Oklahoma Notice To Creditors

Description

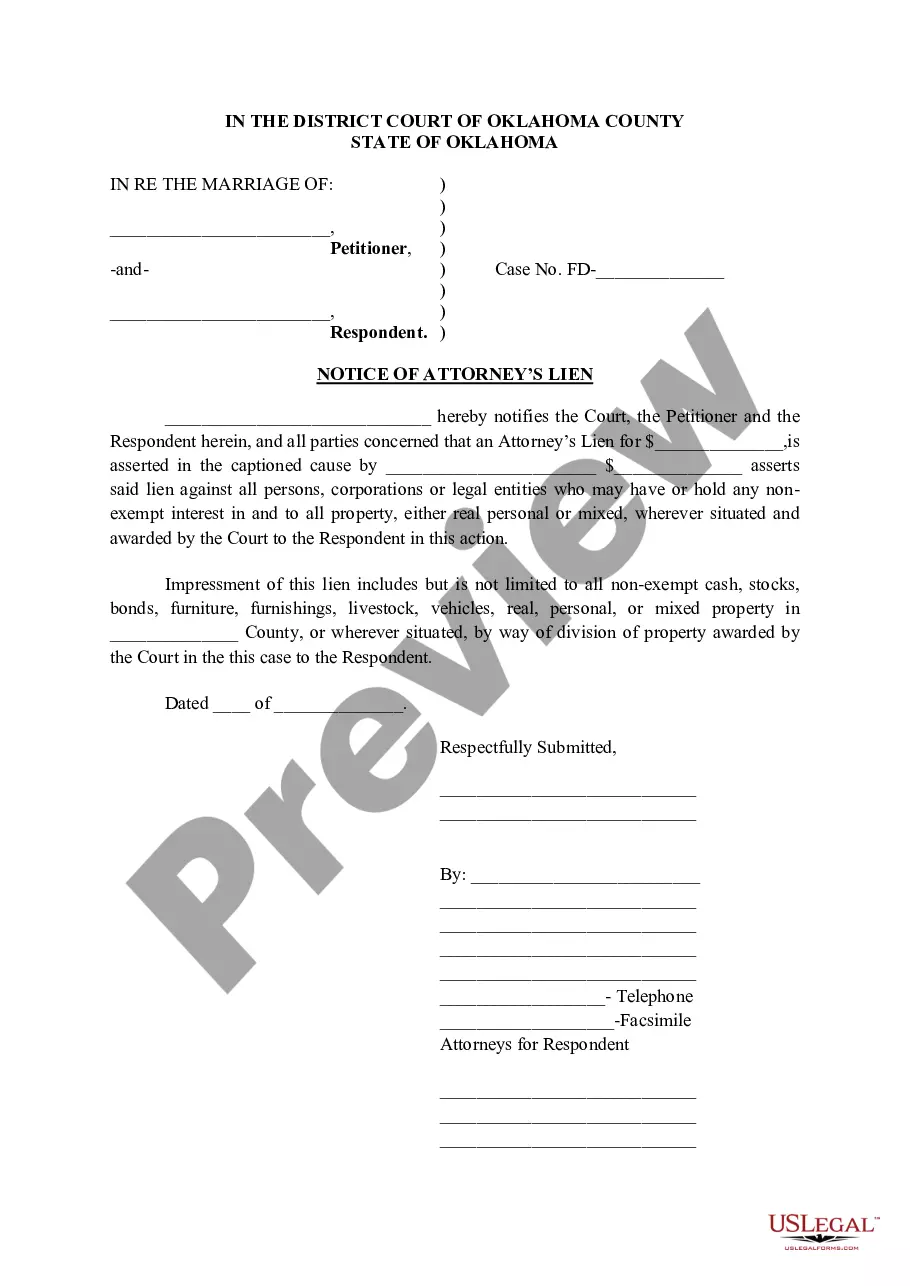

How to fill out Oklahoma Notice Of Attorney's Lien?

How to locate professional legal documents that comply with your state's regulations and prepare the Oklahoma Notice To Creditors without hiring an attorney.

Numerous online services provide templates to address various legal matters and requirements.

However, it may require time to identify which of the offered samples meet both your use case and legal standards.

Download the Oklahoma Notice To Creditors using the corresponding button beside the file name. If you do not have a US Legal Forms account, please follow the steps below: Browse the page you've opened to confirm if the form meets your requirements. To do this, utilize the form description and preview options, if available. Search for a different template in the header providing your state if necessary. Click the Buy Now button once you find the appropriate document. Select the most suitable pricing plan, then either sign in or register for an account. Choose a payment method (by credit card or via PayPal). Change the file format for your Oklahoma Notice To Creditors and click Download. The obtained templates remain yours: you can always revisit them in the My documents section of your profile. Subscribe to our platform and draft legal documents independently as a proficient legal expert!

- US Legal Forms is a trusted platform that assists you in finding official documents created according to the most recent state law revisions and helps reduce costs on legal support.

- US Legal Forms is not a typical online library.

- It's a repository of over 85k verified templates for a variety of business and personal scenarios.

- All documents are organized by category and state to simplify your search process and make it more efficient.

- It also features advanced tools for PDF editing and electronic signatures, enabling users with a Premium membership to swiftly complete their documents online.

- It requires minimal effort and time to acquire the necessary documents.

- If you already possess an account, Log In and verify that your subscription is active.

Form popularity

FAQ

To obtain a letter of administration, you must file a petition with the probate court in the county where the deceased lived. Once the court reviews your application and appoints you as the administrator, you'll receive the letter. This document gives you the authority to manage the estate, including settling debts and distributing assets. Ensure that you follow local laws, such as providing an 'Oklahoma notice to creditors' to notify any potential claimants.

An executor is a person designated in a will to manage the deceased's estate, while a letter of administration is a legal document granted by a court when there is no will. In this case, a designated administrator will manage the estate. Both roles involve responsibility, but typically, the executor follows the terms set in the deceased’s will, while the administrator navigates state laws. It's important to comply with requirements like filing an 'Oklahoma notice to creditors' to properly inform all parties involved.

Yes, you can handle probate without a lawyer in Oklahoma, but it can be complex. You may need to file an 'Oklahoma notice to creditors' to inform interested parties about the probate process. While doing it solo is possible, having legal guidance can simplify the process and ensure you meet all requirements. Utilizing resources like USLegalForms can provide you with the necessary forms and guidance to navigate probate efficiently.

The notice of the meeting of creditors is a formal announcement about a gathering where creditors can discuss claims related to an estate. This meeting allows them to voice their concerns and verify the debts owed, as outlined in the Oklahoma notice to creditors. It ensures that all parties are on the same page regarding the estate's financial responsibilities. Attending this meeting can help creditors understand their rights and the status of outstanding claims.

After a person's death, you should communicate directly with creditors by sending a notice that includes essential information about the deceased's estate. This notice should mention the decedent's passing, provide the executor's contact details, and reference the Oklahoma notice to creditors. Clear communication helps creditors understand the process and what to expect as they file their claims. Additionally, this transparency can maintain trust and ensure a smoother estate settlement.

Issuing a notice to a creditor means formally informing them about a situation involving debts or obligations. In the context of estate administration, the Oklahoma notice to creditors alerts them of a deceased person's passing. This notice provides creditors with an opportunity to claim any debts owed. It is crucial to issue this notice to ensure all debts are addressed in accordance with state law.

In Oklahoma, creditors have a limited time frame of two months from the date they receive the notice to creditors to file a claim against the estate. This timeline is crucial as it ensures that all debts are settled while the estate is still in probate. If a claim is not filed within this period, creditors may lose their right to collect from the estate. Understanding the intricacies of the Oklahoma notice to creditors can help you effectively navigate the claims process.

Yes, in Oklahoma, you must file probate within five years of the decedent's death. If probate is not initiated within this period, it may become challenging to address the deceased's estate properly. Acting quickly can help ensure that all debts and claims are handled appropriately. Resources provided by USLegalForms can guide you in filing timely and meeting all legal requirements in Oklahoma.

In Oklahoma, creditors typically have a timeframe of five years to pursue a debt after the debtor's passing. However, if a creditor receives a notice to creditors, this period may be reduced based on the information provided. It is important to consult with an attorney to understand your specific situation regarding any potential claims against you. Understanding the Oklahoma notice to creditors can help you manage these obligations more effectively.

In Oklahoma, the notice to creditors is a formal announcement that notifies creditors about the probate proceedings. This notice informs them of the need to present their claims against the estate within a specific period. It is crucial that this notice is sent to all known creditors in order to avoid complications later. The Oklahoma notice to creditors plays an essential role in ensuring that all debts are addressed properly.