Oregon Dmv Inheritance Affidavit Without Consent

Description

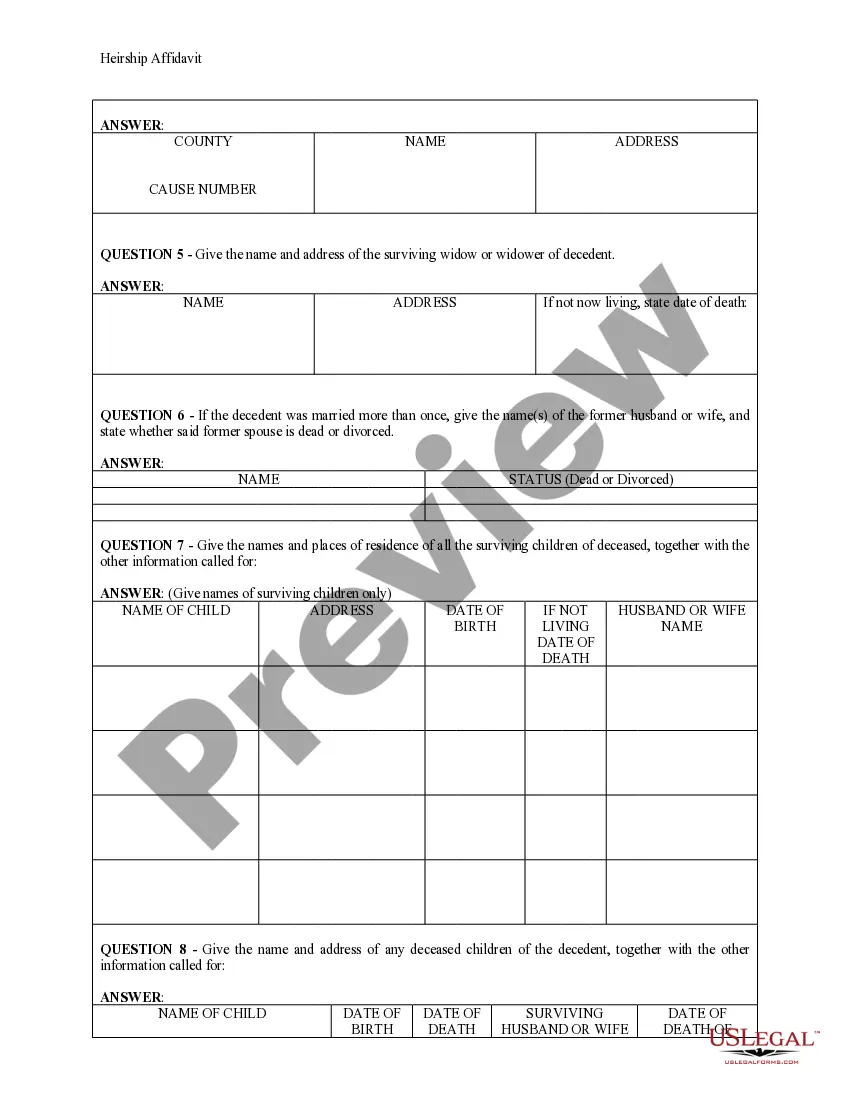

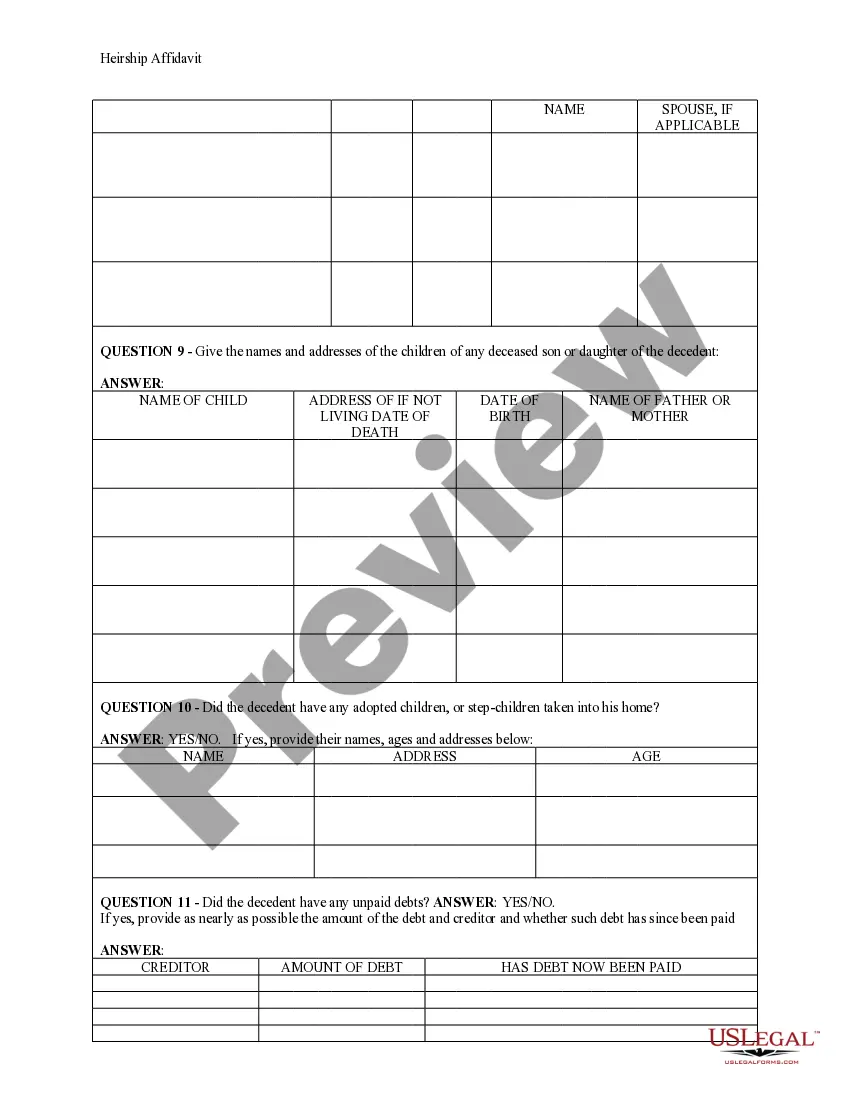

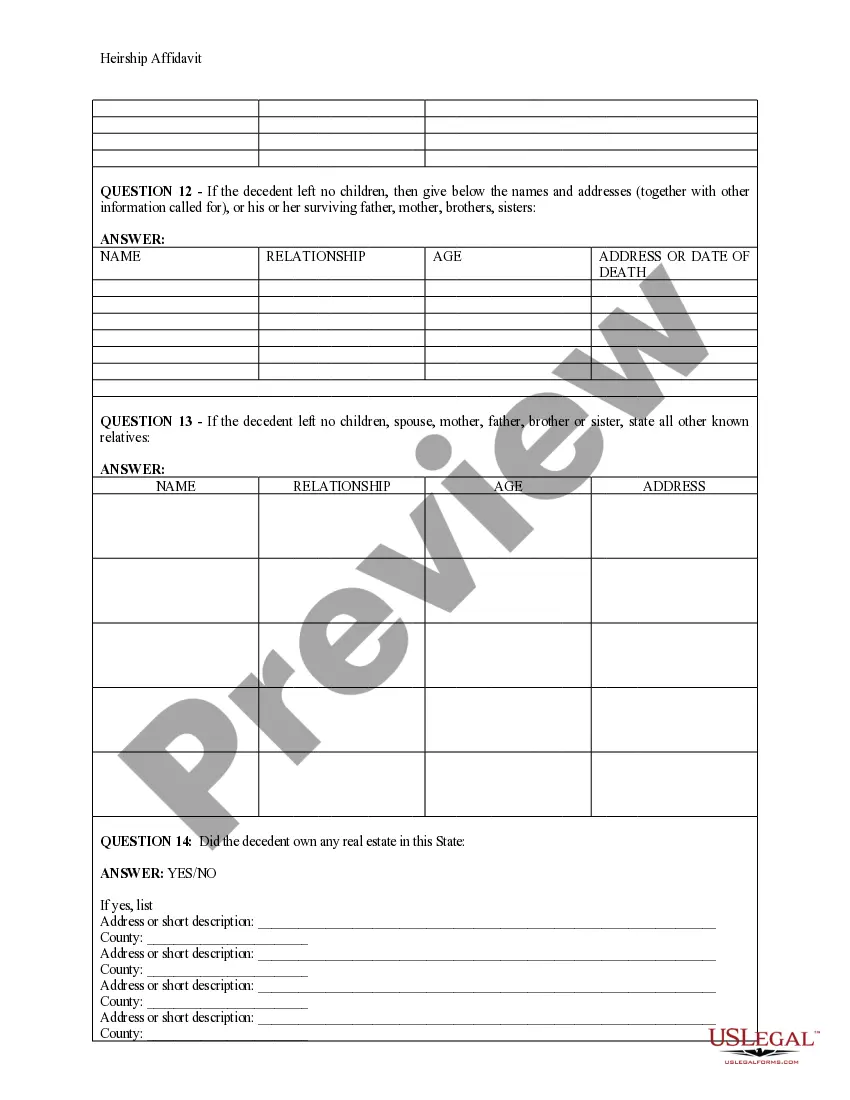

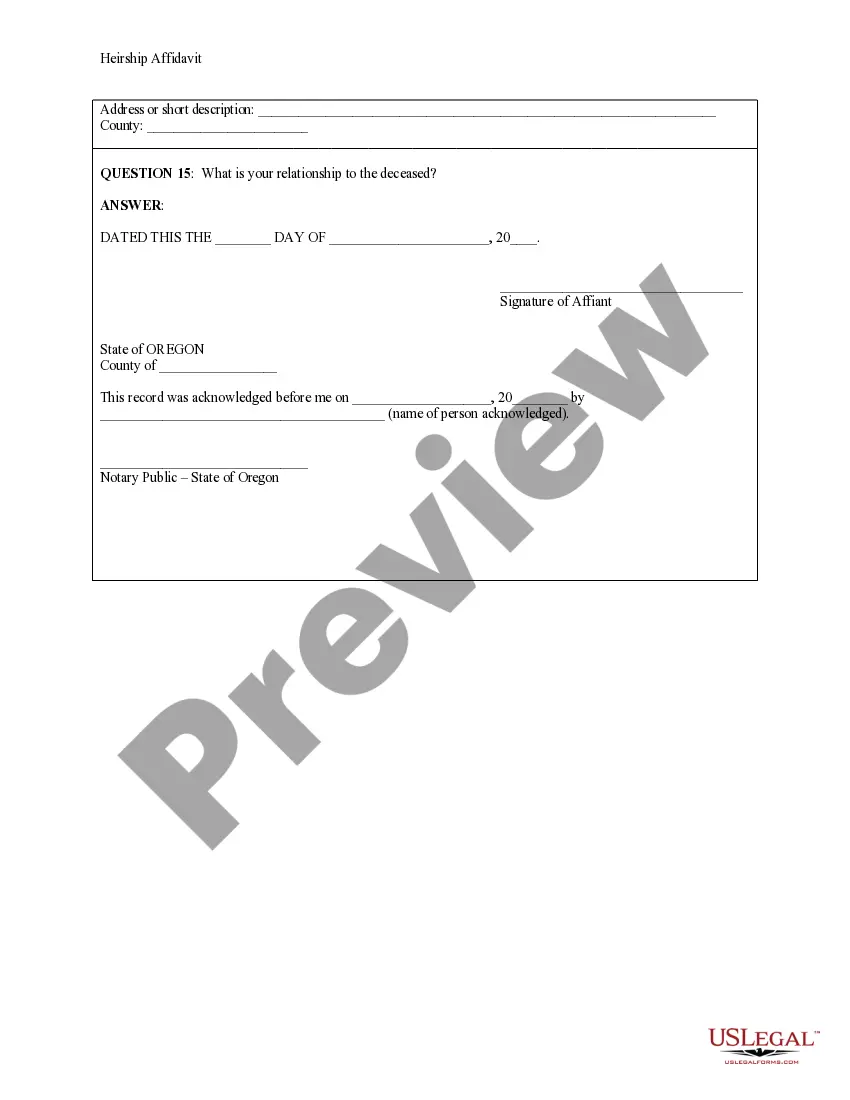

How to fill out Oregon Heirship Affidavit - Descent?

It’s well known that you cannot become a legal expert instantly, nor can you swiftly learn to draft the Oregon Dmv Inheritance Affidavit Without Consent without having a specialized background.

Creating legal documents is a lengthy endeavor that necessitates specific education and skills.

So why not entrust the drafting of the Oregon Dmv Inheritance Affidavit Without Consent to the professionals.

Preview it (if this option is available) and review the accompanying description to see if the Oregon Dmv Inheritance Affidavit Without Consent is what you’re looking for.

If you need a different template, restart your search. Create a free account and select a subscription plan to buy the template. Select Buy now. Once payment is completed, you can download the Oregon Dmv Inheritance Affidavit Without Consent, fill it out, print it, and send it or mail it to the intended recipients or organizations.

- With US Legal Forms, which boasts one of the largest collections of legal templates, you can find anything from court forms to templates for internal corporate communication.

- We understand how important it is to comply with federal and state regulations.

- That’s why, on our platform, all templates are location-specific and current.

- Here’s how you can begin with our website and acquire the document you need in just a few minutes.

- Locate the form you require using the search bar at the top of the page.

Form popularity

FAQ

Title transfer in Oregon if the owner has passed away The original vehicle title, if you have it. An Application for Title and Registration. The heir must fill out Inheritance Affidavit and have it notarized. Odometer disclosure, if applicable. Any bill of sale or lien release from prior owner(s) (not the deceased)

To notify the Oregon DMV, you need to send a written notice to the DMV. The notice should include the deceased's full name, date of birth, and driver license number if known. In case of a vehicle, you need to provide the vehicle identification number (VIN).

If you have trouble meeting DMV requirements, you may find information about other resources by calling 211.

Title transfer in Oregon if the owner has passed away The original vehicle title, if you have it. An Application for Title and Registration. The heir must fill out Inheritance Affidavit and have it notarized. Odometer disclosure, if applicable. Any bill of sale or lien release from prior owner(s) (not the deceased)

A copy of their emancipation papers must be submitted with the Form 516. If the heirs sell the vehicle, they may release on the title, a separate bill of sale, or secure odometer disclosure. The heirs may assign their interest to a buyer by naming that person on Form 516.