Every person claiming a lien created under ORS 87.010 (1) or (2) shall perfect the lien no later than 75 days after the person has ceased to provide labor, rent equipment or furnish materials or 75 days after completion of construction, whichever is earlier. Every other person claiming a lien created under ORS 87.010 shall perfect the lien not later than 75 days after the completion of construction. All liens claimed shall be perfected as provided by subsections (2) to (4) of this section. A lien created under ORS 87.010 shall be perfected by filing a claim of lien with the recording officer of the county or counties in which the improvement, or some part thereof, is situated.

Filing A Lien For Unpaid Hoa Dues

Description

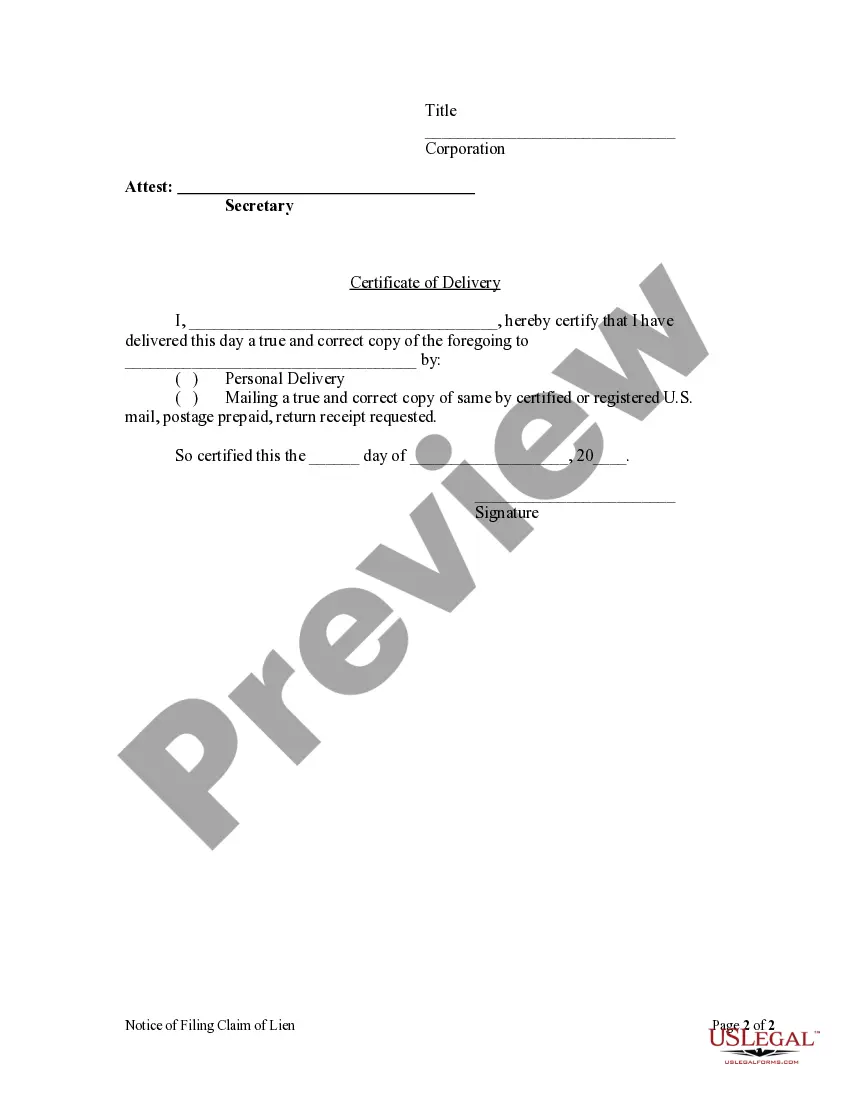

How to fill out Oregon Notice Of Filing Of Lien Claim By Corporation?

- Log into your US Legal Forms account. If you don't have an account, create one to access the document library.

- Search for the appropriate lien form specific to your state’s laws. Use the preview mode to review the form's details.

- If the initial form doesn't meet your needs, utilize the search function to find more options that suit your circumstances.

- Select the desired subscription plan and click the Buy Now button to purchase the document.

- Enter your payment details using a credit card or PayPal, and confirm your order.

- Download the completed form to your device. You can revisit it at any time within the My Forms section of your account.

Once you’ve completed these steps, you’ll be well on your way to filing a lien for unpaid HOA dues efficiently. US Legal Forms not only streamlines the process but also ensures that your documents meet legal standards.

Start your journey toward successful lien filing today. Explore the vast resources available at US Legal Forms and take control of your legal documentation!

Form popularity

FAQ

In Texas, the statute of limitations for filing a lien for unpaid HOA dues is generally four years from the date the debt was incurred. This means that if the HOA does not file a claim within this timeframe, they may lose the right to collect the unpaid dues. Understanding this timeframe can be critical in resolving debts with your HOA effectively.

While HOAs cannot forcibly sell your house directly, they can initiate foreclosure proceedings if you do not resolve your outstanding dues. If the HOA files a lien for unpaid HOA dues and you continue to neglect your obligations, they may take legal action to collect the debt. It's important to address any outstanding dues promptly to avoid further complications.

Yes, an HOA lien can affect your credit score negatively. When the HOA files a lien for unpaid HOA dues, it may be reported to credit bureaus, impacting your creditworthiness. Being proactive in managing your dues is essential to protect your credit health and maintain financial stability.

Ignoring an HOA can lead to serious problems, including the filing of a lien for unpaid HOA dues. This may result in legal actions like foreclosure on your property. To protect your home, it’s advisable to respond to the HOA's communications and address any dues promptly, rather than overlooking them.

Homeowners Associations (HOAs) have significant power because they operate based on rules and regulations agreed upon by the community. These rules protect property values and maintain community standards. When filing a lien for unpaid HOA dues, the association enforces its power to ensure all members contribute to community expenses, making the HOA's authority essential for communal harmony.

Yes, an HOA lien can potentially affect your credit score. If the lien goes unpaid and leads to foreclosure, it will reflect negatively on your credit history. It’s crucial to address any lien for unpaid HOA dues promptly to minimize impact. If you need help understanding the financial implications, USLegalForms can provide valuable insights and resources.

Settling an HOA lien involves negotiation. Begin by contacting your HOA to discuss a payment plan or settlement that is fair for both parties. It's important to document all agreements and ensure you receive a written confirmation. For assistance with the necessary paperwork and to navigate the process of filing a lien for unpaid HOA dues, consider using USLegalForms.

If you want to push back against your HOA, start by understanding the rules outlined in your governing documents. Gather evidence to support your position and communicate effectively with the board. Explore your options, such as mediation or legal action, if necessary. USLegalForms offers resources that can guide you through the process of contesting an HOA decision.

To eliminate an HOA lien, first, review the lien details. Ensure that the HOA has followed proper procedures when filing the lien for unpaid HOA dues. If you believe the lien is unjust, you can negotiate with the HOA or consider legal options. Using USLegalForms can help you understand your rights and streamline the process of disputing or settling the lien.