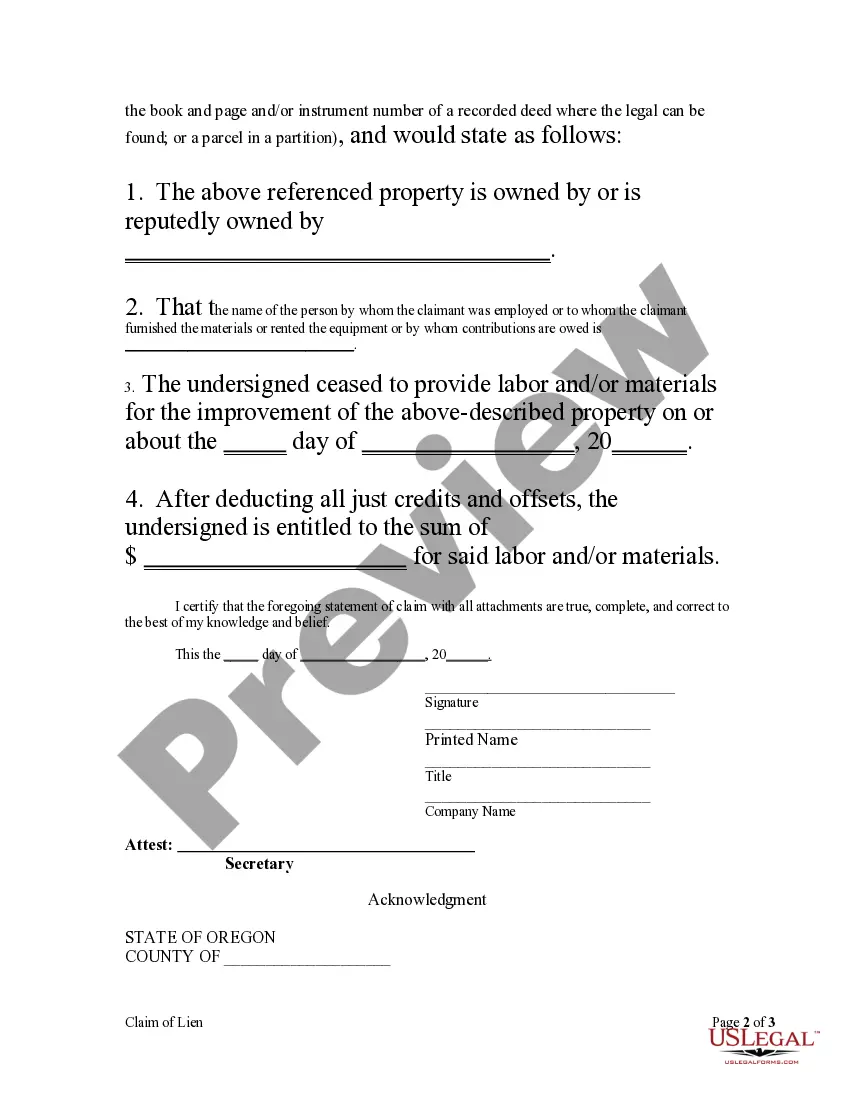

Every person claiming a lien created under ORS 87.010 (1) or (2) shall perfect the lien no later than 75 days after the person has ceased to provide labor, rent equipment or furnish materials or 75 days after completion of construction, whichever is earlier. Every other person claiming a lien created under ORS 87.010 shall perfect the lien not later than 75 days after the completion of construction. All liens claimed shall be perfected as provided by subsections (2) to (4) of this section. A lien created under ORS 87.010 shall be perfected by filing a claim of lien with the recording officer of the county or counties in which the improvement, or some part thereof, is situated.

Llc Stands For Limited Liability Company And Can Issue Stock

Description

How to fill out Oregon Claim Of Lien By Corporation?

- Log in to your account if you're a returning user, ensuring your subscription is active. If not, renew your plan to access documents.

- For first-time users, preview the available form descriptions to select the one that matches your needs and adheres to local jurisdiction requirements.

- If necessary, utilize the Search feature to find alternative templates that fit your criteria.

- Proceed to purchase by clicking the Buy Now button and select your desired subscription plan, creating an account for access.

- Complete your payment using your credit card or PayPal, finalizing your subscription.

- Download your chosen form and save it on your device, ensuring you can revisit it anytime from the My Forms menu.

In conclusion, US Legal Forms provides an unmatched library of over 85,000 easily fillable forms and access to premium experts. This service not only saves you time but ensures accuracy in your legal documents.

Start your journey today by visiting US Legal Forms and simplify your legal documentation process!

Form popularity

FAQ

Certainly, an LLC can issue stock. However, the manner in which you issue stock may depend on the structure of your LLC and its operating agreement. To facilitate the process, functionality offered by USLegalForms can help you generate necessary documents. This capability allows you to take advantage of how an LLC stands for limited liability company and can issue stock, enhancing your organization's financial flexibility.

Yes, LLCs can issue stock certificates, but it is not a requirement like it is for corporations. If you choose to issue stock certificates, they should clearly indicate that the LLC stands for limited liability company and can issue stock. This documentation helps formalize share ownership among members and provides a physical representation of their shares. Consulting with a legal professional can ensure you meet state regulations.

To issue shares in your LLC, you first need to draft an operating agreement outlining the terms. This agreement should specify how many shares you will issue, the rights associated with these shares, and how you will sell them. Remember, the process might require following state-specific laws. Overall, an LLC stands for limited liability company and can issue stock, providing you with more flexibility in ownership.

Yes, you can have an LLC for stock trading, as it allows you to manage your investments while providing liability protection. An LLC provides operational flexibility and can simplify the tax process for trading activities. However, consider the limitations regarding stocks and investments. If you are unsure how to set this up, uslegalforms can guide you through the process to ensure you meet all necessary requirements.

LLCs typically do not offer stock options in the same way that corporations do. Since LLCs stand for limited liability companies and can issue stock, they may provide other forms of equity incentives instead. If your aim is to attract talent or partners, consider alternative benefit structures that appeal to your target market. For tailored solutions, platforms like uslegalforms can help you navigate these options.

Setting up an LLC to trade stocks can be beneficial for liability protection and tax advantages. While an LLC cannot issue stock in the traditional sense, it offers a flexible approach to managing your investments. If you prioritize personal asset protection while trading, an LLC might be the right choice for you. Always consult with a financial advisor to ensure it aligns with your goals.

The best business structure for stock trading often depends on your individual needs. While LLCs provide liability protection and tax flexibility, they do not issue stock like corporations do. A corporation might be more beneficial if you're looking to attract investors who prefer stock ownership. It’s crucial to evaluate your business goals and consult experts to make an informed choice.

Yes, stocks can be owned by an LLC, as LLCs can hold various types of investments, including shares in other companies. This means that if you're an LLC, you can build a diverse investment portfolio that includes stocks. However, it’s essential to properly document these investments to comply with legal regulations. For careful management and record-keeping, consider using a platform like uslegalforms.

Investors may be hesitant to invest in an LLC because, unlike corporations, LLCs do not issue stock. Instead, LLCs are structured differently, which can limit the appeal to investors looking for stock options. Additionally, the flexible ownership structure of an LLC can create uncertainty for some investors. Therefore, if you're an LLC and considering outside funding, you may want to explore alternative funding options.

Yes, you can use an LLC to invest in stocks, which offers several advantages. Because an LLC stands for limited liability company and can issue stock, it allows you to manage your investments while protecting your personal assets. This structure also simplifies the process of managing multiple investments, enabling easier tracking and reporting. Consider consulting with experts or using platforms like US Legal Forms for assistance in setting up your LLC for investment purposes.