Oregon Promissory Note With Payment Schedule

Description

How to fill out Oregon Complaint - Action On Promissory Note?

Administration requires meticulousness and correctness.

If you do not manage filling in documents like Oregon Promissory Note With Payment Schedule regularly, it may lead to some misunderstandings.

Choosing the appropriate sample from the outset will guarantee that your document submission will proceed smoothly and avert any troubles of resending a file or repeating the same task from scratch.

If you are not a subscribed user, finding the needed template may require a few additional steps.

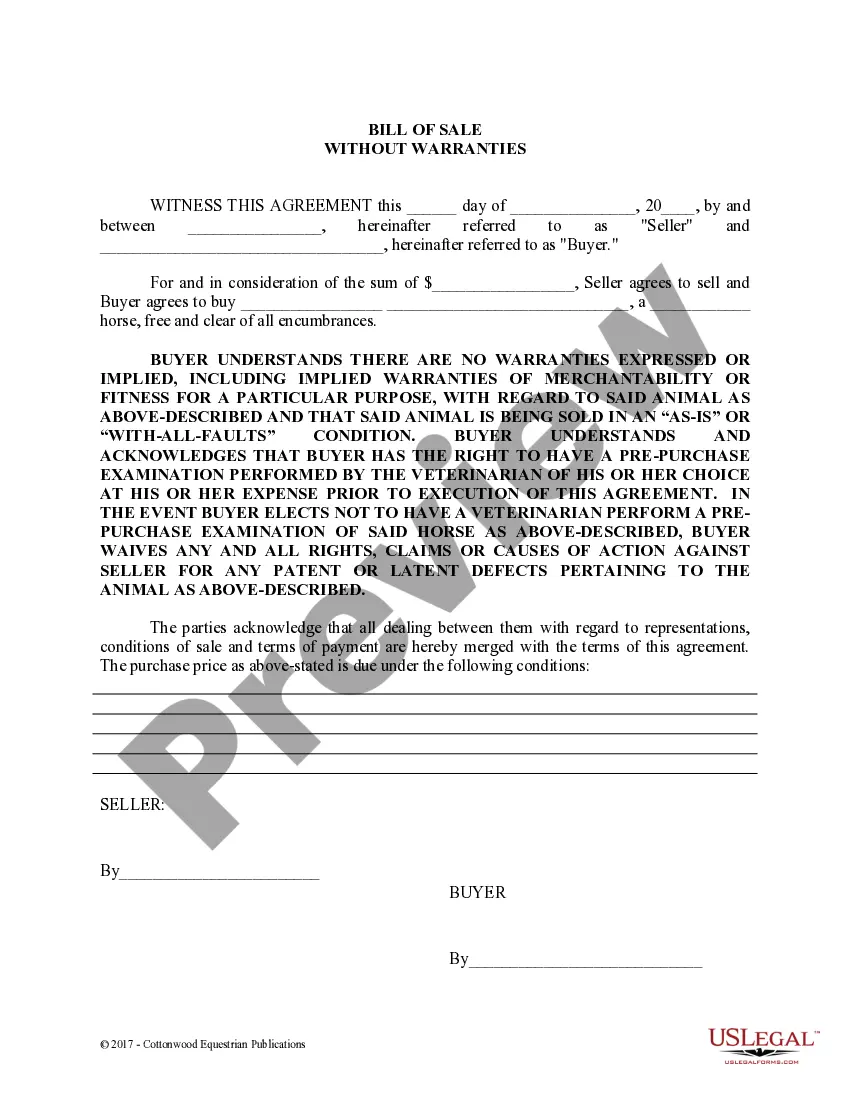

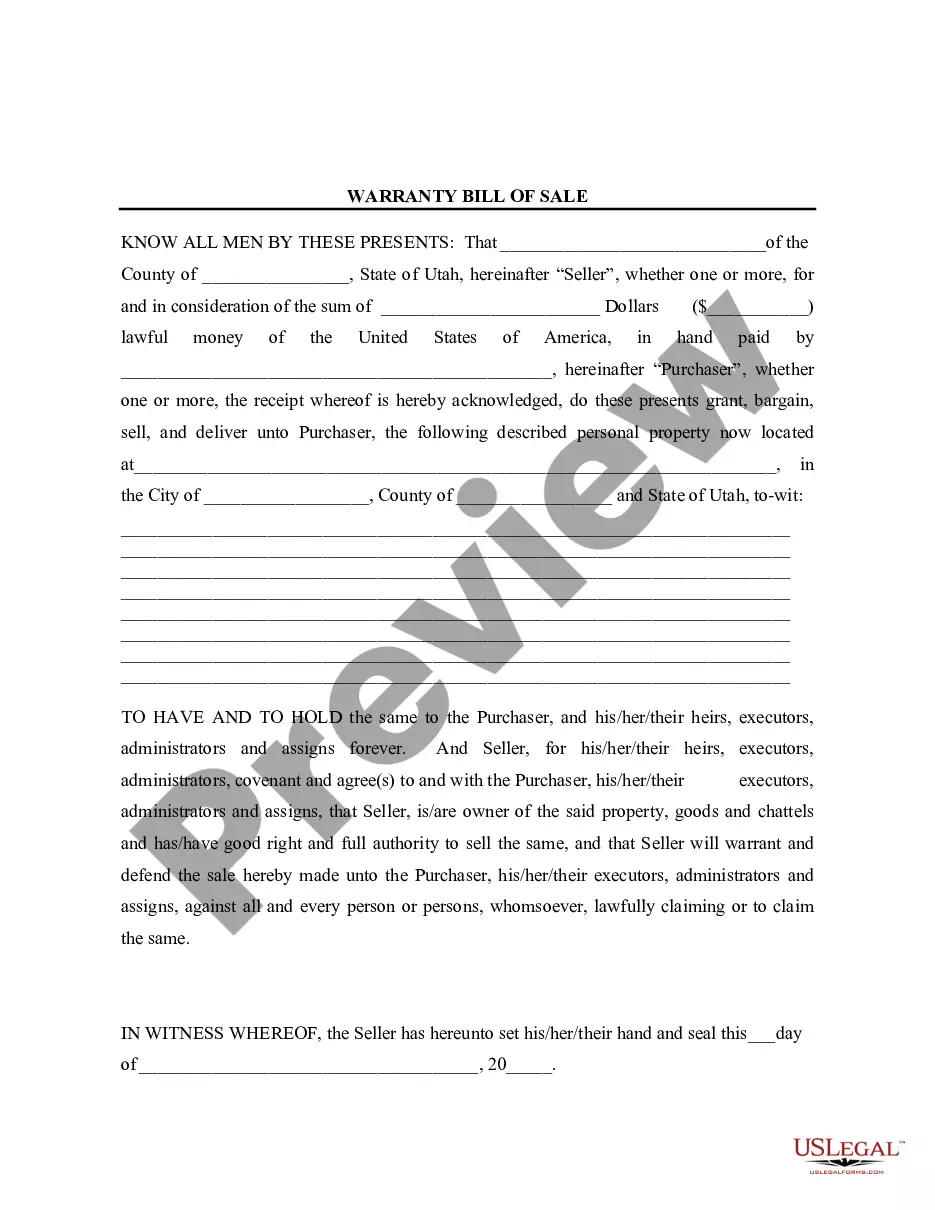

- Acquire the suitable sample for your forms at US Legal Forms.

- US Legal Forms is the largest online forms repository that provides over 85 thousand templates for different fields.

- You can access the latest and most suitable version of the Oregon Promissory Note With Payment Schedule by simply searching for it on the website.

- Find, save, and download forms in your profile or review the description to ensure you have the right one ready.

- With an account at US Legal Forms, you can gather, keep in one place, and sift through the templates you save for easy access.

- When on the website, click the Log In button to authenticate.

- Next, visit the My documents page, where your document list is maintained.

- Review the form descriptions and download the ones you need at any time.

Form popularity

FAQ

Generally, promissory notes do not need to be notarized. Typically, legally enforceable promissory notes must be signed by individuals and contain unconditional promises to pay specific amounts of money.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

There is no legal requirement for most Oregon promissory notes to be notarized. Promissory notes related to real estate loans may require notarization. Most promissory notes in Oregon need to be signed and dated by the borrower and any applicable co-signer.

3. Demand For Payment on Demand Promissory Note InstructionsWrite in a deadline by which you must receive full payment. This deadline may be provided in the terms of the note itself.Consider sending your demand by registered mail.If the deadline you established has passed, do not be afraid to contact a lawyer.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.