particularly when working with the Oregon real estate foreclosures sample case 2 form to ensure compliance.

Yes, Oregon is a single action state, meaning that a lender can only pursue one remedy to recover their debt secured by a mortgage or deed of trust. This typically involves either pursuing foreclosure or suing the borrower for the amount owed, but not both simultaneously. Awareness of this legal structure helps homeowners and real estate professionals handle Oregon real estate foreclosures effectively with documents like the Oregon real estate foreclosures sample case 2 form.

The Oregon Trust Deed Act governs the use of trust deeds in real estate transactions, mainly for financing purposes. It allows lenders to foreclose on properties without going through the courts in most cases, making the process generally faster. Understanding this act is crucial when dealing with Oregon real estate foreclosures, especially when using the Oregon real estate foreclosures sample case 2 form.

You can obtain Oregon real estate forms through various channels, including online legal form platforms like USLegalForms. These platforms provide easy access to official documents, including the Oregon real estate foreclosures sample case 2 form. By using these services, you save time and ensure you use the most current and compliant forms for your real estate needs.

In Oregon, the foreclosure process typically takes about six months to a year, depending on various factors. It's important to note that this timeframe can vary based on court scheduling and the specifics of the case. For those navigating Oregon real estate foreclosures, the process may seem complex, but our resources can help streamline your understanding and actions regarding the Oregon real estate foreclosures sample case 2 form.

Yes, in Oregon, a beneficiary generally has the right to view the trust documents. This right helps ensure transparency regarding how the trust's assets are managed. If you need more details, examining Oregon real estate foreclosures sample case 2 form will offer you important insights into these rights.

The beneficiary owner of a trust refers to the individual who holds the rights to receive income or assets from the trust according to its terms. It’s essential to note how this status can be affected by other factors, such as legal obligations. For more information about your rights, consider reviewing Oregon real estate foreclosures sample case 2 form.

The non-judicial foreclosure process in Oregon involves a series of steps where a lender can initiate foreclosure without court intervention. This process typically includes providing notice to the borrower, as well as public foreclosure announcements. For a complete understanding, you can refer to Oregon real estate foreclosures sample case 2 form, which outlines the specifics.

The primary beneficiary of a trust is the individual or group that stands to benefit first from the assets held in the trust upon its activation. This role is critical as it influences who receives financial support or property after certain events. Utilizing Oregon real estate foreclosures sample case 2 form can help clarify the rights of the primary beneficiary.