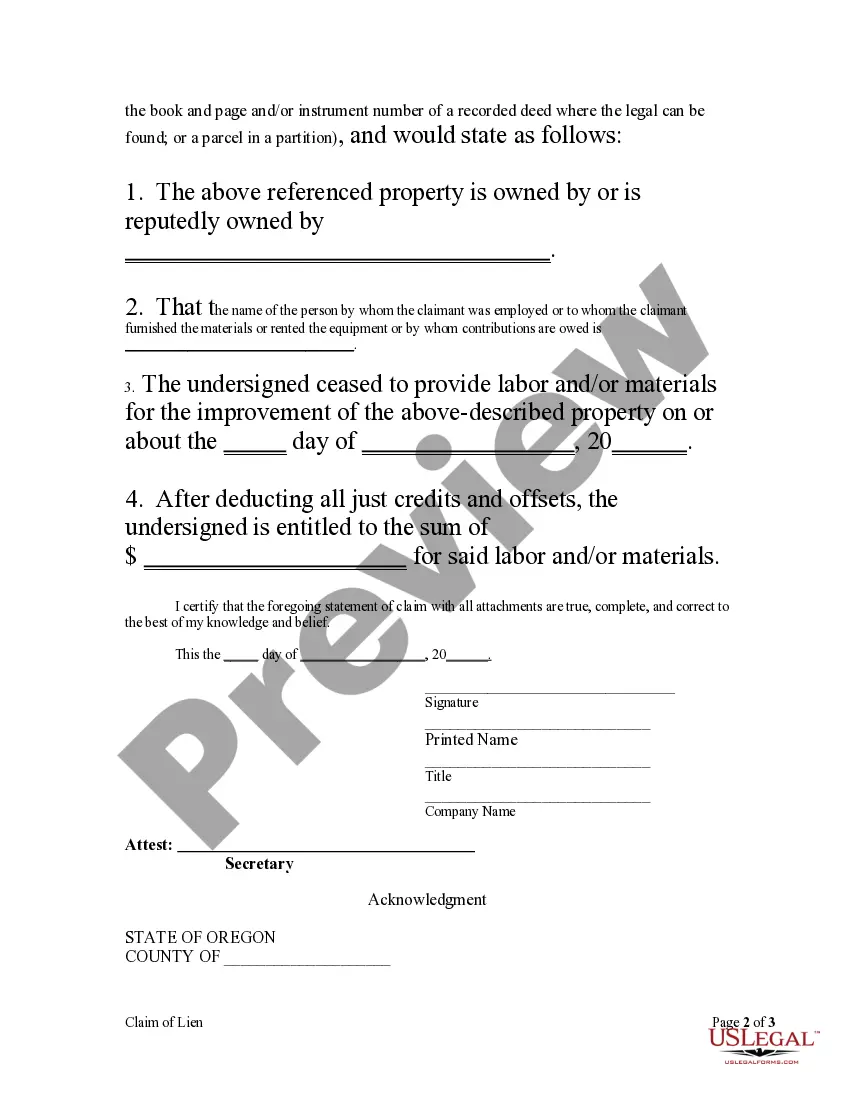

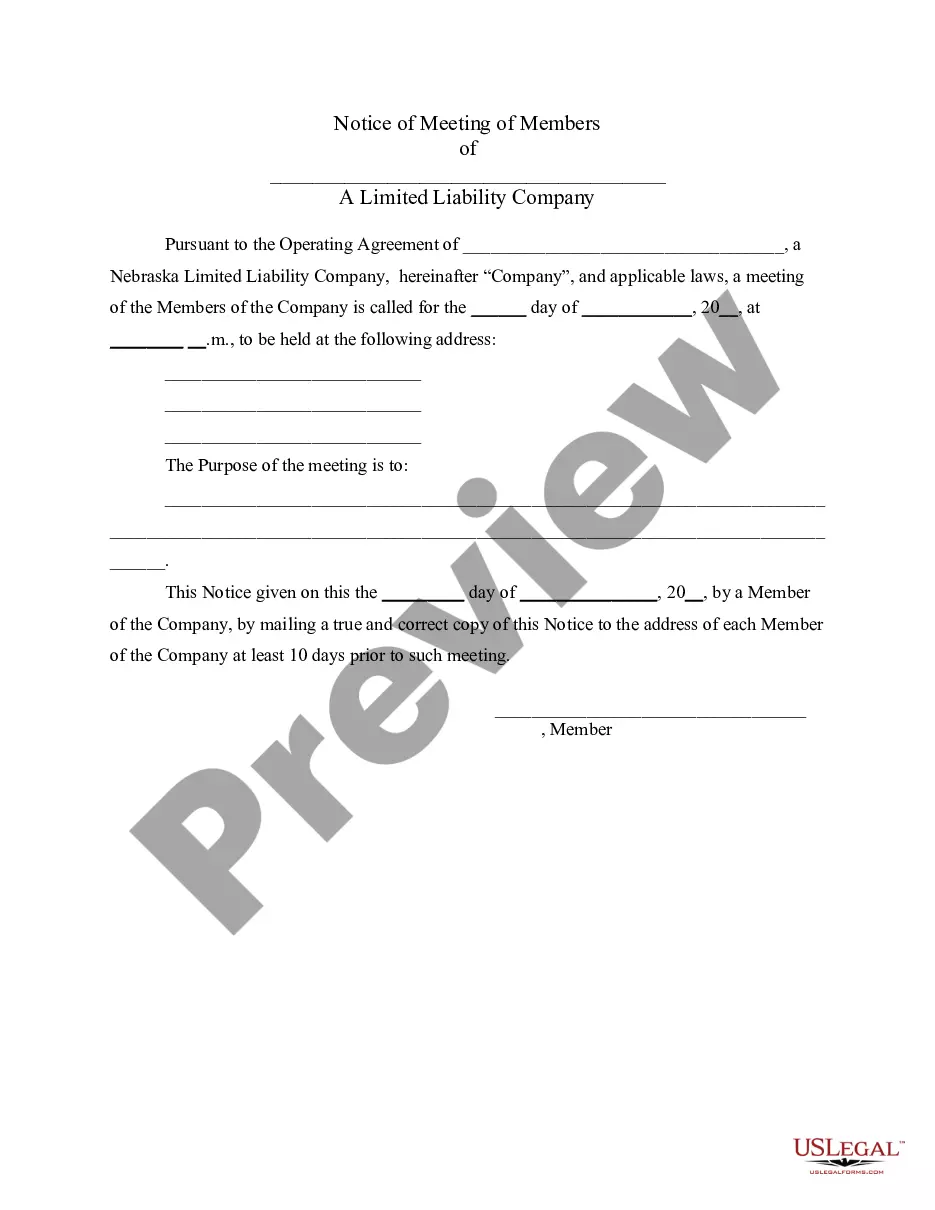

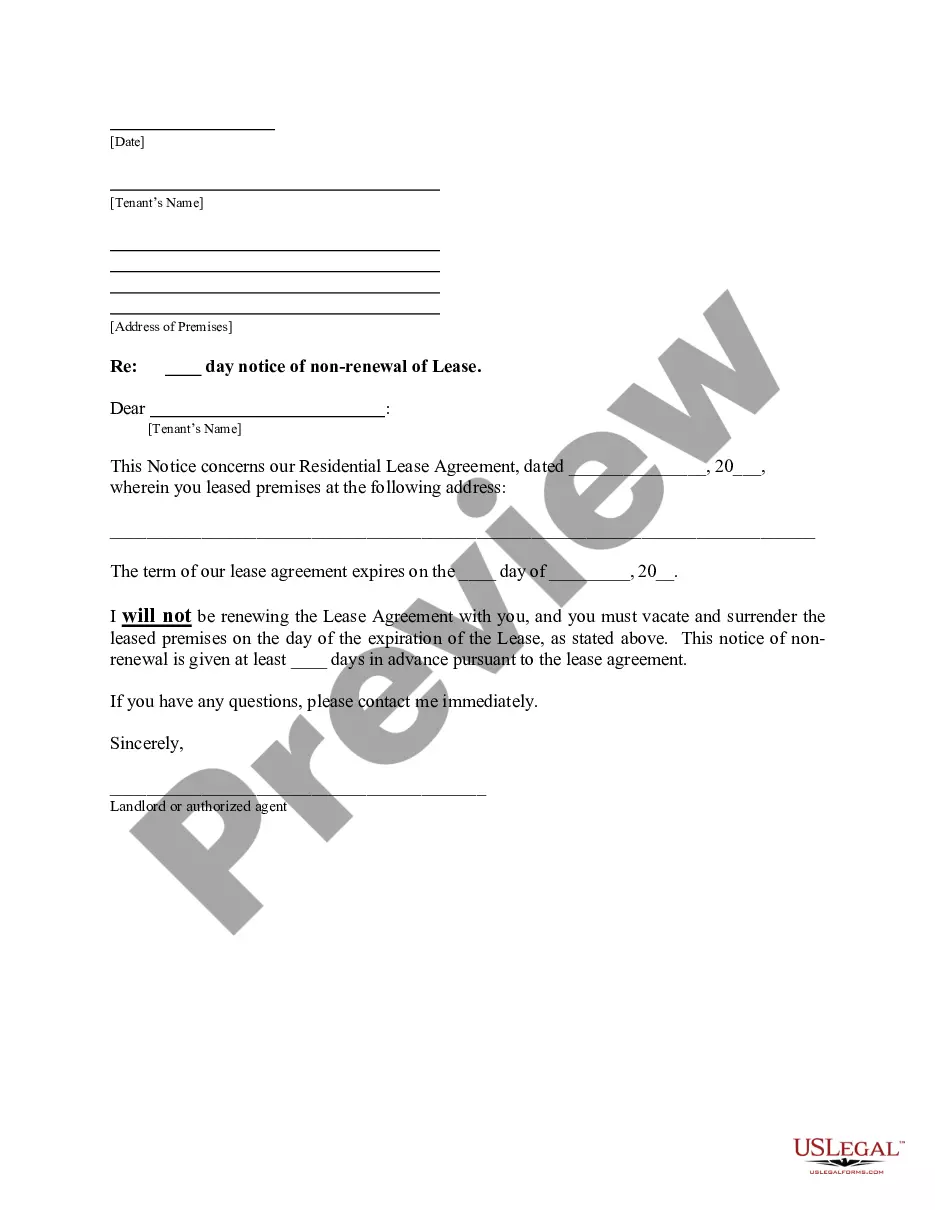

Every person claiming a lien created under ORS 87.010 (1) or (2) shall perfect the lien no later than 75 days after the person has ceased to provide labor, rent equipment or furnish materials or 75 days after completion of construction, whichever is earlier. Every other person claiming a lien created under ORS 87.010 shall perfect the lien not later than 75 days after the completion of construction. All liens claimed shall be perfected as provided by subsections (2) to (4) of this section. A lien created under ORS 87.010 shall be perfected by filing a claim of lien with the recording officer of the county or counties in which the improvement, or some part thereof, is situated.

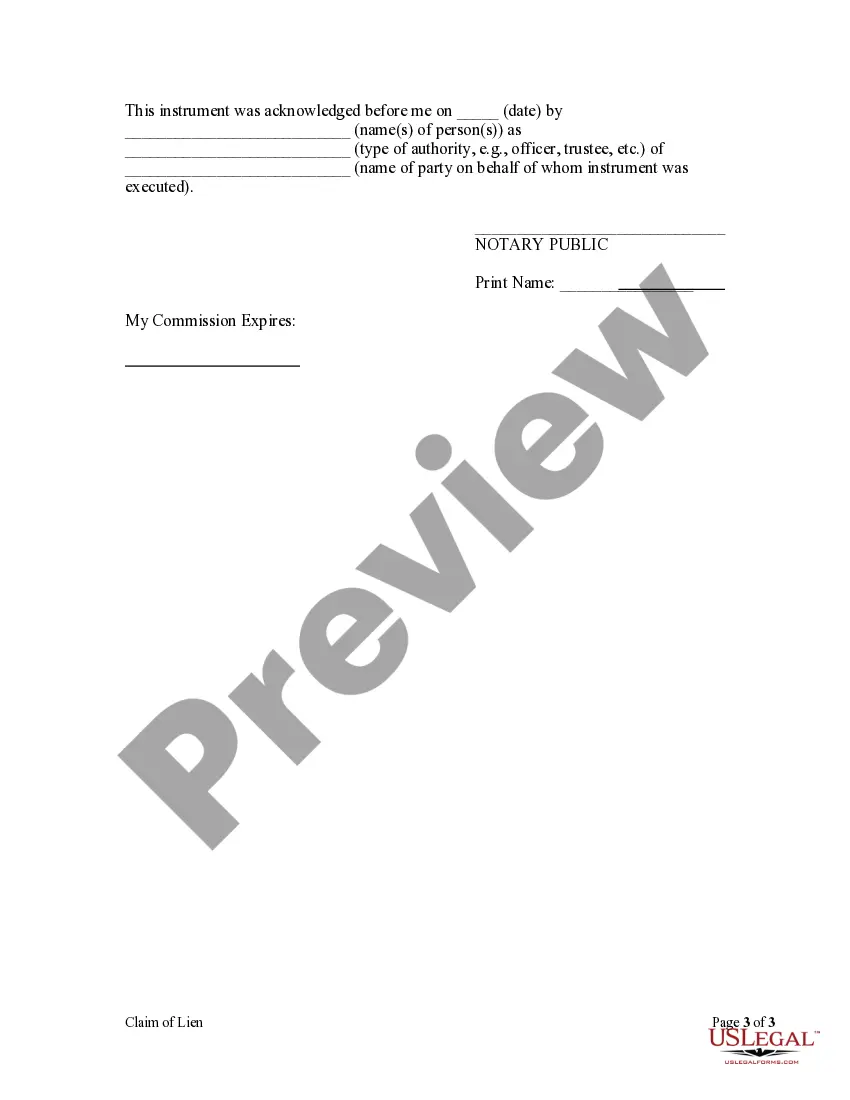

Llc Limited Company With Incorporated

Description

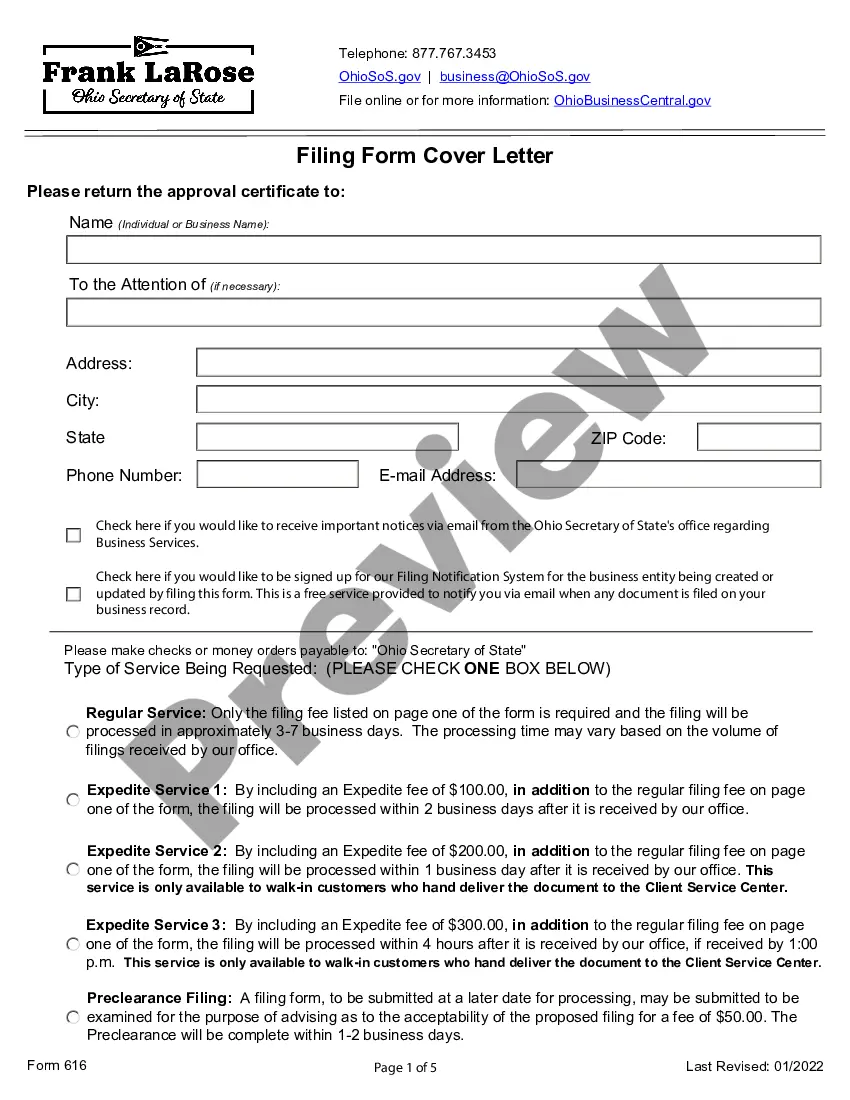

How to fill out Oregon Claim Of Lien By Corporation?

- If you're an existing user, log in to access your account. Verify that your subscription is current before proceeding to download the document you need.

- For new users, first check the Preview mode and form description to ensure you select the right template that aligns with your requirements.

- Use the Search tab to locate another template if the first one does not fit your needs. Finding the correct form is crucial.

- Select the document by clicking the Buy Now button and choose your preferred subscription plan. A registration is necessary to access further resources.

- Complete your purchase by providing your payment information via credit card or PayPal.

- Once your payment is confirmed, download your template directly to your device. You can later access it anytime from the My Forms section in your account.

US Legal Forms stands out by empowering both individuals and attorneys with an efficient way to create legally binding documents. With over 85,000 forms available, users have more options compared to competitors, ensuring all legal needs are met.

In conclusion, utilizing US Legal Forms simplifies the process of forming an LLC limited company with incorporated. Start your journey to legal compliance today and explore the extensive library available.

Form popularity

FAQ

Incorporated and limited are not exactly interchangeable, but they are often related concepts. An LLC limited company with incorporated status indicates a specific legal structure that protects its owners from personal liability while being officially registered. Understanding this distinction is vital for business owners to make informed decisions regarding their company’s formation. If you need assistance navigating these terms and structures, US Legal Forms offers valuable resources and support.

While an LLC limited company with incorporated status offers various benefits, it also has some disadvantages. One issue is the ongoing compliance and regulatory obligations, which can be cumbersome and time-consuming. Additionally, while owners enjoy limited liability, they may face challenges accessing certain financing options. Therefore, it is wise to weigh these factors carefully and consult with experts when considering this business form.

Yes, a company can be both limited and incorporated. An LLC limited company with incorporated rights provides protection to its owners while enjoying some tax benefits. This structure allows flexibility in management and may be more straightforward compared to traditional corporations. It's essential to consult legal resources or professionals to explore the benefits and requirements of this dual-status option.

A limited company is not exactly the same as a corporation, but they often overlap in many respects. Both structures protect owners from personal liability for the company's debts. However, a limited company can also refer to an LLC, which is a flexible business structure distinct from a traditional corporation. When considering an LLC limited company with incorporated status, it's crucial to understand the differences to choose the best entity for your needs.

To file multiple businesses under one LLC, you can utilize DBA (Doing Business As) names. This allows your LLC to operate different businesses under various names while only maintaining one legal entity. It's important to ensure that each DBA aligns with local regulations. Platforms like USLegalForms provide easy resources for managing your LLC limited company with incorporated business activities effectively.

Yes, a single-member LLC can serve as an owner of an S Corporation. This allows the LLC to hold shares in the S Corporation while enjoying pass-through taxation. Therefore, the single-member status provides simplicity, while the S Corporation status adds potential tax benefits. This arrangement can be beneficial for a business owner looking to maximize advantages when forming an LLC limited company with incorporated ownership.

Yes, you can be both an LLC and incorporate at the same time. In fact, many business owners choose this dual approach to enjoy the benefits of both structures. This means you can operate as a limited liability company while also opting for separate incorporation where needed. For your LLC limited company with incorporated benefits, this combination can enhance your business protections and operational flexibility.

member LLC cannot be categorized as a C Corporation. However, it can elect to be taxed as a corporation. By making this election, the LLC can take advantage of C Corporation benefits, even though it remains an LLC at its core. This can be a strategic move when forming an LLC limited company with incorporated taxation options.

Indeed, a corporation can own 100% of an LLC. This arrangement allows the corporation to control all aspects of the LLC while benefiting from the liability protection that comes with the LLC structure. This setup is quite advantageous for business owners looking to limit personal liability while maintaining full ownership. It is a common practice when forming an LLC limited company with incorporated elements.

Yes, an LLC (limited liability company) can indeed be owned by a corporation. In this scenario, the corporation acts as a member of the LLC. This structure can provide several benefits, such as liability protection and tax flexibility. Therefore, when setting up an LLC limited company with incorporated ownership, you can achieve optimal organizational flexibility.