This form is a Transfer on Death Deed where the Grantor/Owner is an individual and the Grantee beneficiary is an individual. This transfer is revocable by Grantor until death and effective only upon the death of the Grantor. This deed must be recorded prior to Grantor's death. This deed complies with all state statutory laws.

Transfer On Death Deed Oregon With Mortgage

Description

How to fill out Oregon Transfer On Death Deed From An Individual Owner/Grantor To An Individual Beneficiary.?

Bureaucracy demands exactness and correctness.

Unless you manage completing paperwork like Transfer On Death Deed Oregon With Mortgage regularly, it may lead to some misunderstanding.

Selecting the appropriate template from the beginning will ensure that your document submission proceeds smoothly and avoids any hassles of resubmitting a file or starting the same task entirely from the beginning.

Finding the correct and current samples for your paperwork is a matter of a few minutes with an account at US Legal Forms. Sidestep the bureaucratic issues and simplify your form handling.

- Locate the template through the search bar.

- Ensure the Transfer On Death Deed Oregon With Mortgage you've discovered is applicable to your state or county.

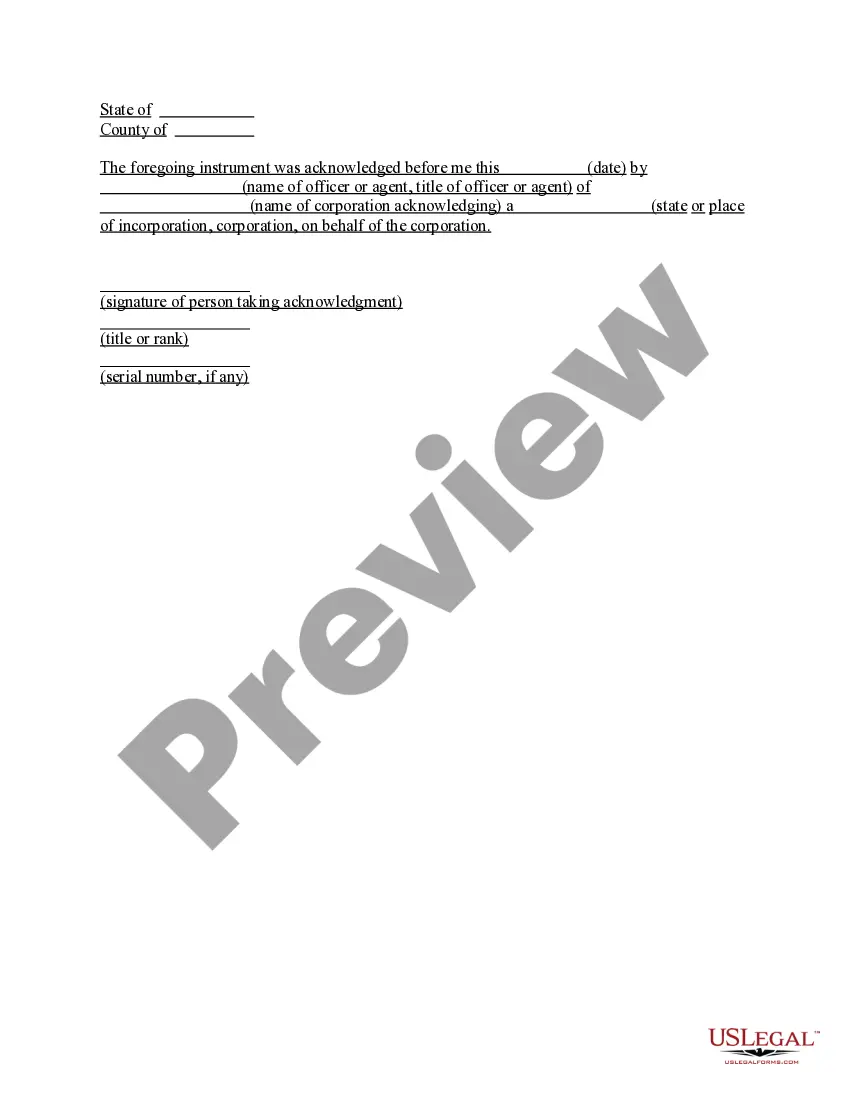

- Review the preview or examine the description containing the information regarding the usage of the template.

- If the result aligns with your search, click the Buy Now button.

- Choose the suitable option from the proposed pricing plans.

- Log In to your account or sign up for a new one.

- Complete the transaction using a credit card or PayPal account.

- Receive the form in your preferred format.

Form popularity

FAQ

To file a transfer on death deed in Oregon, you must complete the required form and submit it to your county's recorder office. Ensure that all information is accurate and that the deed is signed according to state guidelines. After filing, your chosen beneficiary will automatically inherit the property upon your passing, even with a mortgage attached. US Legal Forms can guide you through the filing process, making it easy and efficient.

Yes, you can create a transfer on death deed in Oregon, even if there is a mortgage on the property. This deed allows you to designate a beneficiary who will inherit your property upon your death without the need for probate. It's important to ensure that the deed complies with Oregon laws and that you properly sign and record it. Utilizing platforms like US Legal Forms can simplify the process and provide you with the necessary documents.

Yes, utilizing a transfer on death deed in Oregon allows property to pass directly to the beneficiary without going through probate. This arrangement can save time and reduce costs for the heirs. It is important to ensure that the transfer on death deed is correctly prepared and filed to reap this benefit. For accurate legal documentation and a smooth transfer, refer to US Legal Forms, which offers essential resources.

Transferring ownership of property in Oregon typically involves preparing a deed that indicates the change in ownership. You must ensure that the deed is properly signed and notarized before submitting it to the county recorder's office. If the property transfer involves a transfer on death deed, follow specific state requirements to facilitate a smooth transfer. For assistance with legal forms, consider US Legal Forms to simplify this process.

To transfer a deed after death in Oregon, first determine if a transfer on death deed exists for the property. If one is in place, the designated beneficiary must complete a simple affidavit of death and a transfer deed. It is important to record these documents with the county recorder's office. Using resources like US Legal Forms can provide you with the necessary forms and guidance.

Yes, Oregon allows transfer on death deeds. This legal tool enables property owners to designate a beneficiary who will receive the property upon their death. This method is beneficial because it simplifies the transfer process and helps avoid probate. Be sure to consult with legal resources or platforms like US Legal Forms to ensure compliance with Oregon laws.

To transfer a property deed from a deceased relative in Oregon, you should first obtain a copy of the death certificate. Next, you will need to locate the original deed and verify if a transfer on death deed was recorded. If applicable, complete the necessary documents and file them with the appropriate county recorder. The process may involve legal forms, and using a platform like US Legal Forms can streamline this for you.

The best way to transfer property after death often involves using a transfer on death deed. This deed allows property to pass directly to the named beneficiary without the need for probate, saving time and potential legal costs. To streamline this process, ensure you have filed the deed correctly prior to your passing. A transfer on death deed Oregon with mortgage is an effective approach for many individuals looking to simplify property transfers.

The best way to transfer property title between family members is often through a quitclaim deed or a transfer on death deed. A quitclaim deed allows you to transfer your interest in the property without warranty, while a transfer on death deed specifies that the property will automatically transfer to the beneficiary upon your death. Using a transfer on death deed Oregon with mortgage can provide benefits like avoiding probate and ensuring a swift transition.

There is no waiting period for a transfer on death deed in Oregon, as this deed takes effect immediately upon the owner’s death. This means your designated beneficiaries can obtain the property without delay or the need for probate. However, it is essential to file the deed correctly while you are alive to ensure its effectiveness. A transfer on death deed Oregon with mortgage simplifies this process for many property owners.