Oregon And Living Trust And Assignment Of Property With Liabilities

Description

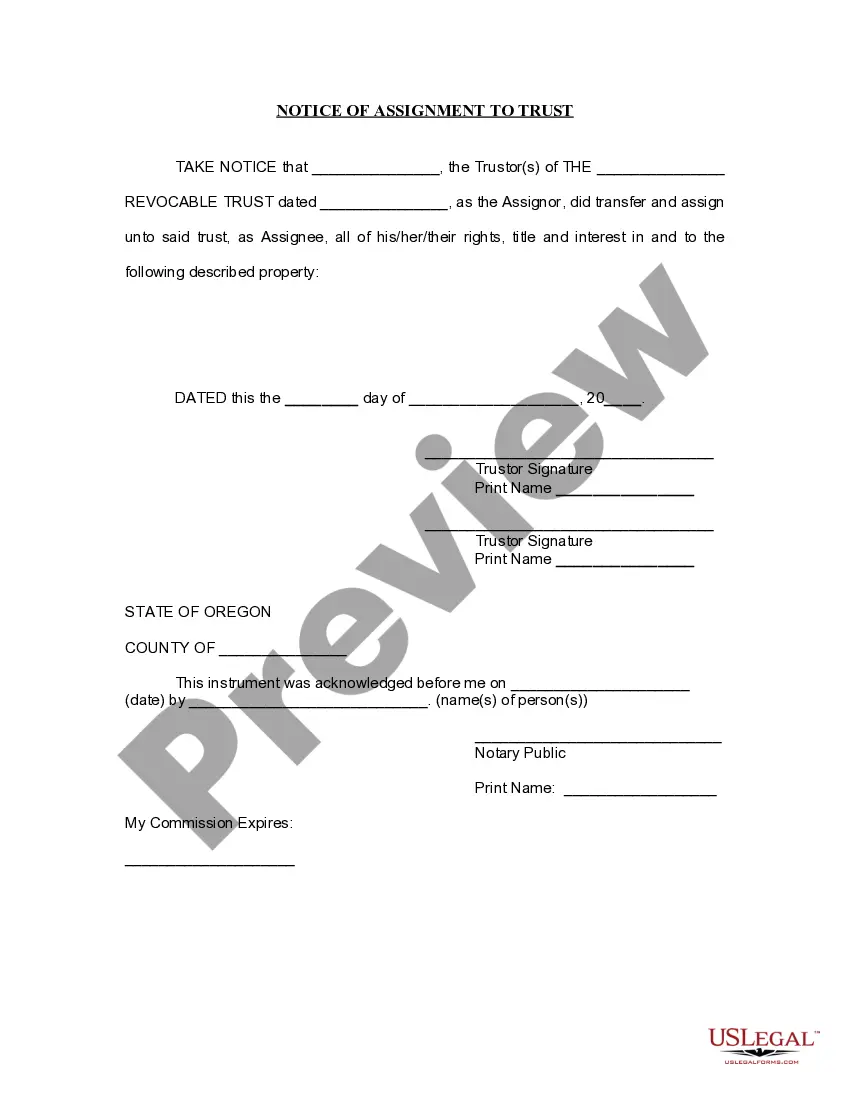

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

Form popularity

FAQ

Transferring debt to a trust is generally not possible since debts such as loans remain personal liabilities. However, you can assign certain assets to the trust that may help mitigate the impact of your liabilities. It’s crucial to understand that while the debt cannot be transferred, your trust can be structured to manage assets effectively. For personalized strategies, consider the guidance provided by USLegalForms to navigate the complexities of living trusts in Oregon.

Certain assets typically cannot be placed in a trust, such as retirement accounts like 401(k)s unless you designate the trust as a beneficiary. Additionally, life insurance policies often cannot be transferred into a trust without specific provisions. It’s also wise to be cautious with assets that have restrictions or are currently tied up in debt obligations. By carefully reviewing your assets with USLegalForms, you can identify what can be included in your Oregon living trust.

To transfer your property to a trust in Oregon, start by creating the trust document that outlines its terms. Next, you'll need to execute a deed that conveys the property from your name to the trust name, ensuring it’s recorded with the local county. It’s important to consult with professionals who can guide you through Oregon’s specific requirements. USLegalForms offers resources that make this process easier for establishing your living trust.

Assets are assigned to a trust through a legal process that requires transferring ownership from the original owner to the trust. This involves preparing and executing necessary legal documents like deeds or assignment forms, depending on the type of asset. It's crucial to ensure that all intended assets are properly documented within the trust to avoid complications. Engaging with USLegalForms can provide you with the tools needed for the correct assignment of property with liabilities.

One major mistake parents make when setting up a trust fund is failing to fund the trust properly. Many assume that creating the trust document is sufficient, but without transferring assets, the trust remains empty. Additionally, neglecting to regularly update the trust as family circumstances change can lead to complications later on. By utilizing USLegalForms, you can avoid these pitfalls and ensure your Oregon living trust is fully functional.

Transferring items to a trust involves changing the ownership from your name to the name of the trust. Begin by gathering the necessary documentation for each item, such as deeds for real estate and titles for vehicles. You may also need to update trust beneficiary designations for bank accounts and investment assets. With the right guidance from USLegalForms, you can execute these transfers effectively within your Oregon living trust.

To assign assets to a trust, you must first create the trust document, specifying the terms and conditions. Next, you will need to transfer ownership of the assets into the trust’s name. This process involves completing title changes for real estate and updating beneficiary designations for financial accounts. Utilizing resources from USLegalForms can help simplify the assignment of property with liabilities in your Oregon living trust.

Yes, you can write your own trust in Oregon, but there are specific legal requirements you must meet. It's important to ensure that the trust complies with Oregon's regulations for living trusts and assignment of property with liabilities. While drafting your own trust may seem straightforward, using a platform like US Legal Forms can guide you through the process. This way, you can ensure that your trust is valid and meets all legal standards.

Transferring assets to a trust is generally not considered a taxable event in Oregon. However, if the trust generates income, that income may be subject to taxation. It's crucial to understand how Oregon's laws regarding living trusts and assignment of property with liabilities may affect your tax obligations. Consulting with a legal expert can help you navigate these considerations more effectively.

One downside of a living trust is that it may not cover all of your assets automatically, especially when it comes to property with liabilities. If you fail to transfer all relevant assets into the trust, those could go through probate, which can be time-consuming and costly. Moreover, while a living trust can help avoid probate, it does not provide asset protection from creditors. Understanding these aspects thoroughly is essential, and uslegalforms can assist you in recognizing the risks associated with setting up a living trust in Oregon.