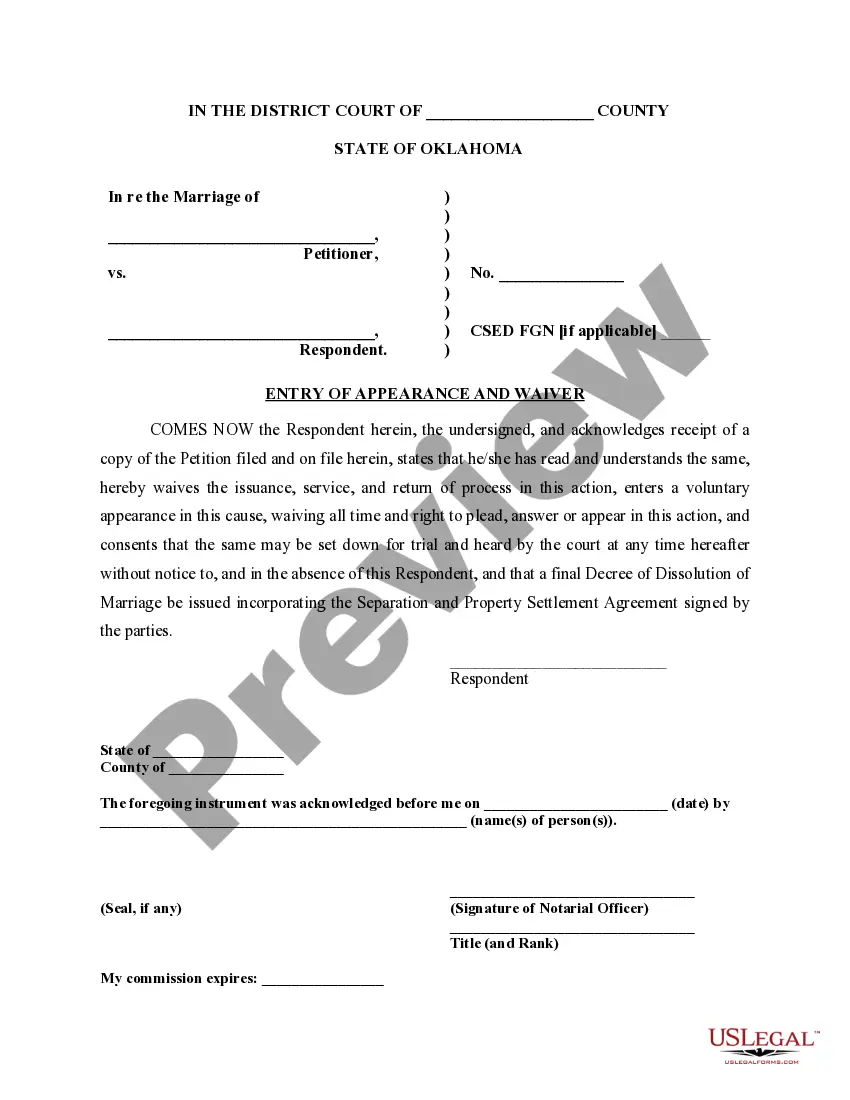

Oklahoma Divorce Waiver Form With Example

Description

How to fill out Oklahoma Divorce Waiver Form With Example?

Getting a go-to place to take the most current and appropriate legal samples is half the struggle of handling bureaucracy. Finding the right legal files demands precision and attention to detail, which is why it is very important to take samples of Oklahoma Divorce Waiver Form With Example only from reputable sources, like US Legal Forms. A wrong template will waste your time and delay the situation you are in. With US Legal Forms, you have very little to be concerned about. You can access and view all the details concerning the document’s use and relevance for your situation and in your state or region.

Take the listed steps to complete your Oklahoma Divorce Waiver Form With Example:

- Use the catalog navigation or search field to find your template.

- View the form’s description to check if it suits the requirements of your state and region.

- View the form preview, if available, to make sure the form is the one you are searching for.

- Go back to the search and look for the right document if the Oklahoma Divorce Waiver Form With Example does not suit your needs.

- If you are positive about the form’s relevance, download it.

- When you are a registered user, click Log in to authenticate and access your selected templates in My Forms.

- If you do not have a profile yet, click Buy now to obtain the template.

- Pick the pricing plan that fits your needs.

- Proceed to the registration to finalize your purchase.

- Finalize your purchase by choosing a transaction method (bank card or PayPal).

- Pick the document format for downloading Oklahoma Divorce Waiver Form With Example.

- When you have the form on your gadget, you can change it with the editor or print it and finish it manually.

Eliminate the inconvenience that comes with your legal documentation. Discover the comprehensive US Legal Forms library to find legal samples, check their relevance to your situation, and download them immediately.

Form popularity

FAQ

Mass.gov content and web services | Mass.gov.

You can be a resident of two states at the same time, usually by maintaining a domicile in one state and spending 183 days or more in another. It is not advisable, as you will be liable to file income taxes in both states, rather than in only one.

Someone's residency in a particular place, especially in a country, is the fact that they live there or that they are officially allowed to live there.

Your home is not in Massachusetts for the entire tax year but you: Maintain a permanent place of abode in Massachusetts, and. Spend a total of more than 183 days of the tax year in Massachusetts, including days spent partially in Massachusetts.

Residency Status You're a part-year resident if you: Move to Massachusetts during the tax year and become a resident, or. Move out of Massachusetts during the tax year and end your status as a resident.

Permanent Place of Abode > 183 Days. Even if an individual is not domiciled in Massachusetts, the individual is still a tax resident of Massachusetts if they maintain a permanent place of abode in Massachusetts and spends more than 183 days of the taxable year in Massachusetts.

Residency Status You're a nonresident if you are neither a full-year nor a part-year resident. Your Massachusetts tax treatment is based on your residency status and not the type of visa you hold. Nonresidents use Form 1-NR/PY - Massachusetts Nonresident or Part-Year Resident Income Tax Return.

Not only must a person maintain a permanent place of abode in Massachusetts, but a person must also spend more than 183 days in Massachusetts to meet the definition of a resident. For purposes of determining presence in Massachusetts, a day is defined as any part of a day spent in Massachusetts for whatever reason.