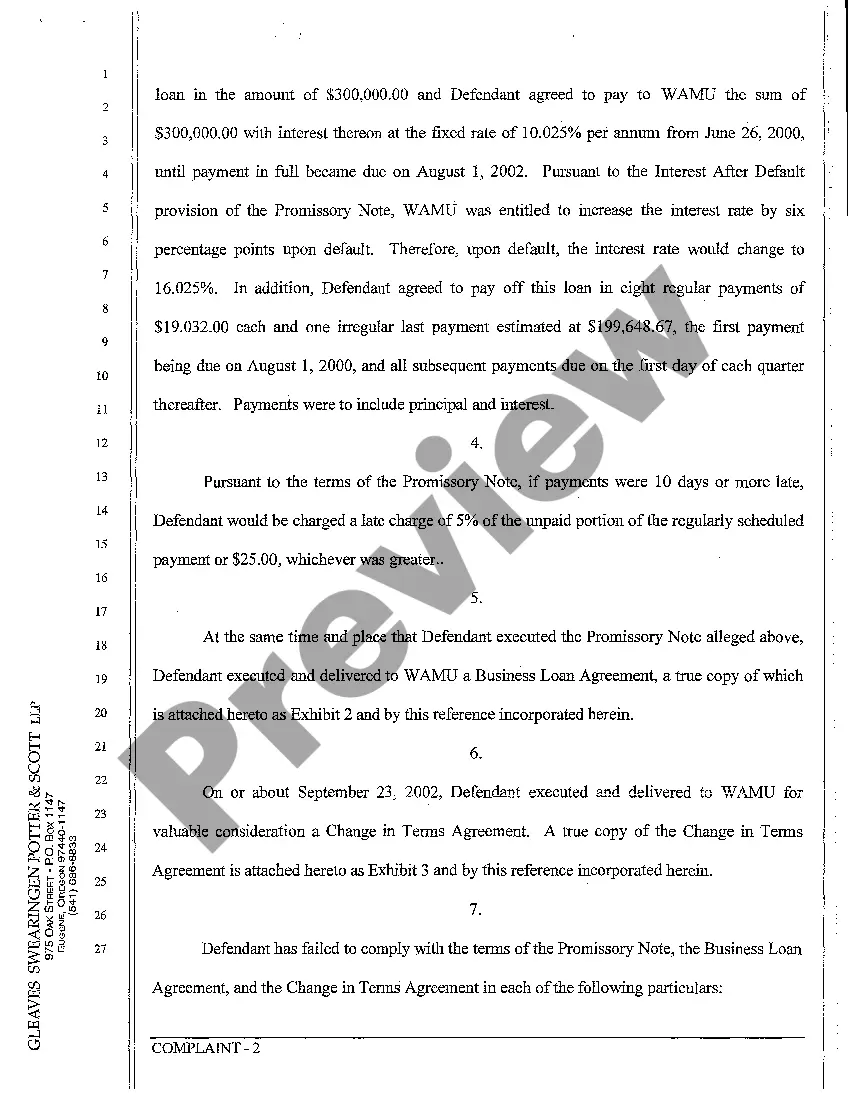

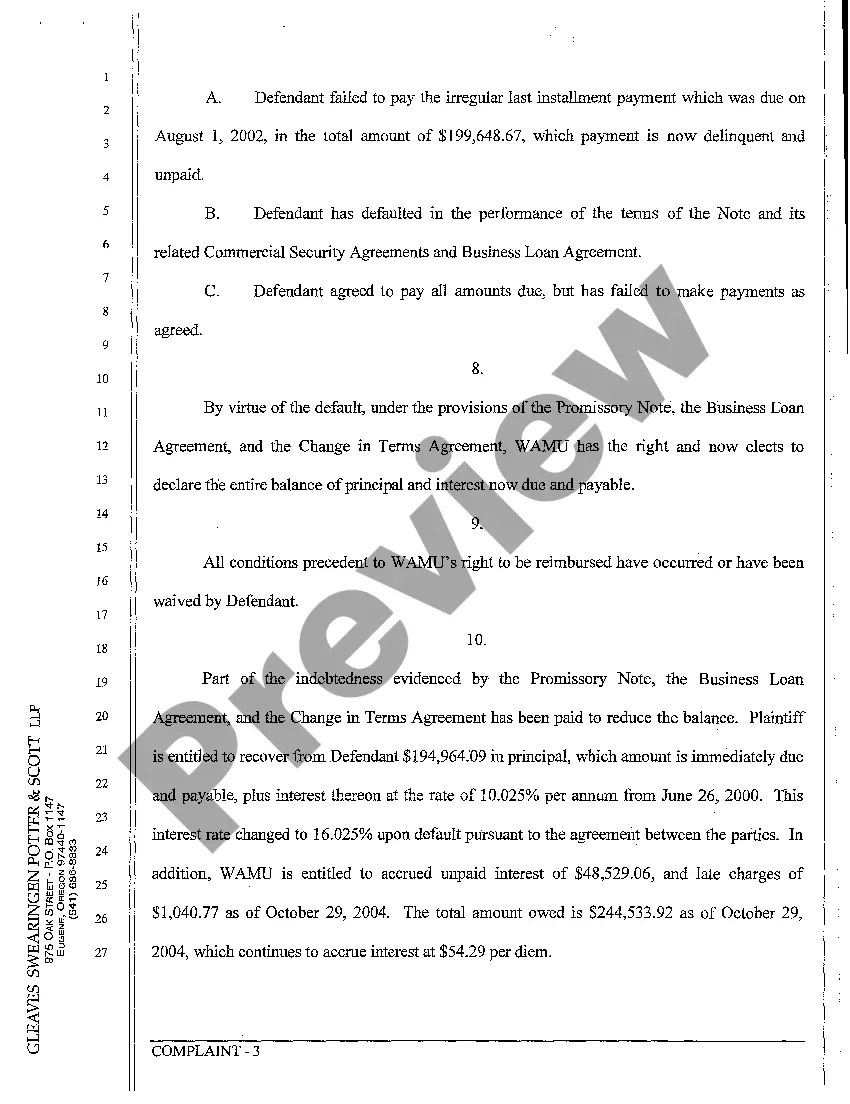

Oregon Promissory Note With Balloon Payment

Description

How to fill out Oregon Complaint - Action On Promissory Note?

There’s no further justification to squander time searching for legal paperwork to adhere to your local state laws. US Legal Forms has gathered all of them in a single location and enhanced their accessibility.

Our platform offers over 85,000 templates for any business and individual legal scenarios categorized by state and area of use. All forms are expertly crafted and verified for authenticity, allowing you to be confident in acquiring a current Oregon Promissory Note With Balloon Payment.

If you are acquainted with our platform and already possess an account, ensure your subscription is active before accessing any templates. Log In to your account, choose the document, and click Download. You can also revisit all saved documents whenever necessary by accessing the My documents section in your profile.

Print your form to fill it out manually or upload the template if you prefer to complete it in an online editor. Preparing official documents under federal and state laws and regulations is quick and straightforward with our library. Experience US Legal Forms today to keep your documentation organized!

- If you haven’t used our platform before, it will require a few more steps to complete the process.

- Here’s how new users can find the Oregon Promissory Note With Balloon Payment in our catalog.

- Examine the page content carefully to ensure it contains the sample you need.

- To do this, utilize the form description and preview options if available.

- Make use of the Search bar above to look for another sample if the previous one did not meet your needs.

- Click Buy Now next to the template name as soon as you locate the correct one.

- Select the most appropriate pricing plan and either register for an account or Log In.

- Complete the payment for your subscription with a credit card or through PayPal to proceed.

- Choose the file format for your Oregon Promissory Note With Balloon Payment and download it to your device.

Form popularity

FAQ

Typically, a balloon payment would represent a percentage of the purchase price of the vehicle. For example, for a car costing R300 000, a 20 % balloon payment would work out at R60 000. This would be paid in one lump sum at the end of the contract period for example 60 months or five years after purchase.

A Promissory Note with Balloon Payments is a loan contract that enables a lender set loan terms with one or more larger payments at the end. This lending document helps you to clarify the terms of a loan, define the payment schedule, and provide an amortization table, if the loan includes interest.

Typically, a balloon payment would represent a percentage of the purchase price of the vehicle. For example, for a car costing R300 000, a 20 % balloon payment would work out at R60 000. This would be paid in one lump sum at the end of the contract period for example 60 months or five years after purchase.

We can use the below formula to calculate the future value of the balloon payment to be made at the end of 10 years: FV = PV(1+r)nP(1+r)n1/r The rate of interest per annum is 7.5%, and monthly it shall be 7.5%/12, which is 0.50%.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.