Llc Limited Liability Company Examples

Description

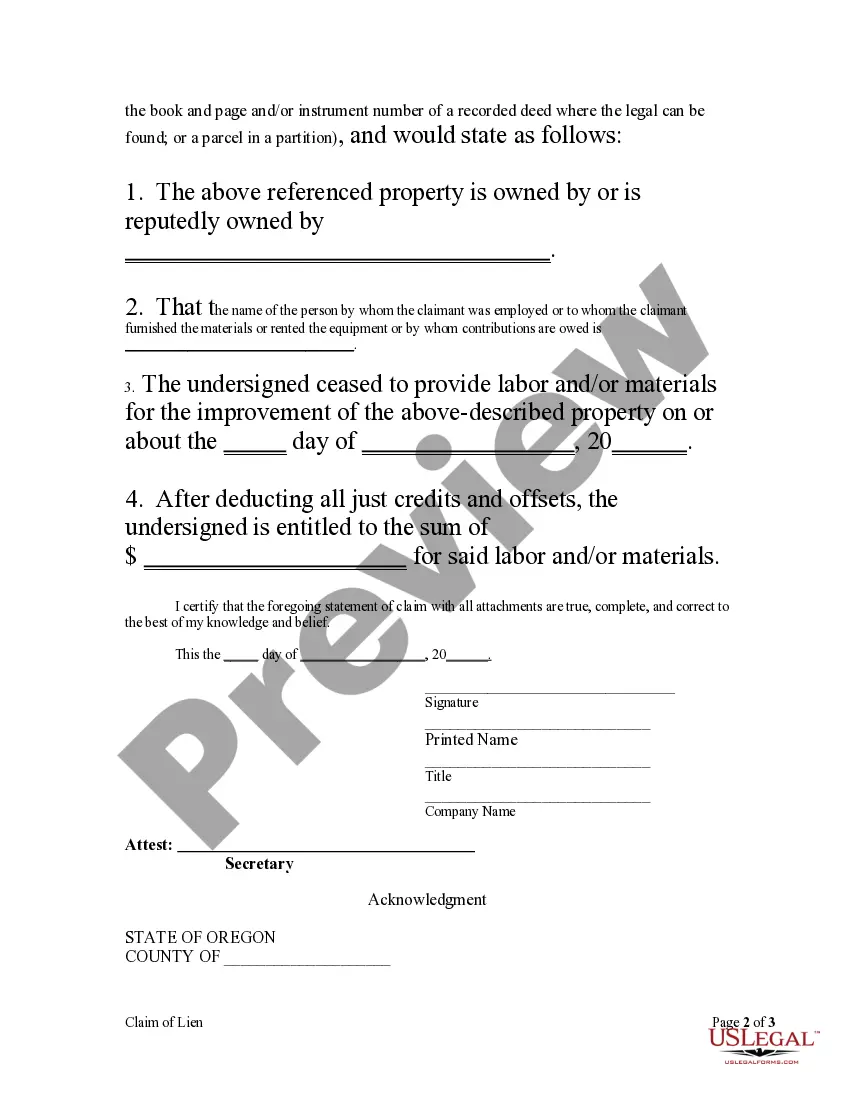

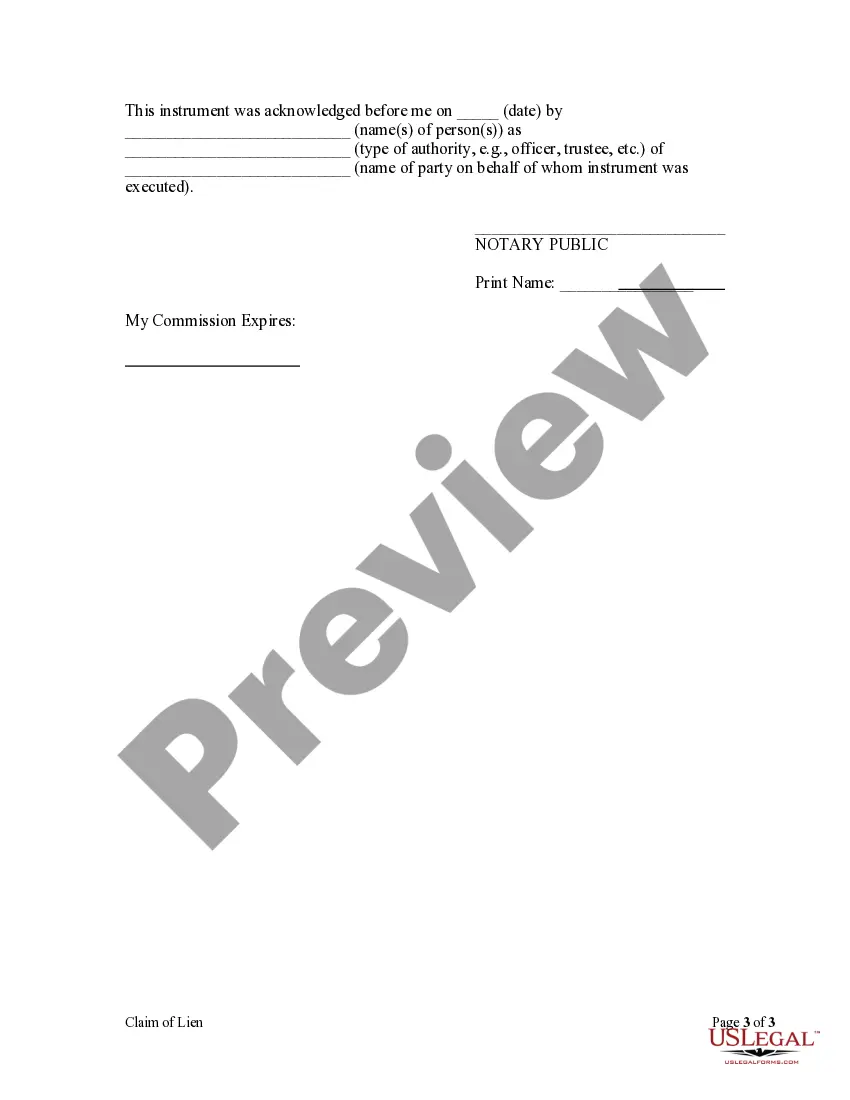

How to fill out Oregon Claim Of Lien By Corporation?

- Log in to your existing US Legal Forms account by navigating to their website and clicking on the login link.

- Verify your subscription is active. If it's expired, follow the renewal process outlined in your payment plan.

- Explore the library and utilize the Preview mode to find suitable LLC templates. Ensure it adheres to your local jurisdiction.

- If necessary, use the Search feature to find alternate templates that may better suit your needs.

- Select the desired document and press 'Buy Now' to choose your preferred subscription plan.

- Complete your purchase by entering your payment details—either credit or PayPal—to proceed.

- Finally, download the chosen form to your device and access it anytime via the 'My Forms' section in your profile.

In conclusion, US Legal Forms not only simplifies the task of creating legal documents but also provides a vast selection to meet diverse needs. Don't hesitate to take advantage of their robust resources to ensure your LLC formation is handled correctly.

Sign up now and start optimizing your legal document experience!

Form popularity

FAQ

In the case of a single-member LLC, you file your LLC taxes as part of your personal tax return using Form 1040. For multi-member LLCs, the business files its own return, while members report earnings on their personal returns based on K-1 forms. Knowing how these tax filings work is essential when looking at various LLC limited liability company examples. For tailored solutions and guidance, consider the resources offered by UsLegalForms.

While a single-member LLC offers liability protection, it can also lead to self-employment tax obligations. Additionally, lenders may view a single-member LLC as less stable than a multi-member one, which can complicate financing options. Understanding these disadvantages is crucial, especially when exploring LLC limited liability company examples. UsLegalForms can help you navigate these challenges and provide valuable insights.

member LLC is treated as a disregarded entity for tax purposes, meaning it does not file a separate tax return. Instead, the owner simply reports income and expenses on Schedule C of their personal tax return, using Form 1040. This streamlined process simplifies tax filing and aligns well with many LLC limited liability company examples. Utilizing platforms like UsLegalForms can provide additional clarity for singlemember LLC owners.

In a multi-member LLC, each member generally needs to report their share of the business profits on their personal tax returns. The LLC itself typically files Form 1065, which reports the income and expenses of the business, while each member receives a Schedule K-1 to report their portion. It's important to understand these tax obligations, especially when considering LLC limited liability company examples. Consulting resources like UsLegalForms can guide you through this process.

While an LLC provides numerous benefits, there are downsides to consider as well. One concern is the self-employment taxes that members may face, which can be higher than those in certain corporation structures. Additionally, LLCs may require more administrative work to maintain compliance, so it's beneficial to weigh these factors against the advantages of LLC limited liability company examples.

Getting a limited liability corporation involves several steps. Start by selecting a business name that follows state rules, then file your articles of organization with the appropriate state department. Many entrepreneurs find that using services like US Legal Forms makes obtaining a limited liability company quick and efficient, thanks to their ready-to-use templates.

An example of a limited liability company (LLC) is a small business, such as a local bakery or a consulting firm. These companies benefit from the protection of personal assets while allowing profits to pass through to the owners. If you're looking for LLC limited liability company examples, consider how various startups leverage this structure for flexibility and reduced liability.

Yes, a single member LLC can elect to be treated as a C Corp for tax purposes. This involves filing Form 8832 to make the election with the IRS. By choosing this classification, your LLC may face double taxation, but it can also offer advantages like retaining earnings within the company. For practical insights, refer to the LLC limited liability company examples that detail such scenarios.

To determine if your LLC is classified as an S Corp or C Corp, check your tax filings. If you filed Form 2553 with the IRS and it was accepted, your LLC is classified as an S Corp. If no election was made, then it is likely treated as a C Corp or a disregarded entity. Studying different LLC limited liability company examples might assist in clarifying this classification further.

A single member LLC is not automatically classified as an S Corp; it defaults to a disregarded entity unless you make an election with the IRS. You can choose to have your LLC taxed as an S Corp by filing Form 2553. This option may provide tax benefits by allowing you to take a salary and potentially lower self-employment taxes. Reviewing LLC limited liability company examples can help illustrate how some owners choose this path.