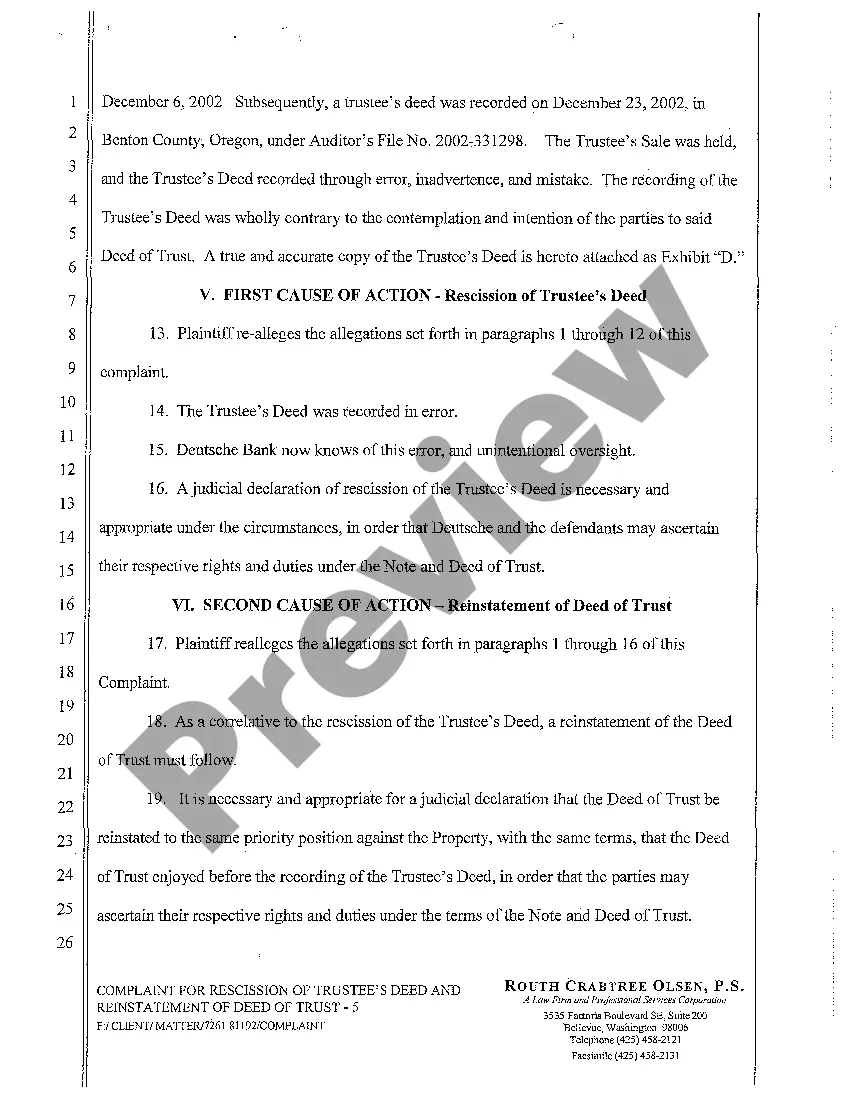

Lender Complaint For Rescission Of Trustee's Deed With Trust

Description

How to fill out Lender Complaint For Rescission Of Trustee's Deed With Trust?

No matter if you deal with documents regularly or if you have to present a legal paper from time to time, it is essential to find a helpful source where all the examples are pertinent and current.

The first step you should take with a Lender Complaint For Rescission Of Trustee's Deed With Trust is to ensure it is the most recent edition, as this determines whether it can be submitted.

If you wish to make your search for the most recent document samples easier, look for them on US Legal Forms.

To acquire a form without an account, follow these instructions: Use the search bar to locate the form you require. Check the Lender Complaint For Rescission Of Trustee's Deed With Trust preview and details to ensure it is the exact one you need. After confirming the form, just click Buy Now. Choose a subscription plan that suits you. Create an account or Log In to your existing one. Provide your credit card information or PayPal account to complete the purchase. Select the document format for download and confirm it. Eliminate the hassle of dealing with legal documents. All your templates will be systematically organized and validated with a US Legal Forms account.

- US Legal Forms is a collection of legal templates that includes nearly every document sample you might need.

- Search for the forms you need, review their relevance immediately, and discover more about their application.

- With US Legal Forms, you can access over 85,000 document templates across various fields.

- Locate the Lender Complaint For Rescission Of Trustee's Deed With Trust samples in just a few clicks and save them anytime in your account.

- A US Legal Forms account will facilitate access to all the samples you need with ease and minimal inconvenience.

- Simply click Log In in the website header and navigate to the My documents section to find all the forms you need readily available.

- You won't have to spend time searching for the right template or verifying its legitimacy.

Form popularity

FAQ

The assignment of note and deed of trust refers to the legal transfer of the borrower’s payment obligation and the security interest in the property from one lender to another. This process allows lenders to sell or transfer their financial interests, and it can affect your rights as a borrower. If you experience issues with this assignment, consider addressing them through a lender complaint for rescission of trustee's deed with trust.

Yes, a lender can serve as the trustee in a deed of trust in California. However, this practice can lead to conflicts of interest and may raise concerns for borrowers. If you face issues related to this arrangement, you might consider filing a lender complaint for rescission of trustee's deed with trust for clarification and resolution.

The conditions for a lender complaint for rescission of trustee's deed with trust generally focus on timing and circumstances. For instance, you must act within a legally specified period after discovering the grounds for rescission. Moreover, you should fulfill any local or federal requirements that apply, as they can influence the outcome of your complaint.

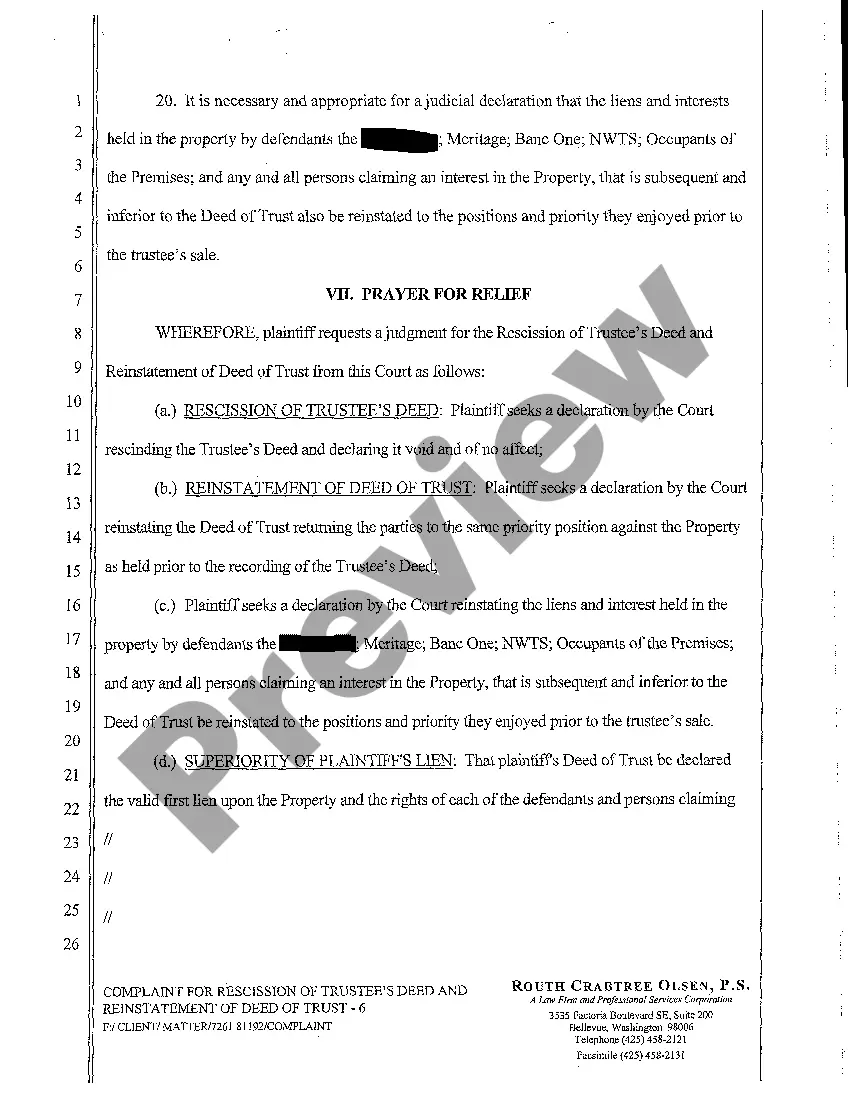

There are several grounds for a lender complaint for rescission of trustee's deed with trust. Common grounds include misrepresentation, lack of informed consent, or failure to provide required disclosures. Establishing these grounds can significantly aid your case, giving you a stronger position when requesting rescission.

The requisites for filing a lender complaint for rescission of trustee's deed with trust include clear evidence of your right to rescind. You must show that the lender did not comply with legal standards, such as giving you the correct disclosures. This can involve complex legal concepts, so consulting a trusted source like US Legal Forms can be beneficial.

When you file a lender complaint for rescission of trustee's deed with trust, specific requirements must be met. You typically need to provide written notice to the lender, along with detailed reasons why you believe rescission is warranted. Additionally, it is crucial to keep records of all communications and documents related to the transaction.

To initiate a lender complaint for rescission of trustee's deed with trust, certain rules apply. These rules often include specified time frames in which you can file your complaint, and the grounds for rescission must be clearly stated. Generally, you need to demonstrate that you have a valid reason to rescind the deed, based on your rights as a borrower.

When a trust deed ends, it typically means that the obligations it created are no longer in effect. This can occur through completion, rescission, or a legal decision. Understanding the implications of this situation is vital if you're addressing a lender complaint for rescission of trustee's deed with trust, as it impacts your legal standing.

The rescission of a trust deed refers to the process of invalidating the deed, effectively reversing the agreement between the involved parties. This may occur when a party can prove there were flaws in the execution of the deed, such as lack of consent or fraud. If you're facing a lender complaint for rescission of trustee's deed with trust, knowing how rescission works is crucial for your rights.

To terminate a deed of trust, parties must follow state-specific legal procedures, which often involve a formal request or filing. Termination may require the consent of the lender and should be documented to ensure clarity. Understanding how to navigate this process is essential if you are dealing with a lender complaint for rescission of trustee's deed with trust.