Homeowners Association Lien Form With Two Points

Description

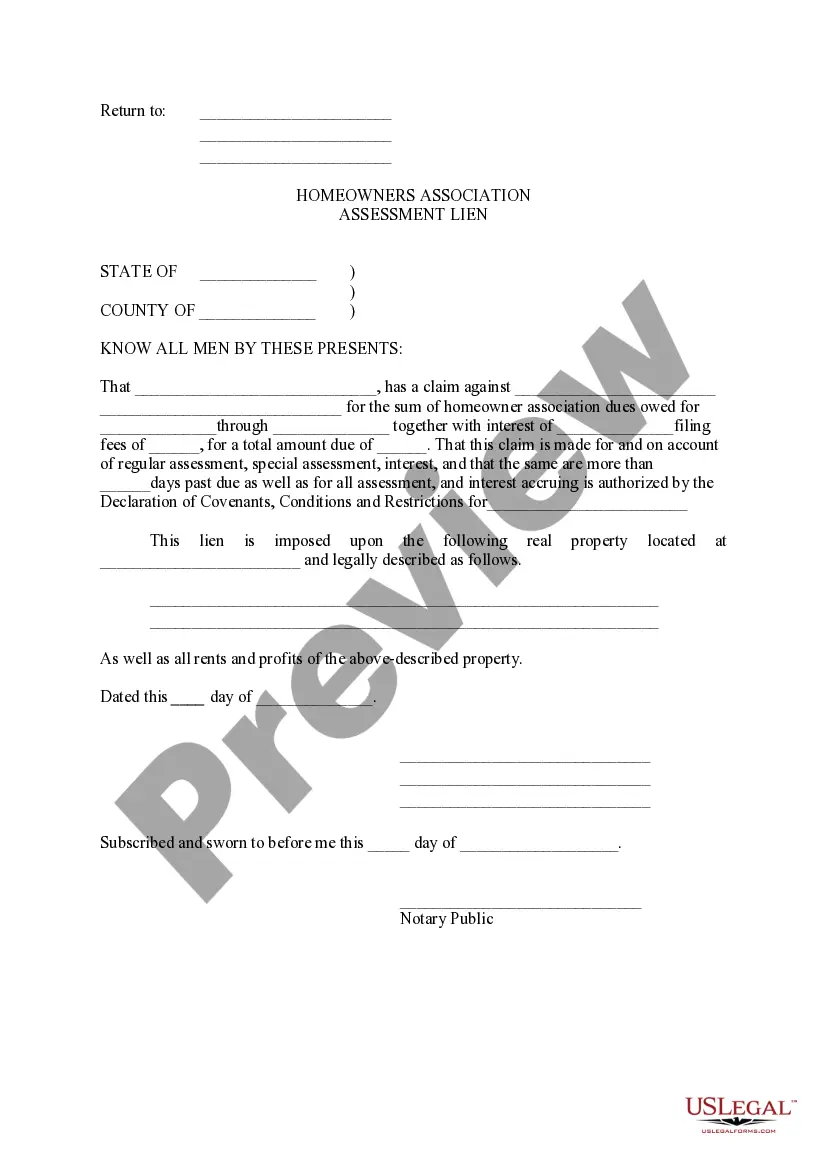

An assessment lien allows the HOA to sell the homeowner's property to repay assessments owed to the HOA.

Form popularity

FAQ

Washington state is classified as a super lien state. This classification allows homeowners associations to secure their financial interests by prioritizing their liens over other debts, such as mortgages. For clarity and assistance in navigating these regulations, the homeowners association lien form available through uslegalforms can be an invaluable resource.

Yes, Washington, D.C. operates as a super lien district. This means that the liens for unpaid HOA dues can take priority over other claims on the property. Familiarizing yourself with the homeowners association lien form can help clarify how these priorities are established and what this means for your property in D.C.

Getting around your HOA typically involves understanding their rules and regulations. However, it is essential to follow these guidelines to avoid liens or fines. If you feel a rule is unfair, you can present your case at an HOA meeting, or you can utilize a homeowners association lien form to ensure that you are fully informed of your rights and obligations.

Washington is indeed a super lien state. This means that when an HOA places a lien on a property for unpaid dues, that lien can take precedence over other types of liens, potentially including mortgage liens. You can find specific details and necessary forms related to homeowners association liens on platforms like uslegalforms.

Yes, Florida operates as a super lien state for homeowners associations. This means that once an HOA files a lien, it can take priority over other existing liens, including mortgages, under certain conditions. Therefore, if you fall behind on your dues, understanding the homeowners association lien form is crucial. This form can help protect your property interests and clarify your obligations.

Homeowners associations (HOAs) in California must follow state laws, and not all rules they create are enforceable. For instance, rules that restrict owners from displaying political signs or limit the type of landscaping they can have may not hold up in court. It's crucial for homeowners to be aware of their rights to challenge these rules. Additionally, understanding the homeowners association lien form with two points can help homeowners navigate disputes with their HOA effectively.

In Texas, an HOA lien is valid for four years from the date of filing. This timeframe ensures that homeowners association debts are addressed promptly. After this period, the lien can become unenforceable unless certain conditions are met. It's wise to complete the homeowners association lien form within this timeline to protect your interests.