Affidavit Of Successor Trustee Form With Irs

Description

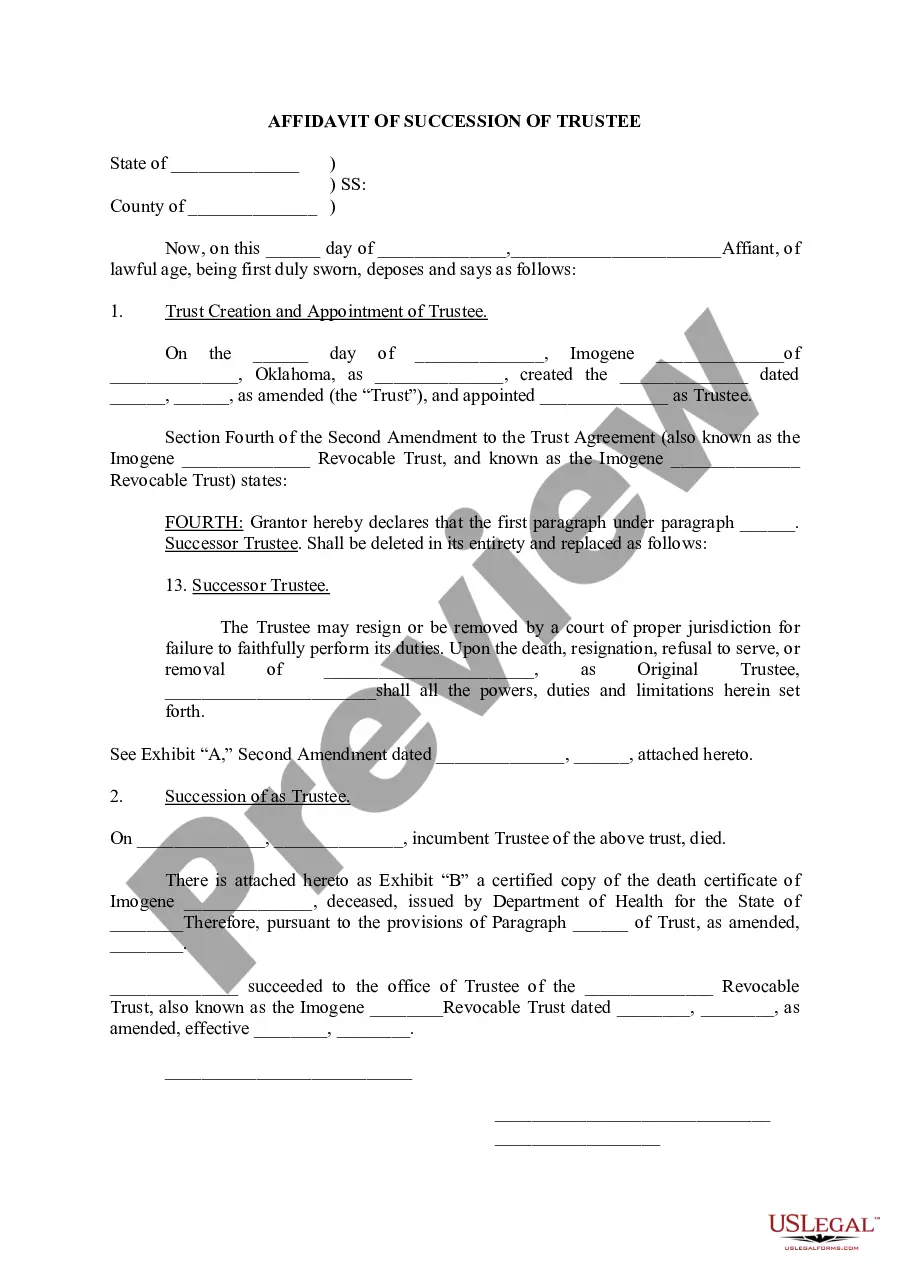

How to fill out Oklahoma Affidavit Of Succession Of Trustee?

Whether for business purposes or for individual affairs, everybody has to manage legal situations sooner or later in their life. Completing legal documents requires careful attention, beginning from picking the correct form sample. For instance, if you pick a wrong edition of the Affidavit Of Successor Trustee Form With Irs, it will be declined once you submit it. It is therefore crucial to get a trustworthy source of legal files like US Legal Forms.

If you need to obtain a Affidavit Of Successor Trustee Form With Irs sample, follow these easy steps:

- Find the template you need by using the search field or catalog navigation.

- Examine the form’s information to ensure it fits your situation, state, and region.

- Click on the form’s preview to see it.

- If it is the wrong document, get back to the search function to locate the Affidavit Of Successor Trustee Form With Irs sample you need.

- Get the template if it matches your needs.

- If you already have a US Legal Forms account, click Log in to gain access to previously saved templates in My Forms.

- If you don’t have an account yet, you may download the form by clicking Buy now.

- Select the correct pricing option.

- Finish the account registration form.

- Pick your payment method: you can use a credit card or PayPal account.

- Select the document format you want and download the Affidavit Of Successor Trustee Form With Irs.

- After it is downloaded, you are able to fill out the form with the help of editing software or print it and finish it manually.

With a large US Legal Forms catalog at hand, you never need to spend time looking for the right template across the internet. Take advantage of the library’s easy navigation to get the appropriate form for any occasion.

Form popularity

FAQ

The trust hasn't changed, just the trustee. To change the trustee, you need to submit IRS form 8822-B, "Change of Address or Responsible Party" naming yourself as the New responsible party.

File Form 56 at Internal Revenue Service Center where the person for whom you are acting is required to file tax returns. If you wish to receive tax notices for more than one form and one of the forms is Form 1040, file Form 56 with the IRS center where the person for whom you are acting is required to file Form 1040.

Form 56, Notice Concerning Fiduciary Relationship, cannot be e-filed with the 1040 return. It must be transmitted separately. Form 56 can only be filed from the current year software.

If you are a guardian, trustee, administrator, or another person responsible for a decedent's estate, you are required to file Form 56. If there are multiple trustees for one estate, each trustee will be required to file IRS Form 56.

The successor trustee should file a Form 56, Notice of Fiduciary Relationship, with IRS to advise that the trust maker has passed away, and the successor trustee will be filing future tax returns.