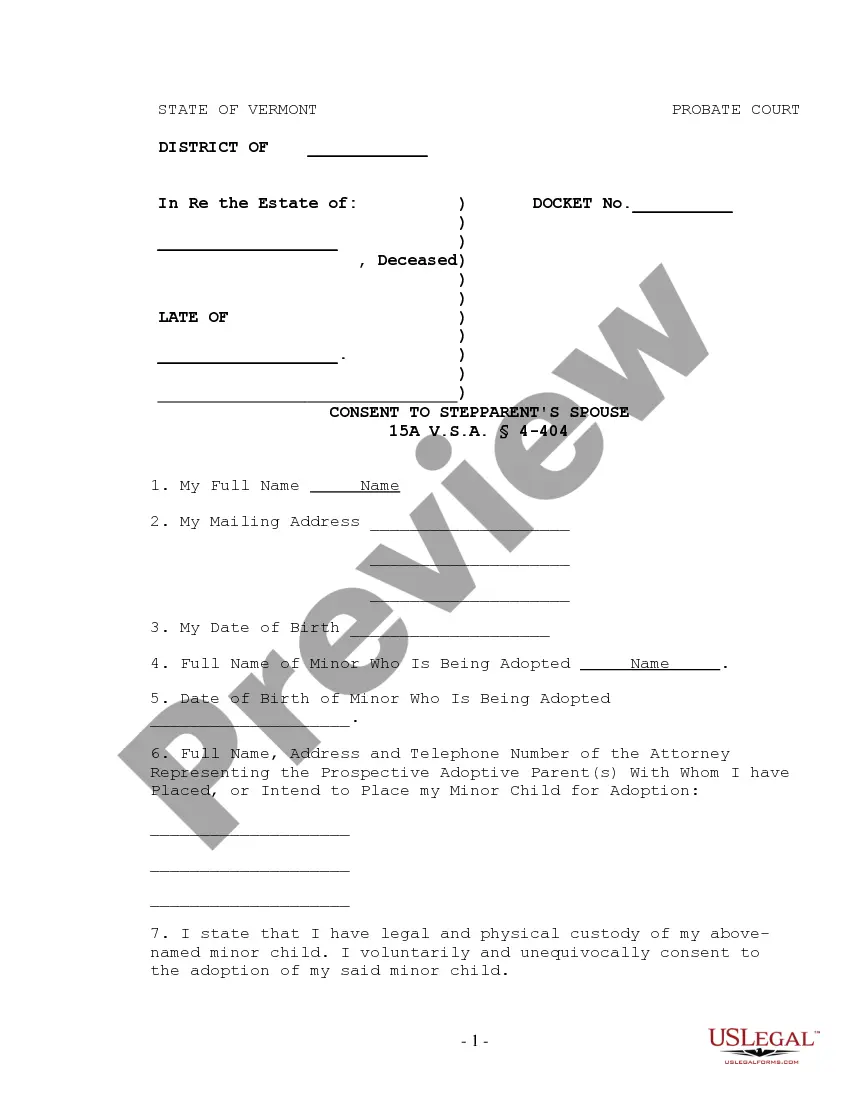

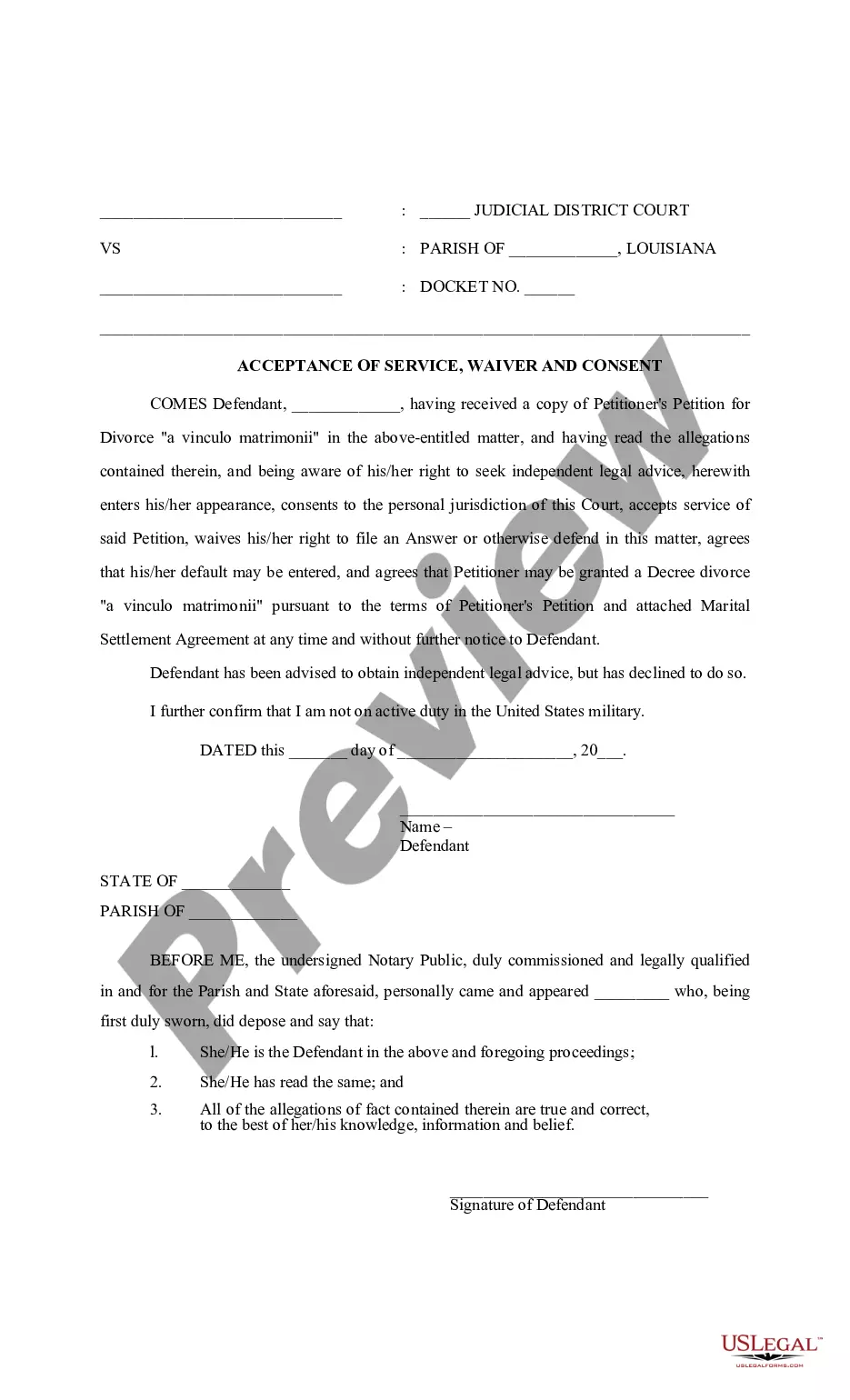

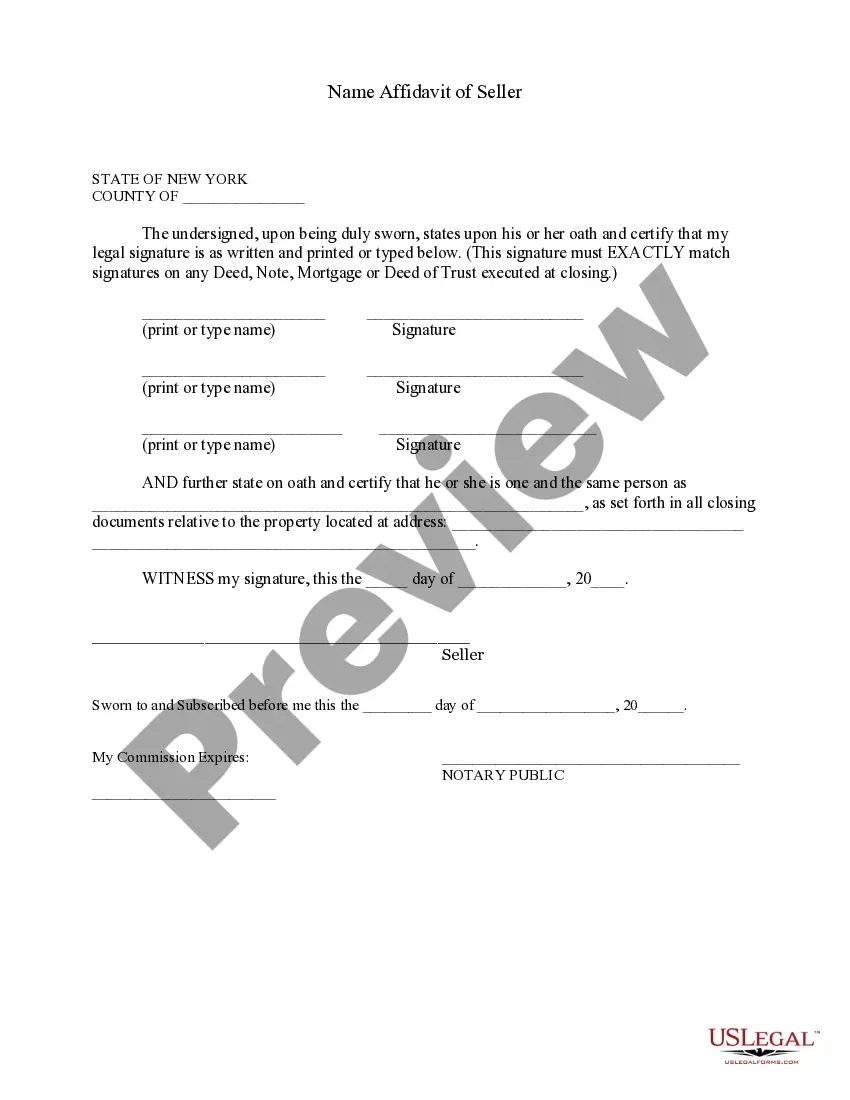

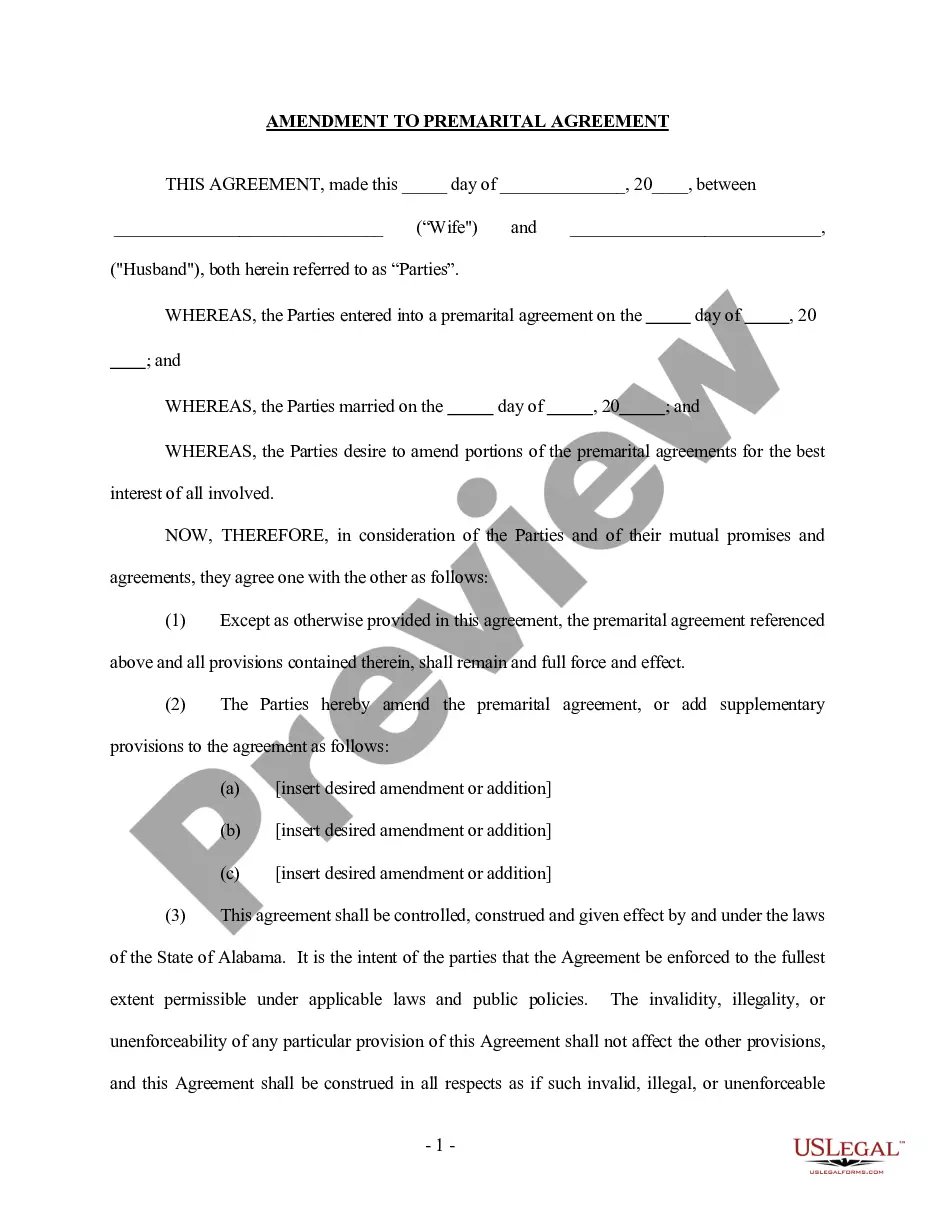

This form is a Quitclaim Deed where the grantor is an individual and the grantee is a trust. Grantor conveys and quitclaims the described property to grantee. This deed complies with all state statutory laws.

Deed Individual Trust With Power Of Sale

Description

How to fill out Oklahoma Quitclaim Deed - Individual To A Trust?

There’s no longer a reason to squander hours searching for legal documents to fulfill your local state obligations.

US Legal Forms has gathered all of them in a single location and improved their accessibility.

Our website provides over 85k templates for various business and personal legal scenarios categorized by state and purpose.

Use the search bar above to find another template if the previous one did not suit your needs. Click Buy Now next to the appropriate template, choose the most suitable pricing plan, and create an account or sign in. Make your subscription payment using a card or via PayPal to proceed. Choose the file format for your Deed Individual Trust With Power Of Sale and download it to your device. Print the form to complete it by hand or upload the sample if you prefer to edit it online. Preparing legal documents under federal and state laws is quick and easy with our platform. Try US Legal Forms now to keep your paperwork organized!

- All forms are expertly crafted and verified for accuracy, ensuring that you receive an up-to-date Deed Individual Trust With Power Of Sale.

- If you are acquainted with our platform and already possess an account, you must confirm that your subscription is active before obtaining any templates.

- Log In to your account, select the document, and click Download.

- You can also access all saved documents anytime by opening the My documents tab in your profile.

- If this is your first time using our platform, the process will require a few additional steps to complete.

- Here’s how new users can locate the Deed Individual Trust With Power Of Sale in our library.

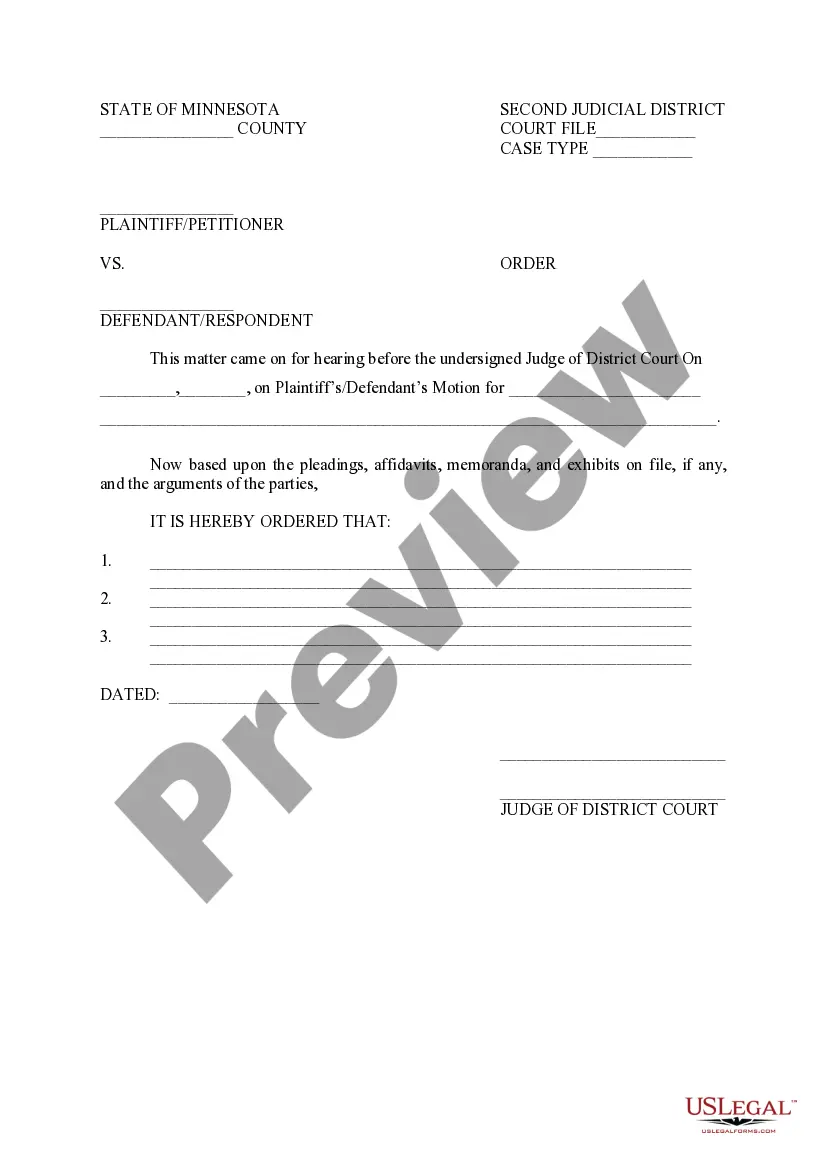

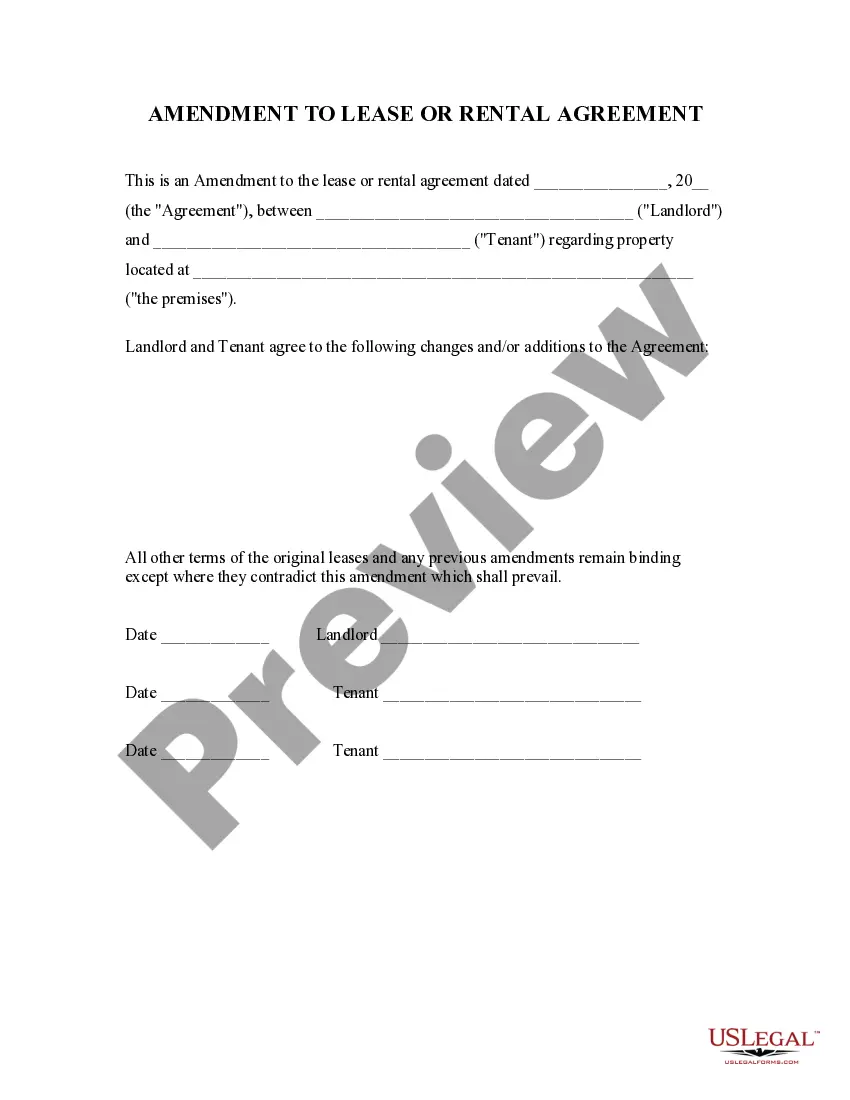

- Review the page content carefully to ensure it has the required sample.

- Utilize the form description and preview options, if available.

Form popularity

FAQ

How to WriteStep 1 Obtain The California Deed Of Trust Form For Your Use.Step 2 Determine And Present Where This Deed Must Be Returned.Step 3 Report The Assessor's Parcel Number.Step 4 Record The Effective Date Of This Deed.Step 5 Produce The Debtor's Identity As The Trustor.More items...?

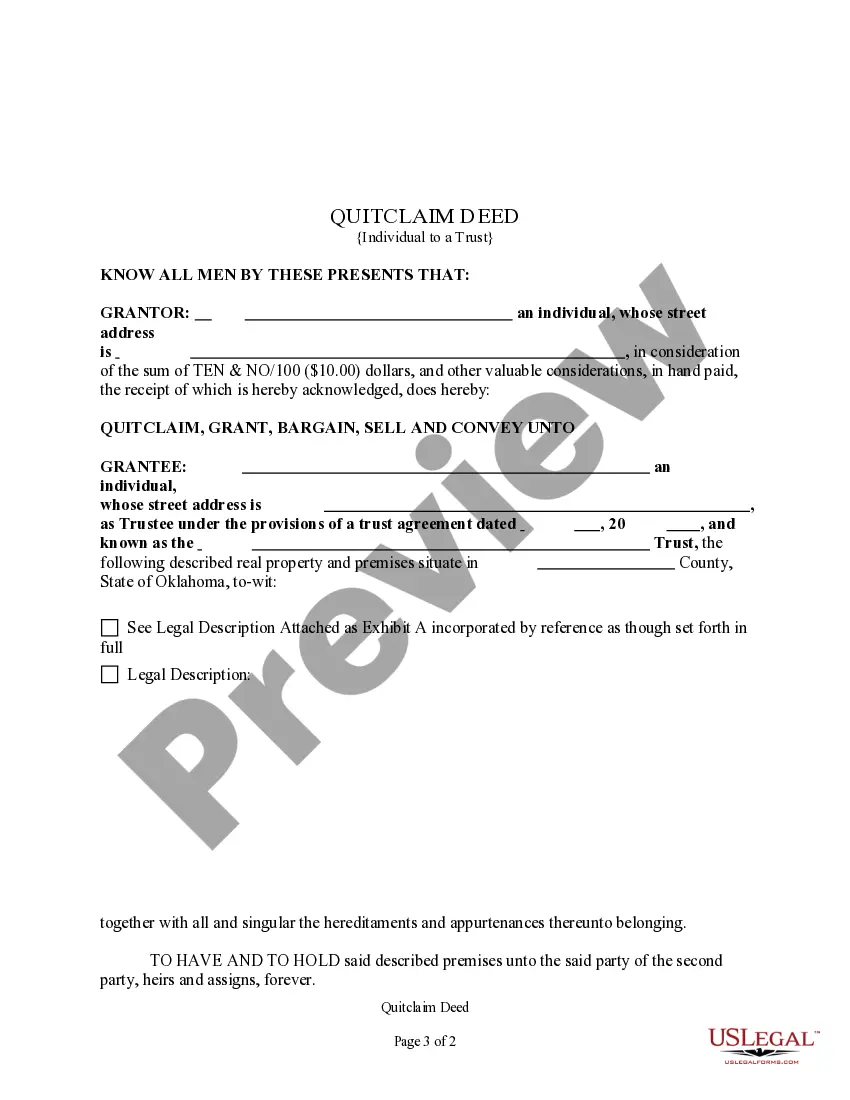

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. It states that the home buyer will repay the loan and that the mortgage lender will hold the legal title to the property until the loan is fully paid.

A mortgage involves only two parties: the borrower and the lender. A deed of trust has a borrower, lender and a trustee. The trustee is a neutral third party that holds the title to a property until the loan is completely paid off by the borrower.

The Deed of Trust must be in writing, signed by the property owner, and filed in the County Clerk property records. The Deed of Trust should describe the loan amount, name a Trustee, and describe the collateral securing the loan. A correct legal description of the property is essential for a valid Deed of Trust.

A deed of trust addresses three parties: The trustor, or obliger, who is the borrower1. The trustee, who holds "bare or legal" title (usually a title company) The beneficiary, who is the lender2.