Filing Lien With The Case

Description

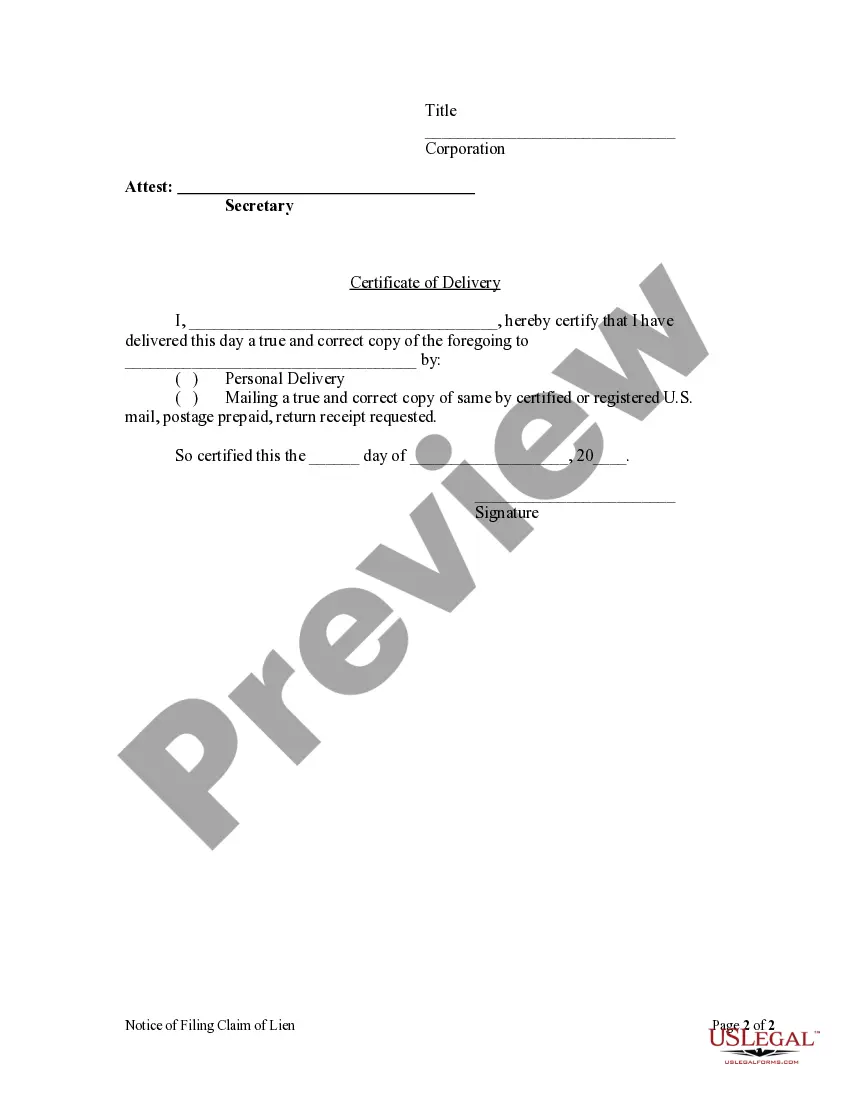

How to fill out Oregon Notice Of Filing Of Lien Claim By Corporation?

- If you're a returning user, log in to your account and ensure your subscription is active before downloading your needed form.

- For new users, start by exploring the Preview mode to understand the form description. Verify it meets your local jurisdiction's requirements.

- Should you require an alternative template, utilize the Search tab at the top of the page to find the correct document that aligns with your needs.

- Select the document by clicking the Buy Now button and choosing your preferred subscription plan. Registration is necessary to access the legal library.

- Complete your transaction by entering your credit card information or utilizing your PayPal account to finalize the subscription payment.

- After your purchase, download the form directly to your device for easy completion and future access in the My Forms section of your profile.

By utilizing US Legal Forms, you can confidently file your lien with the case knowing you have access to an extensive collection of forms and expert support.

Get started today to ensure your legal documentation is accurate and efficient—visit US Legal Forms for all your legal form needs!

Form popularity

FAQ

When writing a letter of intent for a lien, start with a clear statement indicating your intent to file. Include specific details about the debt, the parties involved, and any relevant case references to add context. It's important to maintain a professional tone and articulate the reasons for the lien clearly. For guidance on drafting an effective letter, consider using the resources at uslegalforms, where you can find templates tailored for filing a lien with the case.

The lien process begins when a creditor files a lien against a debtor's property to secure payment for a debt. First, the creditor must prepare and file the lien documents with the appropriate local office, which provides a public record. After filing, the debtor is typically notified, and they have the option to contest the lien if they believe it is unjust. Understanding how to navigate these steps is vital when considering filing a lien with the case.

To fill out a lien affidavit effectively, begin by gathering all necessary information such as the property details, the parties involved, and the amount owed. Ensure you clearly state the nature of the lien and reference any relevant case information. Once you complete the form, review it for accuracy before submitting it. Remember, filing a lien with the case requires precision to ensure compliance with the applicable laws.

The time it takes to release a lien can depend on several factors, including the type of lien and the response from the creditor. Typically, once you fulfill the conditions for a lien release, the process can take anywhere from a few days to a few weeks. Ensuring that all paperwork is in order when filing a lien with the case can help expedite this process. For a seamless experience, uslegalforms provides tools and guidance to manage lien releases efficiently.

In Rhode Island, a lien typically lasts for a specific duration, which varies depending on the type of lien. Generally, a judgment lien remains valid for 20 years, while other types like mechanic's liens may last for a shorter period. It's essential to understand these timelines when filing a lien with the case, as it can affect your rights and obligations. Using resources from uslegalforms can help you navigate these timelines effectively.

To find out if there is a lien on a property in Rhode Island, you can start by checking public records at the local clerk's office or treasurer's office. These offices maintain documents about property ownership and any liens associated with them. Additionally, you can use online services offered by uslegalforms to simplify your search process. By filing a lien with the case where necessary, you can ensure you have accurate and updated information.

In Rhode Island, a lien typically remains on your property for ten years from the date it was filed, unless released or discharged sooner. This means that if you are considering filing a lien with the case, the consequences can last long-term. It's important to keep this timeline in mind while assessing your situation. You can find detailed guidance and tools on US Legal Forms to help manage your lien effectively.

Filing a lien can have several disadvantages. First, it can create tension in business relationships and may lead to costly legal disputes. Additionally, a lien with the case can diminish your property’s marketability, making it harder to sell or refinance. Understanding these implications is essential, and consulting resources like US Legal Forms can help you navigate the process wisely.

In Indiana, you generally have one year from the date of the last service or from the date the project was completed to file a lien. This timeline starts once you fulfill the terms outlined in your contract. It is crucial to be aware of this period, as failing to file a lien with the case within this timeframe can result in losing your rights. To ensure you're on track, consider using US Legal Forms for resources and guidance on filing lien with the case.

The conditions for placing a lien typically include having an outstanding debt, a legal agreement, or a court ruling. Each type of lien may have specific requirements based on the circumstances of the case. Understanding these conditions is vital before filing a lien with the case. To navigate these guidelines effectively, consider using resources from uslegalforms.