Or Liability Company With Limited

Description

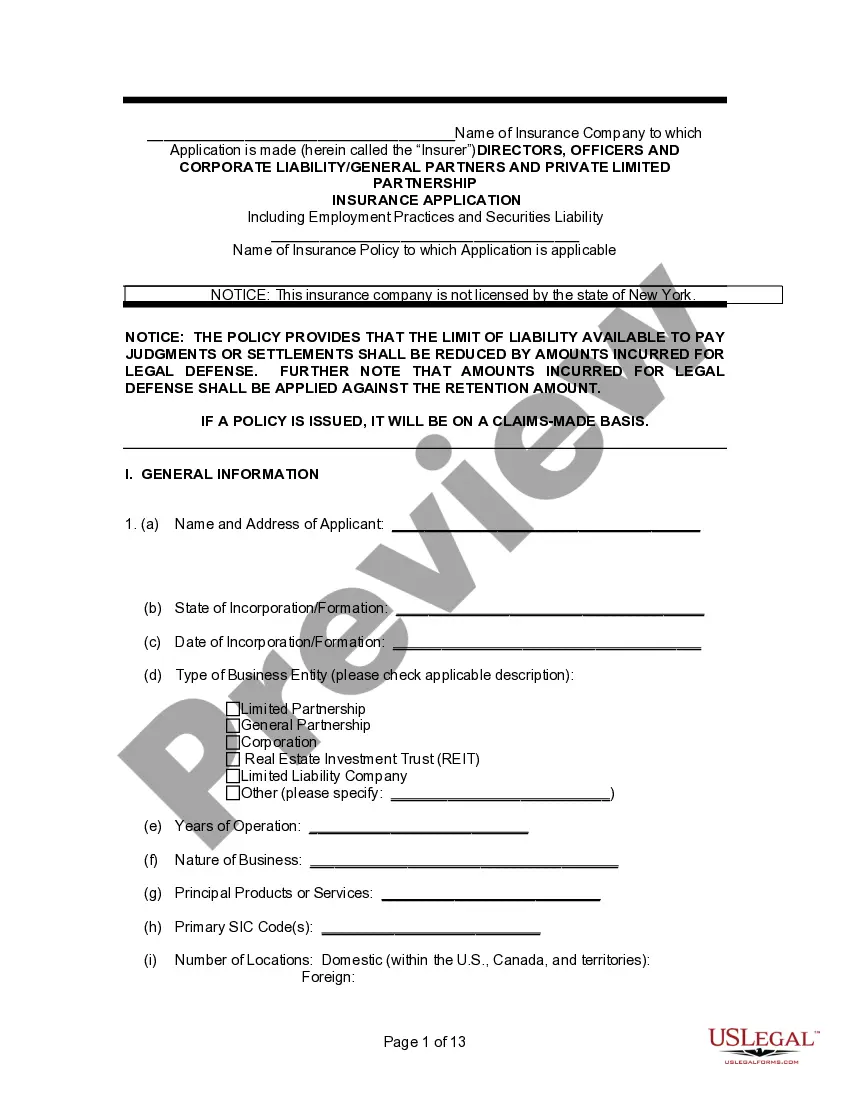

How to fill out Oregon Limited Liability Company LLC Operating Agreement?

Dealing with legal paperwork and procedures could be a time-consuming addition to the day. Or Liability Company With Limited and forms like it usually require you to search for them and understand how to complete them properly. Therefore, regardless if you are taking care of economic, legal, or individual matters, using a extensive and hassle-free web catalogue of forms on hand will go a long way.

US Legal Forms is the top web platform of legal templates, boasting more than 85,000 state-specific forms and a variety of resources that will help you complete your paperwork effortlessly. Check out the catalogue of appropriate documents accessible to you with just a single click.

US Legal Forms provides you with state- and county-specific forms offered by any moment for downloading. Shield your papers management operations with a high quality service that allows you to put together any form within minutes without extra or hidden fees. Simply log in to your account, locate Or Liability Company With Limited and acquire it straight away from the My Forms tab. You can also gain access to previously saved forms.

Is it the first time using US Legal Forms? Register and set up up a free account in a few minutes and you’ll have access to the form catalogue and Or Liability Company With Limited. Then, stick to the steps below to complete your form:

- Ensure you have discovered the proper form by using the Review option and reading the form description.

- Pick Buy Now as soon as all set, and choose the subscription plan that fits your needs.

- Select Download then complete, eSign, and print out the form.

US Legal Forms has 25 years of expertise supporting users deal with their legal paperwork. Get the form you want today and streamline any operation without having to break a sweat.

Form popularity

FAQ

The main advantage to an LLC is in the name: limited liability protection. Owners' personal assets can be protected from business debts and lawsuits against the business when an owner uses an LLC to do business.

Hear this out loud PauseKey takeaways. LLC stands for limited liability company, which means its members are not personally liable for the company's debts. LLCs are taxed on a ?pass-through? basis ? all profits and losses are filed through the member's personal tax return.

A limited liability company (LLC) is a structure that separates companies and their owners. It prevents individuals from being liable for the company's financial losses, debts, and other liabilities.

LLC, there are minor differences, but they are largely the same. LLCs and Ltds are governed under state law, but the primary difference is Ltds pay taxes while LLCs do not. The abbreviation ?Ltd? means limited and is most commonly seen within the European Union and affords owners the same protections as an LLC.

An LLC has pros such as flow-through taxation and limited liability protection. However, there are also disadvantages such as the legal process of ?piercing the corporate veil? and being forced to dissolve the LLC if a member leaves.