Llp Or Llc For Rental Property

Description

How to fill out Oregon Limited Liability Company LLC Operating Agreement?

It’s no secret that you can’t become a legal expert overnight, nor can you figure out how to quickly draft Llp Or Llc For Rental Property without the need of a specialized background. Putting together legal documents is a time-consuming venture requiring a particular training and skills. So why not leave the preparation of the Llp Or Llc For Rental Property to the professionals?

With US Legal Forms, one of the most comprehensive legal document libraries, you can access anything from court paperwork to templates for in-office communication. We understand how crucial compliance and adherence to federal and state laws are. That’s why, on our website, all templates are location specific and up to date.

Here’s how you can get started with our website and get the form you need in mere minutes:

- Discover the document you need by using the search bar at the top of the page.

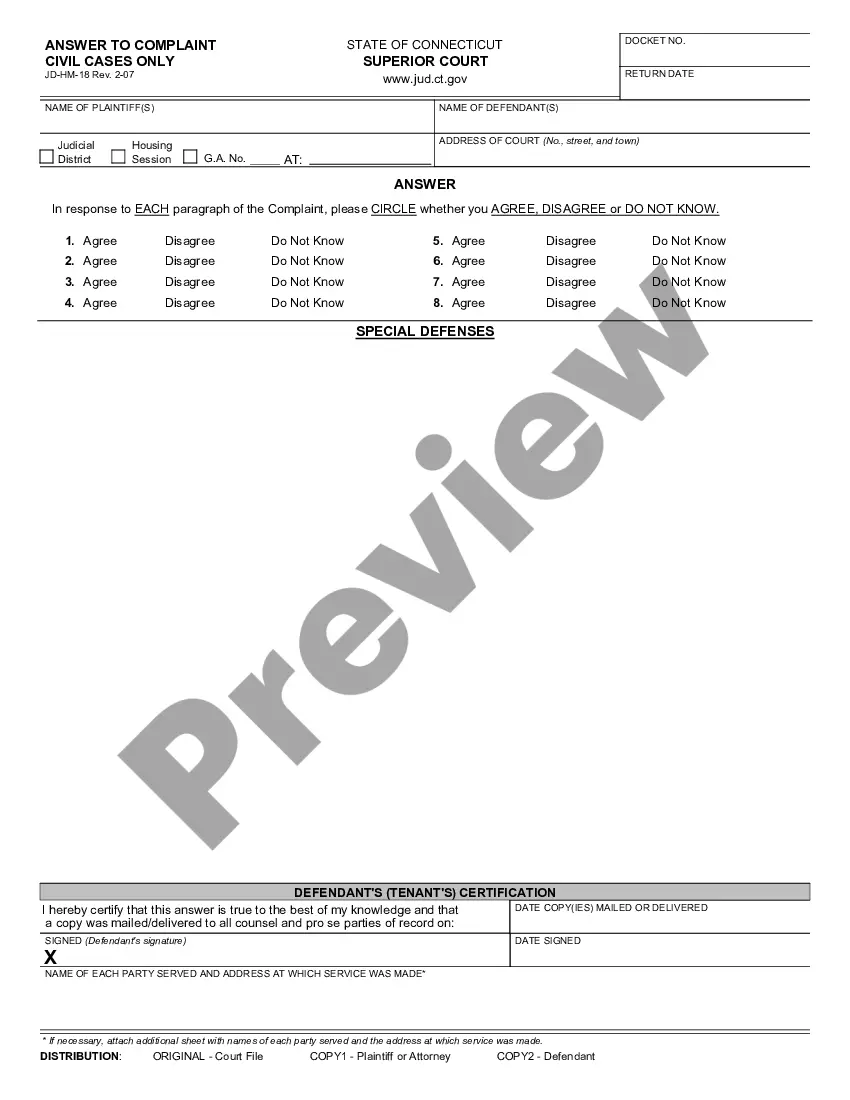

- Preview it (if this option available) and check the supporting description to determine whether Llp Or Llc For Rental Property is what you’re looking for.

- Begin your search over if you need a different form.

- Set up a free account and select a subscription plan to buy the form.

- Choose Buy now. As soon as the transaction is complete, you can get the Llp Or Llc For Rental Property, fill it out, print it, and send or send it by post to the necessary people or entities.

You can re-access your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and locate and download the template from the same tab.

No matter the purpose of your documents-whether it’s financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

One of the major advantages of using a limited liability company for your rental property is pass-through taxation. This means that the LLC does not pay taxes; the business owner pays the taxes, thus eliminating the double taxation that occurs if you were to form a corporation instead.

Generally, an LLC is typically better for rental properties than an S corp. However, both offer: Liability protection for the owners. The chance to avoid double taxation by being taxed as a partnership.

What is the main advantage of a limited liability partnership? The main advantage of a limited liability partnership (LLP) is that each partner is only liable for their own actions and not those of the other partners. This means that if one partner is sued, the other partners will not be held liable.

What is the main advantage of a limited liability partnership? The main advantage of a limited liability partnership (LLP) is that each partner is only liable for their own actions and not those of the other partners. This means that if one partner is sued, the other partners will not be held liable.

Choosing to run your company as an LLC or LLP depends upon your profession and your state. If you're a professional who needs a license to do business, you're better off running your company as an LLP if your state allows it. If you are not a professional, an LLC is usually the best fit for your business.