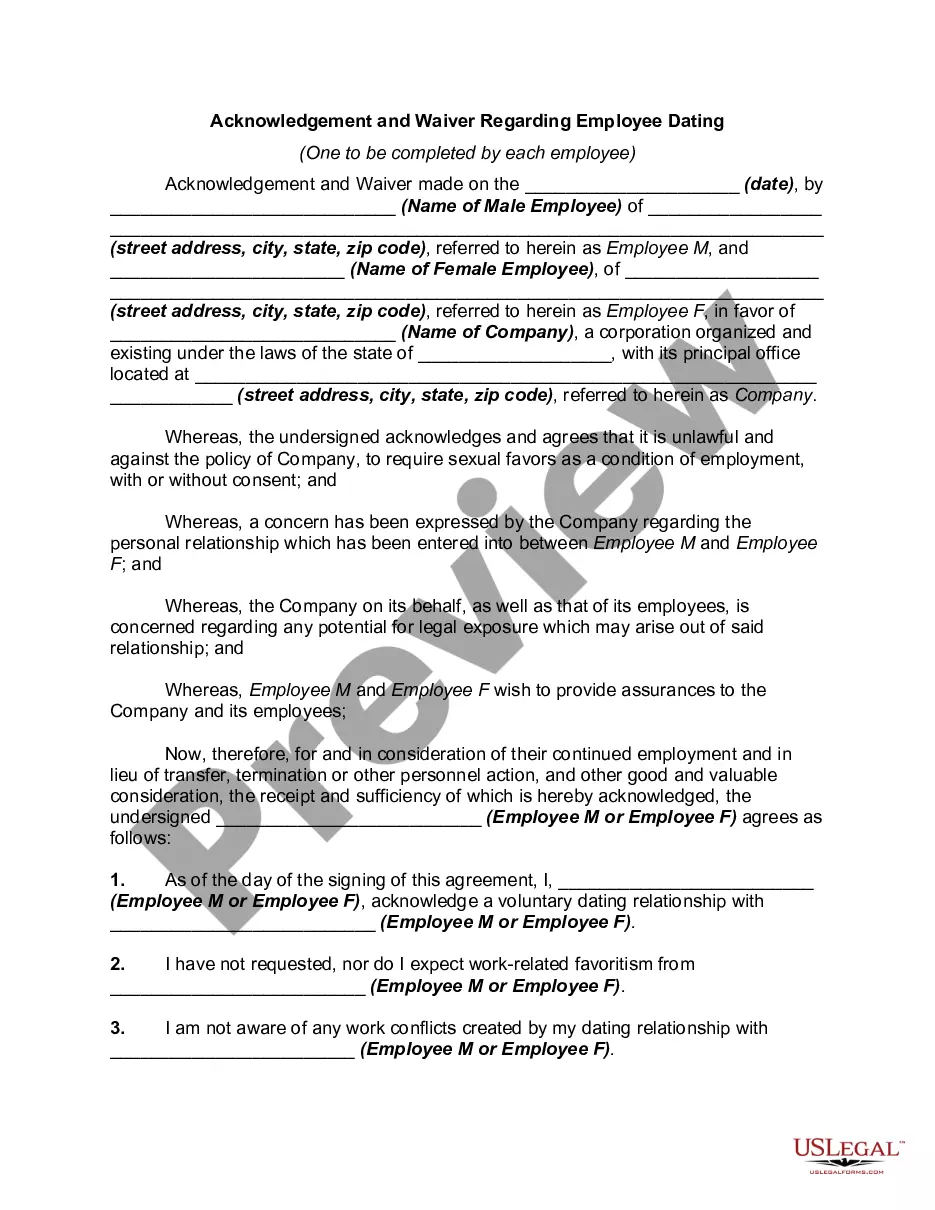

Form 426

Description

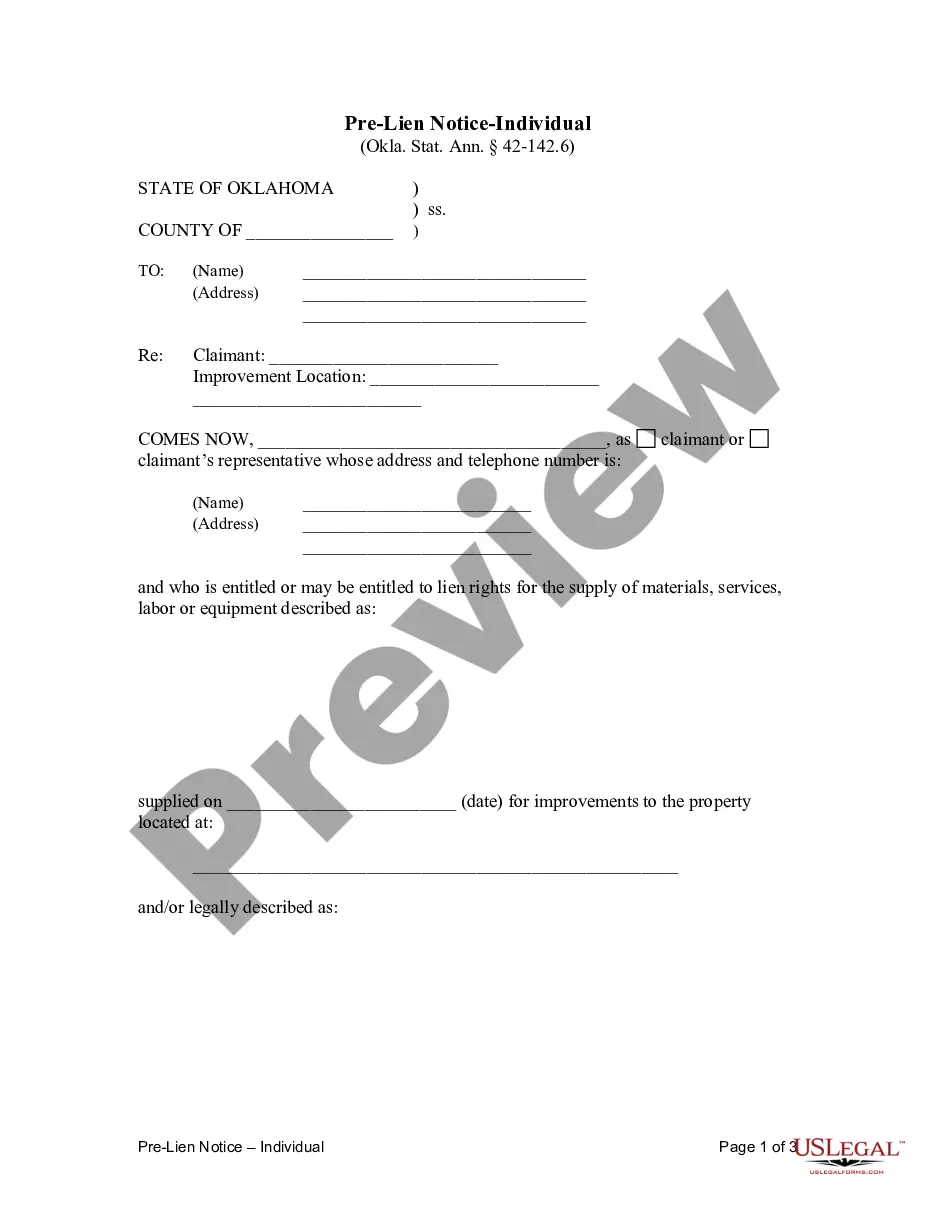

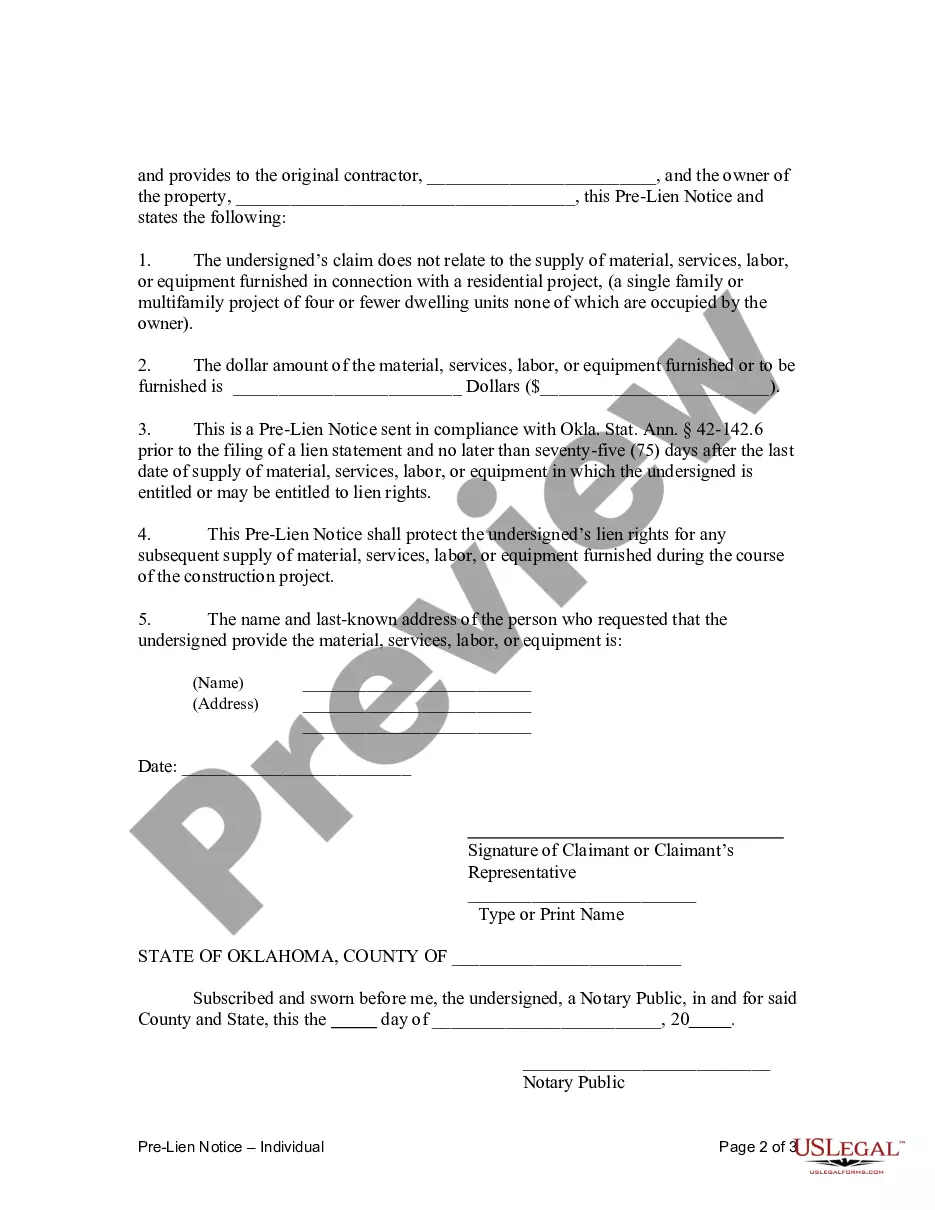

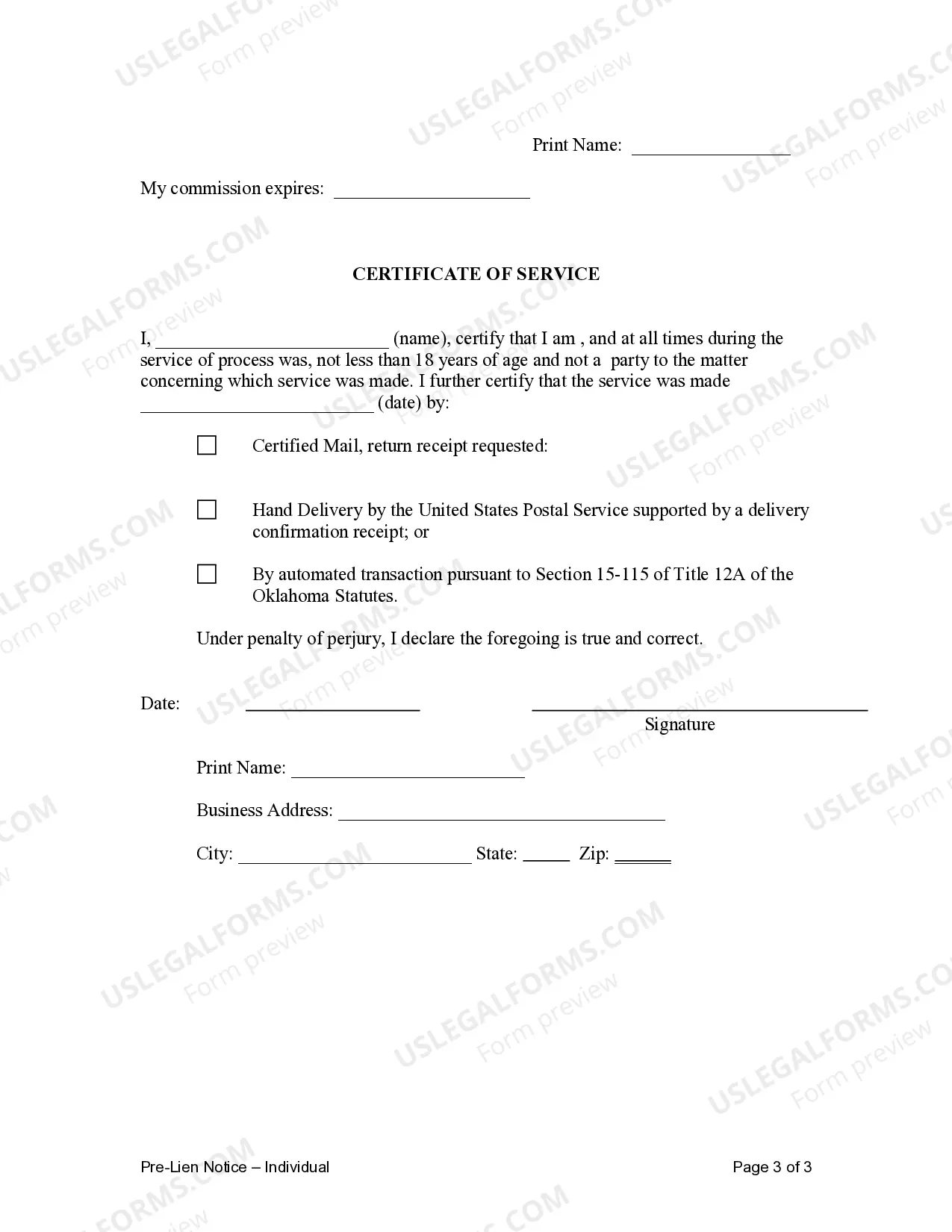

How to fill out Oklahoma Pre-Lien Notice - Individual?

- If you're a returning user, log into your account. Verify your subscription status before proceeding with the download.

- For first-time users, start by checking the Preview mode and description to ensure Form 426 meets your requirements.

- Utilize the Search tab if you need a different template. Make sure to select a form that aligns with your local jurisdiction.

- Proceed to purchase the document by clicking the Buy Now button. Choose a subscription plan that suits your needs.

- Complete the payment process using your credit card or PayPal account.

- Finally, download your form and save it to your device. You can access it anytime through the My Forms section in your profile.

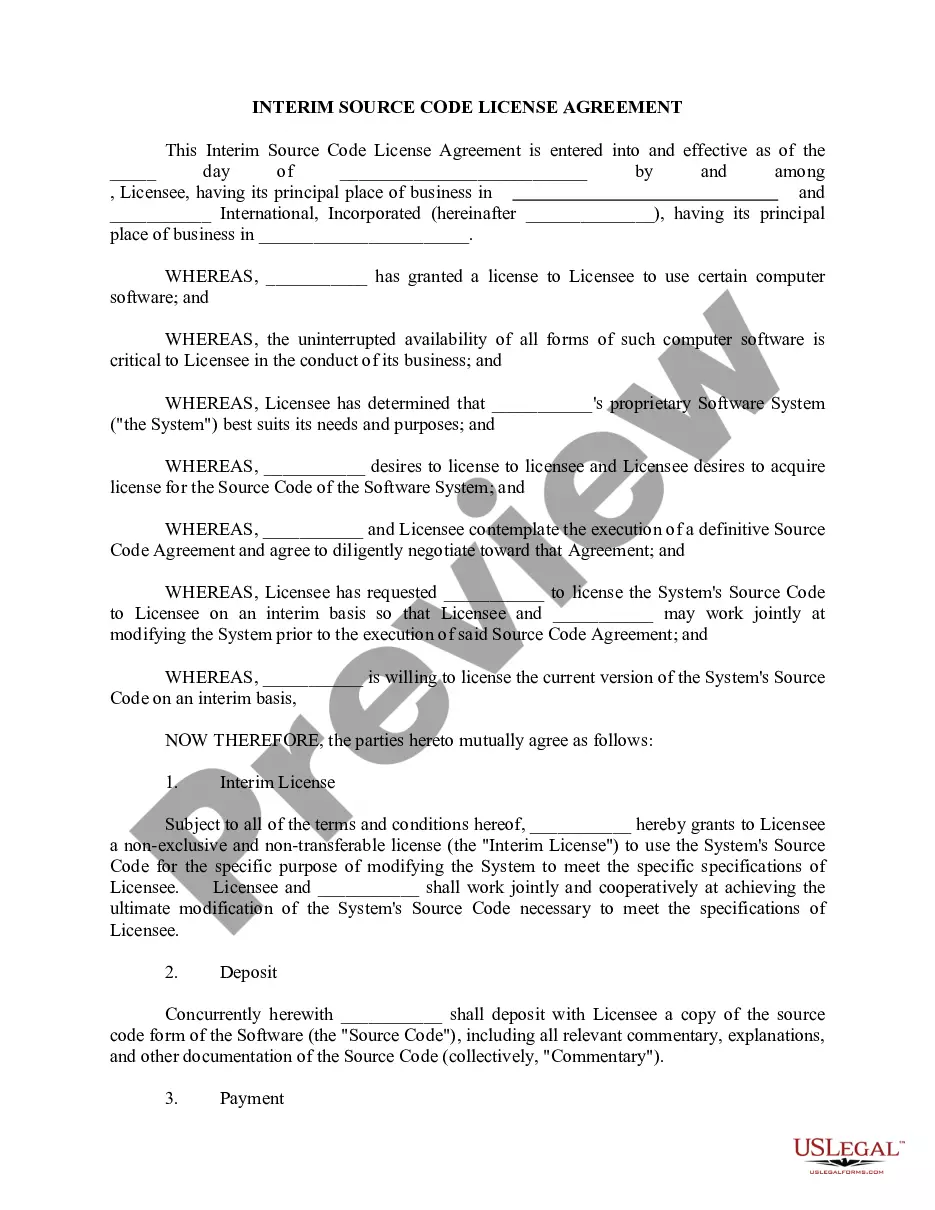

In conclusion, US Legal Forms offers a user-friendly platform with a wide collection of legal documents, including Form 426. It's tailored to provide efficient access and expert assistance to ensure you create precise and legally sound documents.

Start your journey with US Legal Forms today and experience the convenience of having legal forms at your fingertips!

Form popularity

FAQ

To fill out the 7202 tax credit section, gather all necessary documentation related to your qualifying expenses. Carefully input the figures according to the relevant chapters in the IRS instructions. If needed, resources like uslegalforms can help clarify the process.

Submitting form n-426 can typically be done by mailing it to the address specified in the form's instructions. Make sure to check for any specific submission guidelines, such as the required postage or additional documents to include. If you're unsure about the process, consider using uslegalforms for additional resources and aids.

Filling out Form 7202 involves entering relevant personal and financial information accurately. Start by detailing your qualifying wages or compensation, along with any claimable credits. For a step-by-step guide, review the instructions provided by the IRS to ensure successful completion of this important form.

You can claim up to the maximum allowed amount on form 7202 based on your eligibility and the specific tax situation. The exact figure varies, so it’s important to review the IRS instructions for form 7202 thoroughly. Always consider consulting a tax professional if you need help determining your exact claim amount.

To fill out the Employee Withholding Certificate form, begin by providing your personal information, such as your name and Social Security number. Next, indicate your filing status and any additional adjustments you want to make. It’s essential to check the latest IRS guidelines to ensure accuracy and compliance when filling out this form.

Yes, you can file IRS form 7202 electronically. This method is convenient and allows for quicker processing of your form. Additionally, using electronic filing can reduce errors that often occur with paper submissions. Ensure you use authorized software to file this form correctly.

The N-426 can be certified by specific officials, such as commanding officers of military units and other designated authorities. This certification process is essential for ensuring that you meet the necessary eligibility requirements for U.S. citizenship through military service. Accurately completing the Form 426 and obtaining the required certification can streamline your citizenship journey. To find out more about the certification process and related forms, visit US Legal Forms for user-friendly resources.

The Form 426 is an official document used in various legal contexts, specifically for certifying certain eligibility criteria. This form plays a crucial role in immigration processes, particularly for those applying for citizenship in the United States. Understanding how to correctly fill out the Form 426 can significantly impact your application process. For comprehensive guidance, US Legal Forms provides detailed resources to assist you.

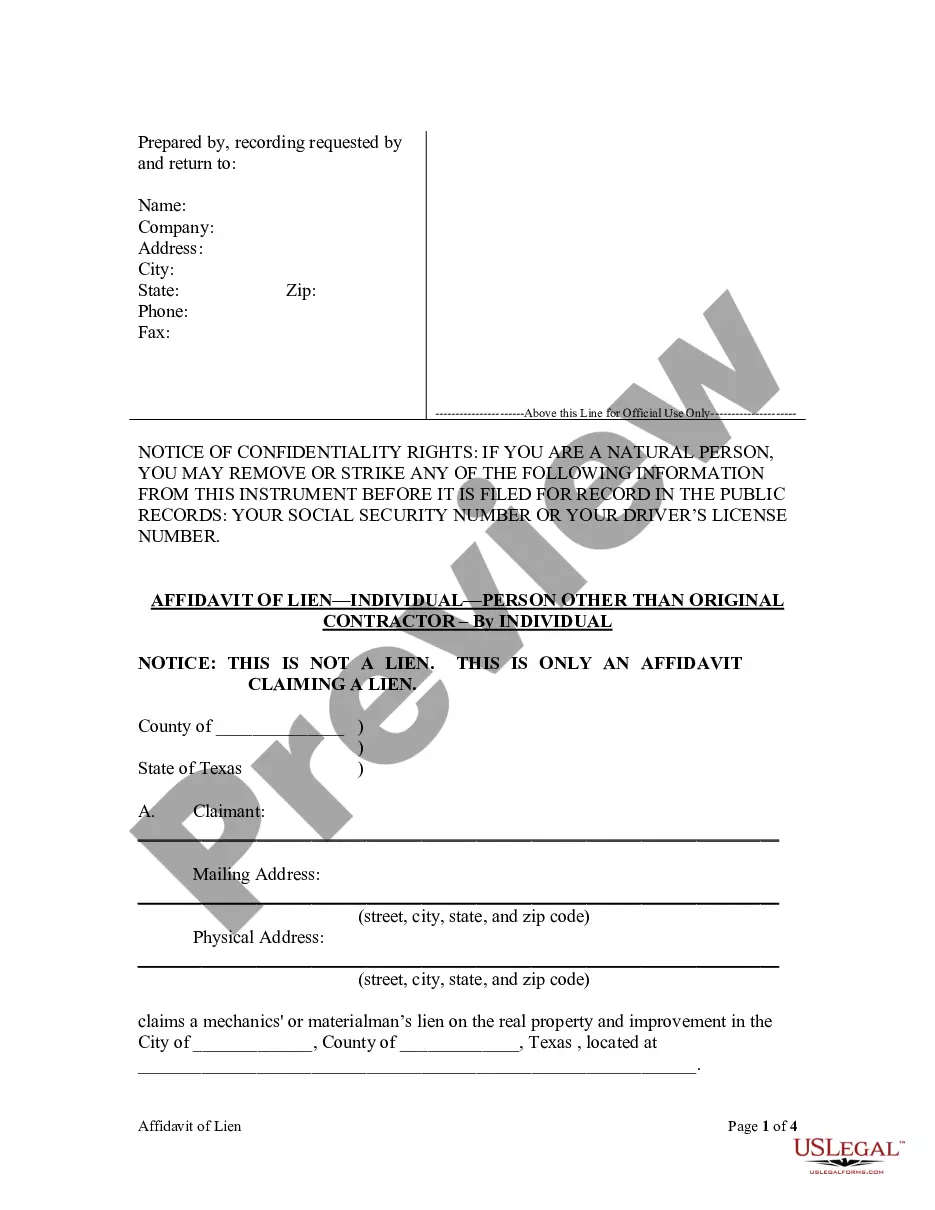

Submitting the SOC 426 involves filling out the form accurately and ensuring all required sections are completed. You can typically submit the form online or by mail, depending on your county's guidelines. It is advisable to double-check that all sections are filled correctly before submission. For more streamlined handling of your documents, consider using the US Legal Forms platform to manage your paperwork efficiently.

The approval process for IHSS can vary, typically requiring several weeks for completion. Factors such as application accuracy and processing times can impact this duration. Staying organized and submitting all necessary documents, including Form 426, can help facilitate a smoother approval experience.