Corporation Or Llc For Small Business

Description

How to fill out Oregon Limited Liability Company LLC Operating Agreement?

Obtaining legal templates that meet the federal and state laws is crucial, and the internet offers numerous options to pick from. But what’s the point in wasting time looking for the right Corporation Or Llc For Small Business sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the greatest online legal library with over 85,000 fillable templates drafted by attorneys for any professional and life scenario. They are simple to browse with all documents collected by state and purpose of use. Our experts stay up with legislative updates, so you can always be confident your paperwork is up to date and compliant when getting a Corporation Or Llc For Small Business from our website.

Getting a Corporation Or Llc For Small Business is fast and simple for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the preferred format. If you are new to our website, follow the guidelines below:

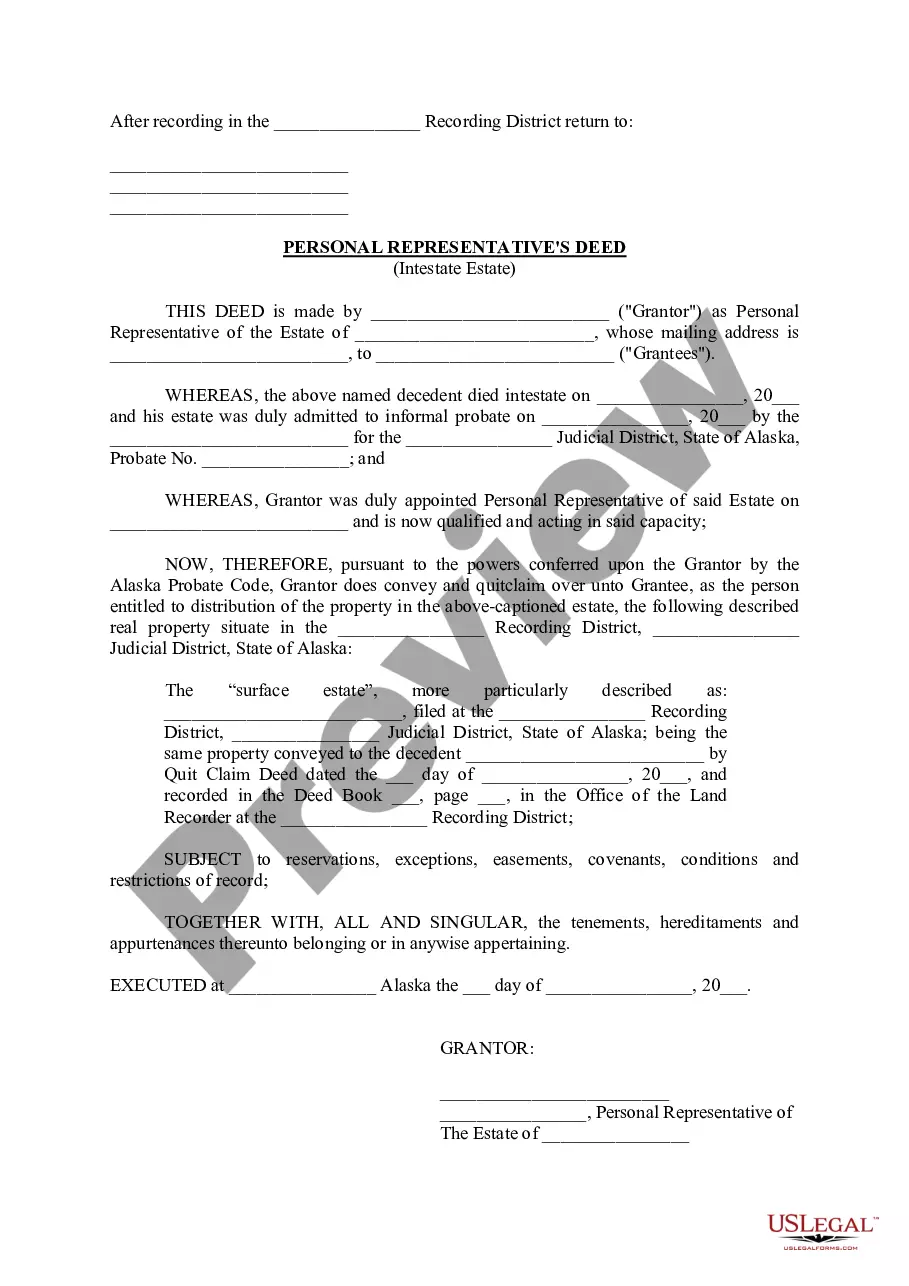

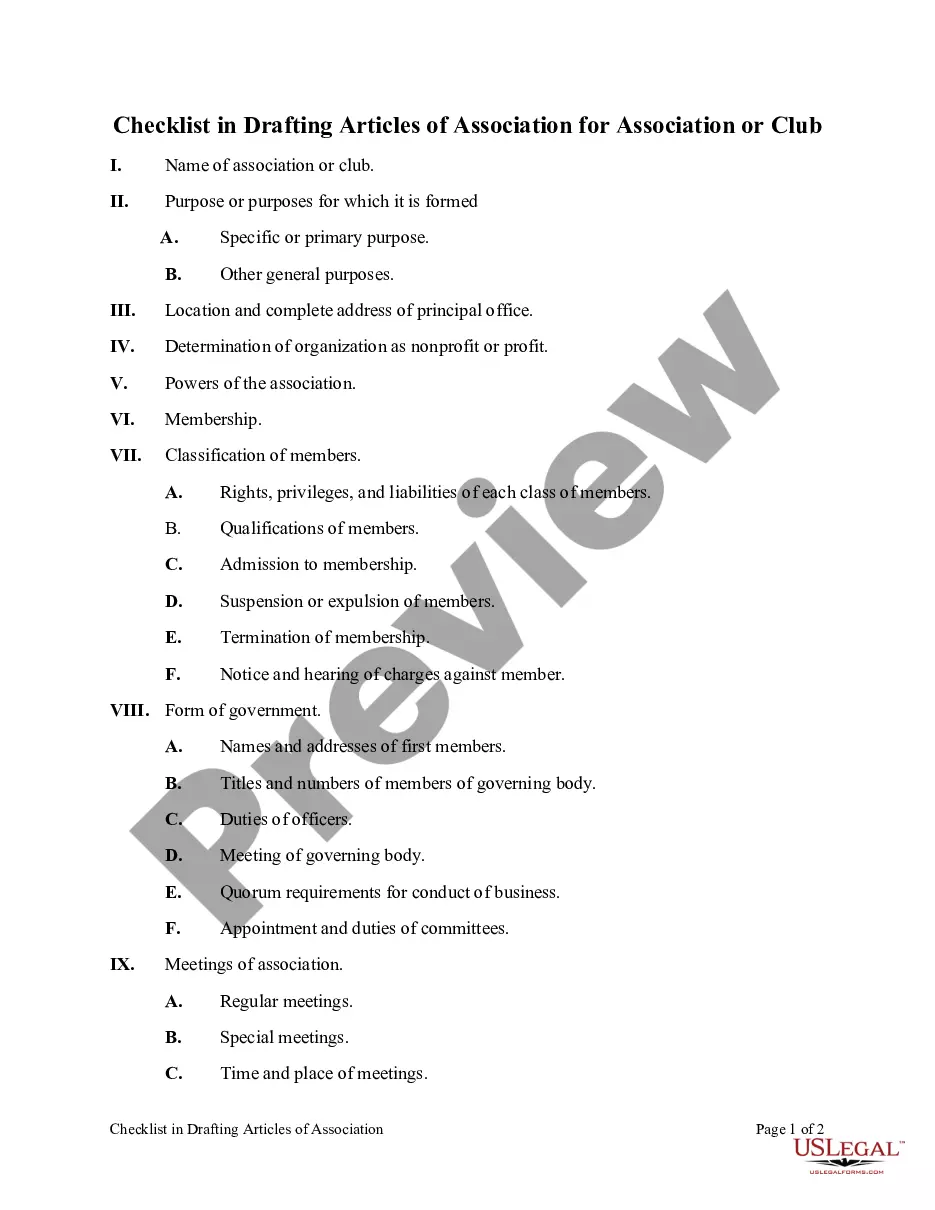

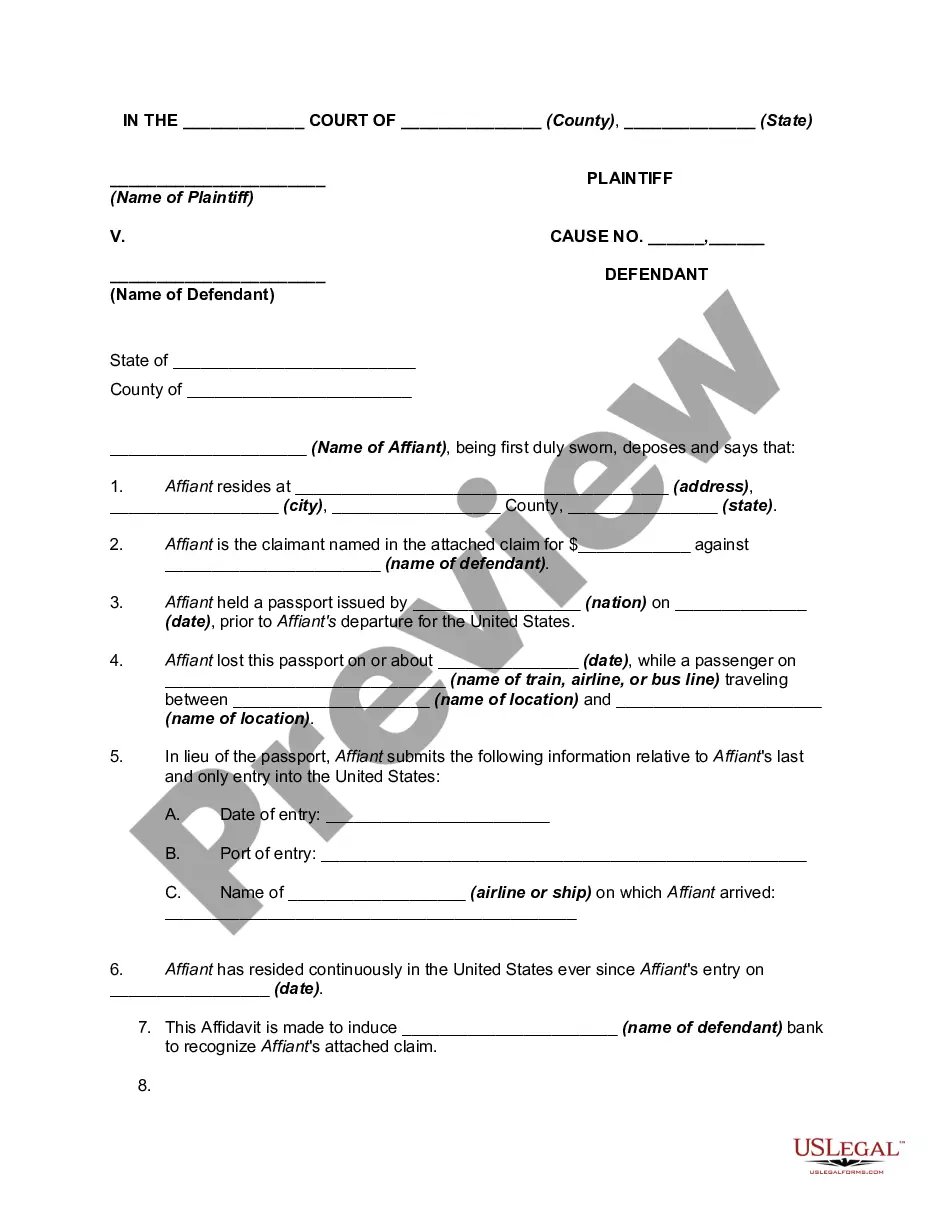

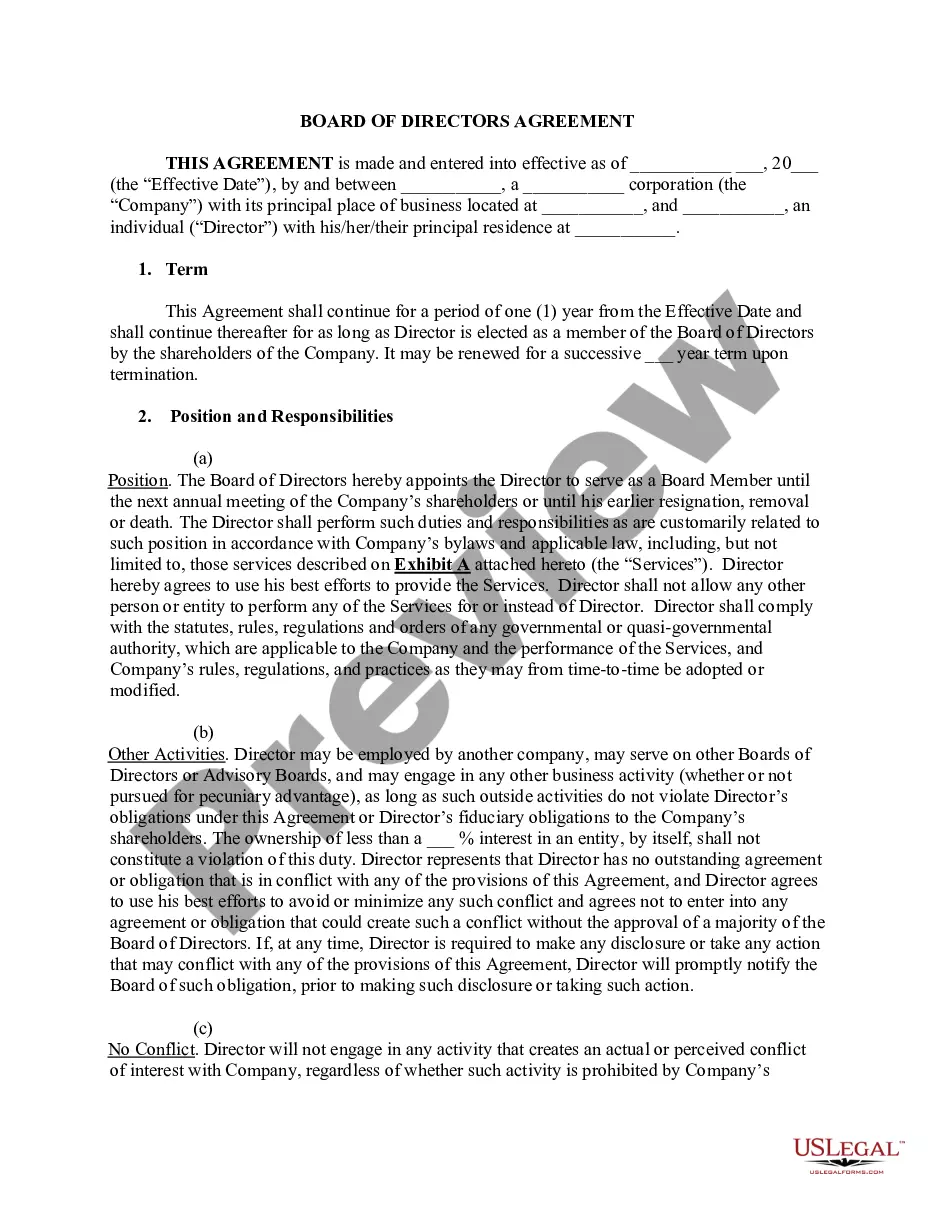

- Take a look at the template using the Preview feature or via the text description to make certain it fits your needs.

- Locate a different sample using the search function at the top of the page if necessary.

- Click Buy Now when you’ve located the correct form and choose a subscription plan.

- Create an account or log in and make a payment with PayPal or a credit card.

- Choose the right format for your Corporation Or Llc For Small Business and download it.

All templates you find through US Legal Forms are multi-usable. To re-download and complete previously saved forms, open the My Forms tab in your profile. Benefit from the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

If there will be multiple people involved in running the company, an S-Corp would be better than an LLC since there would be oversight via the board of directors. Also, members can be employees, and an S-Corp allows the members to receive cash dividends from company profits, which can be a great employee perk.

Forming an LLC or a corporation will allow you to take advantage of limited personal liability for business obligations. LLCs are favored by small, owner-managed businesses that want flexibility without a lot of corporate formality. Corporations are a good choice for a business that plans to seek outside investment.

Typically, an LLC taxed as a sole proprietorship pays more taxes and S Corp tax status means paying less in taxes. By default, an LLC pays taxes as a sole proprietorship, which includes self-employment tax on your total profits.

LLCs can have an unlimited number of members; S corps can have no more than 100 shareholders (owners). Non-U.S. citizens/residents can be members of LLCs; S corps may not have non-U.S. citizens/residents as shareholders. S corporations cannot be owned by corporations, LLCs, partnerships or many trusts.

The main difference between an LLC and a corporation is that an llc is owned by one or more individuals, and a corporation is owned by its shareholders.