Difference Between Old And New Lease

Description

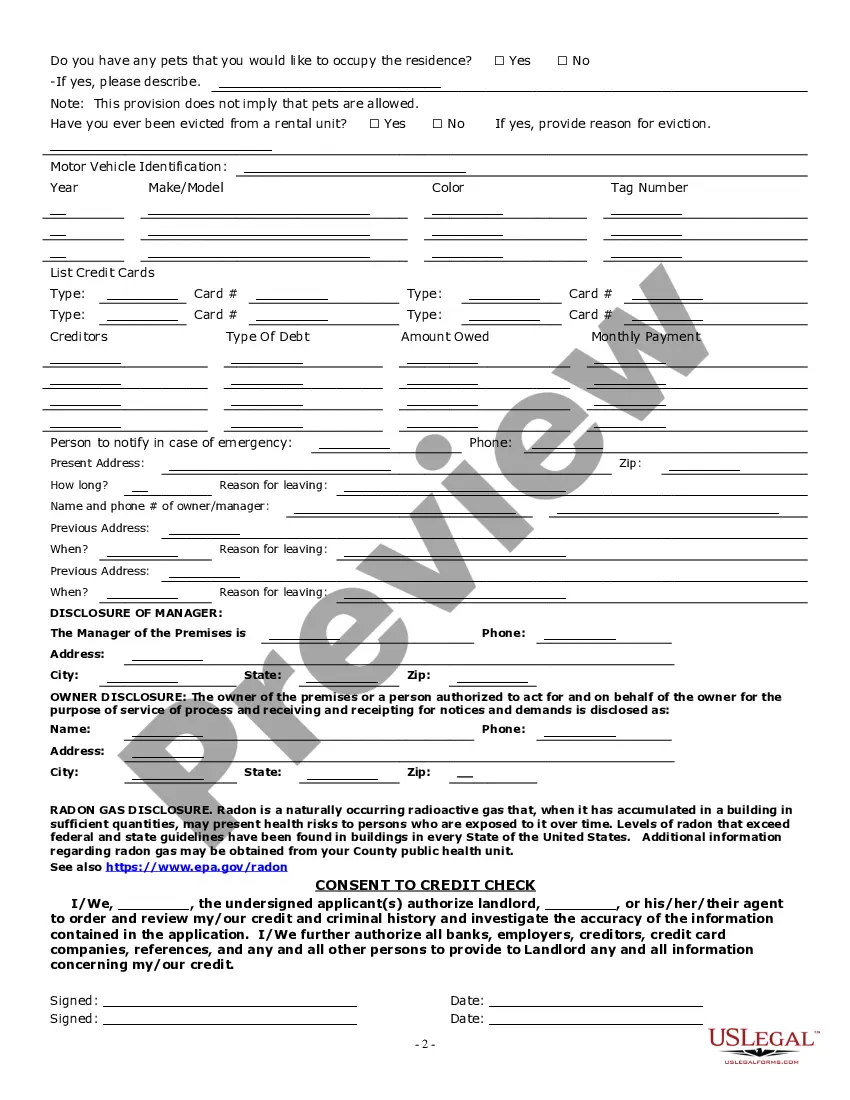

How to fill out Oregon Residential Rental Lease Application?

Accessing legal document samples that comply with federal and state regulations is essential, and the internet offers a lot of options to pick from. But what’s the point in wasting time looking for the correctly drafted Difference Between Old And New Lease sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the greatest online legal library with over 85,000 fillable templates drafted by lawyers for any business and life scenario. They are simple to browse with all files arranged by state and purpose of use. Our professionals keep up with legislative changes, so you can always be confident your form is up to date and compliant when getting a Difference Between Old And New Lease from our website.

Getting a Difference Between Old And New Lease is fast and simple for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you need in the preferred format. If you are new to our website, follow the steps below:

- Take a look at the template utilizing the Preview feature or through the text description to make certain it fits your needs.

- Locate another sample utilizing the search function at the top of the page if necessary.

- Click Buy Now when you’ve located the suitable form and opt for a subscription plan.

- Create an account or log in and make a payment with PayPal or a credit card.

- Pick the format for your Difference Between Old And New Lease and download it.

All templates you locate through US Legal Forms are multi-usable. To re-download and complete previously obtained forms, open the My Forms tab in your profile. Enjoy the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

Under the old standard (ASC 840), the discount rate, fair value, and lease classification are determined at the lease's inception. With the new standard (ASC 842), the discount rate, fair value, and lease classification are determined at lease commencement.

Overall, the new ASC 842 accounting standard affects lessees much more than lessors. The lessor-seller will continue to recognize lease income for their leases, and balance sheet recognition requirements remain the same. However, ASC 842 requires lessors to adopt new terminology to classify the type of lessor lease.

ASC 842 is the new lease accounting standard that replaced ASC 840 in 2019. The main change with ASC 842 is that companies are now required to recognize their lease liabilities on the balance sheet. This means that all leases, including operating leases, must now be reported on the balance sheet.

Under ASC 840, land is separately classified when the fair value of the land is 25% or more of the combined fair value of the land and building. Under ASC 842, the determination of whether or not a contract is a lease or contains a lease is done at the inception date.

ASC 840, Leases, is the former lease accounting standard for public and private companies that follow US GAAP. Under ASC 840, leases were classified as either capital or operating, and the classification significantly impacted the effect the contract had on the company's financial statements.