Oregon Transfer On Death Deed Form With Signature Required

Description

How to fill out Oregon Transfer On Death Deed From An Individual Owner/Grantor To An Individual Beneficiary.?

Creating legal documents from the ground up can occasionally be daunting.

Some situations may require extensive research and significant financial investment.

If you seek a simpler and more cost-effective method of preparing the Oregon Transfer On Death Deed Form With Signature Required or other forms without unnecessary complications, US Legal Forms is consistently accessible to you.

Our online library of over 85,000 current legal documents encompasses nearly every facet of your financial, legal, and personal matters.

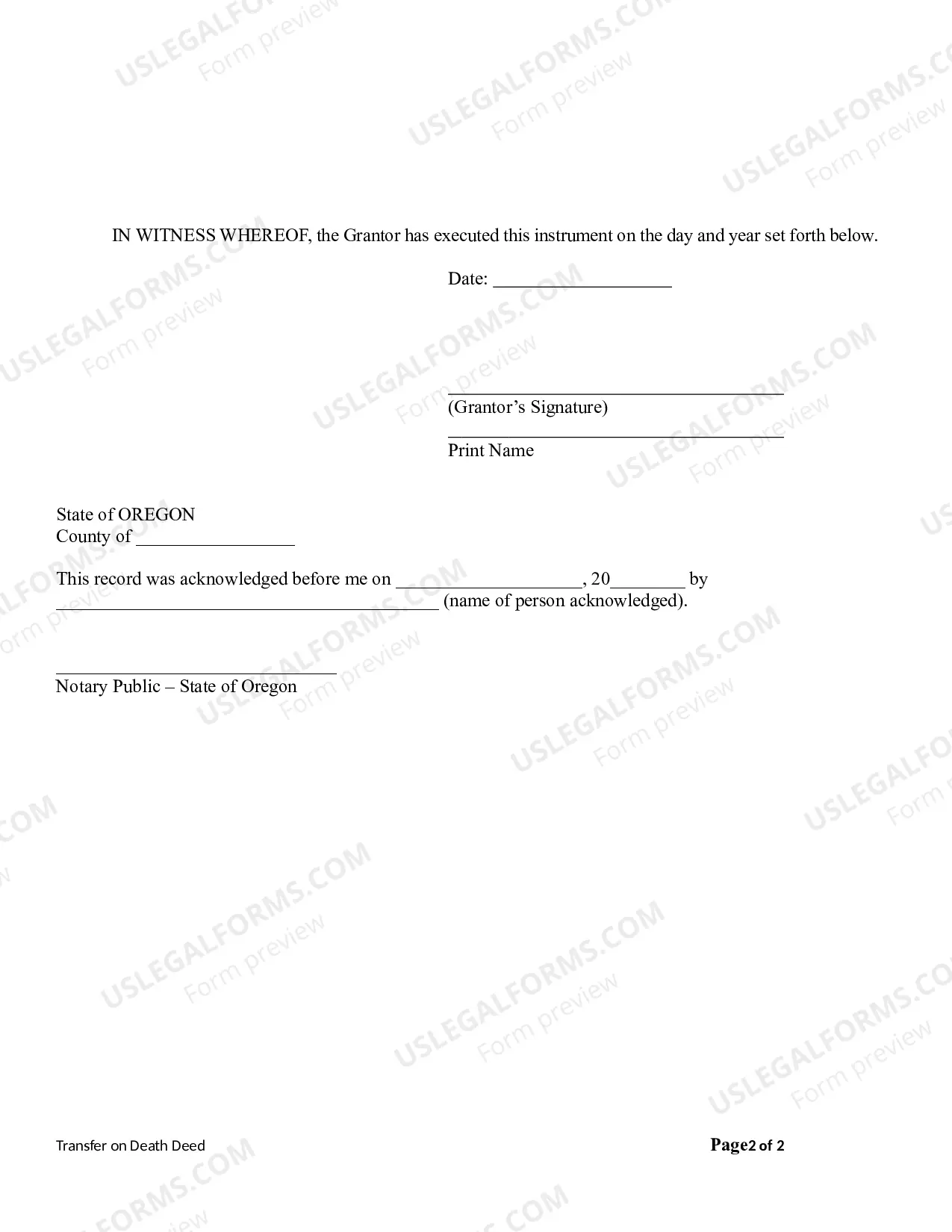

Examine the document preview and descriptions to confirm that you have the correct document. Verify that the form you select meets the specifications of your state and county. Select the appropriate subscription plan to acquire the Oregon Transfer On Death Deed Form With Signature Required. Download the document, then complete, sign, and print it. US Legal Forms has an impeccable reputation and over 25 years of expertise. Join us today and simplify your document completion process!

- With just a few clicks, you can quickly obtain state- and county-compliant templates meticulously crafted by our legal experts.

- Utilize our platform whenever you require trustworthy and dependable services that enable you to effortlessly locate and download the Oregon Transfer On Death Deed Form With Signature Required.

- If you are familiar with our site and have previously created an account, simply Log In to your account, find the template, and download it or retrieve it later from the My documents section.

- No account? No worries. Setting one up takes just a few minutes and allows you to explore our collection.

- Before proceeding to download the Oregon Transfer On Death Deed Form With Signature Required, be sure to follow these guidelines.

Form popularity

FAQ

At your death, the real estate goes automatically to the person you named to inherit it (your "beneficiary"), without the need for probate court proceedings.

A beneficiary who receives real estate through a transfer on death deed becomes personally liable for the debts of the dead property owner without proper counsel from an estate planning professional or a title company. The beneficiary becomes liable to potential financial obligations as a result.

To create a transfer-on-death deed in Oregon, the property owner must execute and record a TOD deed that names one or more beneficiaries who will inherit the property upon the owner's death. The TOD deed must also describe the property and specify the ownership interest that is being transferred.

What Is the Difference Between TOD and Beneficiary? A transfer on death is an instrument that transfers ownership of specific accounts and assets to someone. A beneficiary is someone that is named to receive something of value.

If a person dies leaving very few assets, such as personal belongings or household goods, these items can be distributed among the rightful beneficiaries without the supervision of the court. Estate planning, including Living Trusts, Payment on Death Accounts, and Transfer on Death Deeds, may help avoid Probate.