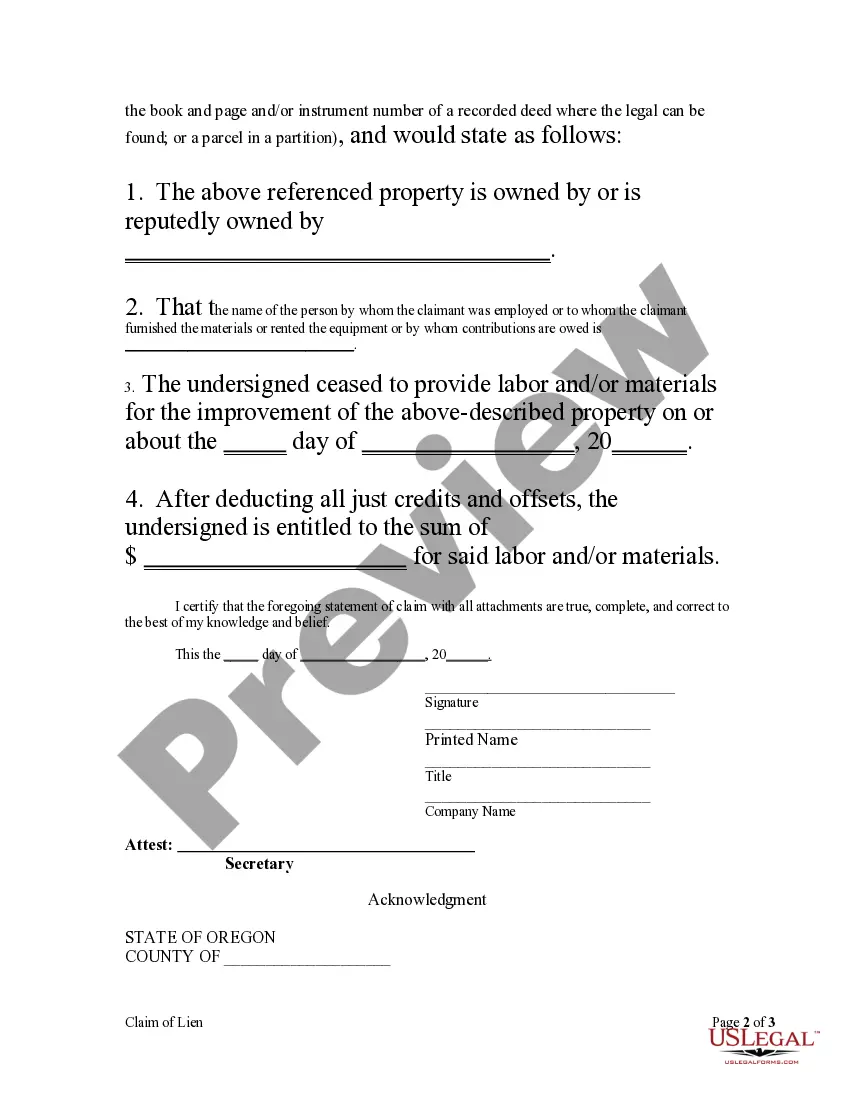

Every person claiming a lien created under ORS 87.010 (1) or (2) shall perfect the lien no later than 75 days after the person has ceased to provide labor, rent equipment or furnish materials or 75 days after completion of construction, whichever is earlier. Every other person claiming a lien created under ORS 87.010 shall perfect the lien not later than 75 days after the completion of construction. All liens claimed shall be perfected as provided by subsections (2) to (4) of this section. A lien created under ORS 87.010 shall be perfected by filing a claim of lien with the recording officer of the county or counties in which the improvement, or some part thereof, is situated.

Llc Limited Company With All

Description

How to fill out Oregon Claim Of Lien By Corporation?

- If you're an existing user of US Legal Forms, log into your account and click the Download button to retrieve your necessary form template. Ensure your subscription is up-to-date.

- For first-time users, start by browsing the Preview mode and form descriptions to ensure you select the correct document that fulfills your local legal requirements.

- Should you find discrepancies in your chosen template, utilize the Search tab to locate the correct form. Verify its suitability before proceeding.

- To proceed with your document, select the Buy Now button and choose your preferred subscription plan. Registration is required for full access to the library.

- Complete your purchase by entering your payment details, either with a credit card or PayPal.

- Finally, download your form and store it on your device. You can always revisit it via the My Forms section in your account whenever needed.

Using US Legal Forms not only streamlines this process but also empowers you with the confidence of having access to premium experts for assistance, ensuring that your documents are legible and compliant.

Don't leave your business documents to chance. Leverage US Legal Forms to ensure your LLC limited company has all the legal backing it needs to thrive!

Form popularity

FAQ

The easiest way to establish an LLC is to utilize an online document provider, such as UsLegalForms. Their user-friendly platform guides you through each step and provides ready-made forms tailored to your state’s requirements. This approach helps you form your LLC limited company with all necessary components, ensuring compliance without the hassle.

To get an LLC quickly, consider using an online service like UsLegalForms, which simplifies the filing process. You can complete the necessary paperwork online and receive guidance throughout the application. By choosing a service that specializes in LLC formations, you can ensure that your LLC limited company with all required documentation is submitted promptly, reducing delays.

Yes, you can run all your businesses under one LLC, also known as a limited liability company. Having a single LLC for multiple businesses helps streamline management, reduces paperwork, and may lower costs. However, it's essential to ensure that your activities are compatible to avoid legal complications. Always consult with a legal expert to understand how to structure your LLC limited company with all your ventures efficiently.

A limited company is a broad term that can refer to various business structures, including LLCs. In contrast, an LLC is specifically focused on providing limited liability protection to its owners. Understanding these distinctions is essential when establishing your business, and platforms like US Legal Forms can help clarify the options available to you.

You can generally have multiple business names, also known as 'DBAs' (doing business as), under one LLC. However, you must register each name separately with the state. This setup allows you to diversify your offerings while maintaining the simplicity of a single LLC structure. Consider US Legal Forms to ensure you follow the necessary steps.

Yes, you can put multiple businesses under one LLC, which simplifies the administrative process. However, you should be aware that each business will share the same liability protection. Using a service like US Legal Forms can help you set up this structure while ensuring compliance with state regulations.

It is possible to put all your businesses under one LLC, but this approach may increase your risk exposure. If one business faces legal issues, it could affect the others. Therefore, consider using US Legal Forms to help you understand the implications and decide if this structure works best for your needs.

Having multiple LLCs can provide flexibility and risk management, but it also comes with administrative challenges. Each LLC requires its own filings, separate accounts, and potentially higher costs. If you plan on creating multiple LLCs, it's wise to evaluate your structure thoroughly to maximize efficiency.

An LLC (limited liability company) can have all limited partners, which are individuals who invest in the company but do not participate in its management. This structure allows investors to benefit from limited liability while keeping their involvement minimal. If you're looking to establish an LLC with all limited partners, consider using a platform like US Legal Forms to simplify the formation process.

Yes, an LLC can be 100% owned by another LLC, commonly seen in the parent-subsidiary structure. This configuration provides tax benefits and shields personal assets from liabilities associated with the subsidiary. It can also simplify reporting and management, making it a popular choice among business owners using the LLC limited company structure.