Form 14

Description

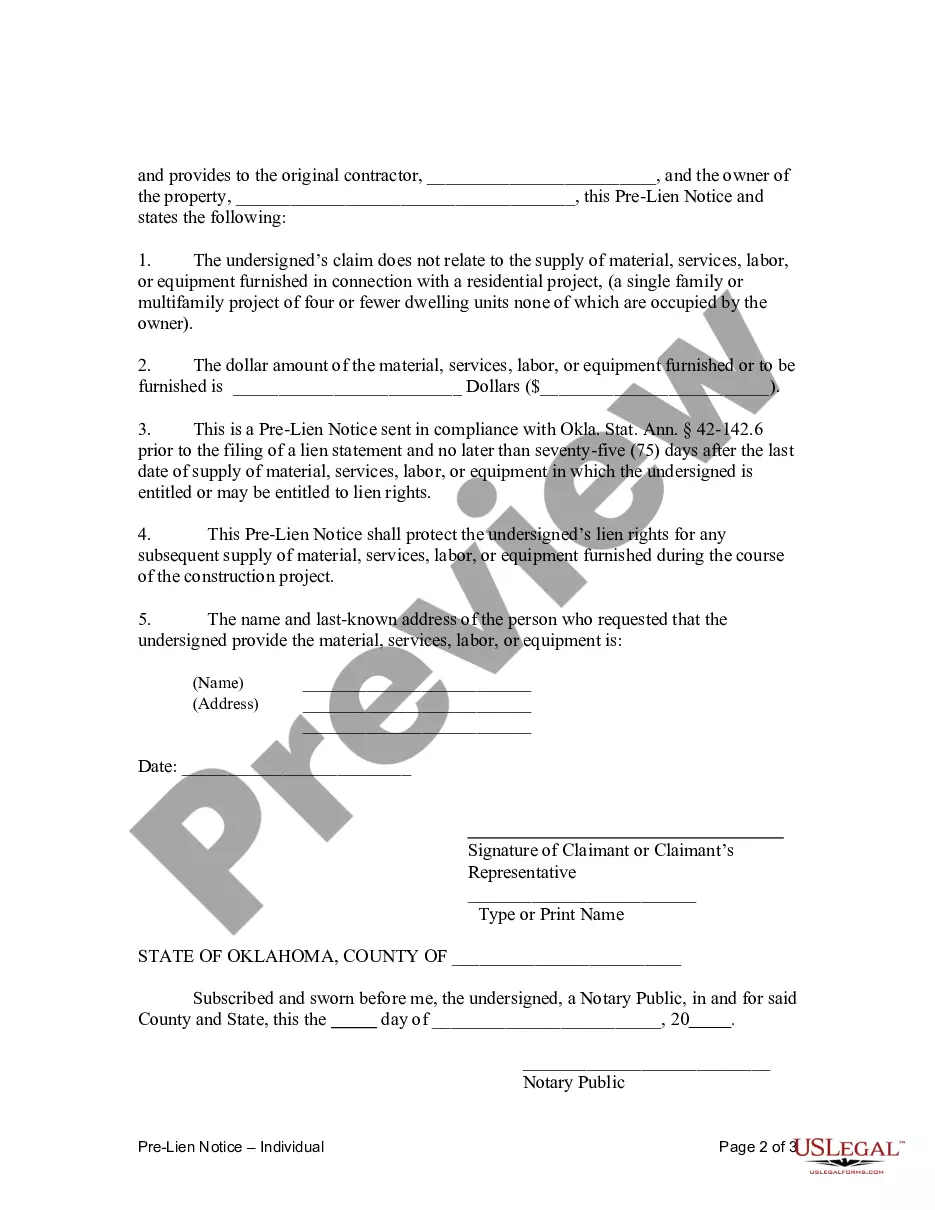

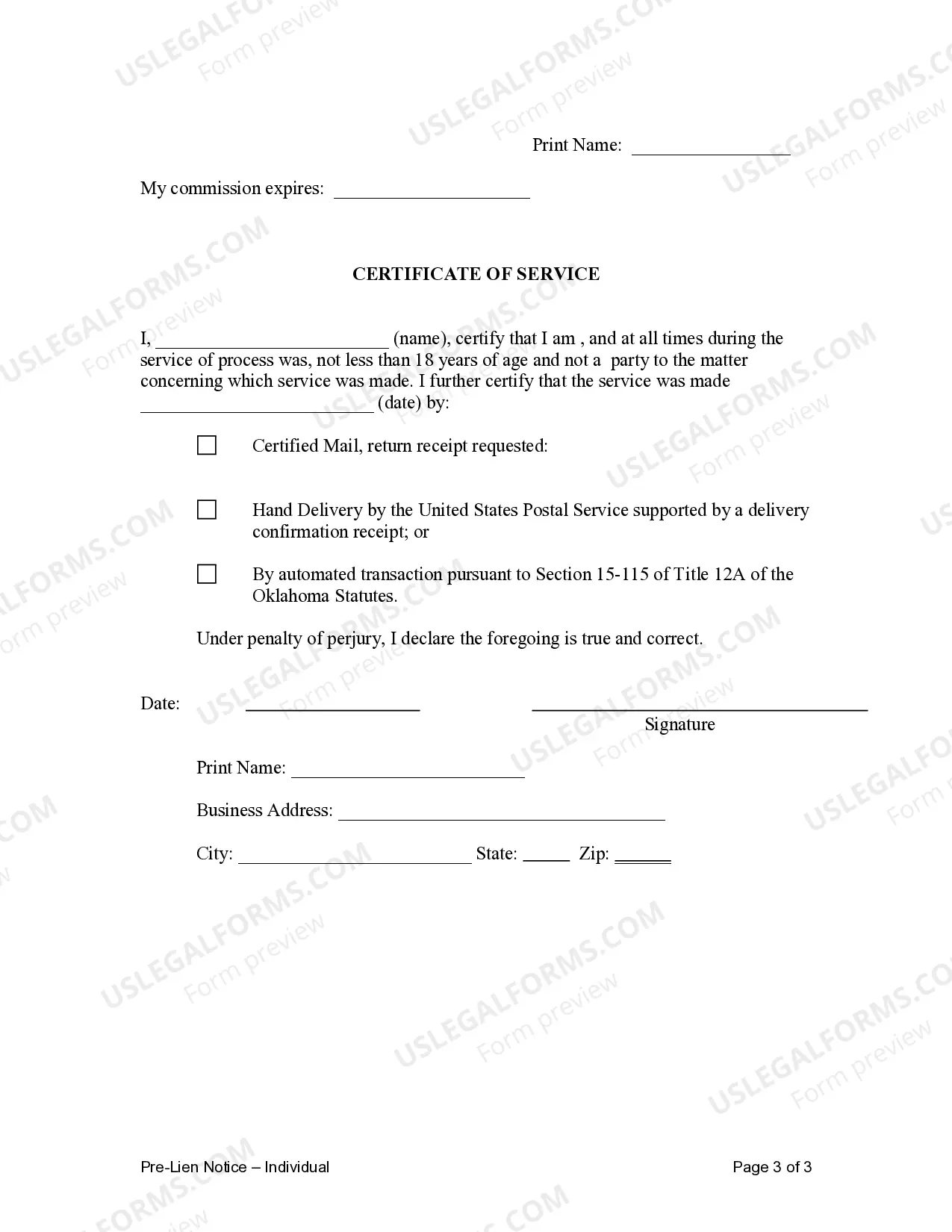

How to fill out Oklahoma Pre-Lien Notice - Individual?

- Log in to your existing US Legal Forms account. Verify that your subscription is active; renew it if necessary.

- If you are new to US Legal Forms, start by browsing for Form 14. Utilize the Preview mode to confirm it suits your requirements.

- If you encounter discrepancies, use the search function to find the correct template that fits your specific needs.

- Select the Buy Now option and choose your preferred subscription plan. Registration is required to access the full library.

- Complete your payment using your credit card or PayPal account to finalize the subscription.

- Download Form 14 to your device for completion. You can easily revisit it from the My Forms section in your account anytime.

In conclusion, US Legal Forms provides an invaluable resource for acquiring Form 14 and other legal documents swiftly and efficiently. Their robust collection and expert assistance ensure that your legal processes are handled accurately.

Experience the vast benefits of US Legal Forms today—start your journey to seamless legal documentation!

Form popularity

FAQ

IRS Form W-14 is designed specifically for certain taxpayers to claim exemption from backup withholding. By filling out this form, individuals can inform payers that they fall within exempt categories, thus retaining more of their income. It's important to complete this form accurately to prevent any issues with withholding taxes in the future. For assistance with tax documentation, consider accessing USLegalForms for comprehensive support.

The W-14 form is a document you may encounter when seeking exemption from backup withholding. It provides the necessary information to your payer, indicating that you meet certain criteria for exemption. Using the W-14 correctly can avoid unnecessary tax withholding from your payments. If you need help navigating tax forms, USLegalForms has resources tailored for your needs.

Box 14 on an IRS form, particularly on the W-2, is used to report various types of compensation or deductions that are not categorized elsewhere. This may include items like disability payments, union dues, or other specific information pertinent to your tax situation. Understanding what appears in box 14 helps you accurately complete your tax return and ensures you're claiming the right deductions. For further clarity on tax forms, USLegalForms offers helpful tools.

To dispute IRS CP14, which notifies you of a balance due, you should first review the notice carefully for any inaccuracies. Next, gather all relevant documentation to support your case, such as tax returns and payment records. Then, contact the IRS directly using the number provided on the notice to discuss your concerns. If you want assistance in understanding these processes, consider using USLegalForms for resources and guidance.

Complaints can be filed with the Office of Special Counsel by using their online submission platform or by mailing a completed Form 14. It is important to follow the guidelines provided on their website to ensure your complaint is processed correctly. You can benefit from the streamlined process offered by uslegalforms, which helps you prepare and submit your complaint effectively.

To obtain USCIS Form N-14, you can visit the official USCIS website or request it through their customer service channels. This form is specific for certain immigration-related processes, and obtaining it promptly is important to avoid delays. Make sure to fill it out accurately to aid your application, especially if it relates to the information in your Form 14.

The Office of the Special Counsel serves to protect federal employees from unfair treatment and whistleblower retaliation. It investigates complaints and ensures compliance with laws that promote transparency and accountability in government. By leveraging their expertise and resources, individuals can gain support after submitting Form 14 and feel more secure in their claims.

The Office of Special Counsel investigates several key acts such as the Whistleblower Protection Act and the Hatch Act. These acts are designed to protect government employees and the integrity of public service. When filing a complaint, such as your Form 14, it's crucial to identify the relevant act to ensure your concerns are addressed effectively.

True. You can file complaints with the Office of Special Counsel through both online methods and traditional mail. This flexibility allows you to choose the best option for your situation when submitting your Form 14. By utilizing the online platform, you can expedite the process and receive immediate confirmation of your submission.

Filling out a child support form requires you to gather information about your financial situation, including income, expenses, and any existing obligations. Start by completing Form 14, as it provides a standard framework for these calculations. Take your time to ensure all information is accurate, as errors can lead to complications later. For additional support, USLegalForms offers user-friendly templates and guides to assist you.