Wat Is Operational Lease

Description

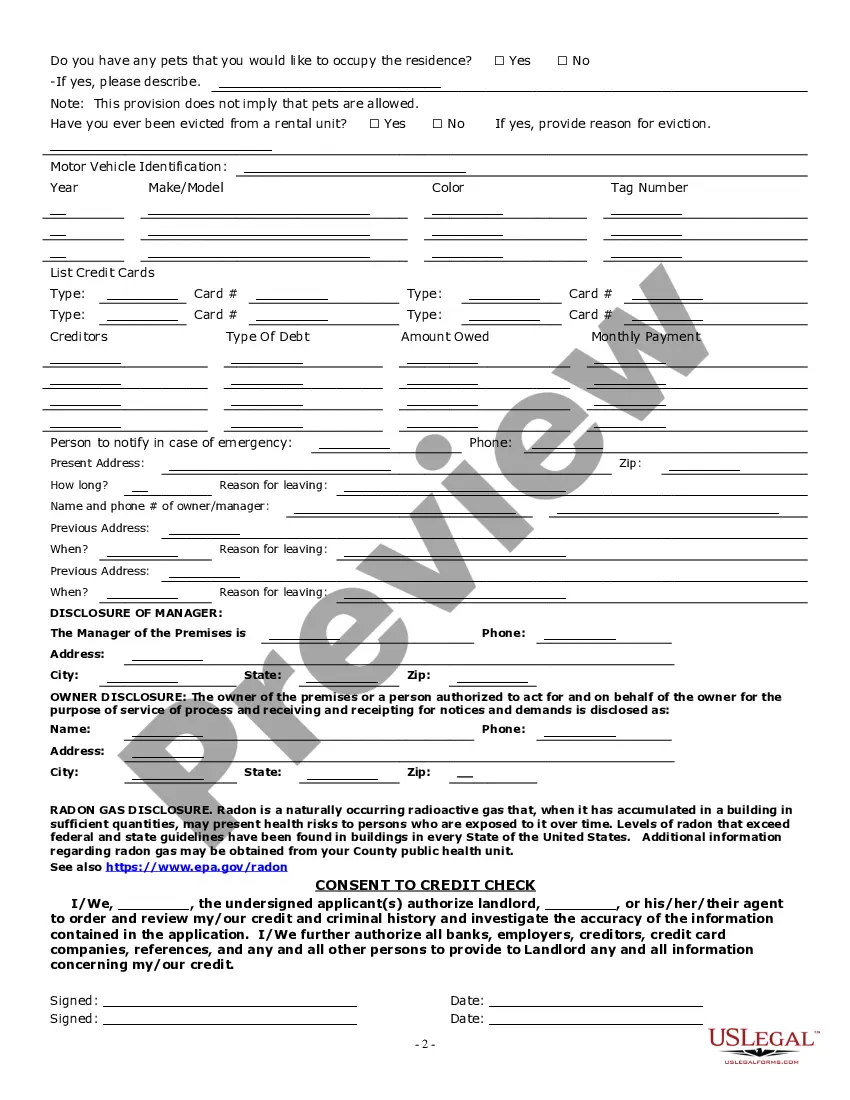

How to fill out Oregon Residential Rental Lease Application?

Whether for business purposes or for personal affairs, everybody has to handle legal situations sooner or later in their life. Filling out legal paperwork requires careful attention, starting with choosing the appropriate form template. For example, when you select a wrong version of a Wat Is Operational Lease, it will be rejected once you send it. It is therefore essential to get a dependable source of legal documents like US Legal Forms.

If you have to get a Wat Is Operational Lease template, stick to these easy steps:

- Find the sample you need using the search field or catalog navigation.

- Check out the form’s information to make sure it matches your case, state, and region.

- Click on the form’s preview to see it.

- If it is the incorrect document, go back to the search function to locate the Wat Is Operational Lease sample you need.

- Download the template when it meets your requirements.

- If you already have a US Legal Forms account, simply click Log in to access previously saved documents in My Forms.

- If you don’t have an account yet, you can obtain the form by clicking Buy now.

- Select the correct pricing option.

- Complete the account registration form.

- Choose your payment method: you can use a credit card or PayPal account.

- Select the document format you want and download the Wat Is Operational Lease.

- When it is downloaded, you are able to fill out the form with the help of editing applications or print it and complete it manually.

With a large US Legal Forms catalog at hand, you never need to spend time searching for the right sample across the internet. Use the library’s straightforward navigation to find the right template for any occasion.

Form popularity

FAQ

Definition: Operating lease is a contract wherein the owner, called the Lessor, permits the user, called the Lesse, to use of an asset for a particular period which is shorter than the economic life of the asset without any transfer of ownership rights.

Leases have two classifications under US GAAP . A capital lease, now known as a finance lease, resembles a financed purchase; the lease term spans most of the asset's useful life. An operating lease resembles a rental agreement in that the asset is used for a set time with useful life remaining at lease end.

An operating lease is a contract that permits the use of an asset without transferring the ownership rights of said asset. A finance lease is a contract that permits the use of an asset and transfers ownership after the lease period is complete, and the lessor meets all other contract obligations.

An operating lease is an agreement to use and operate an asset without the transfer of ownership. Common assets that are leased include real estate, automobiles, aircraft, or heavy equipment.

Operating Lease Accounting can be done by considering that the lessor owns the property and the lessee only uses it for a fixed time. The lessee records rental payments as expenses in the books of accounts. In contrast, the lessor records the property as an asset and depreciates it over its useful life.