Llc Company Meaning

Description

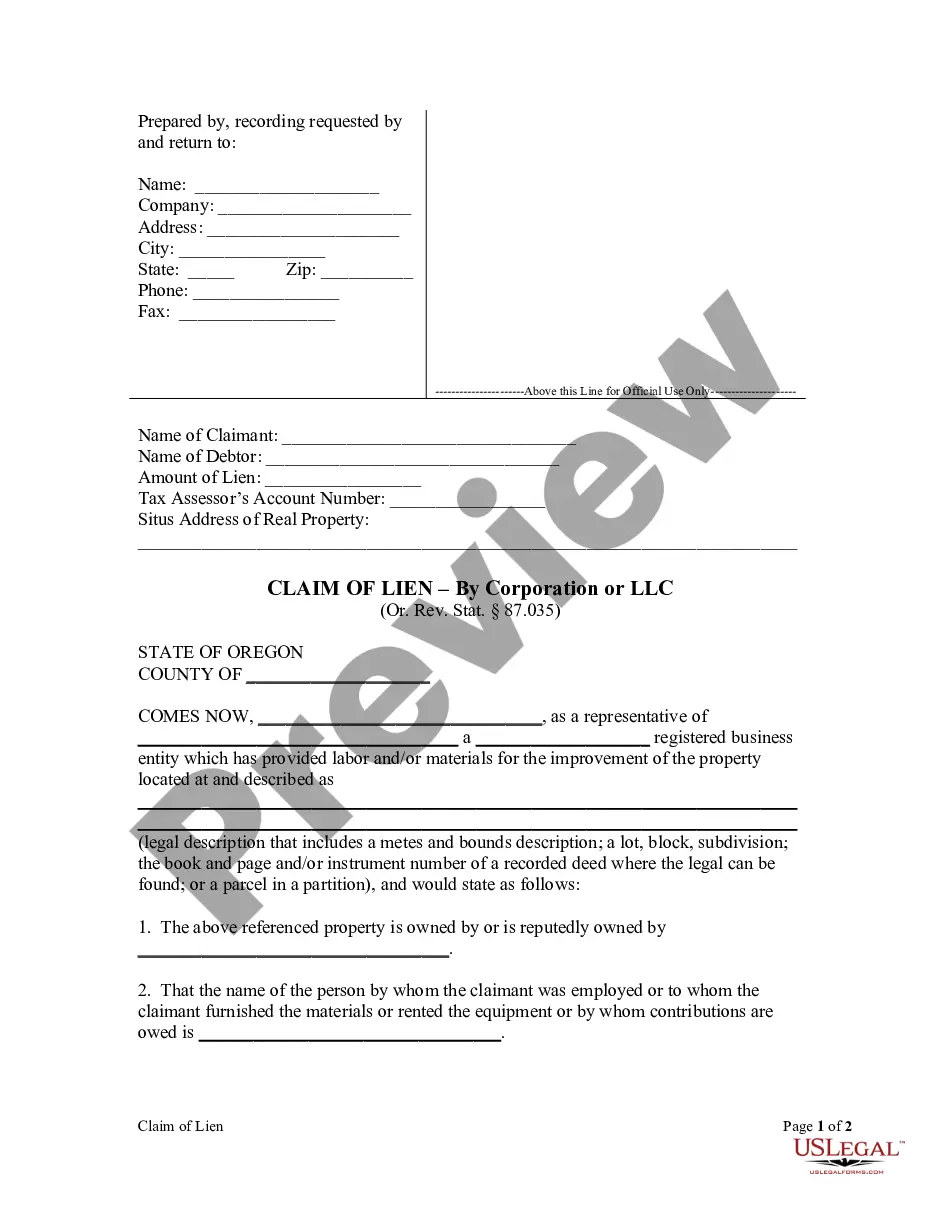

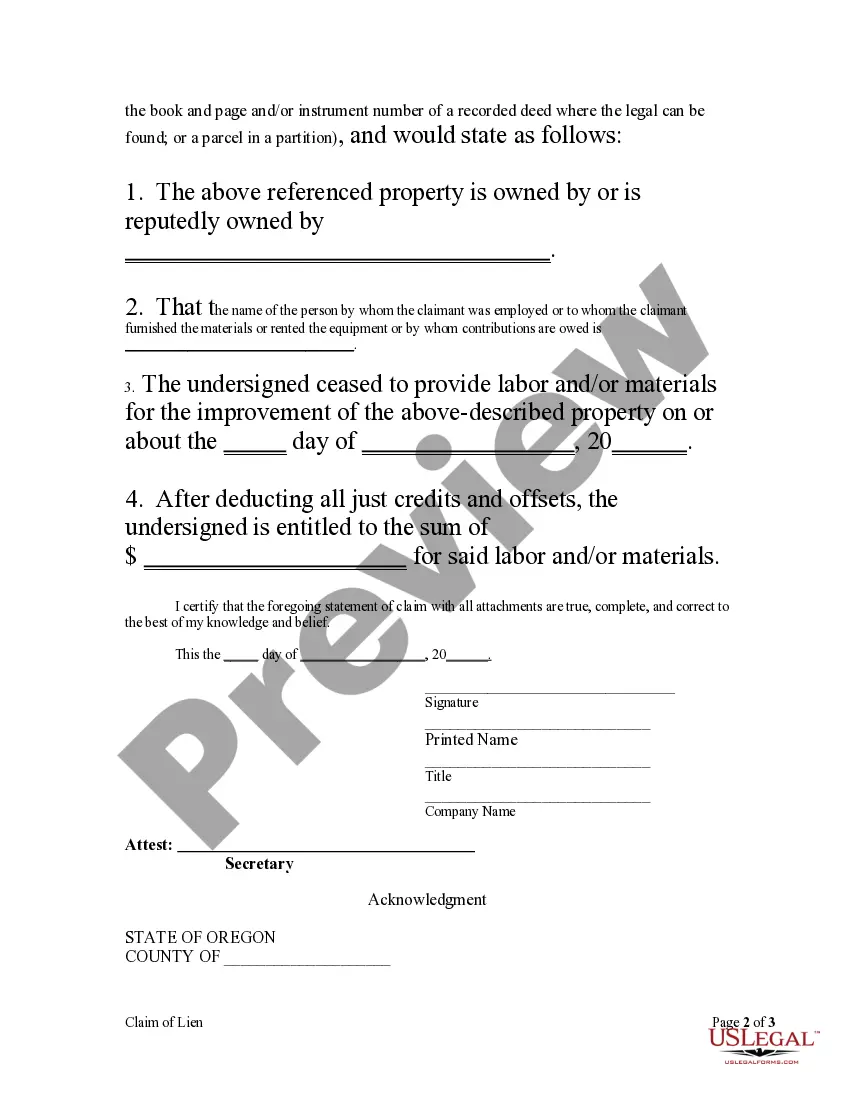

How to fill out Oregon Claim Of Lien By Corporation?

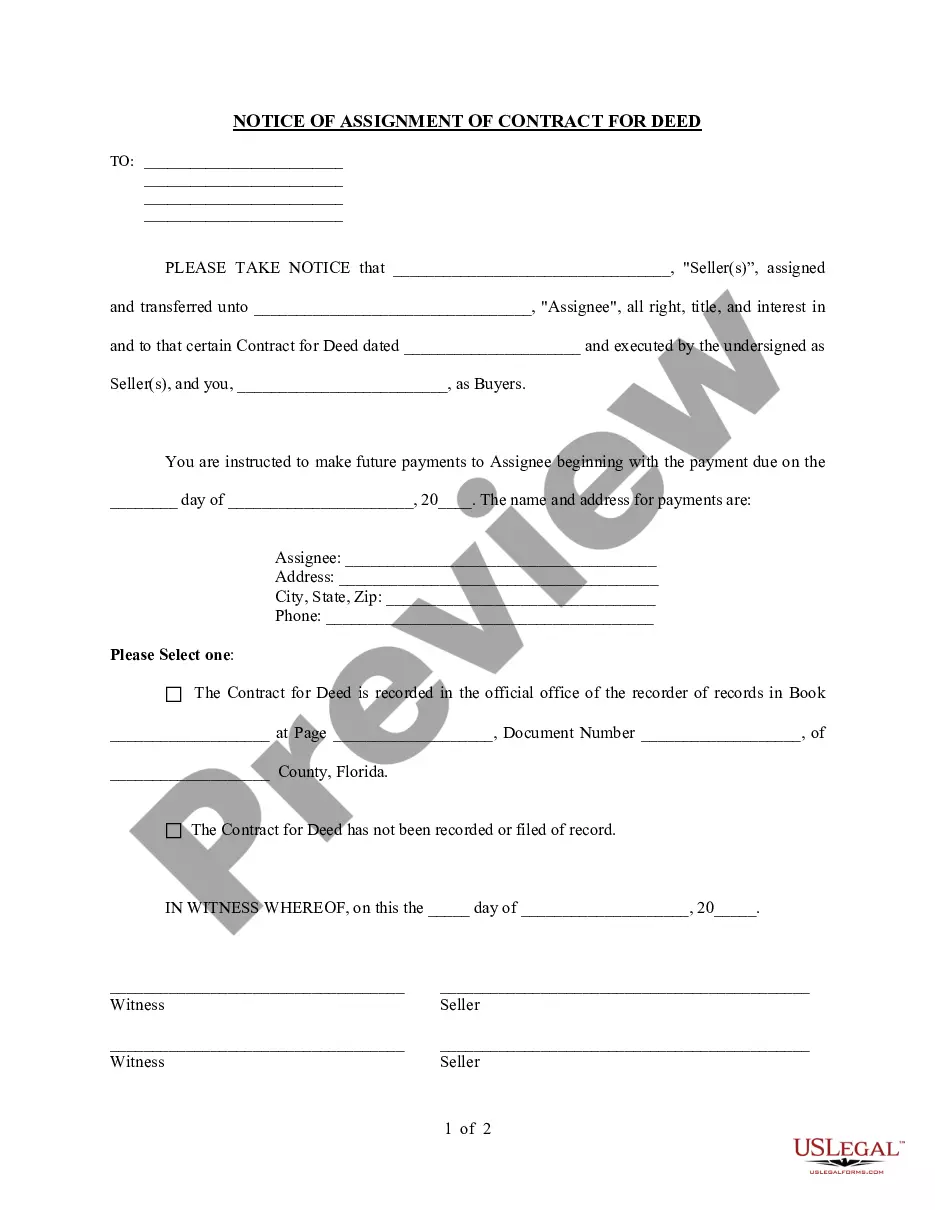

- If you're a returning user, log in to your account. Ensure your subscription is active to avoid interruptions.

- In the Preview mode, check the form description. It is essential to select a template that aligns with your needs and complies with local jurisdiction requirements.

- If needed, perform a search using the Search tab to find alternate templates if your initial choice doesn't fit your criteria.

- Once you've identified the right document, click on the Buy Now button. Select your preferred subscription plan; remember, you’ll need to create an account to access the full library.

- Finalize your purchase by entering your payment details via credit card or PayPal.

- Download your form to your device. Access your saved templates anytime in the My Forms section of your profile.

In conclusion, using US Legal Forms allows individuals and attorneys to efficiently create legally sound documents through an extensive library of over 85,000 forms. With the right tools, navigating the complexities of establishing an LLC can be straightforward.

Start your journey today and explore how US Legal Forms can streamline your legal document needs!

Form popularity

FAQ

To write an LLC example, choose a descriptive name that reflects your business goals, like 'Bright Future Consulting, LLC'. Ensure you include the designation 'LLC' to signify its legal structure. This not only clarifies the nature of your business but also illustrates the LLC company meaning for potential clients and stakeholders.

The term LLC stands for Limited Liability Company, indicating a legal business structure that protects its owners from personal liability for the company’s debts and obligations. This means that personal assets are generally safe in the event of a lawsuit or financial issues. Understanding LLC company meaning is crucial, as it can influence how you operate your business and manage risks.

An LLC should be properly written by including 'LLC' at the end of your business name. For example, if your company is called 'Tech Innovators', it should be written as 'Tech Innovators, LLC'. This clearly identifies your business as a limited liability company, which is important for legal and operational purposes.

To write an LLC example, you can create a fictional company name such as 'Green Leaf Landscaping, LLC'. After that, include relevant details, such as the business purpose and the names of the members or managers involved. This example can help illustrate LLC company meaning clearly to others who may be exploring this business structure for their own ventures.

Filing for an LLC involves several steps. Begin by gathering the required information such as your business name, address, and the details of the members or managers. After that, you can complete the articles of organization form, which you will file with your state’s business filing office. Moreover, using platforms like USLegalForms can streamline this process, providing templates and guidance tailored to your specific state.

To write a company LLC, start by choosing a unique name that adheres to your state's LLC naming guidelines. Next, include 'LLC' or 'Limited Liability Company' in the name to clearly indicate your business structure. You can then register your LLC by preparing and filing the necessary articles of organization with the appropriate state authority, ensuring compliance with all local regulations.

While no business can legally avoid taxes, an LLC can implement strategies to minimize tax liabilities. By choosing pass-through taxation, an LLC can ensure profits are only taxed once at the personal income level. Moreover, taking advantage of business expense deductions helps lower taxable income. Uslegalforms provides tools and resources to guide you through effective tax planning strategies for your LLC.

An LLC is best for small to medium-sized businesses that seek flexibility and liability protection. It works well for entrepreneurs who want to be involved in daily operations while protecting their personal assets. Additionally, LLCs are ideal for business owners who anticipate profits, want to reinvest them, and minimize tax burdens. With uslegalforms, you can establish an LLC tailored to your specific business needs.

When you understand the LLC company meaning, you recognize that one major tax benefit is the option for pass-through taxation. This allows the LLC's profits to be taxed only at the member level, avoiding double taxation faced by corporations. Additionally, LLC members can manage tax deductions for business expenses more effectively. Uslegalforms can help you set up your LLC correctly to take full advantage of these tax benefits.

An LLC means a business structure that combines the benefits of a corporation and a partnership. It allows owners, known as members, to maintain limited liability while participating actively in management. This structure also provides more taxation flexibility compared to corporations, which can optimize financial outcomes. Uslegalforms is here to simplify your journey in forming an LLC to enjoy these advantages.