Filing Lien With The Client

Description

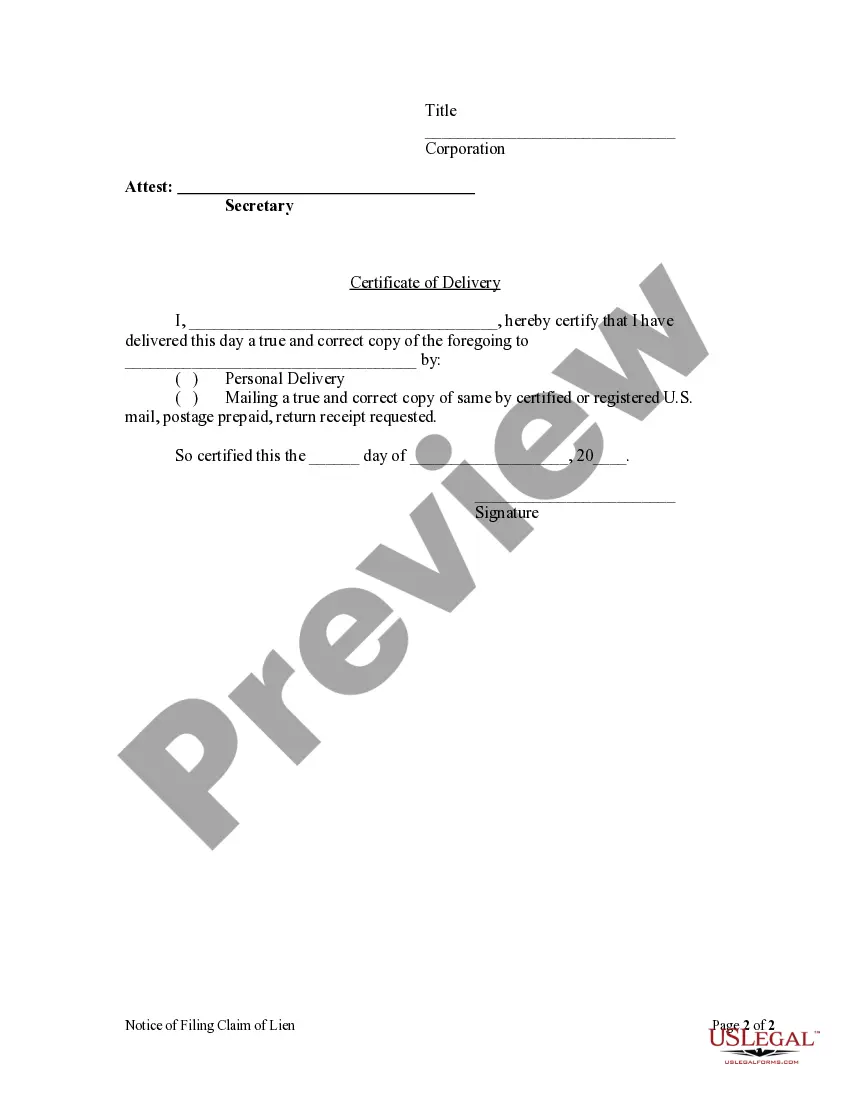

How to fill out Oregon Notice Of Filing Of Lien Claim By Corporation?

- Log in to your US Legal Forms account to access your purchased templates, ensuring your subscription is current. If not, renew your subscription according to your plan.

- Review the Preview mode and descriptions of the forms to confirm you’ve selected one that meets your specific requirements and aligns with local jurisdiction.

- In case you need to search for alternative templates, utilize the Search feature for better accuracy in picking the right form.

- Complete the purchase by clicking the Buy Now button. Choose your subscription plan, and create an account if you haven’t done so.

- Finalize your payment using credit card details or your PayPal account to gain access to your document.

- Download the form to your device and access your purchased documents via the My Forms section whenever needed.

By following these steps, you can utilize the comprehensive library offered by US Legal Forms, which includes over 85,000 customizable legal documents. Our robust collection ensures that you have the right form at your fingertips, along with the option to seek expert guidance.

Start crafting your legal documents today with US Legal Forms and experience the ease of obtaining the forms you need. Take control of your legal paperwork now!

Form popularity

FAQ

A lien can be deemed invalid in Florida for several reasons, such as improper filing procedures, missing essential information, or failure to meet deadlines. Additionally, if the work done does not comply with local laws or codes, the lien may be challenged. Thus, it’s crucial to ensure that all steps are followed correctly. Filing lien with the client accurately helps avoid these pitfalls and ensures your claim remains valid.

The rules for liens in Florida require individuals to provide a Notice to Owner before filing a lien. Additionally, liens must contain specific information and are subject to deadlines. Filing lien with the client according to these rules establishes your claim legally, ensuring you have recourse if payments are not made. It is advisable to familiarize yourself with these requirements or seek help from a professional for accuracy.

Florida's lien laws provide a structured framework for contractors, subcontractors, and suppliers to secure payments for services or materials provided. These laws grant individuals the right to file a lien against a property if they haven't received payment. Filing lien with the client not only safeguards your interests but also establishes your position in case of disputes. Understanding these laws is key for protecting your rights and investments.

In Virginia, the time frame to file a lien generally spans from the completion of the work to within 90 days. To effectively handle this process, it’s essential to act promptly. Filing lien with the client in this timeframe ensures that your rights are preserved. Keep in mind, specific scenarios may vary, so it’s wise to check local regulations or consult with a legal expert.

In Florida, a lien law warning serves to inform property owners and contractors about their rights related to unpaid work. Filing lien with the client protects a contractor's right to receive payment for services rendered. Understanding this warning can help prevent disputes and ensure fair compensation for all parties involved. Always consult legal resources or professionals for guidance specific to your situation.

In Rhode Island, a lien typically remains on your property for a period of 10 years, unless it is renewed or removed through a specific legal process. Filing a lien with the client may lead to a resolution that could shorten this duration if the debt is settled. Understanding the persistence of liens can help you plan your financial future more effectively. If you need assistance navigating this, uslegalforms can provide the necessary resources.

When a lien is placed on you, it signifies that another party has filed a legal claim against your property or assets due to an unpaid debt. This can affect your credit score, limit your ability to sell or refinance the property, and lead to potential legal action. It’s crucial to resolve the underlying debt to lift the lien effectively. By proactively addressing liens, you can maintain your financial health.

A lien serves as a legal claim on a property to secure the satisfaction of a debt. By filing a lien with the client, the creditor can ensure they have a right to payment if the debt remains unpaid. This process protects the creditor's interests and adds a layer of security in financial transactions. Knowing the reasons for a lien can help you navigate your obligations effectively.

In Florida, lien rules dictate the requirements and processes for filing liens with the client. These rules can vary depending on the type of lien, such as construction liens or judgment liens. It's essential to follow the legal procedures carefully, as improper filing may result in complications. By understanding these rules, you can effectively manage your legal interests during the filing lien process.

To file a lien in New York state, you must complete a lien form specific to your situation and submit it to the county clerk's office where the property is located. Ensure you provide all the required information, including the amount owed and proof of the debt. Adhering to the proper filing procedures is crucial to protect your rights. Utilizing US Legal Forms can help you navigate the specifics of filing a lien with the client in New York.