Garnishment Hardship Form Oklahoma

Description

How to fill out Oklahoma Claim For Exemption And Request For Hearing?

Acquiring legal document samples that comply with federal and local laws is essential, and the internet provides numerous options to choose from.

However, what is the purpose of spending time searching for the appropriate Garnishment Hardship Form Oklahoma template online if the US Legal Forms digital library already has such resources gathered in one location.

US Legal Forms is the largest online legal repository with over 85,000 fillable templates created by attorneys for various business and personal situations.

Review the template using the Preview feature or through the text description to ensure it satisfies your needs.

- They are easy to navigate with all documents organized by state and intended use.

- Our experts keep abreast of legislative changes, ensuring you can trust that your form is current and compliant when acquiring a Garnishment Hardship Form Oklahoma from our site.

- Getting a Garnishment Hardship Form Oklahoma is straightforward and quick for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the document sample you require in the desired format.

- If you are a first-time visitor to our site, follow the steps outlined below.

Form popularity

FAQ

Wage garnishments can be stopped through two options: 1) Pay the debt in full with interest and attorney fees. 2) File bankruptcy. You may file for Chapter 7 or Chapter 13 bankruptcy.

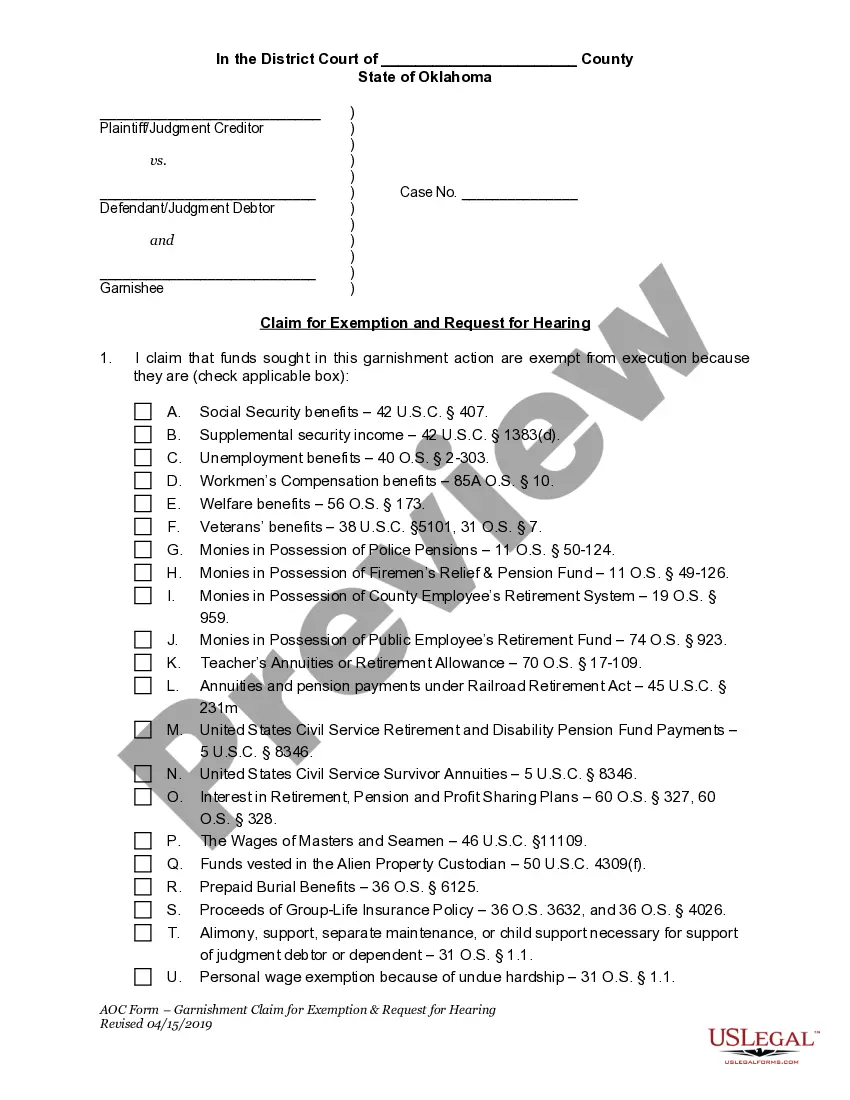

Time is VERY IMPORTANT when you ask for a hardship exemption. YOU MUST ASK FOR THE EXEMPTION WITHIN 5 (FIVE) DAYS FROM THE DATE THAT YOU RECEIVE YOUR GARNISHMENT NOTICE!! This is done by filing the Claim for Exemption and Request for Hearing form with the Court Clerk.

The garnishment amount is limited to 25% of your disposable earnings for that week (what's left after mandatory deductions) or the amount by which your disposable earnings for that week exceed 30 times the federal minimum hourly wage, whichever is less. (15 U.S.C. § 1673).

Is there anything I can do to stop the garnishment? Exempt funds or income. In Oklahoma, there are some types of money that are protected from garnishment by a creditor such as social security. ... Bankruptcy. ... One at a time (except if one of the garnishments is child support). ... Undue Hardship.

The Garnishor should file Garnishment Summons and attach to the Summons the filed Garnishment Affidavit, the Claim for Exemption and Request for Hearing, Notice of Garnishment and Exemptions, Garnishee's Answer, and Calculation for Garnishment of Earnings using event Request To Issue Garnishment Summons.