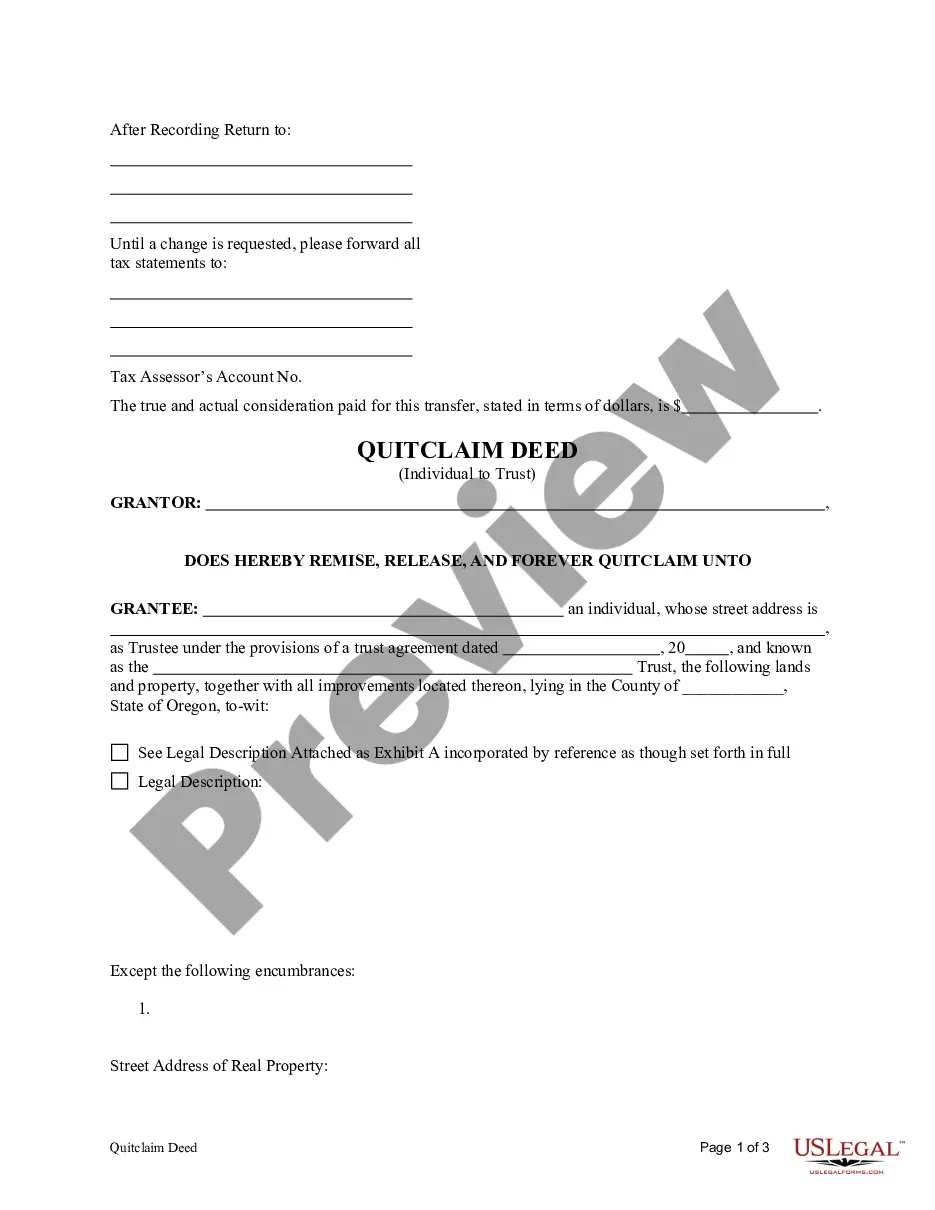

This form is a Quitclaim Deed where the Grantor is an individual and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Oregon Deed Of Trust Form

Description

How to fill out Oregon Deed Of Trust Form?

How to obtain official legal documents that comply with your state's regulations and prepare the Oregon Deed Of Trust Form without seeking help from a lawyer.

Numerous online services provide templates for a variety of legal needs and formalities. However, it may require effort to determine which of the accessible samples meet both your requirements and legal standards.

US Legal Forms is a trusted resource that assists you in locating official documents created in alignment with the most recent state law updates, helping you save on legal costs.

If you do not possess an account with US Legal Forms, follow the instructions below: Review the page you’ve opened and verify if the form meets your requirements. To assist with this, utilize the form description and preview options if they are available. Search for another example in the header related to your state if necessary. Click the Buy Now button once you locate the correct document. Choose the most suitable pricing plan, then Log In or create an account. Select your payment method (via credit card or through PayPal). Change the file format for your Oregon Deed Of Trust Form and click Download. The obtained templates remain yours: you can always return to them in the My documents section of your profile. Register on our platform and create legal documents independently like a seasoned legal professional!

- US Legal Forms is more than just an ordinary online directory.

- It's a compilation of over 85,000 validated templates for different business and personal situations.

- All documents are categorized by industry and state to simplify your searching experience.

- In addition, it connects with advanced solutions for PDF editing and electronic signatures, allowing users with a Premium subscription to swiftly complete their documents online.

- Obtaining the necessary paperwork requires minimal effort and time.

- If you already have an account, Log In and verify that your subscription is active.

- Download the Oregon Deed Of Trust Form by clicking the corresponding button next to the file name.

Form popularity

FAQ

Yes, Oregon is a deed state, meaning that real property titles are transferred through deeds. In Oregon, the use of a deed of trust, especially the Oregon deed of trust form, provides an additional layer of security for lenders. Understanding how deeds function in Oregon is critical for any property transaction.

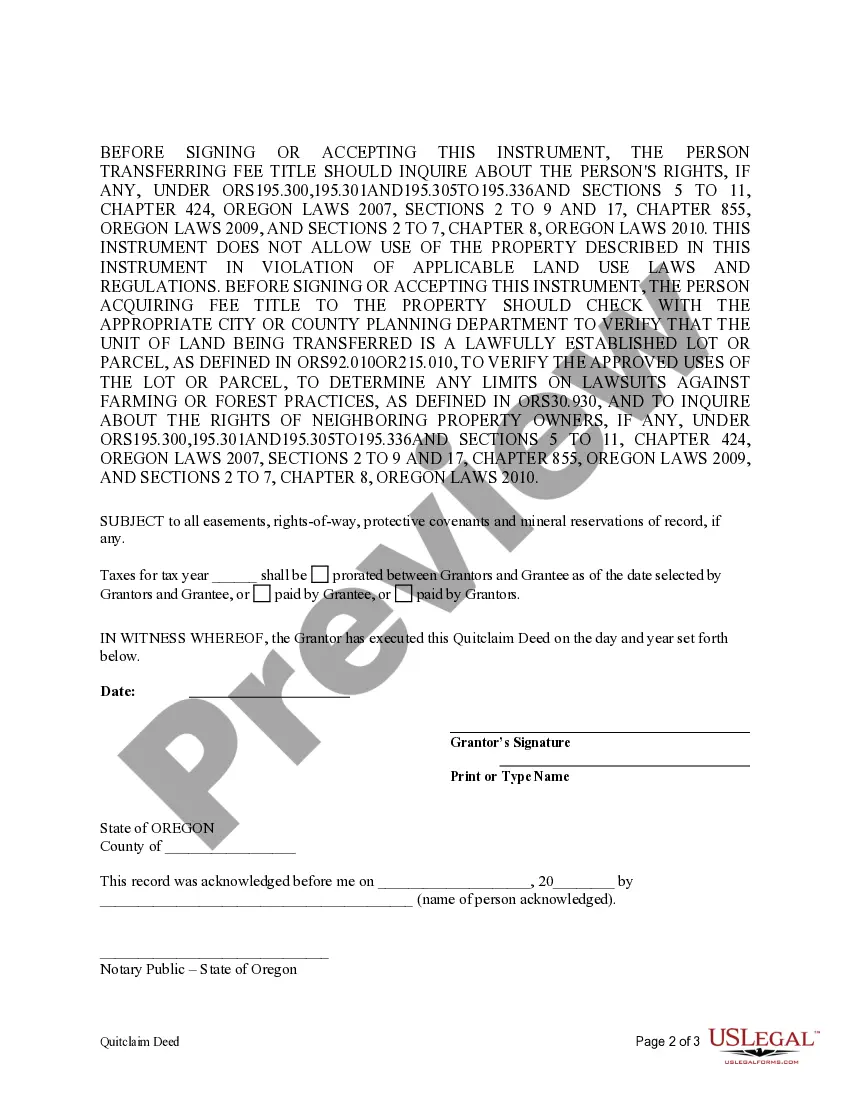

To record a deed in Oregon, you must first complete the deed, ensuring it follows state laws. Then, submit the completed document to the county clerk’s office where the property is located. Recording the Oregon deed of trust form provides public notice and protects your rights to the property.

In Oregon, a deed does not need to be recorded to be valid; however, recording is highly recommended. An unrecorded deed can still be effective between parties, but third parties would not be aware of your property claim. For your security, utilizing the Oregon deed of trust form is an essential step to protect your interest against future claims.

To release a deed of trust in Oregon, you must execute a 'Deed of Reconveyance' once the underlying debt has been satisfied. This document needs to be recorded with the county clerk where the original Oregon deed of trust form was filed. Filing this release promptly protects your credit and ensures clear ownership of the property.

Filing a trust in Oregon involves several steps. First, draft a trust document that meets state standards, then fund the trust by transferring assets, including real property. While there's no formal court filing for most trusts, using an Oregon deed of trust form can streamline the process of transferring real estate into the trust.

To transfer your property to a trust in Oregon, you will need to create a trust document outlining the terms of the trust. You then execute a new deed, like the Oregon deed of trust form, transferring the property into the trust's name. It's essential to consider consulting a legal expert to ensure all steps are correctly completed.

In Oregon, a deed must contain specific elements, including the names of the parties, a legal description of the property, and the signature of the grantor. Moreover, for a deed of trust, the Oregon deed of trust form must also meet state requirements for security interests. Ensuring compliance will help facilitate smooth property transactions.

An unrecorded deed can be considered valid in Oregon, but it may lead to complications. While the deed is effective between the parties involved, it is advisable to record the Oregon deed of trust form with the county clerk. Recording protects your rights and provides public notice of your interest in the property.

Oregon primarily functions as a deed of trust state, as most real estate transactions utilize a deed of trust instead of a standard mortgage. This choice offers streamlined processes for lenders and enhanced protections for borrowers. When you prepare an Oregon deed of trust form, you engage in a legal agreement that supports effective borrowing while minimizing potential complications down the road.

Oregon is indeed a deed of trust state, which means that property financing often involves a deed of trust rather than a traditional mortgage. This process provides certain advantages for both borrowers and lenders, including simplified foreclosure procedures. Utilizing an Oregon deed of trust form is essential for ensuring this arrangement is legally binding and secure.