Difference Between Cosigner And Guarantor

Description

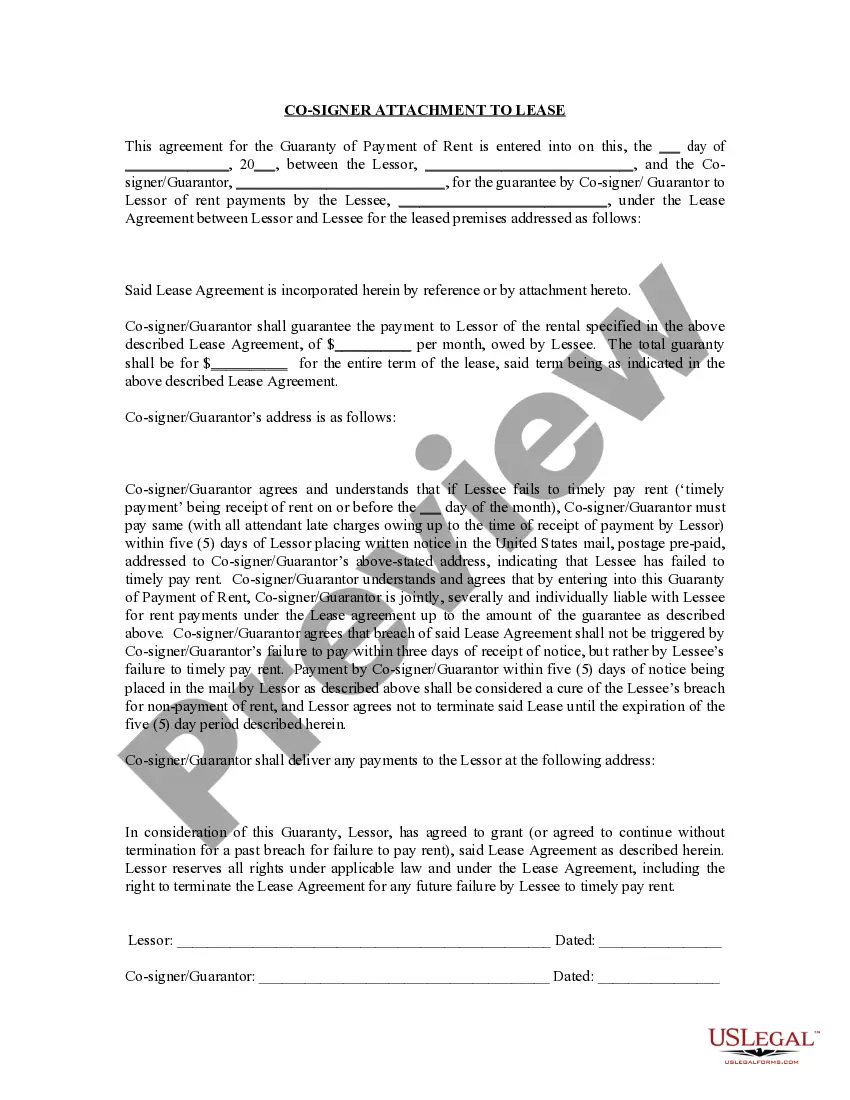

How to fill out Oregon Guaranty Attachment To Lease For Guarantor Or Cosigner?

The Distinction Between Cosigner And Guarantor you observe on this page is a versatile legal template crafted by expert attorneys in accordance with national and local laws and regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal practitioners with more than 85,000 validated, state-specific forms for any commercial and personal circumstances. It’s the quickest, most straightforward, and most reliable method to acquire the documents you require, as the service assures the utmost level of data security and anti-malware safeguards.

Register for US Legal Forms to have confirmed legal templates for all of life’s situations readily available.

- Examine the document you need and verify it.

- Select the pricing plan that fits your needs and set up an account.

- Choose the format you prefer for your Difference Between Cosigner And Guarantor (PDF, Word, RTF) and store the template on your device.

- Fill out and sign the document.

- Access your paperwork again whenever necessary.

Form popularity

FAQ

Deciding whether to have a cosigner or guarantor ultimately depends on your financial situation and the lender's requirements. A cosigner provides immediate backing, which may enhance approval chances, whereas a guarantor offers a safety net if the borrower defaults. Understanding the difference between cosigner and guarantor can help you make a more informed choice. For personalized advice tailored to your situation, consider exploring uslegalforms.

One downside of being a guarantor is that your credit could be impacted if the borrower fails to meet their obligations. Unlike a cosigner, your liability is secondary, but it can still affect your financial standing. This distinction emphasizes the difference between cosigner and guarantor, which you should carefully consider. If you're uncertain, uslegalforms can provide resources to help you understand your responsibilities.

Yes, having a cosigner can increase your chances of approval for loans or leases. Lenders see cosigners as additional security, reducing their risk. This advantage highlights the difference between cosigner and guarantor, as a cosigner's obligation is immediate and comprehensive. If you need assistance navigating these options, uslegalforms can guide you through the process.

Choosing between being a cosigner or a guarantor depends on your relationship with the borrower and the specific agreement. A cosigner shares liability equally, while a guarantor only steps in if the borrower defaults. Hence, the difference between cosigner and guarantor can influence your financial responsibilities. Assess your comfort level with risk before deciding which role suits you better.

Being a guarantor itself typically doesn't show up on your credit record with credit reference agencies. However, there are other ways that being a guarantor might impact your report: You will be liable for making the loan repayments if the borrower is unable to do so, and this will appear on your credit report.

A cosigner is essentially a roommate and has equal rights to the space as other tenants. A guarantor, on the other hand, assumes financial responsibility for the lease agreement but doesn't live in the home or have the right to occupy the space ? even if the original tenant fails to pay rent!

To collect on the guarantee, the lender would have to prove the default by the underlying borrower, which, of course, would not be the case with the co-borrower arrangement. Obviously, having a co-borrower would appear to be better, from a lender's point-of-view, than having a guarantor.

Having a co-applicant can make an application more attractive since it involves additional sources of income, credit, or assets. A co-applicant has more rights and responsibilities than a co-signer or guarantor.

And while the terms are similar, a co-borrower ? or joint applicant ? shares ownership of the loan and assumes responsibility for payments from the start. On the other hand, a co-signer is only liable for the loan if the primary borrower fails to make payments.