Filing Lien For Unpaid Work

Description

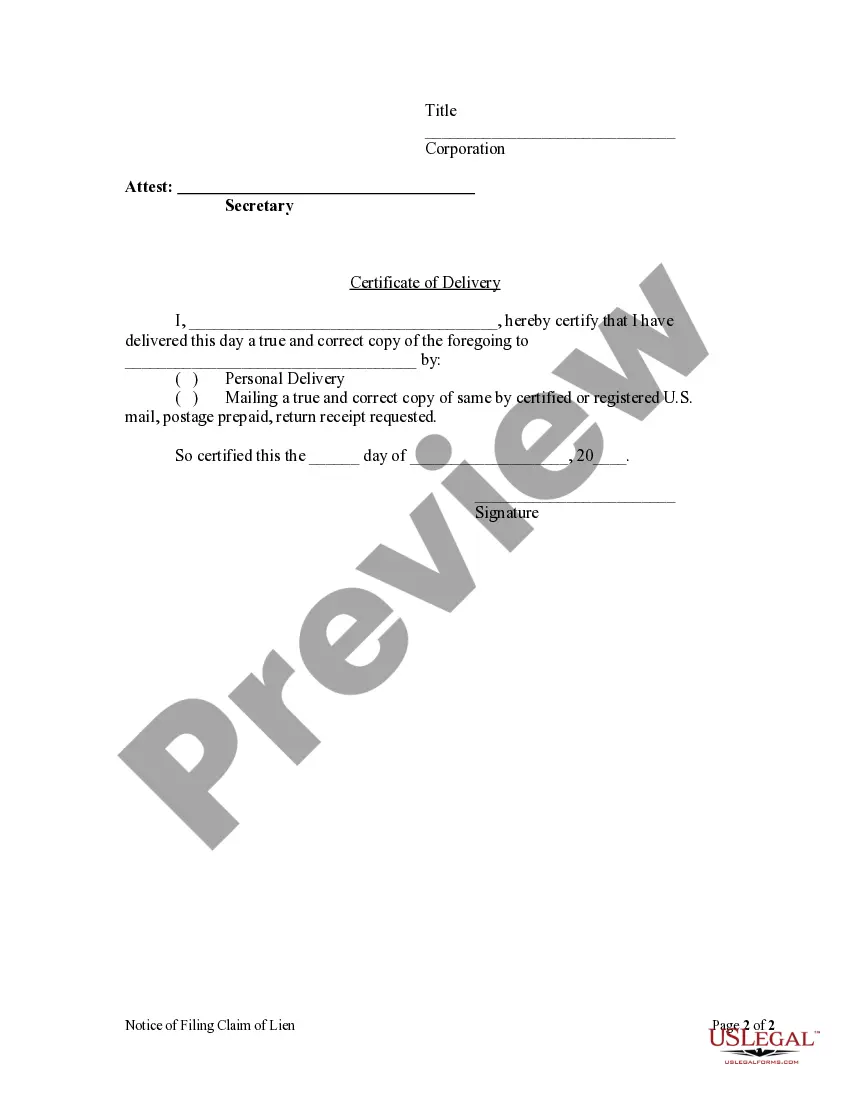

How to fill out Oregon Notice Of Filing Of Lien Claim By Corporation?

- Log in to your US Legal Forms account. If you're new, create an account for access.

- Browse through the lien form options available in the library. Utilize the Preview mode to determine the correct document specific to your needs.

- If you don't find what you need, use the search feature to find alternative templates that meet your jurisdiction requirements.

- Once you identify the correct form, click the Buy Now button and select your subscription plan for access.

- Complete your purchase by entering your payment details to activate your subscription and gain access to the forms.

- Download the lien form onto your device to fill it out. You can also revisit your downloads anytime through the My Forms menu in your profile.

In conclusion, US Legal Forms stands out with its robust collection of over 85,000 customizable legal forms, ensuring you find exactly what you need. Whether you're a seasoned professional or a first-timer, you can confidently file a lien for unpaid work with the right documentation.

Start your journey today by visiting US Legal Forms and simplify your legal process!

Form popularity

FAQ

An unpaid lien is a legal claim against a property due to unpaid work or services. Essentially, when a contractor or supplier does not receive payment, they can file a lien for unpaid work to secure their right to collect what is owed. This process involves placing a claim on the property, which can complicate the sale or refinancing of that asset. Using a reliable service like US Legal Forms can guide you through the process of filing a lien for unpaid work, ensuring that you protect your financial interests effectively.

You must file a lien in Alabama within one year from the last date of your work or when your materials were provided. If you miss this timeframe, you forfeit your opportunity to file a lien for unpaid work. It is critical to keep track of these deadlines to protect your rights.

A notice of intent to file a lien is a document that alerts the property owner of your intent to file a lien due to unpaid work. This notice must be sent before you file the actual lien and typically contains details about the debt owed. Notifying the property owner can often lead to a resolution before filing a lien for unpaid work becomes necessary.

To place a lien on someone's property in Alabama, start by gathering the necessary documentation, including invoices and a summary of the unpaid work. Then, draft and file a lien statement with the appropriate county office. This process is straightforward, but many find using a service like US Legal Forms helps ensure accuracy and compliance.

To file a lien, specific conditions must be met, including proof of the unpaid work and the identity of the property owner. Additionally, you must serve proper notice and adhere to filing deadlines. Clarity on these conditions is essential for successfully filing a lien for unpaid work.

In Alabama, several types of liens exist, including mechanic's liens, tax liens, and judgment liens. Each type serves a unique purpose, and knowing these can help you decide when filing a lien for unpaid work might be appropriate. Understanding the distinctions can better position you in your dealings.

In Alabama, you generally have one year from the date of the unpaid work to file a lien on a property. However, if you are dealing with a construction lien, this period may be shorter. Filing a lien for unpaid work promptly ensures your rights are protected, so it is wise to act quickly.

Yes, you can place a lien on your own property to secure a debt you owe. This is often done to demonstrate the seriousness of the unpaid work in which you are involved or to establish a claim against property. However, it's advisable to understand the legal implications of self-imposed liens. Using US Legal Forms can provide the needed assistance in managing licenses and completing the necessary paperwork for filing a lien for unpaid work.

Yes, a lien can be placed on your home without your direct knowledge. This often occurs when someone files a claim related to unpaid debts for work performed on the property. To protect yourself from unexpected liens, it’s essential to stay informed about any legal actions or debts associated with your home. Consider consulting resources from US Legal Forms for more clarity on managing potential liens for unpaid work.

Yes, you can put a lien on property that you own, but it generally pertains to debts related to that property. When filing a lien for unpaid work, it is essential to follow your state's legal requirements closely, as this ensures that your claim is enforceable. A lien can be a powerful tool for recovering owed funds, but accuracy in the filing process is crucial. Utilize services like uslegalforms to assist you in filing a lien effectively.