Lien Filing Meaning

Description

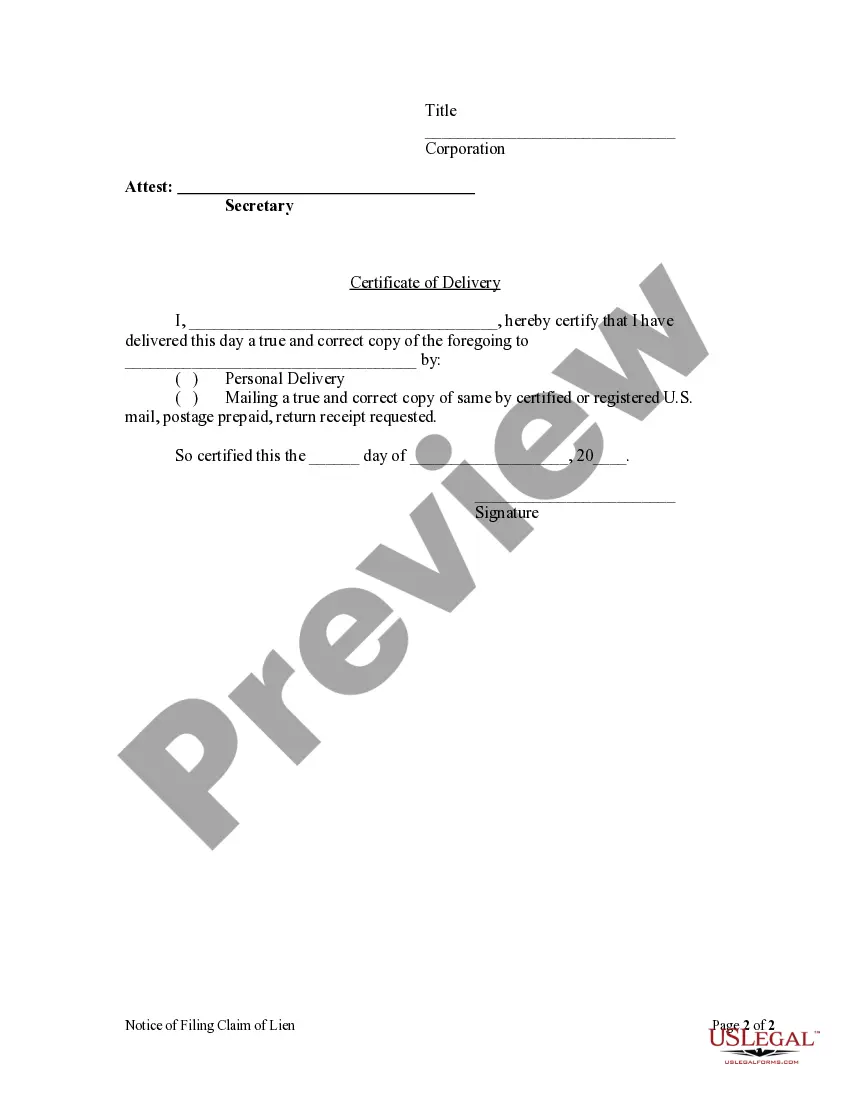

How to fill out Oregon Notice Of Filing Of Lien Claim By Corporation?

- To begin, log in to your existing US Legal Forms account. Make sure your subscription remains active to download the necessary form template.

- If you're new to US Legal Forms, start by exploring the extensive library. Preview the forms and descriptions to find one that meets your specific requirements and adheres to local jurisdiction standards.

- Should you discover that your chosen form isn't quite right, utilize the Search feature to locate an alternative template that suits your needs better.

- Once you find the right document, proceed to purchase it. Click the 'Buy Now' button and select a subscription plan that fits your needs, which will require account registration for full access.

- Complete your purchase by entering your credit card information or opting for PayPal to finalize the subscription.

- Finally, download the form to your device. You can later access it anytime through the 'My Forms' section of your account, ensuring you have it at your fingertips when needed.

In conclusion, US Legal Forms streamlines the process of lien filing through its robust collection of legal documents. With over 85,000 forms at your disposal and expert assistance available, securing your legal rights has never been easier.

Start exploring the US Legal Forms library today and take control of your lien filing needs!

Form popularity

FAQ

When someone has a lien, it means that a legal claim exists against their property or assets. This claim allows the lienholder to secure payment for a debt or obligation. In simpler terms, if the debtor fails to meet their financial obligation, the lienholder can potentially take possession of the property. Understanding lien filing meaning is crucial for anyone involved in financial transactions or property ownership.

In most cases, the debtor is responsible for paying to remove a lien, as it is tied to their obligations. This often requires settling the underlying debt first. Understanding lien filing meaning can empower you to negotiate or work through your options when it comes to resolving financial obligations and removing a lien.

Processing a lien typically varies depending on local laws and the type of lien being filed. Generally, it can take anywhere from a few days to several weeks for the lien to be officially recorded. Familiarizing yourself with lien filing meaning can help you anticipate timelines and prepare for any upcoming responsibilities.

The lien process involves several steps, starting with the creditor assessing the debt and then filing the necessary paperwork. Once filed, the lien becomes a public record, notifying others of the debt. Knowing the lien filing meaning allows you to follow the process closely and take appropriate action if needed.

Liens serve to protect creditors by ensuring they can claim a debtor's property if debts go unpaid. They often arise from unpaid loans, contractor work, or tax obligations. By grasping the lien filing meaning, you can see how it secures creditor interests while also understanding your own rights as a debtor.

When a lien is placed on you, it creates a legal claim against your property, impacting your ability to sell or refinance it. This can lead to complications, especially if you wish to access equity tied to the property. It's essential to understand lien filing meaning to manage these situations properly and address any outstanding debts promptly.

To file a lien, specific conditions must be met. First, there needs to be a valid debt, such as unpaid bills or loans. Additionally, the creditor must provide proper notice to the debtor before filing the lien. Understanding lien filing meaning can help you navigate these requirements effectively.

Common types of liens include mortgage liens, tax liens, and mechanics liens. Each serves a unique purpose, often tied to unpaid debts or services. Familiarizing yourself with these types improves your understanding of the lien filing meaning and its implications.

A lien can significantly impact your financial landscape and property rights. It restricts your ability to sell or refinance your property until the lien is resolved. Thus, recognizing the lien filing meaning is crucial for homeowners to avoid unexpected complications.

In Rhode Island, most liens can remain on your property for up to 10 years, unless they are renewed. After this period, if the lien is not renewed, it expires. To better understand how to manage such timelines, grasping the lien filing meaning becomes essential.