Oregon Rental Application With Cosigner

Description

How to fill out Oregon Commercial Rental Lease Application Questionnaire?

Whether for business purposes or for personal matters, everybody has to handle legal situations sooner or later in their life. Filling out legal paperwork demands careful attention, starting with picking the correct form sample. For instance, when you pick a wrong edition of the Oregon Rental Application With Cosigner, it will be rejected once you submit it. It is therefore essential to get a trustworthy source of legal files like US Legal Forms.

If you have to obtain a Oregon Rental Application With Cosigner sample, follow these simple steps:

- Get the template you need by using the search field or catalog navigation.

- Examine the form’s description to make sure it fits your case, state, and region.

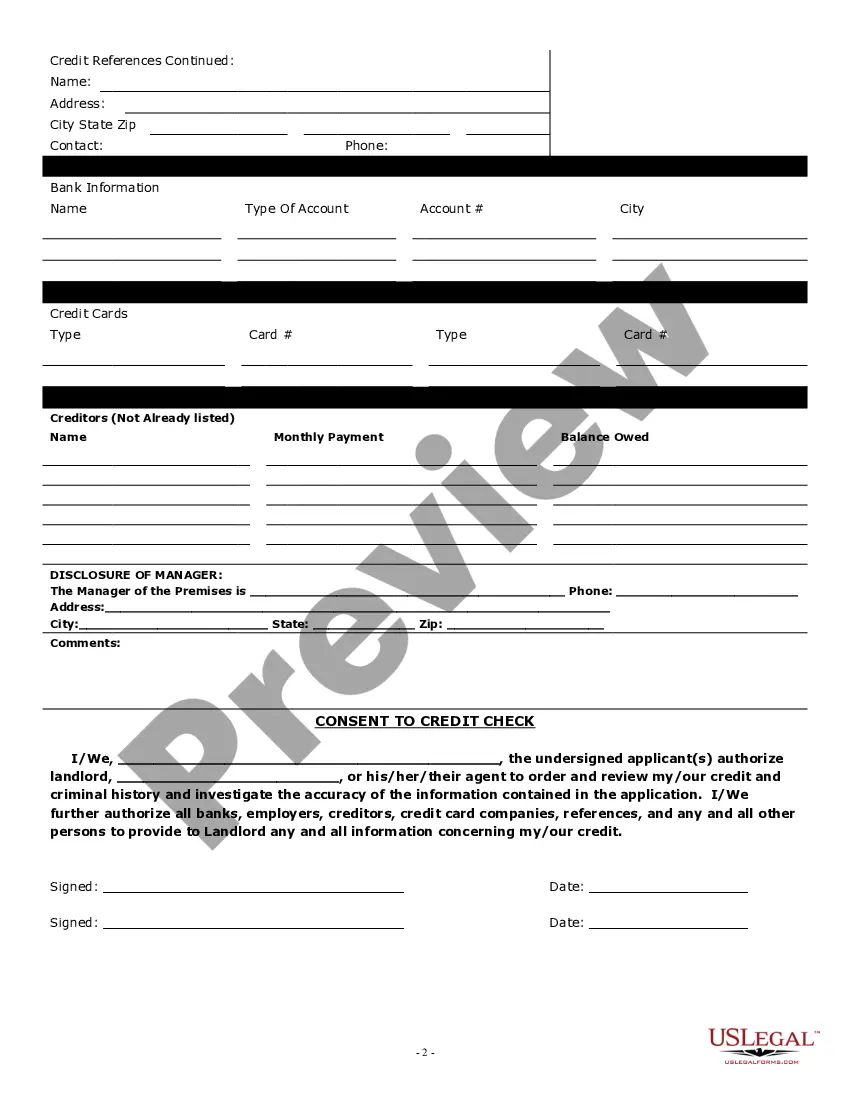

- Click on the form’s preview to examine it.

- If it is the incorrect document, go back to the search function to find the Oregon Rental Application With Cosigner sample you require.

- Get the template if it matches your requirements.

- If you already have a US Legal Forms account, simply click Log in to access previously saved templates in My Forms.

- If you don’t have an account yet, you may download the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the account registration form.

- Pick your payment method: use a credit card or PayPal account.

- Select the file format you want and download the Oregon Rental Application With Cosigner.

- Once it is downloaded, you can fill out the form with the help of editing applications or print it and finish it manually.

With a large US Legal Forms catalog at hand, you don’t need to spend time looking for the appropriate template across the internet. Use the library’s straightforward navigation to get the right form for any occasion.

Form popularity

FAQ

Thus, a co-signer only serves as a secondary source of payment in support of the borrower. Meanwhile, co-applicants share in the transaction itself.

Once they have found a co-signer, treat them as an additional tenant and have them fill out an online rental application, and run a screening report to ensure they are financially fit to be a co-signer.

To qualify as a cosigner, you'll need to provide financial documentation with the same information needed when you apply for a loan. This may include: Income verification. You may need to provide income tax returns, pay stubs, W2 forms or other documentation.

applicant doesn't necessarily have to live with you to be equally responsible for the loan, but the rules vary by lender.

The cosigner is a party with an established financial history who agrees to back up one or more tenants on the lease. They function as a safety net for the landlord. If the other people named in the lease can't make rent or cause damages they can't afford to repair, the cosigner has agreed to pay instead.