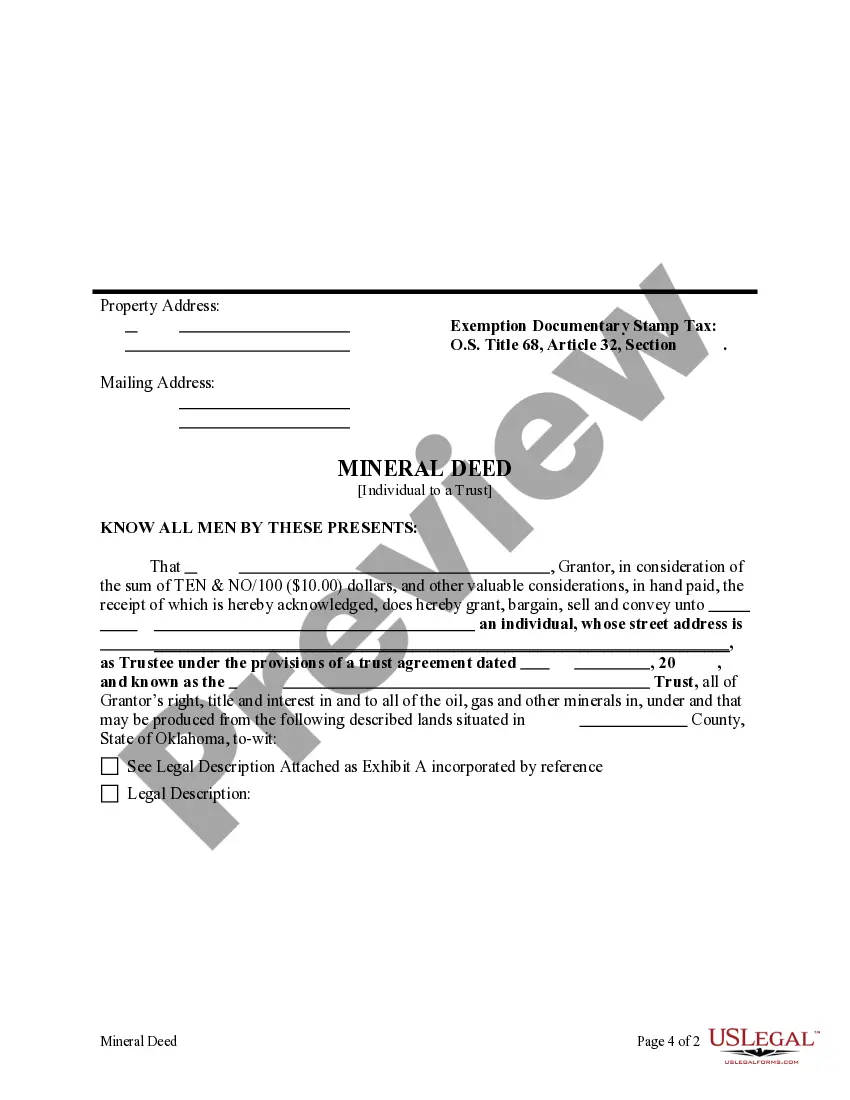

This form is a Warranty Mineral Deed where the Grantor is an Individual and and the Grantee is a Trust. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

Ok Mineral Real For Sale

Description

How to fill out Oklahoma Warranty Mineral Deed From An Individual To A Trust?

It’s obvious that you can’t become a law professional overnight, nor can you grasp how to quickly draft Ok Mineral Real For Sale without having a specialized set of skills. Putting together legal documents is a time-consuming process requiring a specific education and skills. So why not leave the creation of the Ok Mineral Real For Sale to the professionals?

With US Legal Forms, one of the most extensive legal template libraries, you can find anything from court paperwork to templates for internal corporate communication. We know how important compliance and adherence to federal and state laws and regulations are. That’s why, on our platform, all templates are location specific and up to date.

Here’s how you can get started with our website and obtain the form you require in mere minutes:

- Discover the form you need by using the search bar at the top of the page.

- Preview it (if this option provided) and check the supporting description to determine whether Ok Mineral Real For Sale is what you’re searching for.

- Begin your search over if you need a different template.

- Register for a free account and choose a subscription option to buy the template.

- Choose Buy now. As soon as the transaction is complete, you can get the Ok Mineral Real For Sale, complete it, print it, and send or send it by post to the designated individuals or organizations.

You can re-gain access to your documents from the My Forms tab at any time. If you’re an existing client, you can simply log in, and find and download the template from the same tab.

Regardless of the purpose of your forms-whether it’s financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

Effect of Property Taxes on Mineral Rights Oklahoma has no inheritance tax. Capital gains tax must be paid on any sale of mineral rights and income generated from royalty streams. However, if the mineral rights have not been severed from the property, the county may not charge taxes beyond property taxes.

When it comes to mineral rights, the standard admonition has long been consistent and emphatic: Avoid selling them. After all, simply owning mineral rights costs you nothing. There are no liability risks, and in most cases, taxes are assessed only on properties that are actively producing oil or gas.

After the sale is complete, you will receive payment for the sale of the mineral rights, either in a lump sum or in the form of royalties based on the production of minerals from the land.

Your basis in mineral rights can affect how much tax you owe when selling mineral rights vs collecting royalties. If you inherited mineral rights, it nearly always makes sense to sell. 2. Diversification: In our opinion, another key reason to sell mineral rights is diversification.

Buying mineral rights in Oklahoma Find land with mineral rights for sale in Oklahoma that includes legal subsurface ownership of oil and gas minerals and other valuable rocks and resources. The 25 matching properties for sale in Oklahoma have an average listing price of $608,600 and price per acre of $6,394.