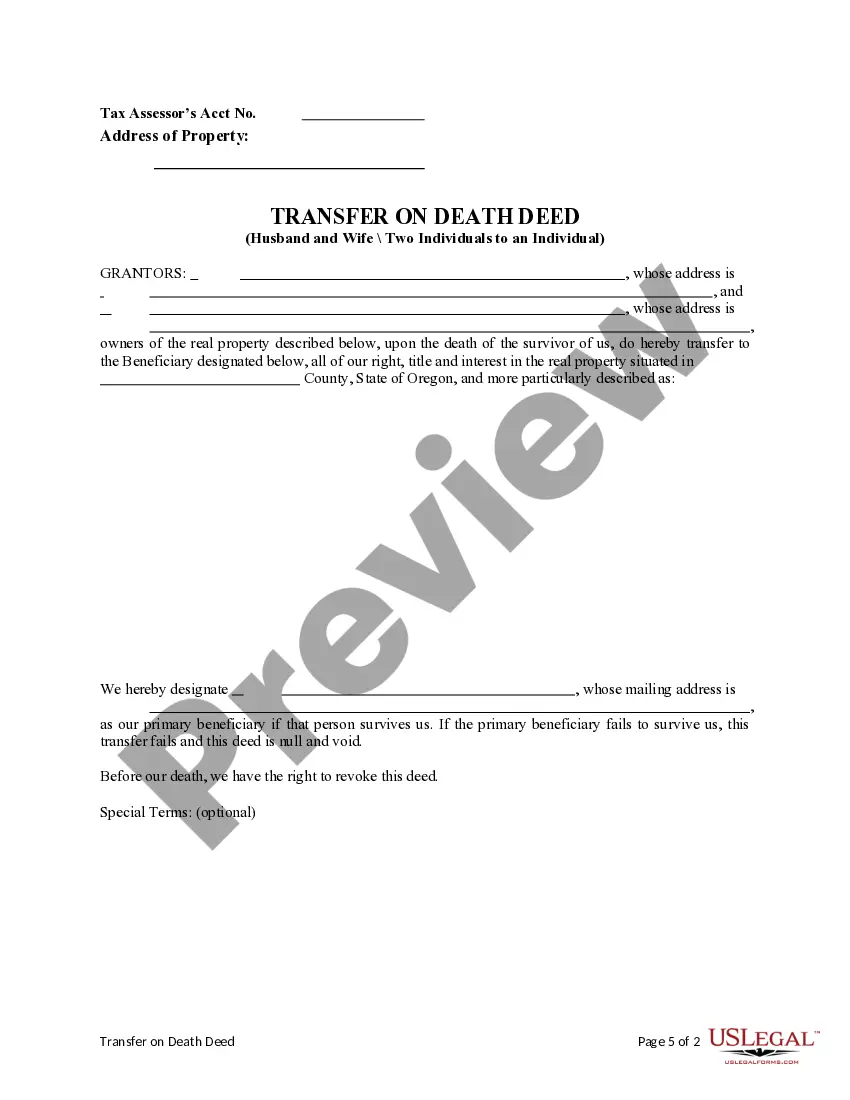

This form is a Transfer on Death Deed where the Grantors are husband and wife and the Grantee / Beneficiary is an individual. This transfer is revocable until Grantor's death and effective only upon the death of the last surviving Grantor. The primary beneficiary / Grantee takes the property if the primary beneficiary survives the Grantors. There is no provision for an alternate beneficiary. If the primary beneficiary does not qualify, the deed is null and void. This deed complies with all state statutory laws.

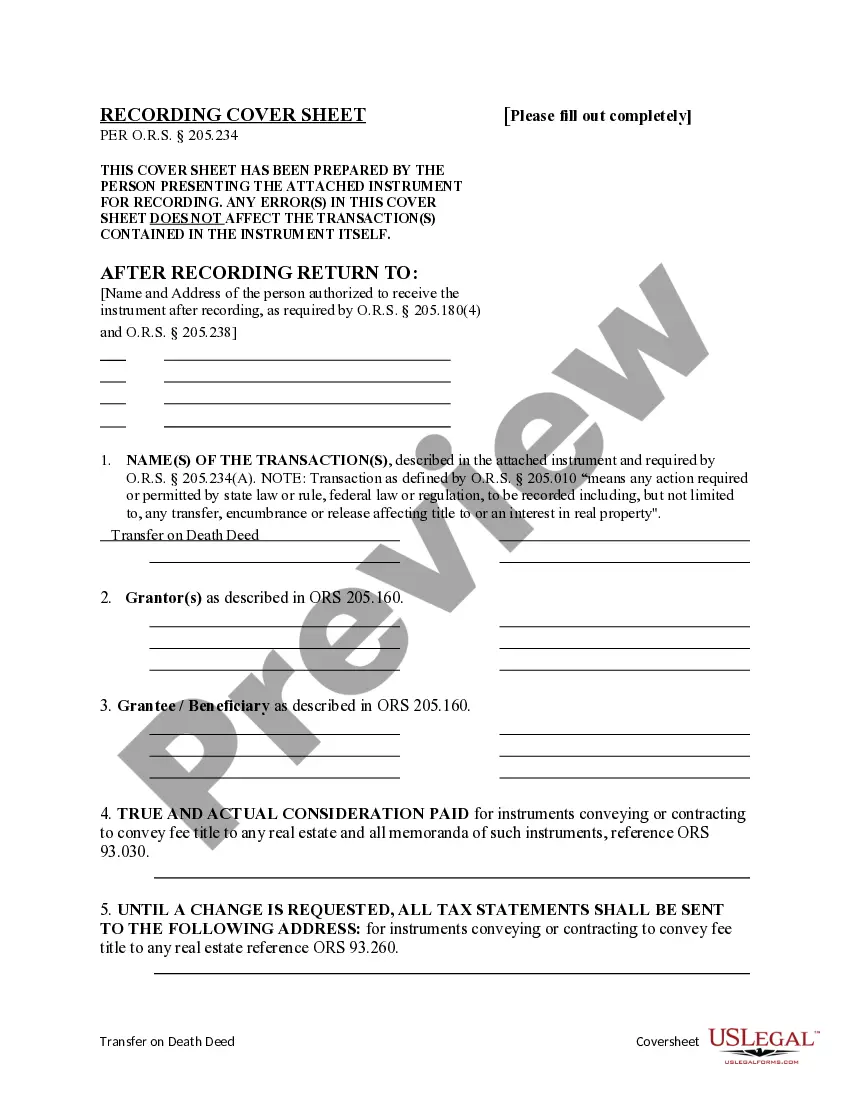

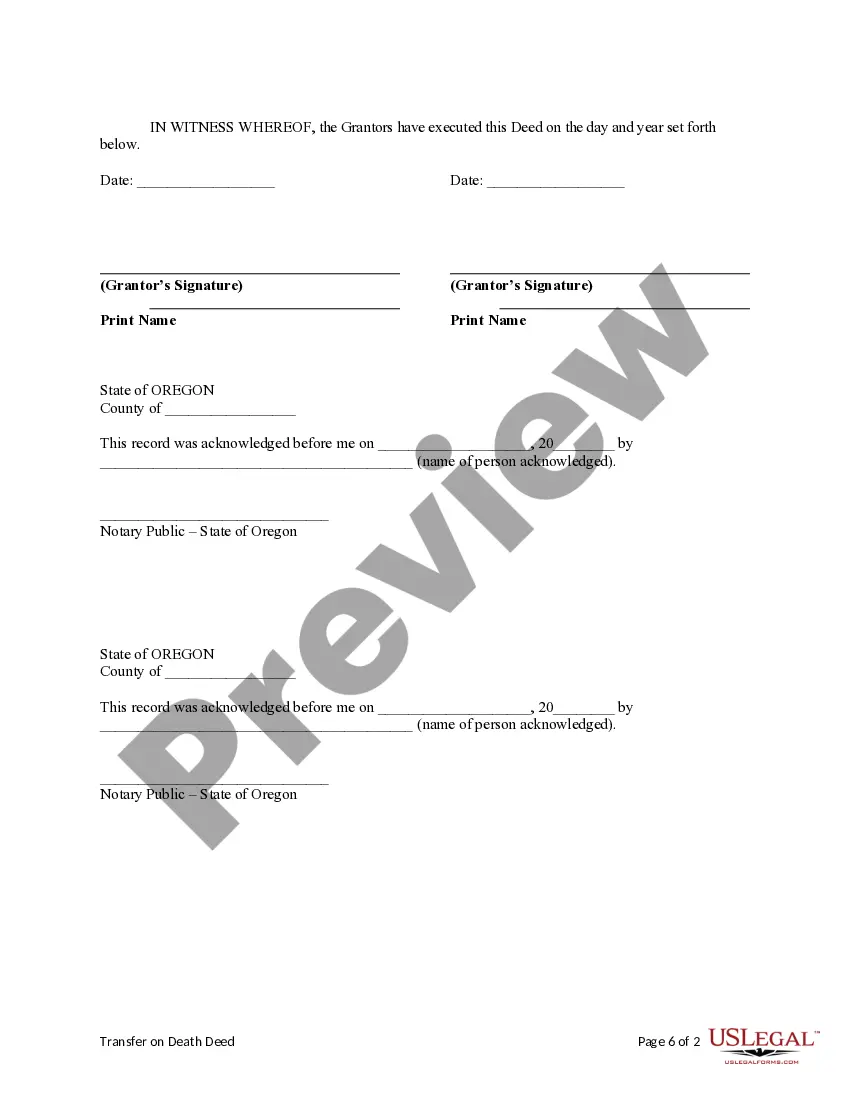

Oregon Transfer Death Form with Notary: A Detailed Overview The Oregon Transfer Death Form with Notary is a legal document used to transfer assets upon the death of an individual in the state of Oregon. It allows the deceased person's designated beneficiary to receive the assets directly without the need for probate proceedings, making the transfer process faster and smoother. The involvement of a notary ensures the validity and authenticity of the document. There are two main types of Oregon Transfer Death Form with Notary: 1. Oregon Transfer on Death ("TOD") Deed: This form specifically deals with the transfer of real estate or property upon the death of the owner. By completing this form, a property owner can legally designate a beneficiary who will receive the property automatically upon their death. This transfer avoids the need for a traditional probate process and ensures a smooth transition of ownership. 2. Oregon Transfer on Death Beneficiary Agreement: This form is used to transfer various non-real estate assets such as bank accounts, securities, stocks, or bonds. It allows the asset owner to designate one or more beneficiaries who will inherit the assets directly upon their death, bypassing the probate process. This form provides a convenient way to transfer financial assets while minimizing legal complexities. The notary's role in the Oregon Transfer Death Form is crucial. They act as an impartial witness, ensuring the authenticity of the document. The notary verifies the identity of the person executing the form, confirms their willingness to sign it, and acknowledges their signature. The notary's seal and signature on the form enhance its legal validity and enforceability. Using the Oregon Transfer Death Form with Notary offers several advantages. It helps individuals establish clear instructions regarding the distribution of their assets after death without the necessity of a will or probate. This method is often preferred due to its simplicity, cost-effectiveness, and the ability to maintain privacy by avoiding public probate records. To summarize, the Oregon Transfer Death Form with Notary provides a straightforward and efficient way to transfer assets in Oregon upon an individual's death. Whether its real estate through the TOD Deed or non-real estate assets through the Beneficiary Agreement, these forms simplify the transfer process. By involving a notary, the documents gain authenticity and legal recognition. Consider consulting an attorney or legal professional to ensure correct and accurate completion of these forms as per Oregon state laws.