Dissolution Dissolve Corporation With The Eu

Description

How to fill out Oregon Dissolution Package To Dissolve Corporation?

- Log in to your US Legal Forms account if you are a returning user. Ensure your subscription is active; renew it if necessary.

- For new users, browse the extensive library and use the preview feature to select the correct dissolution form that aligns with your requirements and jurisdiction.

- If the form you need isn't available, utilize the search bar to find a different template that meets your needs.

- Proceed by clicking the Buy Now button, selecting your preferred subscription plan, and creating an account to gain access to their resources.

- Complete your purchase by entering your payment details or opting for PayPal to finalize your subscription.

- Download your chosen form and save it for future use. You can always access it from the My Forms section in your profile.

Utilizing US Legal Forms allows individuals and attorneys to access a vast selection of over 85,000 legal forms easily. The platform is designed to ensure that your documents are filled out correctly, which is crucial for compliance and legal soundness.

Take the stress out of dissolving your corporation. Start your journey today with US Legal Forms for a smoother, more efficient experience.

Form popularity

FAQ

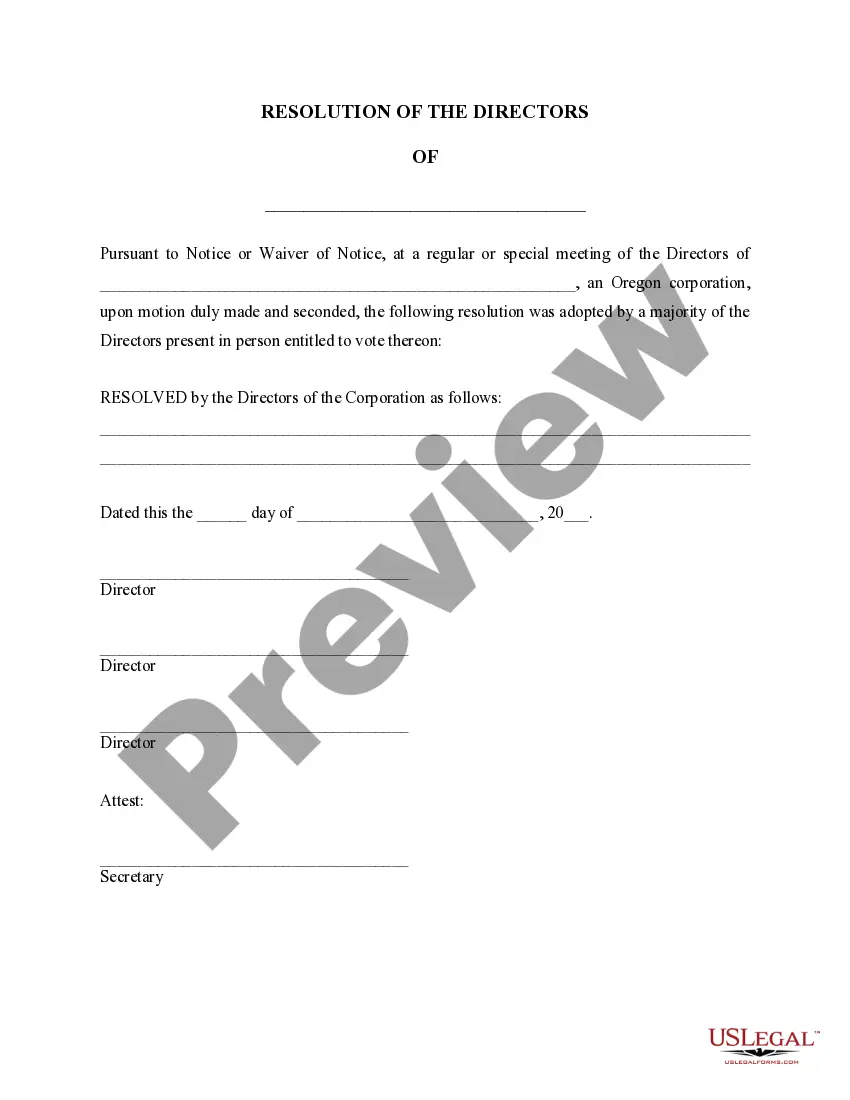

A corporate resolution to dissolve is a formal decision made by a corporation's board of directors or shareholders to initiate the process of dissolution. This resolution is essential as it provides the legal authority to proceed with winding up business operations. It outlines the decision and ensures all necessary parties are informed and compliant with the dissolution to dissolve corporation with the EU. By utilizing tools from US Legal Forms, you can efficiently draft and manage this essential resolution.

When considering the dissolution of a corporation, there are several methods available. Common approaches include voluntary dissolution based on shareholder approval and administrative dissolution initiated by the state for failing to meet regulatory requirements. Each method has its specifics, and it's crucial to follow the correct procedures to avoid complications. Using platforms like US Legal Forms can help guide you through the necessary documentation required for the dissolution to dissolve corporation with the EU.

To dissolve a US corporation, you need to follow a structured process. Start by holding a meeting with the shareholders to vote on the dissolution. Once approved, you must file dissolution documents with your state and notify relevant parties of the decision. This step is crucial, as it ensures a legitimate and orderly dissolution when you want to dissolve a corporation with interests in the EU.

The dissolution process of a company involves several key steps. Initially, the owners or board of the company must make a formal decision to dissolve. Then, they must file the necessary paperwork with the state, ensuring compliance with local requirements. Throughout this procedure, it is essential to settle outstanding debts and obligations, especially when considering the dissolution of a corporation with the EU.

There are generally three modes of dissolving a corporation: voluntary dissolution, involuntary dissolution, and administrative dissolution. Voluntary dissolution occurs when the shareholders agree to end the business, while involuntary dissolution can happen due to legal issues. Understanding these methods allows you to choose the appropriate way to dissolve a corporation with the EU.

You can terminate a corporation with the IRS by filing Form 966, which informs the IRS of your decision to dissolve. Ensure that all tax returns have been filed and that any final obligations are met. This is a necessary step in the formal process to dissolve a corporation with the EU.

To notify the IRS that your business is closed, you should file your final tax return and include a note indicating that it is your last return. Additionally, you can send a letter to the IRS stating your business's name, address, and EIN. This communication is vital in the process to dissolve a corporation with the EU.

A corporation completes its dissolution by first obtaining the approval of its shareholders, followed by filing the articles of dissolution with the state. It is also important to notify creditors and settle accounts. Following this process helps ensure a compliant dissolution to dissolve a corporation with the EU.

Dissolving a corporation can have several tax consequences, including potential capital gains taxes if assets are sold. It is crucial to settle any outstanding tax liabilities before the dissolution. Understanding these implications is key for anyone looking to dissolve a corporation with the EU.

Yes, you should cancel your Employer Identification Number (EIN) when you close your business. However, you do not need to cancel it until you have completed the dissolution process. Properly managing your EIN is part of the overall procedure to dissolve a corporation with the EU.