Oregon Security Deposit Demand Letter Without Notice

Description

How to fill out Oregon Letter From Tenant To Landlord Containing Notice Of Failure To Return Security Deposit And Demand For Return?

Securing a reliable source for the latest and pertinent legal templates is a significant part of navigating bureaucracy. Identifying the appropriate legal documents requires precision and meticulousness, which is why it is essential to obtain samples of the Oregon Security Deposit Demand Letter Without Notice exclusively from trustworthy providers, such as US Legal Forms. A flawed template could lead to wasted time and prolong the issue you are facing. With US Legal Forms, there is minimal need for concern. You can review and access all details regarding the document's applicability and significance for your situation and in your locality.

Follow these steps to complete your Oregon Security Deposit Demand Letter Without Notice.

After obtaining the document on your device, you can edit it using the editor or print it out and complete it by hand. Eliminate the stress associated with your legal documentation. Explore the comprehensive US Legal Forms library where you can discover legal templates, assess their applicability to your situation, and download them instantly.

- Use the catalog navigation or search bar to find your template.

- Review the form’s description to determine if it aligns with the needs of your state and locale.

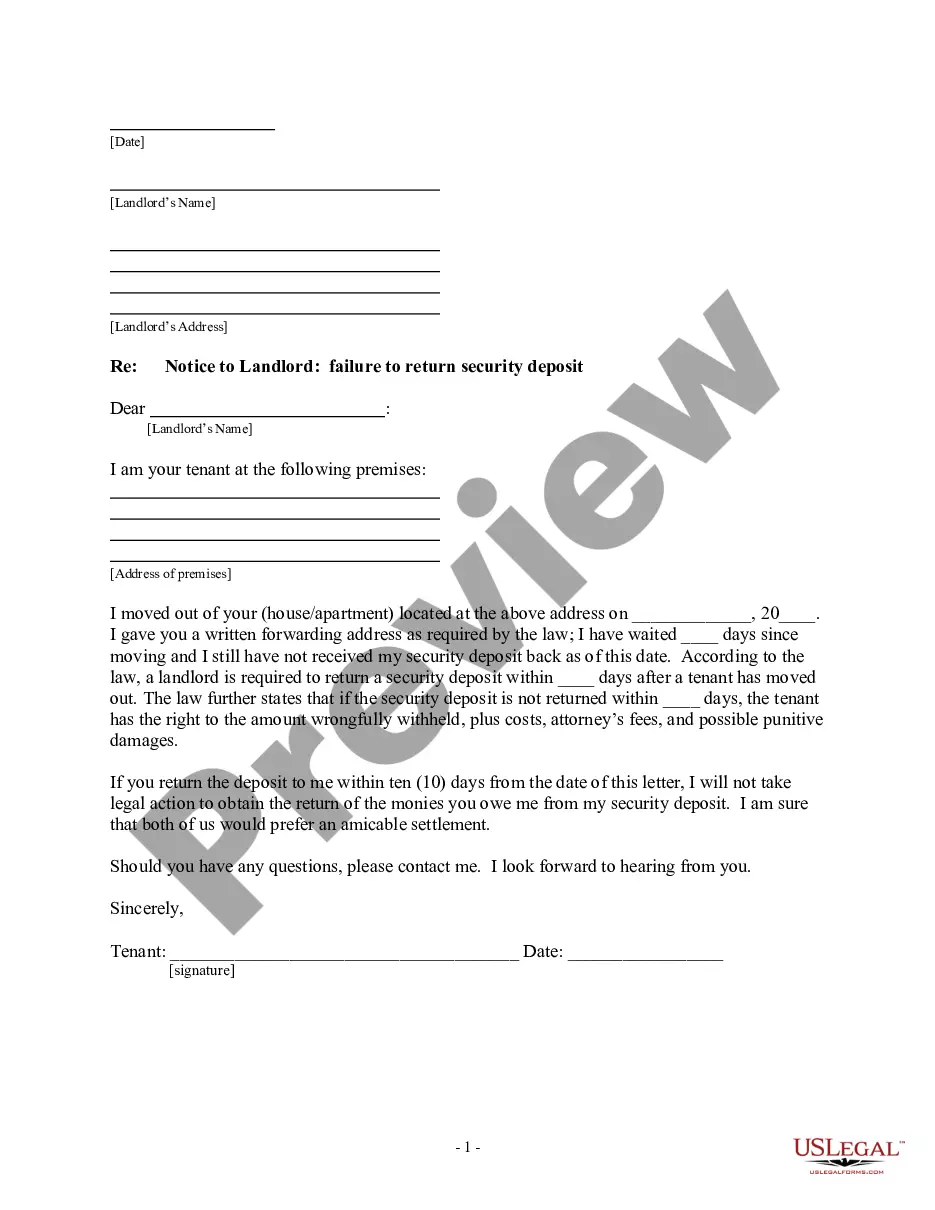

- View the form preview, if available, to confirm that the template is what you are seeking.

- Return to the search if the Oregon Security Deposit Demand Letter Without Notice does not meet your requirements.

- If you are confident about the form’s applicability, proceed to download it.

- If you are a registered user, click Log in to verify and retrieve your selected forms in My documents.

- If you do not yet have an account, click Buy now to purchase the form.

- Select the pricing option that suits your needs.

- Continue to the sign-up process to finalize your purchase.

- Complete your transaction by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading the Oregon Security Deposit Demand Letter Without Notice.

Form popularity

FAQ

You should claim the total number of exemptions to which you are entitled to prevent excessive over-withholding, unless you have a significant amount of other income. If you expect to owe more income tax than will be withheld, you may either claim a smaller number of exemptions or have additional amounts withheld.

Form 3. A partnership must annually report the partnership's income to the Department of Revenue on a Form 3, Partnership Return of Income if: It has a usual place of business in Massachusetts, or. Receives federal gross income of more than $100 during the taxable year.

A personal income tax exemption allows a portion of Massachusetts filers' salary to be deducted from the income tax they owe. Check for additional tax exemptions, including those for nonresidents and part-year residents, legal blindness and medical and dental expenses.

Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks, so you get more money now with a smaller refund. Claiming 0 allowances may be a better option if you'd rather receive a larger lump sum of money in the form of your tax refund.

The new tax, which was approved by voters last year and went into effect in 2023, applies to Massachusetts residents with incomes over $1 million. The new tax adds an extra 4% on earnings above that threshold, making the state's income tax rate one of the highest in the U.S.

If you file a Massachusetts tax return, you're entitled to a personal exemption regardless of whether you can claim a personal exemption on your federal return or not. The amount of personal exemptions you're allowed depends on the filing status you claimed.

An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately. Usually, those who are married and have either one child or more claim three allowances.

2022 Form PV Massachusetts Income Tax Payment Voucher.