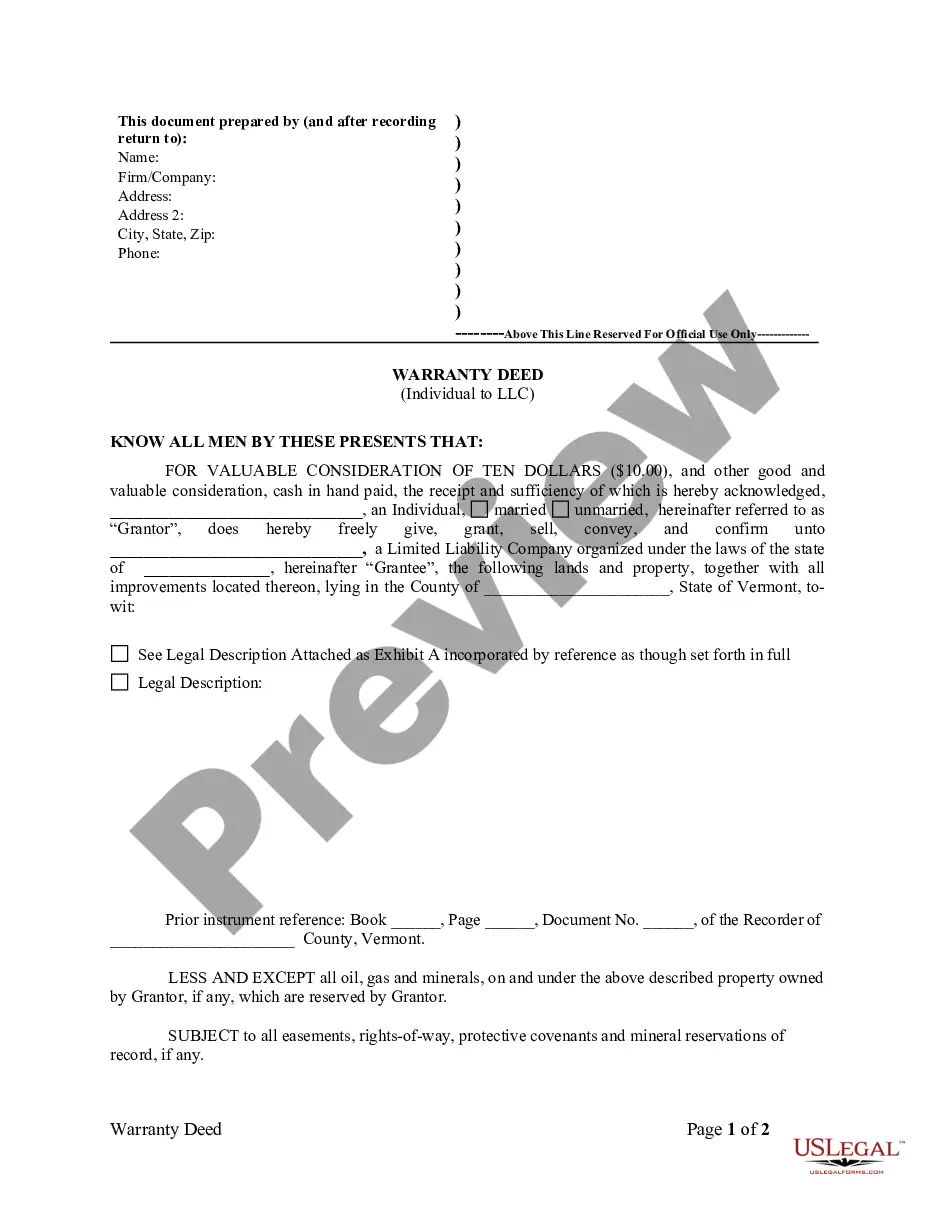

This form is a Transfer on Death Deed where the Grantor/Owner is an individual and the Grantee beneficiary is an individual. This transfer is revocable by Grantor until death and effective only upon the death of the Grantor. This deed must be recorded prior to Grantor's death. This deed complies with all state statutory laws.

Oregon Transfer On Death Deed Form With Trust

Description

How to fill out Oregon Transfer On Death Deed Form With Trust?

Dealing with legal papers and operations can be a time-consuming addition to your entire day. Oregon Transfer On Death Deed Form With Trust and forms like it usually require that you search for them and navigate how to complete them effectively. For that reason, whether you are taking care of financial, legal, or personal matters, having a extensive and practical online catalogue of forms on hand will greatly assist.

US Legal Forms is the top online platform of legal templates, offering over 85,000 state-specific forms and a number of tools to assist you complete your papers effortlessly. Discover the catalogue of relevant papers available to you with just one click.

US Legal Forms gives you state- and county-specific forms offered by any moment for downloading. Safeguard your papers managing operations with a top-notch services that allows you to put together any form within a few minutes with no additional or hidden charges. Just log in in your profile, find Oregon Transfer On Death Deed Form With Trust and acquire it right away in the My Forms tab. You can also access formerly downloaded forms.

Is it your first time utilizing US Legal Forms? Sign up and set up an account in a few minutes and you will have access to the form catalogue and Oregon Transfer On Death Deed Form With Trust. Then, stick to the steps below to complete your form:

- Ensure you have found the right form using the Preview option and reading the form description.

- Choose Buy Now once all set, and select the subscription plan that meets your needs.

- Choose Download then complete, sign, and print out the form.

US Legal Forms has twenty five years of expertise assisting consumers manage their legal papers. Find the form you want today and improve any process without having to break a sweat.

Form popularity

FAQ

Probate clears the titles to stocks, bonds, other securities and cars; officially puts real estate into the name of the person who inherited it; and stops others, including creditors, from claiming any of the property after the probate ends.

While there are no specific statutory steps, one way for the surviving beneficiary to formalize the conveyance is by executing and recording an affidavit of survivorship. This document, when accompanied by a certified copy of the deceased owner's death certificate, provides official notice of the change in ownership.

What Is the Difference Between TOD and Beneficiary? A transfer on death is an instrument that transfers ownership of specific accounts and assets to someone. A beneficiary is someone that is named to receive something of value.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

Estate planning, including Living Trusts, Payment on Death Accounts, and Transfer on Death Deeds, may help avoid Probate.