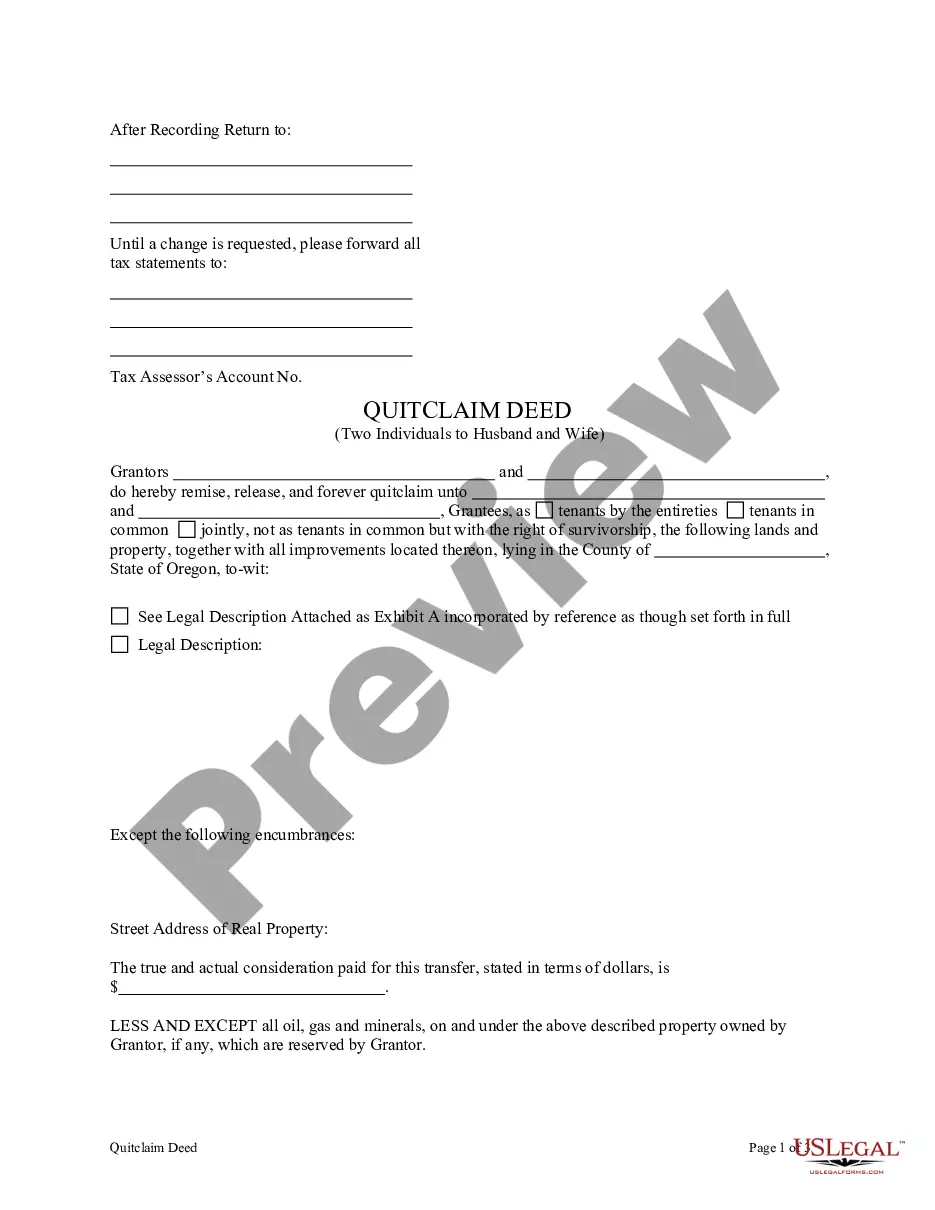

This Quitclaim Deed by Two Individuals to Husband and Wife form is a Quitclaim Deed where the Grantors are Two Individuals and the Grantees are Husband and Wife. Grantors convey and quitclaim the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors. This form complies with all state statutory laws.

Oregon Deed Of Trust Statute

Description

How to fill out Oregon Deed Of Trust Statute?

When you need to finalize Oregon Deed Of Trust Statute that adheres to your local state's laws, there can be various alternatives to select from.

There's no need to inspect every document to ensure it fulfills all the legal requirements if you are a US Legal Forms member.

It is a dependable resource that can assist you in obtaining a reusable and current template on any topic.

Acquiring expertly crafted formal documentation becomes effortless with US Legal Forms. Additionally, Premium users can also utilize the robust integrated features for online PDF editing and signing. Give it a shot today!

- US Legal Forms is the most extensive online archive with a collection of over 85k ready-to-use documents for business and personal legal needs.

- All templates are verified to comply with each state's laws.

- Thus, when acquiring Oregon Deed Of Trust Statute from our site, you can be assured that you possess a legitimate and current document.

- Obtaining the necessary sample from our platform is remarkably easy.

- If you already have an account, simply Log In to the system, ensure your subscription is active, and save the chosen file.

- In the future, you can access the My documents tab in your profile to keep access to the Oregon Deed Of Trust Statute at any time.

- If it's your first time using our site, please follow the instructions below.

- Review the suggested page and verify it against your needs.

Form popularity

FAQ

Oregon operates primarily as a deed of trust state. The Oregon deed of trust statute allows lenders to utilize trust deeds instead of traditional mortgages. This method offers benefits such as a streamlined foreclosure process. By understanding this distinction, borrowers can make more informed decisions about their financing options.

Yes, Oregon is a lien state. This means that liens are used to secure loans against property. In the context of the Oregon deed of trust statute, lenders file a deed of trust to ensure their interest in the property. This legal mechanism strengthens the lender's position in case of default.

Yes, Oregon is generally recognized as a deed state. In this context, the Oregon deed of trust statute governs real estate transactions through the use of deeds, which convey property rights. This means that ownership and transfer of real estate in Oregon typically rely on recorded deeds. Understanding this framework is crucial for anyone engaged in property transactions.

To file a trust in Oregon, you must create a trust document that outlines the terms and beneficiaries of the trust. If your trust involves real property, ensure that it complies with the Oregon deed of trust statute. You may consider using trusted platforms like uslegalforms to simplify the drafting process. After preparing your trust document, it typically does not require formal filing, but you'll want to keep it in a secure place.

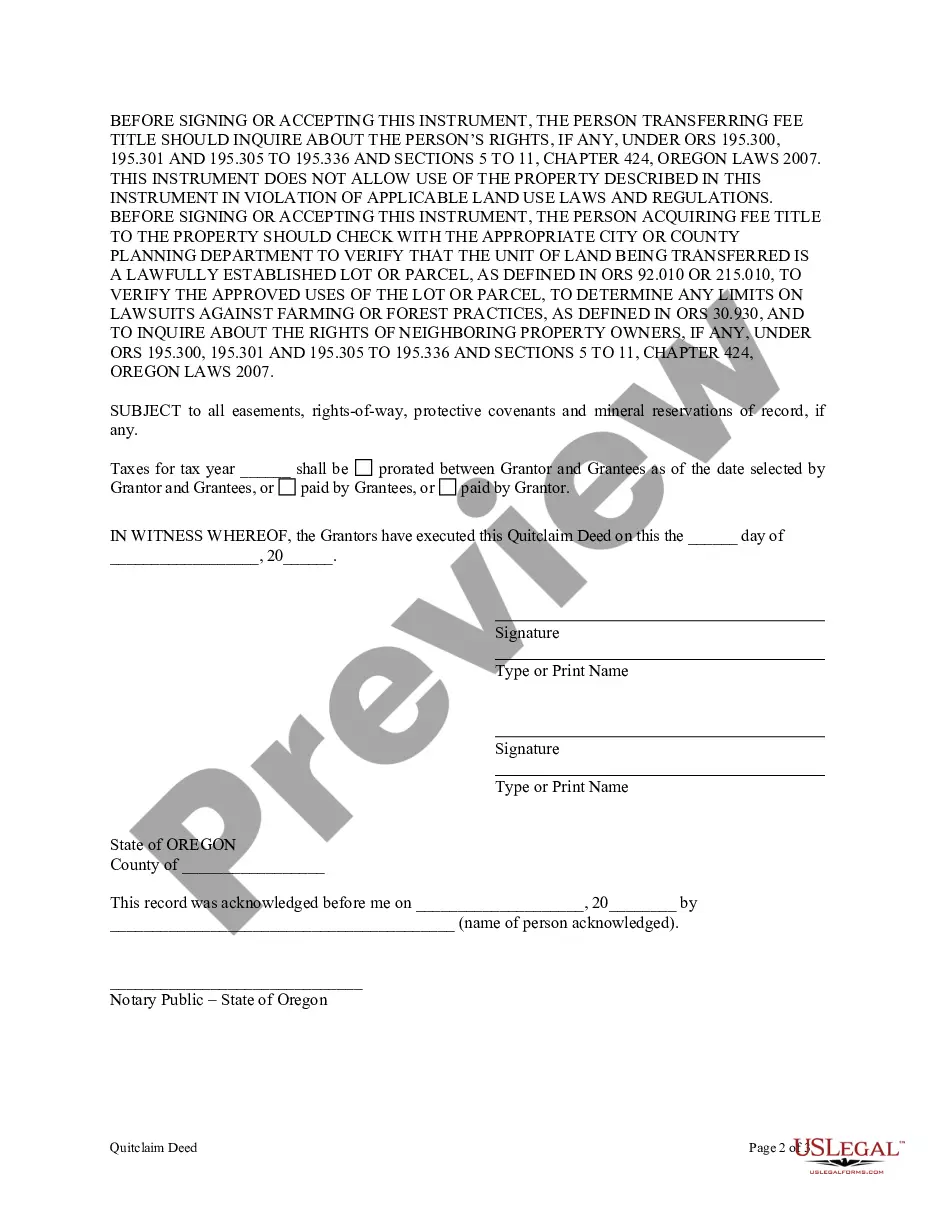

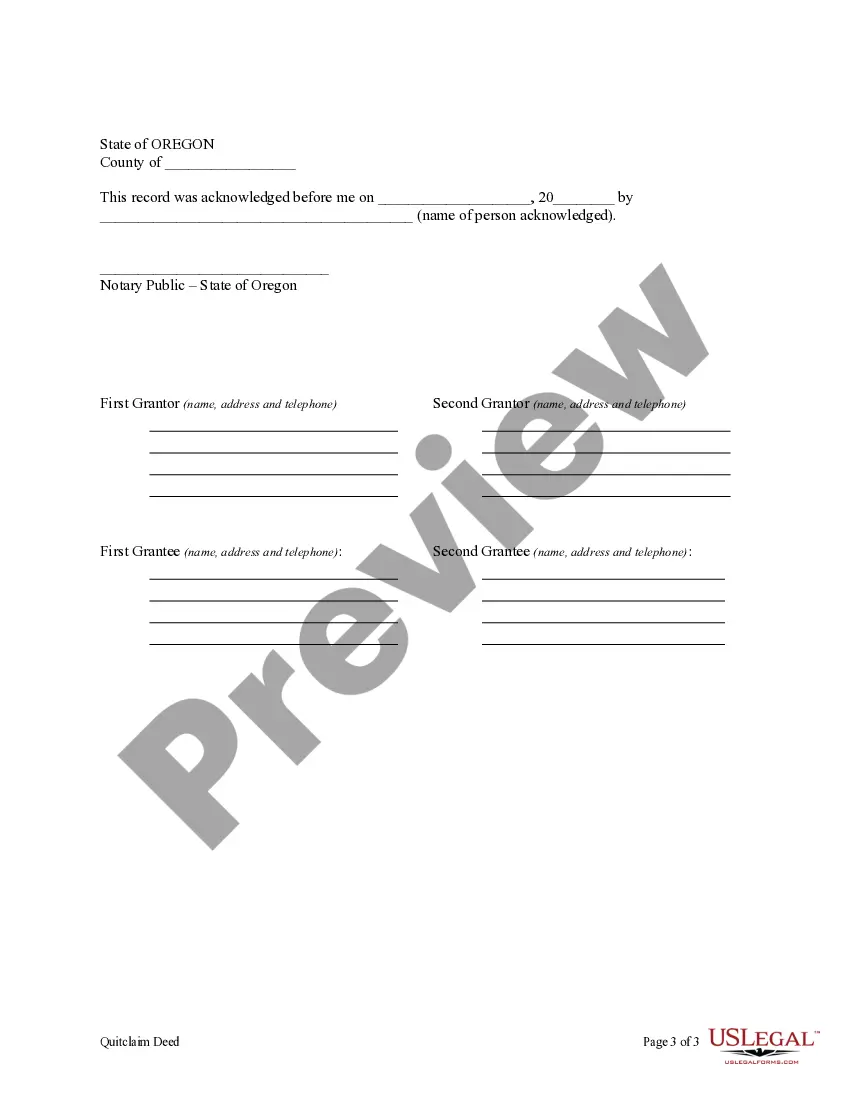

In Oregon, a valid deed must include certain key elements as specified in the Oregon deed of trust statute. The deed should clearly identify the grantor and grantee, contain a legal description of the property, and be signed by the grantor. Additionally, it is necessary to acknowledge the deed before a notary public. Meeting these requirements ensures that your deed is recognized and enforceable.

An unrecorded deed can still be valid in Oregon; however, it may create complications regarding the property's legal ownership. According to the Oregon deed of trust statute, recording a deed provides notice to the public and protects your interest against claims. Without recording, your deed may be challenged by anyone who records a subsequent deed. Therefore, it is always advisable to record your deed promptly.

To transfer your property to a trust in Oregon, you will need to create a trust document and execute a deed that transfers the property title into the trust. This process typically involves drafting a new deed, which must comply with the Oregon deed of trust statute. Using services like uslegalforms can streamline this process, ensuring that all paperwork is completed correctly.

Oregon is primarily a deed of trust state, which means that property transactions often use trust deeds instead of traditional mortgages. This method provides a more streamlined foreclosure process, protecting both lenders and borrowers. Understanding the Oregon deed of trust statute is essential for anyone engaging in real estate transactions in the state.

In Oregon, a deed does not have to be recorded to be valid; however, doing so provides public notice of the transaction. Recording a deed protects your interests and secures your title against future claims. The Oregon deed of trust statute emphasizes the importance of registration, making your ownership clear and enforceable.

The primary beneficiary of a trust is the person or entity that receives benefits from the trust's assets or income. In the context of an Oregon trust deed, this is typically the lender who holds an interest in the property. Understanding the designation of the primary beneficiary is vital for borrowers, as it outlines who has a claim to the property in case of default. Legal resources through US Legal Forms can help clarify these roles and responsibilities.