Or Liability Company With The Most Money

Description

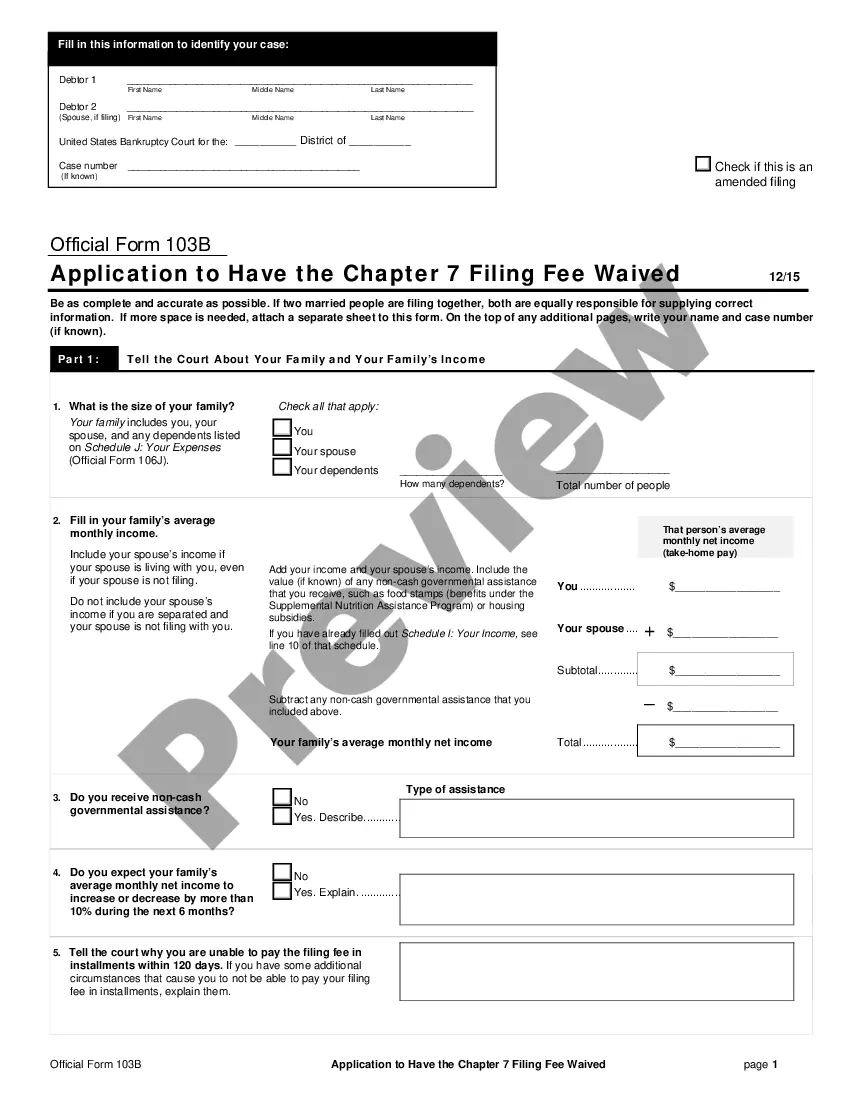

How to fill out Oregon Limited Liability Company LLC Operating Agreement?

Drafting legal documents from scratch can sometimes be daunting. Certain scenarios might involve hours of research and hundreds of dollars spent. If you’re searching for a simpler and more affordable way of preparing Or Liability Company With The Most Money or any other forms without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our online catalog of over 85,000 up-to-date legal documents addresses almost every element of your financial, legal, and personal matters. With just a few clicks, you can instantly access state- and county-specific forms carefully prepared for you by our legal specialists.

Use our website whenever you need a trusted and reliable services through which you can quickly locate and download the Or Liability Company With The Most Money. If you’re not new to our services and have previously set up an account with us, simply log in to your account, locate the template and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No worries. It takes minutes to register it and explore the library. But before jumping directly to downloading Or Liability Company With The Most Money, follow these tips:

- Check the form preview and descriptions to ensure that you are on the the document you are looking for.

- Check if template you choose complies with the requirements of your state and county.

- Pick the best-suited subscription option to buy the Or Liability Company With The Most Money.

- Download the form. Then fill out, certify, and print it out.

US Legal Forms has a spotless reputation and over 25 years of experience. Join us today and turn form execution into something easy and streamlined!

Form popularity

FAQ

Use your business structure to limit liability Sole proprietorship. ... General partnership. ... Limited Partnership (LP) ... Regular (C) corporation. ... LLC may be best entity choice. ... LLCs protect assets far better than partnerships. ... Protecting your personal assets from business creditors.

One of the most advantageous ways to get paid from your LLC is as a W-2 employee. Using this method, you will receive a regular paycheck as would an employee of any business. This is a good way to have a predictable income for your personal finances.

A corporation carries the least amount of personal liability since the law holds that it is its own entity. This means creditors and customers can sue the corporation, but they can't gain access to any personal assets of the officers or shareholders.

Sole proprietors have unlimited liability and are legally responsible for all debts against the business. Their business and personal assets are at risk. May be at a disadvantage in raising funds and are often limited to using funds from personal savings or consumer loans.

A limited liability company (LLC) is a business entity that prevents individuals from being liable for the company's financial losses and debt liabilities. In the event of legal action or business failure, liability is assumed by the company rather than its constituent partners or shareholders.