Oregon Transfer On Death Deed Form With Texas

Description

How to fill out Oregon Transfer On Death Deed From An Individual Owner/Grantor To An Individual Beneficiary.?

Managing legal documents and processes can be a lengthy addition to your entire day.

Oregon Transfer On Death Deed Form With Texas and similar forms often necessitate you to locate them and comprehend the best way to fill them out accurately.

Thus, whether you are addressing financial, legal, or personal issues, utilizing a thorough and efficient online repository of forms when needed will be beneficial.

US Legal Forms is the leading online platform for legal templates, providing over 85,000 state-specific documents and various tools to help you complete your paperwork effortlessly.

Is this your first time using US Legal Forms? Sign up and create a free account in just a few minutes, and you will gain access to the form library and Oregon Transfer On Death Deed Form With Texas. Then, follow the steps below to complete your document: Ensure you have located the correct form by utilizing the Preview feature and reviewing the form description. Select Buy Now when ready, and choose the subscription plan that fits your needs. Click Download then fill out, eSign, and print the document. US Legal Forms has twenty-five years of expertise assisting users in managing their legal documents. Find the form you need today and simplify any process effortlessly.

- Explore the collection of pertinent documents available to you with just a single click.

- US Legal Forms provides state- and county-specific forms that can be downloaded at any time.

- Protect your document management processes by utilizing a high-quality service that allows you to prepare any form in minutes without any extra or concealed costs.

- Simply Log In to your account, locate Oregon Transfer On Death Deed Form With Texas, and download it instantly within the My documents section.

- You can also access previously saved documents.

Form popularity

FAQ

Effective September 1, 2015, Texas joined the growing number of states that allow owners of real estate to transfer property to their beneficiaries outside the probate process by creating the Texas Transfer on Death Deed. The deed works like a beneficiary designation on a retirement plan or an insurance policy.

At your death, the real estate goes automatically to the person you named to inherit it (your "beneficiary"), without the need for probate court proceedings.

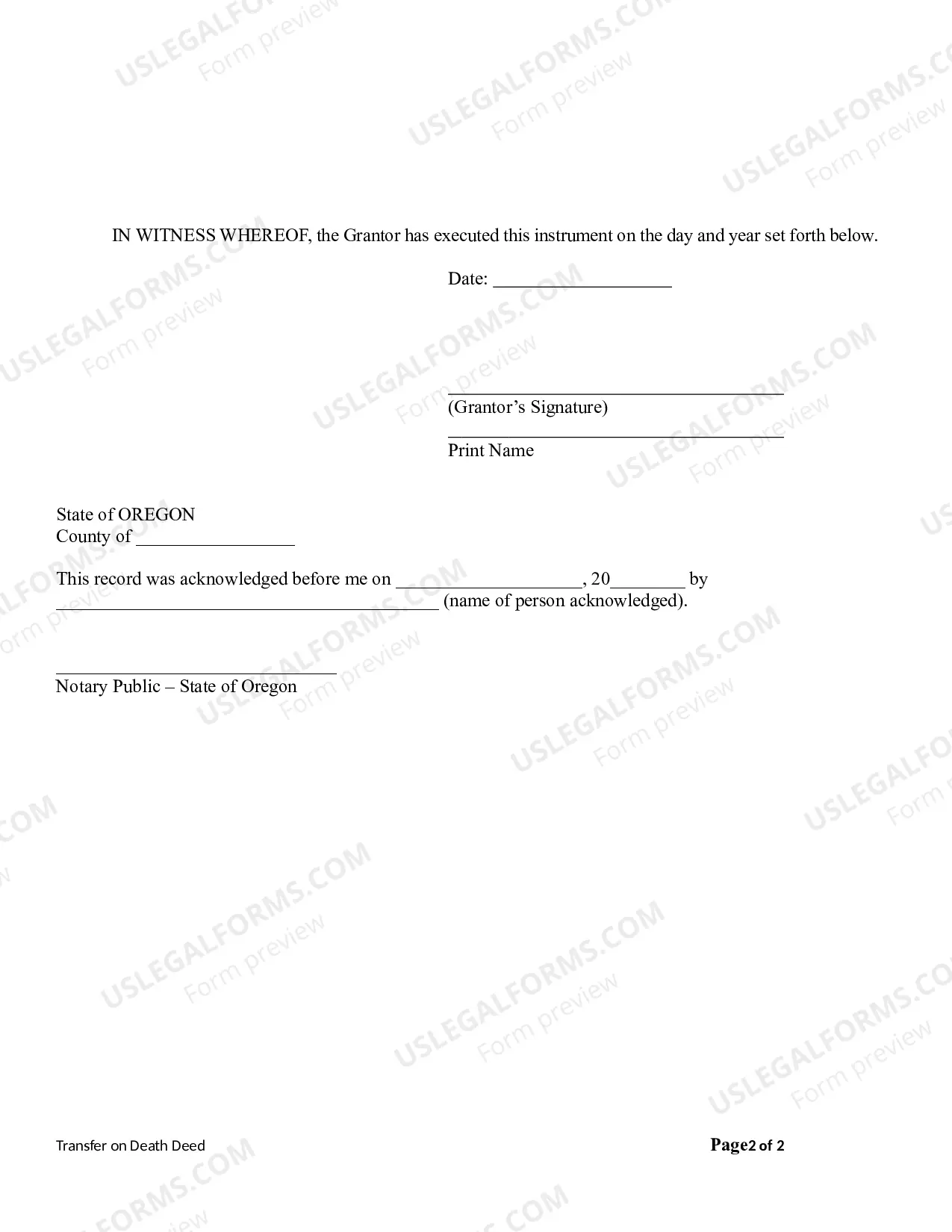

The Transfer on Death Deed must: Be in writing, signed by the owner, and notarized, Have a legal description of the property (The description is found on the deed to the property or in the deed records. ... Have the name and address of one or more beneficiaries, State that the transfer will happen at the owner's death,

If a person dies leaving very few assets, such as personal belongings or household goods, these items can be distributed among the rightful beneficiaries without the supervision of the court. Estate planning, including Living Trusts, Payment on Death Accounts, and Transfer on Death Deeds, may help avoid Probate.

Yes, Oregon does have a transfer-on-death deed (also known as a TOD deed or a beneficiary deed) option that allows property owners to transfer ownership of their real property to one or more designated beneficiaries upon their death.