Lease Or Finance For Car

Description

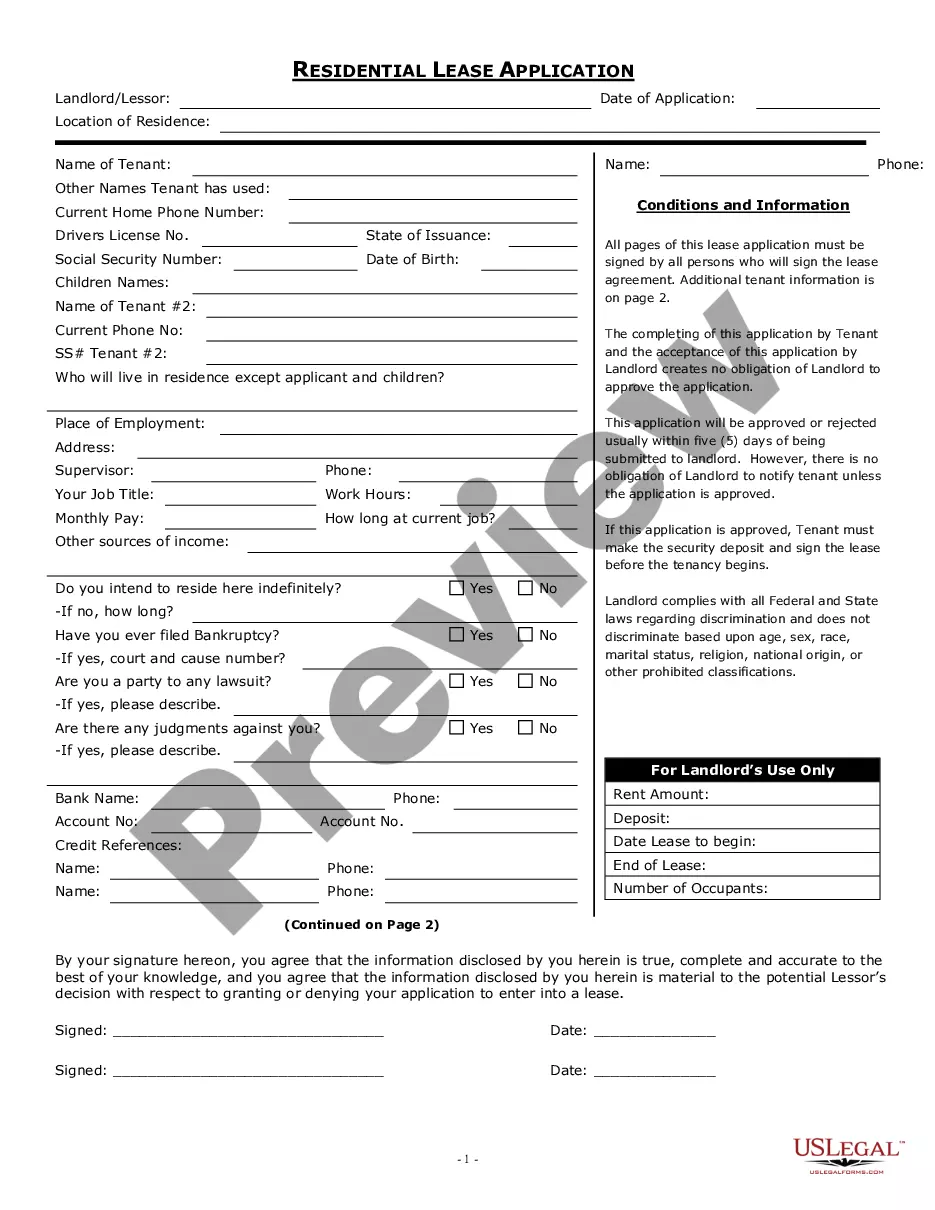

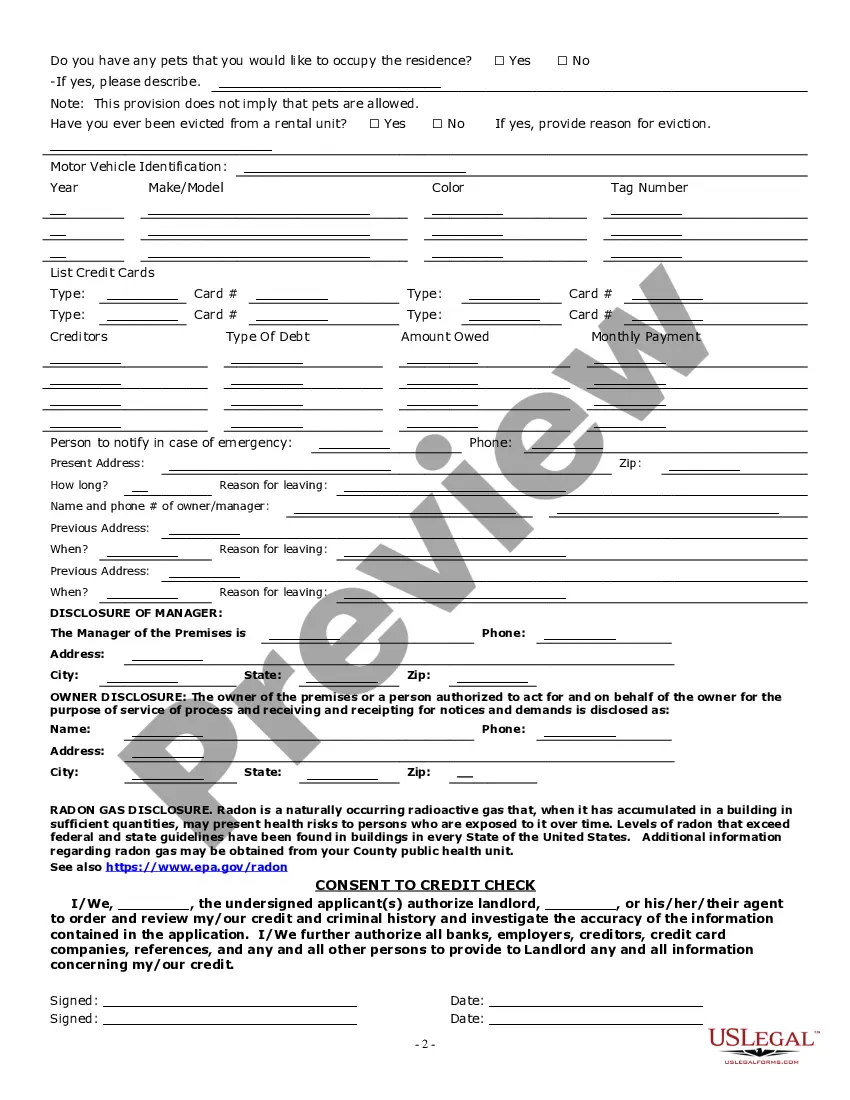

How to fill out Oregon Residential Rental Lease Application?

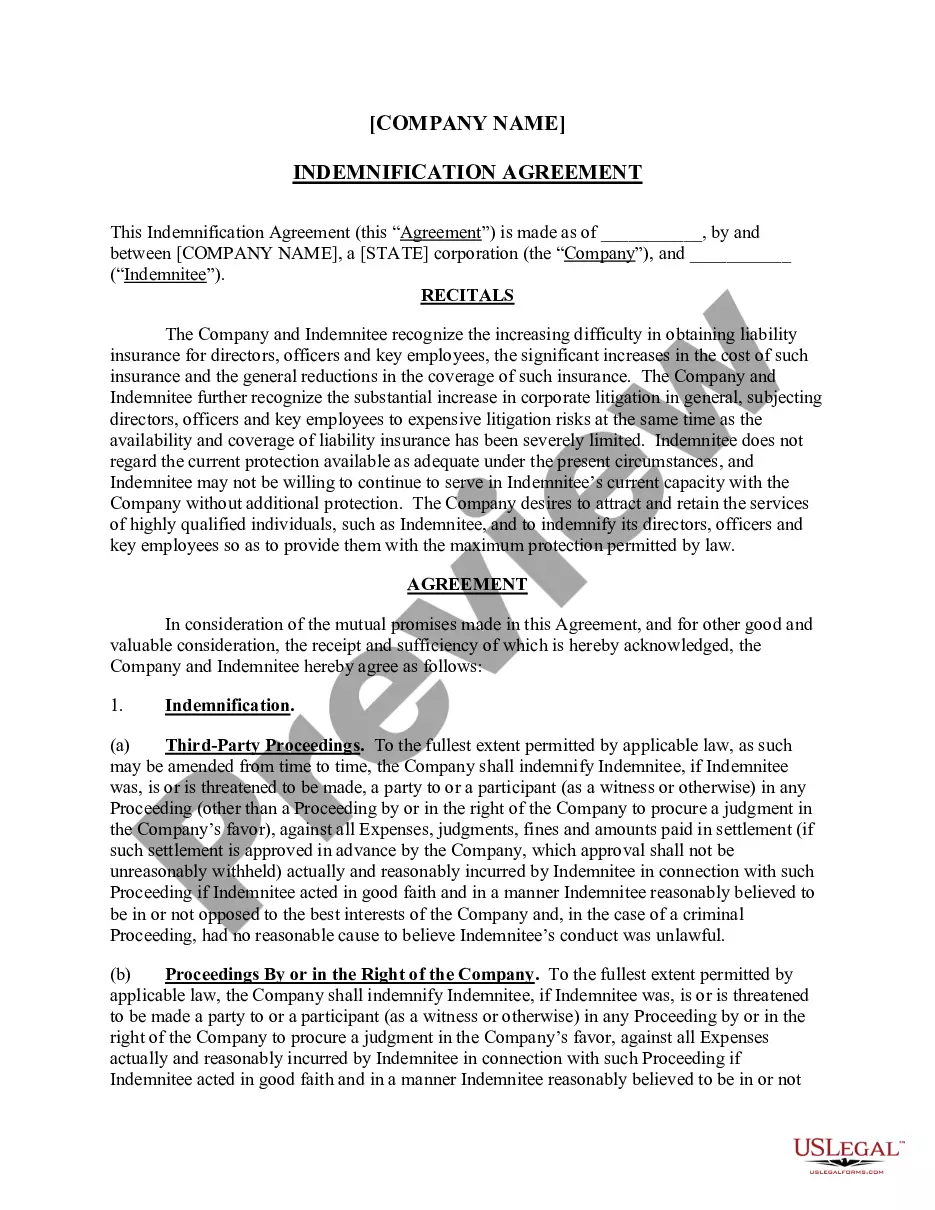

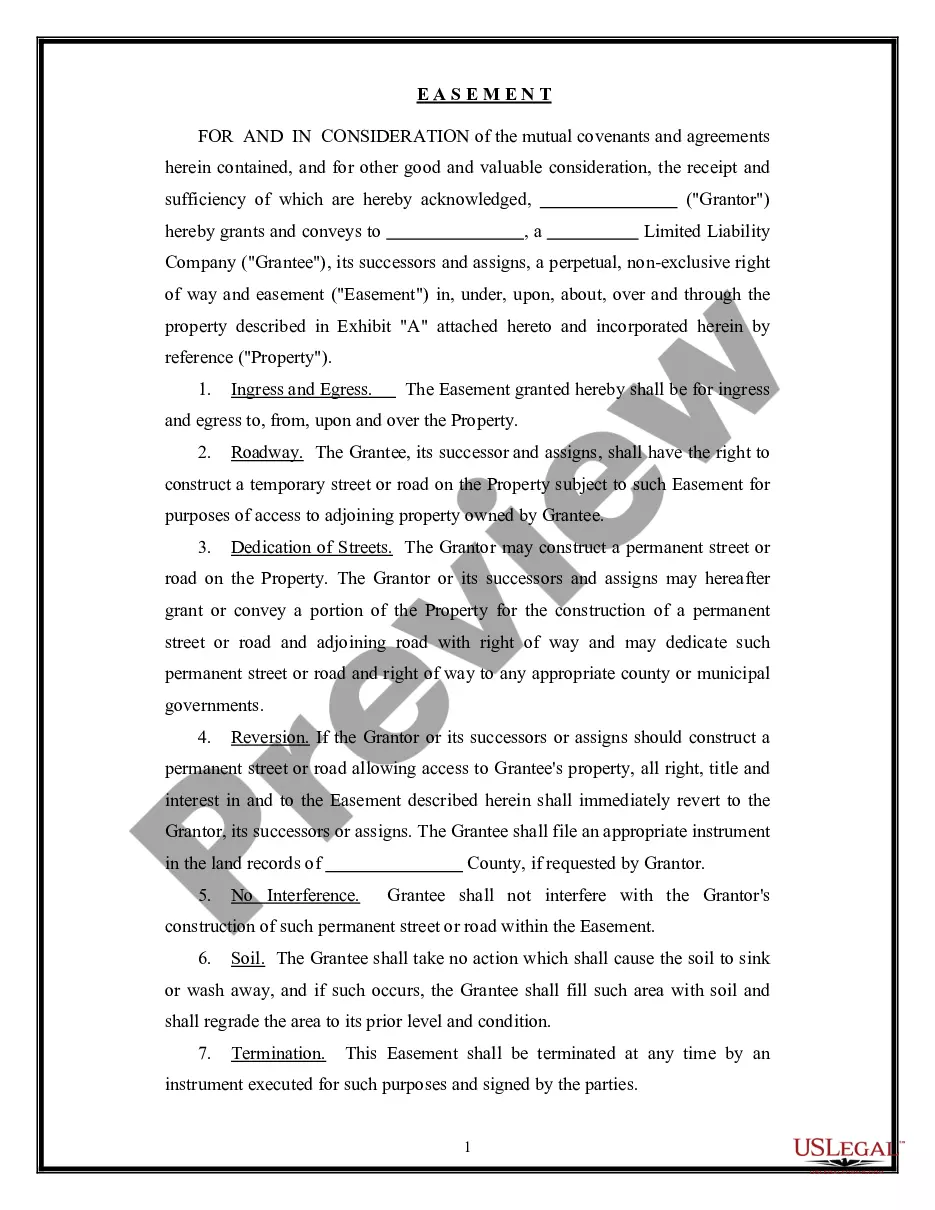

Legal document managing can be overpowering, even for the most experienced experts. When you are searching for a Lease Or Finance For Car and do not get the a chance to commit looking for the correct and updated version, the processes can be demanding. A robust web form catalogue might be a gamechanger for anyone who wants to handle these situations efficiently. US Legal Forms is a market leader in web legal forms, with more than 85,000 state-specific legal forms accessible to you at any time.

With US Legal Forms, you may:

- Access state- or county-specific legal and organization forms. US Legal Forms handles any needs you could have, from personal to enterprise paperwork, in one spot.

- Use advanced resources to accomplish and handle your Lease Or Finance For Car

- Access a resource base of articles, tutorials and handbooks and materials connected to your situation and needs

Help save effort and time looking for the paperwork you will need, and use US Legal Forms’ advanced search and Preview feature to locate Lease Or Finance For Car and download it. For those who have a monthly subscription, log in for your US Legal Forms account, search for the form, and download it. Take a look at My Forms tab to see the paperwork you previously saved and also to handle your folders as you see fit.

If it is the first time with US Legal Forms, create a free account and obtain unlimited usage of all benefits of the platform. Here are the steps for taking after getting the form you want:

- Verify it is the right form by previewing it and reading its description.

- Be sure that the sample is acknowledged in your state or county.

- Pick Buy Now once you are all set.

- Select a subscription plan.

- Find the format you want, and Download, complete, sign, print out and send out your document.

Enjoy the US Legal Forms web catalogue, backed with 25 years of expertise and stability. Transform your everyday document management in to a easy and user-friendly process right now.

Form popularity

FAQ

For accounting purposes, short-term leases under 12 months in length are treated as expenses and longer-term leases are capitalized as assets. For tax purposes, operating lease payments can be written off as expenses during the term of the lease.

If you're on a tight budget, leasing might be a cheaper option. Limits your vehicle options: Because financing a car is more expensive than leasing upfront, it might limit the types of vehicles you can realistically afford. Cost of maintenance: Financing a car means you're responsible for all maintenance costs.

Vehicle Loan: The bank owns the car until you pay off the loan. Vehicle Lease: Leasing is like a long-term rental. You pay rent for use of the car.

Step 1: Calculate the lease liability and ROU asset opening balance. Step 2: Post the initial recognition journal entry. Step 3: Calculate interest expense and amortization expense. Step 4: Recognize a fixed asset in the month of purchase.

Ing to NerdWallet, the exact credit score you need to lease a car varies from dealership to dealership. The typical minimum for most dealerships is 620. A score between 620 and 679 is near ideal and a score between 680 and 739 is considered ideal by most automotive dealerships.