Oregon Sale Real Or Without Tax

Description

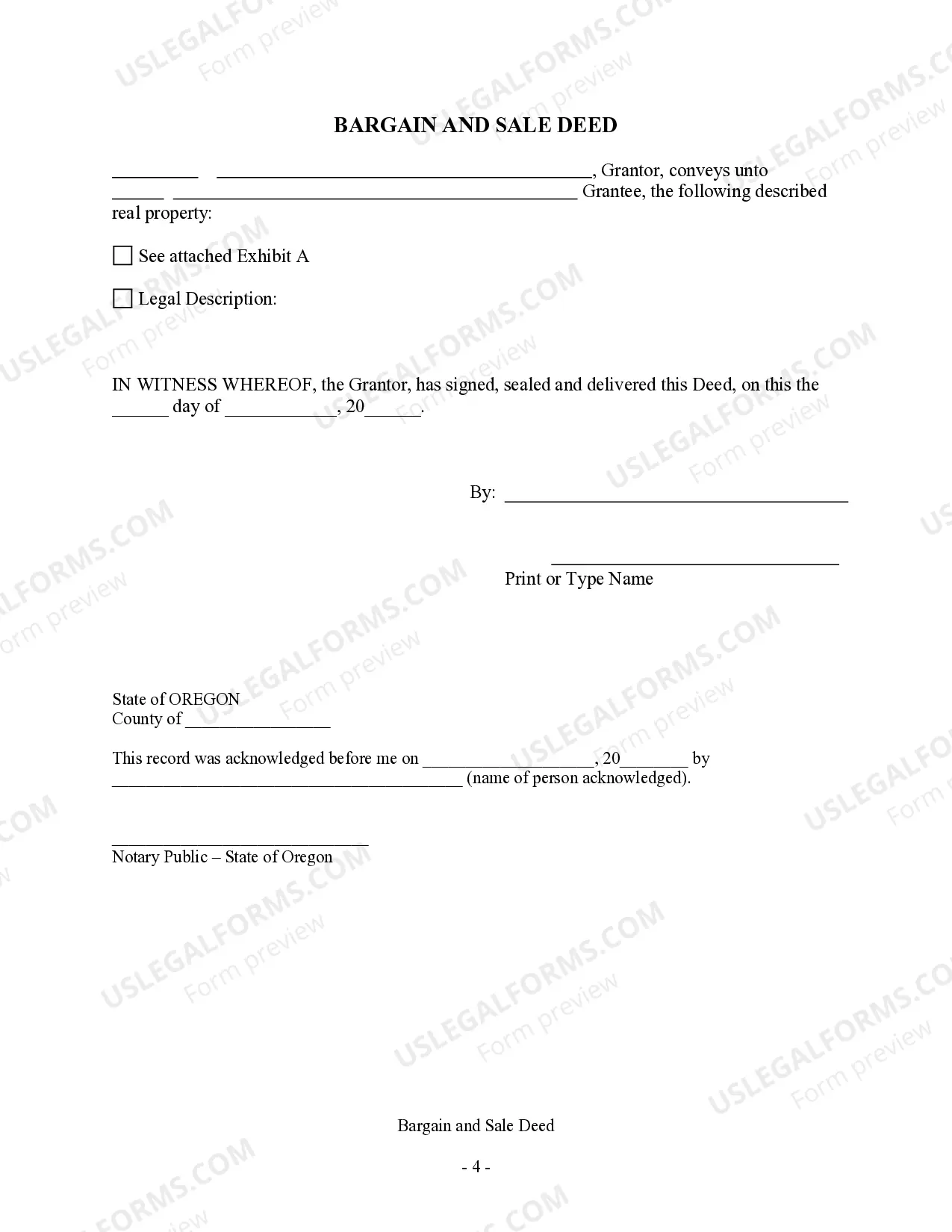

How to fill out Oregon Bargain And Sale Deed - Individual To Individual?

Finding a go-to place to take the most recent and relevant legal templates is half the struggle of dealing with bureaucracy. Choosing the right legal papers demands precision and attention to detail, which is the reason it is crucial to take samples of Oregon Sale Real Or Without Tax only from reliable sources, like US Legal Forms. A wrong template will waste your time and delay the situation you are in. With US Legal Forms, you have little to worry about. You can access and check all the information about the document’s use and relevance for the situation and in your state or county.

Take the listed steps to complete your Oregon Sale Real Or Without Tax:

- Make use of the library navigation or search field to locate your sample.

- Open the form’s description to check if it matches the requirements of your state and area.

- Open the form preview, if available, to ensure the template is definitely the one you are looking for.

- Resume the search and look for the right template if the Oregon Sale Real Or Without Tax does not suit your requirements.

- When you are positive about the form’s relevance, download it.

- If you are a registered customer, click Log in to authenticate and access your selected templates in My Forms.

- If you do not have an account yet, click Buy now to obtain the form.

- Select the pricing plan that fits your preferences.

- Go on to the registration to complete your purchase.

- Finalize your purchase by choosing a transaction method (credit card or PayPal).

- Select the file format for downloading Oregon Sale Real Or Without Tax.

- Once you have the form on your gadget, you may change it using the editor or print it and complete it manually.

Get rid of the hassle that comes with your legal paperwork. Discover the comprehensive US Legal Forms library to find legal templates, check their relevance to your situation, and download them on the spot.

Form popularity

FAQ

Oregon is a tax-free state and doesn't have a sales tax If Oregon residents buy goods or services online, they are not required to pay sales tax in another state. However, sales tax may be imposed on online purchases in exceptional cases.

Throughout almost all of Oregon, you won't pay any real estate transfer taxes. The one exception is Washington County, which levies a transfer tax of $1 per every $1,000 of value. So, if your home sells for $500,000, you'll need to pay $500.

Oregon does not have a general state sales tax. The personal income tax is the largest source of state tax revenue, expected to account for 86% of the state's General Fund for the 2021?2023 biennium. Oregon's taxable income is closely connected to federal taxable income.

Oregon is one of the 13 states that don't require buyers or sellers to pay any transfer taxes when a piece of property exchanges hands ? with one exception. This one exception is for the residents of Washington County in Oregon who are unfortunately subject to transfer taxes.

Four percent of the consideration (sales price); ? Eight percent of the gain that is includable in Oregon taxable income; or ? The net proceeds disbursed to the transferor.