Subcontracting Business

Description

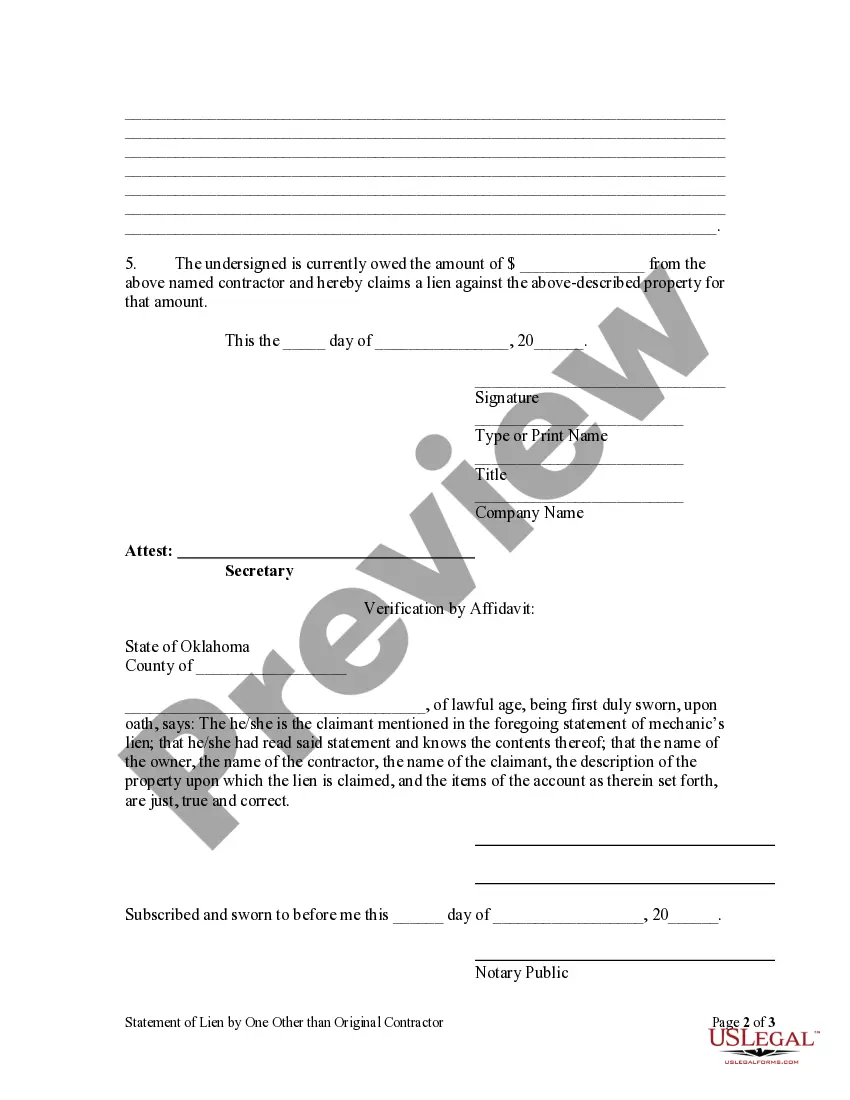

How to fill out Oklahoma Statement Of Lien - Subcontractor And Other By Corporation?

- If you are an existing user, log in to access your account and download the required form template. Ensure that your subscription is up-to-date; if not, renew it based on your payment plan.

- For first-time users, begin by reviewing the Preview mode and form descriptions to select the appropriate form that aligns with your local jurisdiction's requirements.

- If you find discrepancies in your current selection, use the Search tab to find the correct template that fits your needs.

- Once you've identified the right document, click on the Buy Now button and choose your preferred subscription plan. You will need to create an account to access their extensive library.

- Complete your purchase by entering your payment details, either via credit card or PayPal.

- Finally, download the form, save it on your device, and access it anytime later in the My Forms section of your profile.

By following these straightforward steps, you ensure that your subcontracting business has the legal documents it needs to operate smoothly.

Don’t hesitate to explore US Legal Forms today to simplify your legal documentation needs and unequivocally strengthen your subcontracting business!

Form popularity

FAQ

For a subcontractor, you will need a valid contract outlining the project requirements, payment terms, and deadlines. Additionally, collecting a W-9 form from the subcontractor is essential for tax reporting. Depending on your jurisdiction, you may also need to gather specific licenses or insurance documentation from the subcontractor.

To start a subcontracting business, first, identify your niche and target market. Then, register your business with the appropriate local and state authorities, and obtain any necessary licenses or permits. Creating a solid business plan will guide your operations and help secure contracts with primary contractors.

Yes, you should request a W-9 form from subcontractors before you begin working with them. This form collects important information, including the subcontractor's legal name and taxpayer identification number. By obtaining a W-9, you ensure all necessary tax reporting is accurate for your subcontracting business.

As a subcontractor in your subcontracting business, you will report your income on Schedule C of your personal tax return, along with any business expenses incurred. It's important to maintain detailed records of all your earnings and expenditures. Additionally, you may need to make estimated tax payments throughout the year.

Subcontractors must provide proof of their qualifications, such as licenses or certifications relevant to the work. Besides, they should share a W-9 form for tax purposes and any documentation that supports their insurance coverage. These items help protect both you and the subcontractor in your subcontracting business.

To hire a subcontractor for your subcontracting business, you need a written agreement outlining the scope of work, payment terms, and deadlines. This contract serves as a clear reference for both parties. Additionally, collect a W-9 form from the subcontractor to ensure proper tax reporting.

Starting a subcontracting business begins with assessing your skills and identifying your target market. You should create a solid business plan, obtain the necessary licenses, and gather tools required for your trade. Utilizing platforms like USLegalForms can help you access the legal documents needed to formalize your business and protect your interests.

A subcontractor is typically classified as a professional who provides specific services to a contractor, working under their supervision but retaining control over how these services are delivered. They usually work on a contract basis, focusing on certain tasks within a larger project. This arrangement is common in construction and other skilled trades, making it a vital part of the subcontracting business.

Finding subcontracting opportunities involves networking with general contractors, attending industry trade shows, and utilizing online platforms that specialize in job listings. Additionally, you can join industry organizations and use social media to connect with potential clients. Engaging actively in your community can also lead to valuable connections that can boost your subcontracting business.

To successfully work as a subcontractor, you need to have strong skills in your trade, proper licensing, and essential tools for your job. Furthermore, keeping a good network of contacts can lead to more opportunities. Understanding contracts and negotiations is also crucial for navigating the subcontracting business effectively.