Limited Liability Company For Dummies

Description

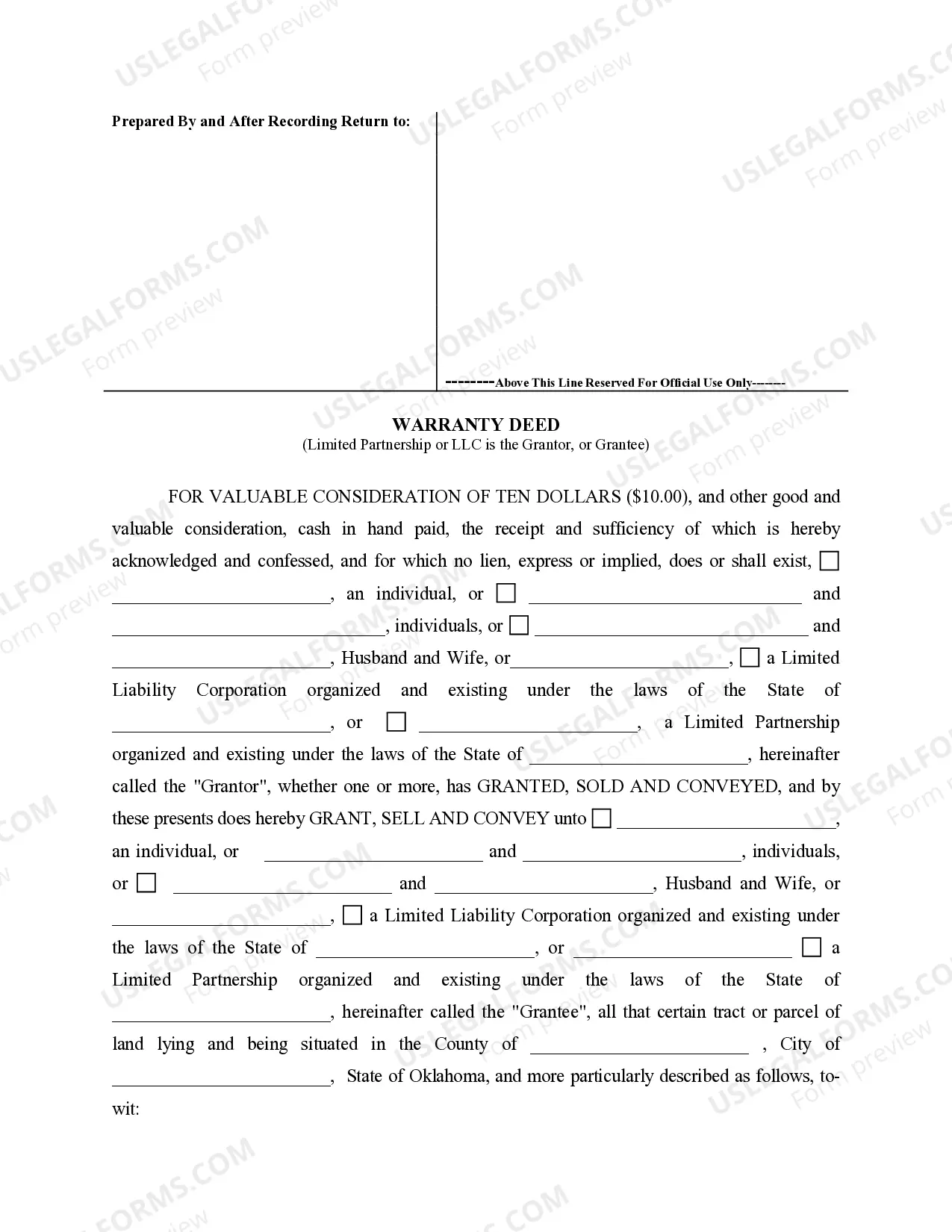

How to fill out Oklahoma Warranty Deed From Limited Partnership Or LLC Is The Grantor, Or Grantee?

- Log into your US Legal Forms account if you already have one, and ensure your subscription is active. If it needs renewal, update it accordingly.

- If you're new to US Legal Forms, start by viewing the form descriptions and previews to find the right template that meets your jurisdiction's requirements.

- Should you need a different document, use the search feature to find alternatives that suit your needs.

- Once you've found the template you need, click the 'Buy Now' button to select your preferred subscription plan, and create an account if you haven't already.

- Enter your payment information via credit card or PayPal to complete your purchase.

- After buying, download the form to your device. You can access it anytime from the 'My Forms' section in your profile.

US Legal Forms provides a robust collection of legal templates that surpasses competitors, giving you access to over 85,000 editable forms and packages.

With expert assistance at your fingertips, you can ensure your documents are accurate and legally sound. Start your LLC journey today with US Legal Forms!

Form popularity

FAQ

Filing taxes for your limited liability company involves reporting your income and expenses based on its structure. If it’s a multi-member LLC, it usually files a partnership return, while a single-member LLC may use your personal tax return. For those new to the process, the limited liability company for dummies offers simplified insights to help you navigate your tax obligations confidently.

Yes, you can file your limited liability company separately from your personal taxes if you elect to have it taxed as a corporation. This option gives you different tax treatment, allowing some strategic advantages. If you're unsure how this impacts your financial situation, consider consulting resources like limited liability company for dummies for a clear explanation.

The best way to file for an LLC involves thorough preparation and understanding of your state's requirements. You should gather necessary documentation, choose an appropriate name, and accurately fill out the articles of organization. Many find assistance through services like US Legal Forms beneficial in ensuring everything is done correctly, especially if you are a beginner, as seen in limited liability company for dummies.

If you do not file taxes for your limited liability company, it can lead to penalties and fines from the IRS. Additionally, failing to file can jeopardize your LLC's good standing in your state. Maintaining compliance helps you avoid unnecessary troubles, and understanding this topic is easier with limited liability company for dummies.

Yes, you can file for your limited liability company independently if you understand the process. Generally, this involves choosing a business name, preparing articles of organization, and submitting them to your state’s business division. If you need assistance or want to ensure accuracy, using platforms like US Legal Forms can simplify your filing experience.

A single owner LLC, often known as a single-member LLC, files taxes as a sole proprietorship by default. This means that the income and expenses will be reported on your personal tax return using Schedule C. The limited liability company designation protects your personal assets while allowing you to leverage the simple tax structure. For clear guidance, many find resources on limited liability company for dummies helpful.

Yes, you can have a limited liability company (LLC) and not actively conduct business. However, it is important to maintain compliance with state regulations, such as filing annual reports or paying fees. This ensures that your LLC remains in good standing. If you choose to hold an LLC without operations, consider using the US Legal Forms platform to help you stay organized and compliant.

LLC should always be written in uppercase letters. This represents the formal abbreviation for Limited Liability Company. Using uppercase ensures clarity and signifies that you are referencing the legal structure of the business.

In layman's terms, an LLC, or Limited Liability Company, is a type of business structure that protects its owners from personal liability. This means if the business faces debts or legal issues, your personal assets remain safe. Think of it as a shield that separates your personal life from your business.

The correct way to write LLC is by using capital letters: LLC. It stands for Limited Liability Company and is a legal designation indicating the company structure. Always ensure to capitalize 'LLC' in any formal documentation to reflect its proper status.