Oklahoma Rental Application With Guarantor

Description

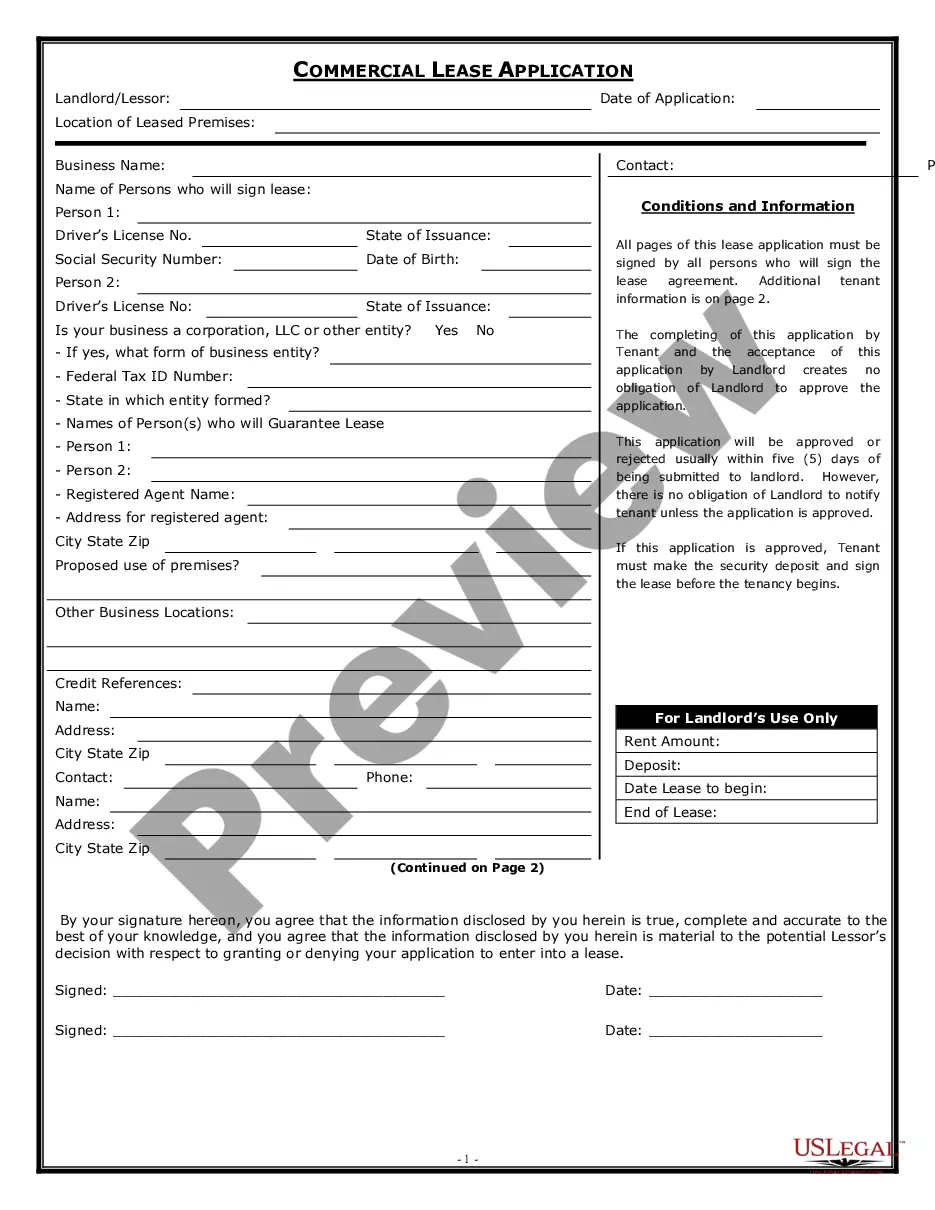

How to fill out Oklahoma Rental Application With Guarantor?

When you have to complete the Oklahoma Rental Application With Guarantor in compliance with your local state legislation and guidelines, there may be many choices to select from.

There's no requirement to scrutinize every document to ensure it satisfies all the legal specifications if you are a subscriber of US Legal Forms.

It is a reliable service that can assist you in obtaining a reusable and current template on any subject.

Navigating expertly crafted official documents becomes easy with US Legal Forms. Additionally, Premium users can utilize the advanced built-in tools for online PDF editing and signing. Give it a try today!

- US Legal Forms is the largest online repository with a compilation of over 85k ready-to-utilize documents for business and personal legal situations.

- All templates are verified to adhere to each state's legislation and regulations.

- Therefore, when you download the Oklahoma Rental Application With Guarantor from our platform, you can be confident that you possess a legitimate and current document.

- Acquiring the required sample from our site is exceedingly simple.

- If you already possess an account, merely Log In to the system, confirm your subscription is valid, and save the chosen file.

- Subsequently, you can access the My documents tab in your profile and maintain access to the Oklahoma Rental Application With Guarantor at any time.

- If this is your initial encounter with our database, please follow the directive below.

Form popularity

FAQ

Having a guarantor often makes it easier to secure an apartment, as landlords can feel more confident about potential rent payments. A guarantor acts as a safety net, reassuring landlords, especially if your financial history is less than perfect. Thus, when filling out the Oklahoma rental application with guarantor, it can significantly enhance your chances of approval.

While landlords cannot force you to use a guarantor, they may require one if your credit or income does not meet their rental criteria. It's beneficial to understand the landlord's policies before applying and to be prepared to find a guarantor if necessary. Asking clear questions about the Oklahoma rental application with guarantor can help clarify their stance.

Yes, many landlords are open to accepting a guarantor, especially in competitive rental markets where tenants may lack strong credit histories. This practice allows landlords to feel secure about the financial responsibility of tenants. However, verify with each specific landlord regarding their policies on the Oklahoma rental application with guarantor.

If you cannot find a guarantor, consider discussing alternative options with your landlord, such as providing a higher security deposit or paying several months' rent upfront. You might also explore rental assistance programs or specialized services that can help you secure a lease without a guarantor. Remember, completing an Oklahoma rental application with guarantor ensures that you cover all bases.

Approval for an apartment with a guarantor often depends on the financial stability of both you and your guarantor. If your guarantor has a strong credit history and sufficient income, your chances of approval improve. Additionally, be sure to present a well-filled Oklahoma rental application with guarantor to streamline the process.

To get approved for an apartment with a guarantor, first ensure that your guarantor meets the landlord's requirements, usually involving income verification and credit checks. Next, you should complete the Oklahoma rental application with guarantor accurately, providing all necessary documentation. Finally, emphasize your commitment to responsible renting during any discussions with the landlord.

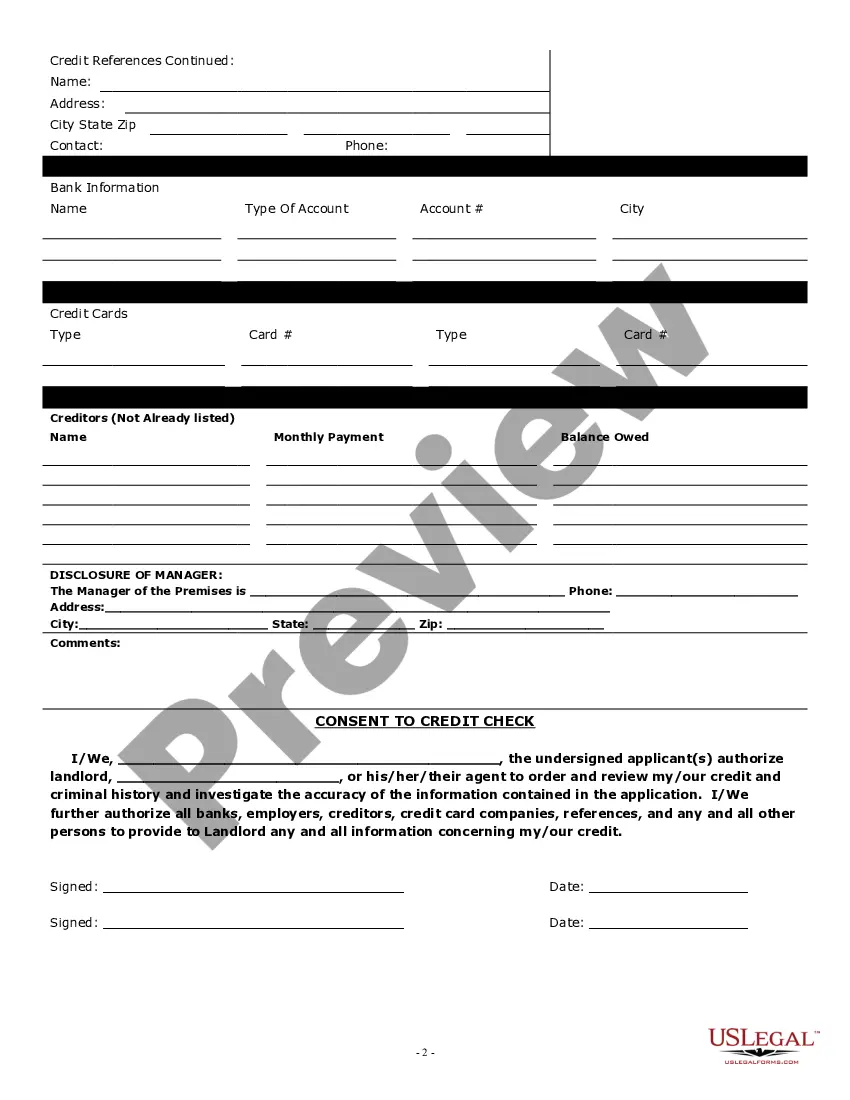

Adding a guarantor to your Oklahoma rental application with guarantor is a straightforward process. You'll usually need to include their details in the application form, along with the necessary supporting documents. Make sure to communicate with your landlord or property manager about this addition, ensuring they understand the arrangement. For assistance, you can use platforms like US Legal Forms, which provide templates to simplify the application process.

To add a guarantor to your rental application, include their information in the designated sections of the application form. Make sure to provide documentation that supports their financial capability, such as proof of income or bank statements. Providing complete and truthful information is essential, as it enhances your chances of securing the rental agreement.

To fill out a rental application with a cosigner, both parties should provide personal and financial information completely and accurately. Include details about the cosigner's income and credit history, as this information helps the landlord assess the application. Using a straightforward template can also simplify this process.

Filling out a guarantor form involves providing your personal information, including your full name, address, and financial details. Ensure that you meet the requirements outlined by the landlord and that you highlight your ability to meet the financial obligations of the lease. For clarity, consider using a reliable resource like uslegalforms to navigate the details accurately.