Application For Commercial Lease Without Personal Guarantee

Description

How to fill out Oregon Commercial Rental Lease Application Questionnaire?

Managing legal documents can be daunting, even for seasoned professionals.

If you are searching for an Application For Commercial Lease Without Personal Guarantee and lack the time to invest in finding the appropriate and current version, the procedures can be stressful.

US Legal Forms meets all your requirements, from personal to business documentation, all in one convenient location.

Utilize advanced tools to complete and manage your Application For Commercial Lease Without Personal Guarantee.

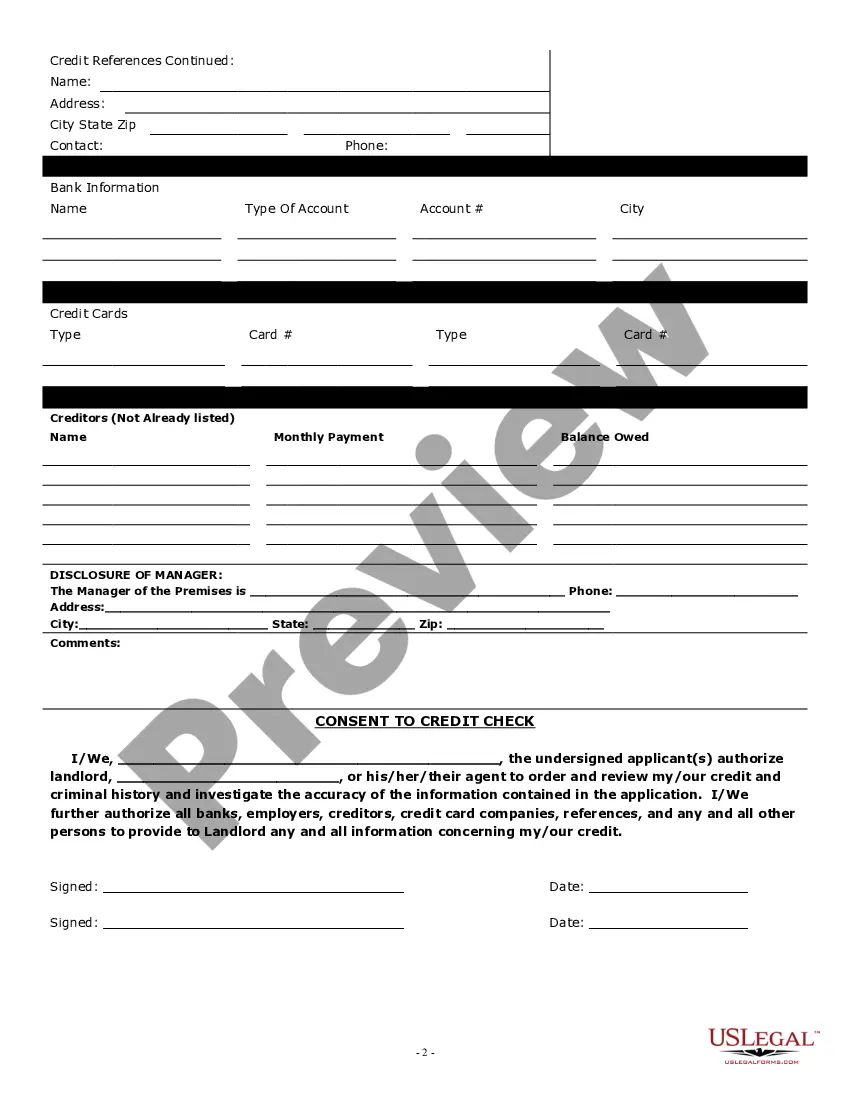

Here are the steps to follow after downloading the required form: Verify that it is the correct document by previewing it and reviewing its description. Ensure that the template is valid in your state or county. Click Buy Now when you are prepared. Select a monthly subscription option. Choose the desired format, and Download, fill out, sign, print, and submit your documents. Enjoy the US Legal Forms online library, backed by 25 years of expertise and trustworthiness. Transform your daily document management into a simple and user-friendly experience today.

- Tap into a repository of articles, guides, and materials pertinent to your circumstances and requirements.

- Conserve time and effort while searching for the documents you need, and use US Legal Forms’ enhanced search and Preview feature to find your Application For Commercial Lease Without Personal Guarantee.

- If you hold a monthly subscription, Log In to your US Legal Forms account, search for the document, and obtain it.

- Check your My documents tab to review the documents you have previously downloaded and manage your folders as you wish.

- If this is your first experience with US Legal Forms, create an account and gain unlimited access to all the benefits of the library.

- A comprehensive online form library can significantly benefit anyone seeking to handle these matters effectively.

- US Legal Forms stands out as a leader in online legal forms, offering over 85,000 state-specific legal documents available to you at any time.

- With US Legal Forms, you can access a wide range of state- or county-specific legal and business documents.

Form popularity

FAQ

Paying off the business loan is the easiest way to be released from a personal guarantee. If the business finances are sound and there is a good deal of cash on the books, it may make sense to do so. Often it is not prudent to retire the business loan. If so, refinancing is necessary.

How to get out of a personal guarantee on a commercial lease. Subleasing the space to another tenant is often the simplest way to get out of a personal guarantee, but it can be difficult to find a qualified subtenant. You'll also need to get approval from your landlord before proceeding.

Offer collateral: One way to reduce the lender's risk and potentially avoid a personal guarantee is to offer collateral, such as real estate, equipment, or inventory, as security for the loan. If you default on the loan, the lender can seize the collateral to repay the debt.

Traditionally, a distinction is made between: Real guarantees relating to assets having an intrinsic value. Personal guarantees involving a debt obligation for one or more people. Moral guarantees that do not provide the lender with any real legal security.

An otherwise valid and enforceable personal guaranty can be revoked later in several different ways. A guaranty, much like any other contract, can be revoked later if both the guarantor and the lender agree in writing. Some debts owed by personal guarantors can also be discharged in bankruptcy.