Cosigner Vs Guarantor

Description

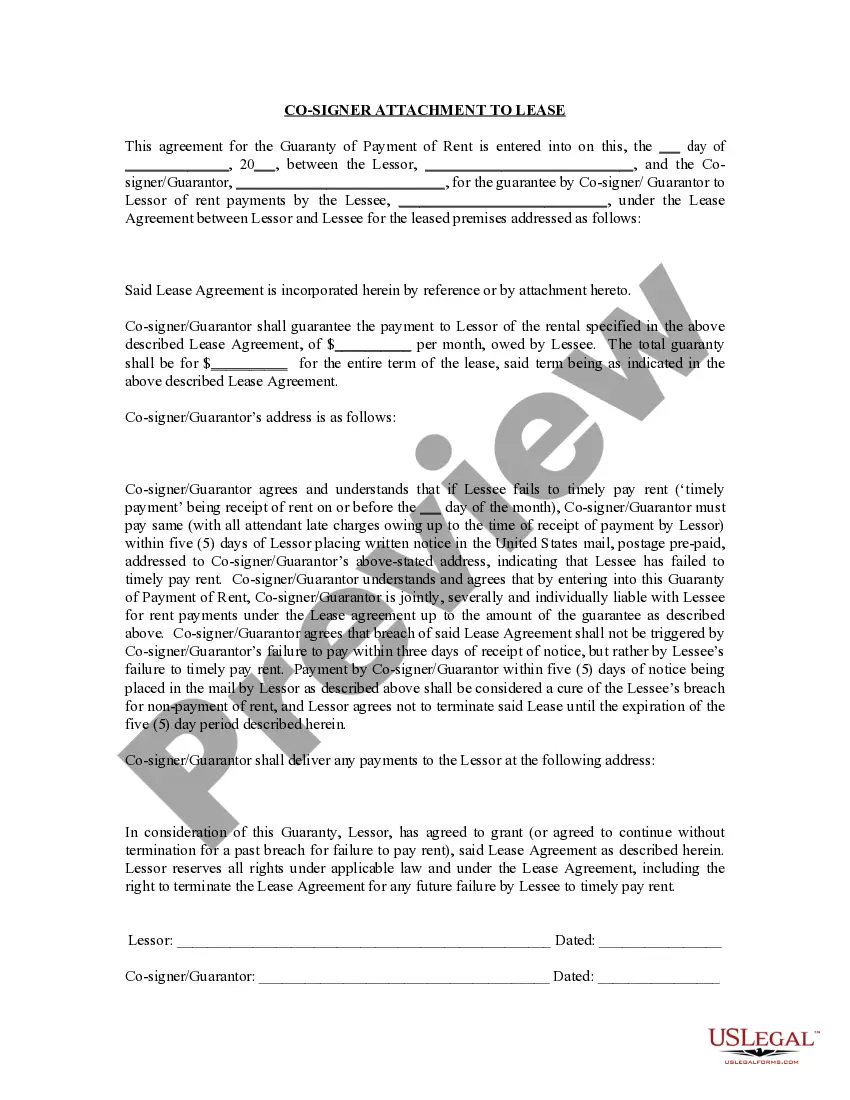

How to fill out Oregon Guaranty Attachment To Lease For Guarantor Or Cosigner?

Acquiring legal templates that adhere to federal and state laws is essential, and the web provides numerous choices to select from.

However, what is the benefit of spending time searching for the properly drafted Cosigner Vs Guarantor example online if the US Legal Forms online library already has such templates gathered in one location.

US Legal Forms is the largest online legal directory with over 85,000 fillable templates created by attorneys for any business and personal situation.

Review the template using the Preview feature or through the text description to confirm it meets your requirements.

- They are easy to navigate with all documents categorized by state and intended use.

- Our experts keep up with legal updates, ensuring that your documents are always current and compliant when obtaining a Cosigner Vs Guarantor from our site.

- Acquiring a Cosigner Vs Guarantor is straightforward and quick for both existing and new users.

- If you already possess an account with an active subscription, Log In and retrieve the document sample you need in the appropriate format.

- If you are unfamiliar with our website, follow the steps below.

Form popularity

FAQ

One downside of being a guarantor is the potential impact on your credit score if the borrower defaults. You may also face financial strain if you need to step in and cover payments. Additionally, being a guarantor can complicate your financial commitments, as lenders may view you as responsible for the debt. Understanding these risks is essential when considering the role of a cosigner vs guarantor.

Signing as a guarantor can impact your credit. If the primary borrower misses payments, it could reflect negatively on your credit report. However, if they make timely payments, it can help establish or improve your credit score. Knowing the implications of being a guarantor versus a cosigner is crucial for making informed financial decisions.

To be a guarantor, you typically need a stable income that meets the lender's requirements. Lenders often look for a certain debt-to-income ratio to ensure you can cover the borrower’s obligations if needed. It's important to have enough income to comfortably support the payments in case the primary borrower defaults. Understanding the differences between a cosigner vs guarantor can help clarify your financial responsibilities.

Having a co-applicant can make an application more attractive since it involves additional sources of income, credit, or assets. A co-applicant has more rights and responsibilities than a co-signer or guarantor.

To qualify as a cosigner, you'll need to provide financial documentation with the same information needed when you apply for a loan. This may include: Income verification. You may need to provide income tax returns, pay stubs, W2 forms or other documentation.

Once they have found a co-signer, treat them as an additional tenant and have them fill out an online rental application, and run a screening report to ensure they are financially fit to be a co-signer.

The primary difference between a co-signer and a guarantor is how soon each individual becomes responsible for the borrower's debt. A co-signer is responsible for every payment that a borrower misses. However, a guarantor only assumes responsibility if the borrower falls into total default.

A guarantor is an individual that agrees to pay a borrower's debt if the borrower defaults on their obligation. A guarantor is not a primary party to the agreement but is considered to be an additional comfort for a lender.