Co-signer Or Guarantor On Any Debt

Description

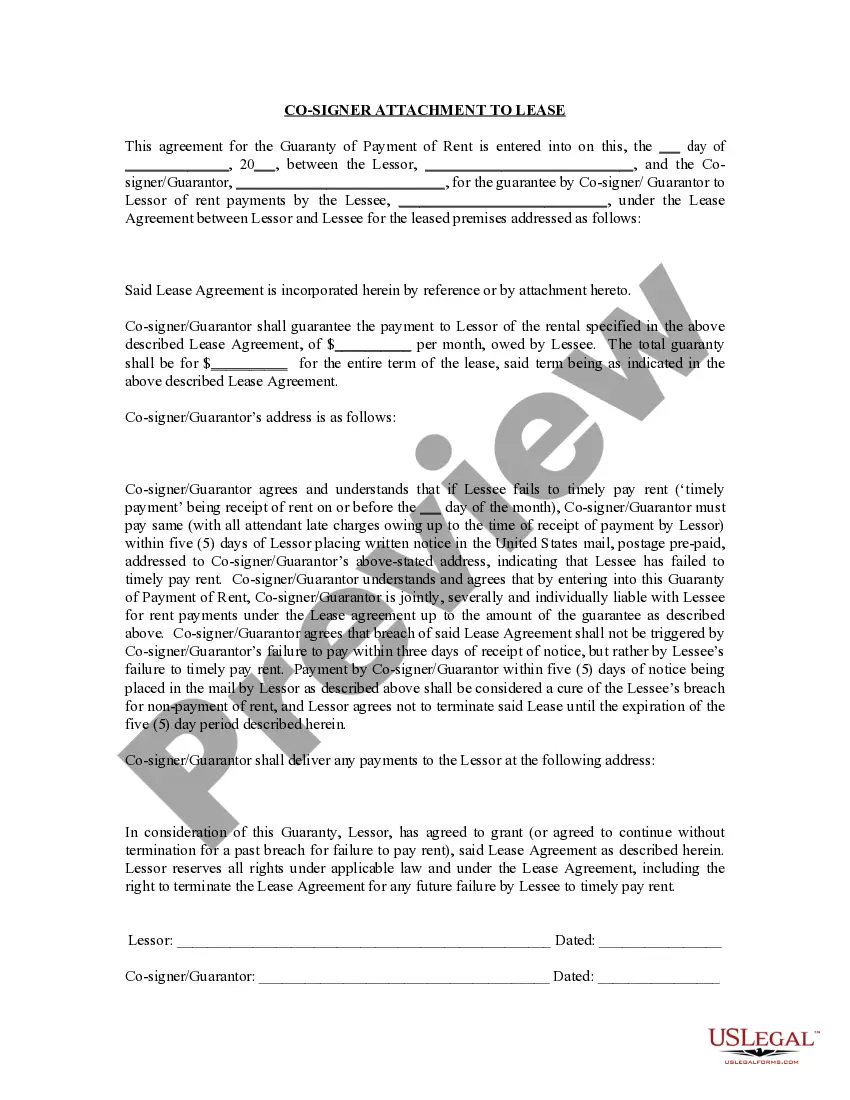

How to fill out Oregon Guaranty Attachment To Lease For Guarantor Or Cosigner?

Whether for business purposes or for personal affairs, everyone has to deal with legal situations at some point in their life. Completing legal documents needs careful attention, starting with choosing the proper form sample. For example, when you pick a wrong version of a Co-signer Or Guarantor On Any Debt, it will be turned down once you send it. It is therefore essential to get a reliable source of legal documents like US Legal Forms.

If you need to get a Co-signer Or Guarantor On Any Debt sample, stick to these simple steps:

- Get the template you need by using the search field or catalog navigation.

- Examine the form’s information to ensure it matches your case, state, and county.

- Click on the form’s preview to view it.

- If it is the wrong document, return to the search function to find the Co-signer Or Guarantor On Any Debt sample you need.

- Download the template when it meets your needs.

- If you already have a US Legal Forms account, just click Log in to access previously saved templates in My Forms.

- If you don’t have an account yet, you can download the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the account registration form.

- Choose your payment method: use a credit card or PayPal account.

- Choose the document format you want and download the Co-signer Or Guarantor On Any Debt.

- Once it is saved, you can complete the form with the help of editing software or print it and complete it manually.

With a substantial US Legal Forms catalog at hand, you never have to spend time looking for the appropriate template across the web. Make use of the library’s simple navigation to get the correct form for any situation.

Form popularity

FAQ

What does being a guarantor mean? Being a guarantor involves helping someone else get credit, such as a loan or mortgage. Acting as a guarantor, you ?guarantee? someone else's loan or mortgage by promising to repay the debt if they can't afford to. It's wise to only agree to being a guarantor for someone you know well.

A cosigner on a rental property is someone who signs a lease with you and assumes equal liability for paying the rent, while a guarantor is only liable to make payments when the primary borrower can't or won't pay.

Write out your qualifications as a guarantor -- your income, assets and other personal details supporting why you would be able to take responsibility should the tenant or borrower fail to do so. You can also list your accountant to testify to your financial state, as well as other character references.

A guarantor's form should include a space to fill in the home address, work address, phone number, and email address. The contact details are what will be used to contact the guarantor in the future if the principal fails to meet agreement terms.

The primary difference between a co-signer and a guarantor is how soon each individual becomes responsible for the borrower's debt. A co-signer is responsible for every payment that a borrower misses. However, a guarantor only assumes responsibility if the borrower falls into total default.